This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

It was a nightmare for the shareholders of LinkedIn recently when LinkedIn shares collapsed by 18.61% to close at $205.21 after the company announced an extremely disappointing revenue outlook for the current quarter and rest of the financial year. The company announced that it would be able to generate an EPS of $1.90 as against its earlier forecast of $2.95.

Its not only LinkedIn which witnessed such a steep fall in the last couple of weeks on the Wall Street. The list is long and it has more big names including Twitter, Facebook, Yelp, Apple etc. These companies either reported poor quarterly results or announced a poor earnings outlook for the coming few months or quarters.

It was Facebook first which reported its slowest quarterly earnings growth in two years and then it was Twitter’s turn to disappoint its investors . However, Apple reportedly faced a few issues with its recently launched iWatch and the bears took it as an opportunity to drag its share price lower by $3.50 to close at $125.14.

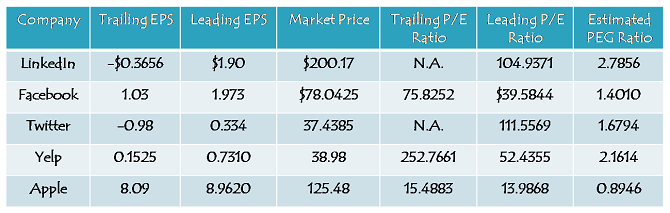

If we analyse the valuations of all these social networking sites, it appears that all of them are trading at high valuations. At an estimated EPS of $1.90 for the ongoing fiscal year, LinkedIn is trading at 105 times. Facebook is trading at 39-40 times, Twitter at 111-112 times and Yelp at 52 times.

I think these valuations are unreasonably higher for businesses in which there is a high degree of uncertainty whether they would exist or not after a few years.

If I talk about Indian online retailers or recharge websites, the names which instantly come to my mind are Flipkart, Snapdeal, Jabong, Myntra, Amazon, Paytm, Freecharge, Mobikwik, Tastykhana etc. These sites have attracted a lot of attention in the last two years or so and their businesses have grown multi folds.

Currently, only 3% of India’s population shop online with a market size of $3.8 billion. Investors investing in Indian online retailers see huge potential of growth here in the next 5 years at least. These sites expect to continue growing their revenues during this period and also have quite aggressive plans for future expansions. Currently, they expect a growth of anywhere between 30-200% in their revenues in the next 1-2 years.

Despite of the fact that only a small percentage of Indian population currently shops online, I think there is a huge potential to grow it multifolds and no way the offline retailers can ignore this trend.

But, all of these so-called online Indian e-commerce giants have incurred losses in the past and I think most of them are still in the red. They have been able to attract customers by offering deep discounts or high cashbacks or free shipping or easy returns or some other kind of differentiated offerings.

But, when I analyse the financials of some of these listed companies, like LinkedIn or read about their private equity fundings in the newspapers or websites, like Foodpanda, Paytm or Mobikwik etc., I find it quite unreasonable for them to get such high valuations.

So, the point is, are all these social networking sites and online e-commerce platforms in some kind of bubble zone? I think it is impossible to continue with the kind of freebies or discounts Indian e-commerce websites are offering right now. Let us first check some of the offers which I availed in the last couple of months and think are not sustainable in the long run:

Rs. 10,000 Cashback on Buying iPhone 6 from Paytm – I bought an iPhone 6 last month from Paytm and availed Rs. 10,000 cashback on a selling price of approximately Rs. 49,500. At a time when no other online or offline retailer was selling it for less than Rs. 46,000, Paytm was selling it for Rs. 49,500 and giving a cashback of Rs. 10,000.

I don’t think the margin on selling an iPhone 6 would be as high as Rs. 5,000 per phone for Paytm to offer Rs. 10,000 cashback. What do you think about it?

Rs. 150 Cashback on Adding Rs. 1,500 to Your Mobikwik Wallet – Mobikwik has been offering to give you a cashback of 10% (up to Rs. 150) on adding money to your wallet through a credit card or debit card. It is like transferring Rs. 1,500 lying in my bank account to my Mobikwik wallet, getting Rs. 1,650 there and then able to use it for paying mobile or electricity bills. I think such kind of high cashbacks are unsustainable. Do you agree?

Rs. 50 Cashback on a Recharge or Bill Payment of Rs. 250 or more on Paytm – Paytm has been very aggressive as far as cashbacks on mobile recharges or bill payments have been concerned. I don’t think these online platforms or offline recharge vendors enjoy a margin of 20% on mobile recharges or bill payments. So, how do you think Paytm is managing to offer up to 20% discount?

50% Cashback on Placing Orders from Foodpanda – It was a long weekend for me as the stock markets were closed on Friday as well. On Thursday, I placed an order for food using Foodpanda platform and got 50% cashback using Paytm wallet for making online payment. I think such offers offering 50% cashback are also not sustainable in the long run.

Some of these excesses were seen in the beginning of Dot Com bubble as well, and I think we are seeing the same excesses now as well. We are in a situation where companies won’t make a profit with the freebies they currently have to offer, and at the same time they won’t be attractive enough for customers to use their services after the freebies are stopped.

Perhaps the only good thing about these startups is that they are not listed as yet, so only sophisticated investors like VCs can lose their money on them, not retail investors who get carried away by the hype.

totally agree with you…once the discounts are gone, customers will go too.

my thoughts : 1. Samir Arora said that the current level of offers and discounts where co’s funded by PE / VC funds is the largest DBT scheme ( direct benefit transfer ie from US investors to Indian consumers !)

2. Among the list of top 15 internet based co’s based on market cap in 1995 only Apple remains in the list today, others are gone.

Thanks Shankar for sharing your thoughts!

Though I admire Samir Arora’s thoughts and agree that some e-tailers are burning their cash unnecessarily, I think some managements are smart and their cashback offers are part of their marketing efforts. It is tough, but only time will tell who survives this bubble.

it is possible that what we are witnessing is a bubble.But I do know that Apple offers good margins to its dealers (http://articles.economictimes.indiatimes.com/2014-07-16/news/51600583_1_iphone-sales-iphone-5s-smartphones).

Hi Vijay,

Apple offers these kind of margins on the MRP, which is currently at Rs. 56,000 for iPhone 6 16 GB model. The price at which I bought iPhone 6 on Paytm was below the cost of any dealer. Dealers were ready to buy it from the customers at a higher price, say Rs. 44,000 to Rs. 46,000. I don’t know why !!

There can be one and only one explanation for that….The stuff being sold is not exactly from the Apple stable but an identical clone which is manufactured and has found its way into the markets through a grey channel….It is a question of time before it is busted….

Already,quite a few firms have refused to offer any kind of warranty on products sold online on e-commerce sites e.g:Lloyd Airconditioners for example….

It is an Apple product and we have got it checked with Apple for its authenticity. Apple is also providing all kind of warranties for this product. E-commerce websites are giving a tough competition to the offline retailers with such unsustainable discounts. This is one of the reasons which prompted me to write this post.

Yup, I think that’s true. Such cashbacks are not sustainable. Perhaps the Indian retail startups are telling their investors that they’d make money from selling advertising in future?

A few years back, Nokia was everything, today Nokia is nothing. I think e-commerce businesses are also dynamic and technology changes things very rapidly. Today companies like Paytm and Mobikwik are very aggressive in giving cashbacks, discounts etc., which is definitely unsustainable in the long run. Advertising revenues alone cannot justify high valuations that these companies are enjoying.