This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Shriram Transport Finance Company Limited (STFC) is launching its public issue of non-convertible debentures (NCDs) from the coming Monday, October 15, 2018. This will be the second public issue by the company in the current financial year. The company plans to raise Rs. 1,350 crore from this issue, including the green shoe option of Rs. 1,050 crore.

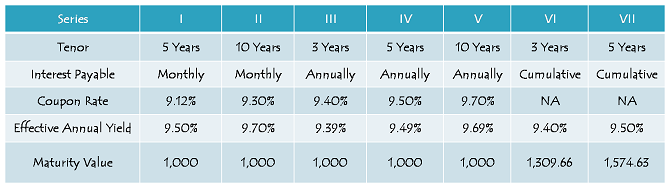

These NCDs will carry coupon rates in the range of 9.12% to 9.70%, resulting in an effective yield of 9.39% to 9.70% for the retail individual investors. The issue is scheduled to close on October 29, unless the company decides to close it prematurely.

Before we take a decision whether to invest in this issue or not, let us first check the salient features of this issue.

Size & Objective of the Issue – Base size of the issue is Rs. 300 crore, with an option to retain oversubscription of an additional Rs. 1,050 crore, making the total issue size to be Rs. 1,350 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.70% p.a. for a period of 10 years, 9.50% p.a. for 5 years and 9.40% p.a. for 3 years. These rates would be applicable for annual interest payment and cumulative interest options only. Monthly interest payment option is available only with 5 years and 10 years tenors, and coupon rates for these periods would be 9.12% p.a. and 9.30% p.a. respectively.

0.25% Additional Coupon for Senior Citizens – Like its previous issue, the company has decided to offer an additional coupon of 0.25% p.a. to the senior retail investors, as well as senior HNI investors, who would hold these NCDs on the relevant record date for the purpose of interest payment.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 135 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 135 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 40% of the issue is reserved i.e. Rs. 540 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 540 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CRISIL and India Ratings have rated this issue as ‘AA+’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal – These NCDs are proposed to get listed on both the stock exchanges, Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). As against 12 working days earlier, these NCDs will get listed on the exchanges within 6 working days after the issue gets closed. Moreover, there is no option of a premature redemption, and the investors would be required to sell these NCDs on either of the stock exchanges in order to encash these NCDs before maturity.

Demat A/c. Mandatory – Demat account is mandatory to invest in these NCDs as the company is not providing the option to apply for these NCDs in physical or certificate form.

ASBA Mandatory – Like IPOs, SEBI has made ASBA mandatory to apply for debt issues as well effective October 1. So, writing cheques would become history now in applying for these debt instruments.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000.

Minimum Investment Size – STFC has fixed Rs. 10,000 as the minimum amount to invest in this issue. So, if you want to invest in this issue, you need to apply for a minimum of ten NCDs worth Rs. 1,000 each.

Should you invest in Shriram Transport Finance NCDs?

Indian financial markets are in turmoil, and it all started with IL&FS and DHFL, along with high crude prices and a weaker Indian Rupee. In the last nine months or so, most of the investors have lost their hard earned money in almost all the asset classes, be it equity, or debt, or real estate, or gold, or currency (read INR and crypto currencies). Though I consider bank fixed deposits to be one of the most unattractive financial investments, I believe people who invested in bank FDs must have been the happiest of the lot during this same period.

And, at this moment, most of the retail investors are scared of investing their investible surplus in any of the volatile asset classes, and want to keep it in safe havens as much as possible. When ‘AAA’ rated NCDs of companies like DHFL are trading at an yield of 10% or more, then why a person would like to invest in NCDs of a ‘AA+’ rated company at a lower effective yield of 9.40% to 9.70%? Personally, I would not.

But, I still believe that things are not as bad as they seem to be at this moment, and Shriram Transport Finance is a fundamentally sound company with a good management. At the same time, the interest rates offered by a private company in this issue are not attractive enough for me to put my money. So, if you are not liable to pay any tax on your total income or fall in the 10% or 20% tax bracket, or if you are a brave investor with a reasonable confidence on STFC’s business prospects and its management, then only you should invest in these NCDs for the shortest period possible, with either monthly or annual interest payment option.

Application Form of Shriram Transport Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in STFC NCDs, you can contact us at +91-9811797407

Shiv, in case of mat holding of the above, what is the tax percentage for income from this NCD

Shiv, please recommend few Tax-Free Bonds available at attractive price.

Thanks for your information.

When ‘AAA’ rated NCDs of companies like DHFL are trading at an yield of 10% or more

–> Is there any list which I can refer, to get all these NCDs with attractive yeilds, readily (may be along with NSE/BSE codes) ?

https://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Thank you!

Subscribing for comments

Will any TDS be done on cumulative NCDs? If yes, when?

No TDS on NCDs held in a demat form, whether interest is paid periodically or on maturity.

Thanks. Very useful link.

How to check status of Shriram Transport NCD subscription?

The subscription status can be checked from NSE Website , under IPO.

https://www.nseindia.com/products/content/equities/ipos/debt_ipo_current_stncdt2.htm

How to check subscription status for other issues?

How can I find subscription status after issue opens?

No update yet?

if one redeems at maturity will it be at face value or market value. Can anyone clarify. will his investment be affected by the market value?

Redemption at maturity will be at face value.

Only the secondary market purchases / sales done on NCDs before the maturity period, is subjected to market value.

I am sr citizen. If I invest Rs 1 Lakh in series I, How much monthly interest I will get?

Just around 780 rupees /month/lac invested in series 1.

Why don´t you consider Post Office Senior Citizen scheme which offers much better safety.

I have already completed full quota of 15 Lakhs>

Shiv, incase of demat holding of the above what is the tax percentage for income from this NCD. Is there a slab wise value. Amy article where this has been explained

The total interest earned in a financial year , will be clubbed to your Annual Income. The tax slab depends on your total income there after. If some one has less income, their tax liability is less. Tax you pay on NCDs depend on the tax bracket you are falling in.

One strategy could be to choose monthly interest (Option II), and divert it to a good mutual fund SIP.

As an example, 1 Lac invested in these NCDs generares guaranteed 775/ month.

Same amount if invested in a SIP over 10 period can give 2,15,000 ( assuming avg. annual returns of 15% which is highly likely).

This amount, in addition to principal 1 lac at the end of tenor Totals around 3 Lacs..

This way, one can leverage equity benift while protecting capital..

Sir, kindly send your recommendations. These are very helpful.

Sir, To have these NCDs in Demat form compulsory? Kindly suggest. Thanks.

This issue is only in DMAT form…

Sir, Is investment in Demat form compulsory? Then TSD 10% will be deducted as physical form is not possible? Kindly suggest. Thanks.

For NCDs held in demat form tax will not be deducted at source (TDS).

However, in case of NCDs held in physical form, TDS will be there from interest payable on such if such interest exceed Rs 5,000 (unless form 15 G/H is submitted) in any financial year.

This particular issue is only in DMAT form, hence no TDS.

Onus is on individual, to declare such income during annual tax filing.

Great inputs from you Vasu, thanks a lot!

So applying for these NCDs is possible? But article in one place says that Demat A/C is mandatory? Kindly suggest.

Hi Rakesh,

Yes, these NCDs are getting issued only in demat form.

But, when these NCDs get allotted, investors have the option to get them converted to physical form, in case they want to close their demat account. Once converted to physical form, TDS does get deducted.

Why one would invest in this new issue if DHFL AAA rated NCDs are available at 10-11% return?

Also other NCDs from ECL,STFL,IndiaBulls,Tata etc etc are available at very lucrative returns as some small players are selling it at high discount in secondary market.

True. But one need to be careful in placing the orders with stop loss, because last traded price may not apply due to low liquidity. The value varies for every transaction which depends on buyer offer / seller purchase demand.

Hi Yogesh,

I completely agree with you on this. Rather than investing in these new offers carrying below 10% coupon, one should invest in already listed NCDs trading at such an attractive yields.

Shiv, awaiting your recommendations/verdict on whether to subscribe/invest in this SHRIRAM TRANSPORT FINANCE NCD issue.

Thanks, Shiv.

However, it may be noted that the recent DHFL NCDs fell to a record Rs 821 each, justa couple of days ago, against the issue price of Rs 1000.

Shiv, please recommend few Tax Free Bonds available at attractive price/yield

Hi S.K.,

If the issues around NBFCs are hyped, then DHFL NCDs at 11%+ yield are attractive.

Tax-Free Bonds are yielding around 6.45% these days. I personally prefer NHB for tax-free bonds.

My major concern with NCDs – poor LIQUIDITY. Very difficult to sell.

Yes, that is a concern, especially with small private issues.