This is another post from the Suggest a Topic page, and today I’m going to look at some features of the ICICI Prudential Guaranteed Savings Insurance Plan.

The ICICI Pru Guaranteed Savings Insurance plan is an endowment life insurance plan, and it gives you life insurance cover plus a certain amount at the maturity of the plan.

This plan falls under Section 80C tax saving schemes which means the premium payable will be applicable for deduction from your taxable salary under section 80C.

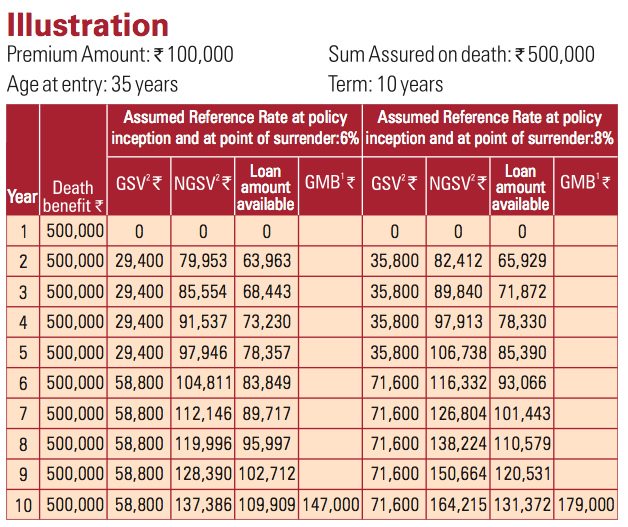

I find that the easiest way to explain how this plan works is to take an example of one option with certain figures and go through it. Let’s use the same example that they use in their benefit illustration page.

Let’s say you choose the 15 year term policy and decide on a premium of Rs. 25,000.

First thing to keep in mind is that in this option you have to pay premiums for the first 7 years, but you get the money at the time of maturity which is at the end of the 15th year. The good part about this is that your insurance cover lasts for 15 years as well.

So, how much is the insurance cover?

Insurance Cover = Annual Premium x Number of Premiums

In this case – 25,000 X 7 = Rs. 175,000.

From the sample term insurance post – you know that this is not much and you can get a cover of as much as Rs. 50 lakhs with an annual premium of Rs. 5,000 or so.

However, this is one benefit you do get – so keep that in mind.

Now, the next and slightly trickier part – how much money do you get back?

You will get your money back at the time of maturity so in this case at the end of 15 years, and they have split how much you get in three buckets.

- Premium Payment: This is simply the sum of premiums that you have paid, so your own cash, and this forms part of the guaranteed payment they talk about.

- Regular Additions: Every year, they will declare a certain percentage of the sum assured that will be added to how much you receive back from them. From the past numbers – I see that this is around the 4% mark, so in our case 4% of Rs. 1,75,000 or Rs. 7000 will be added to what you get at the maturity. This will be added throughout the term of the policy, so in our case – 7,000 x 15 = Rs. 1,05,000. This is also part of what they consider the guaranteed payment. So, the guaranteed total is Rs. 1,75,000 + Rs. 105,000 viz. Rs. 2,80,000.

- Maturity Benefit: On top of the two amounts above – they will also give you a maturity benefit, but this doesn’t fall under the guaranteed category. I think this means that they are not obliged to pay this amount, however in their illustration they have shown this to be Rs. 74,292.

If you sum up these three amounts – you will get a value of Rs. 3,54,292.

So, under the ICICI Guaranteed Savings Insurance plan, if you were to pay Rs. 25,000 for 7 years, you may get Rs. 3,54,292 according to the illustration that they have shown. Note that the only number that you can be certain of in this calculation is the premium because that’s an absolute, and they will return that.

For the Regular Additions amount – they will pay you a percentage that’s at least half of the 10 year G-Sec and so far that’s hovered around the 4% mark, and from their documentation I couldn’t find anything about the maturity benefit, but at least for this illustration they have used the same rate as the regular addition so let’s just assume that you will get that.

Now, that I have this number – I want to know at what rate should I invest my money myself to reach this target. Let’s choose a conservative number and say that I can only grow my money at 6% per year.

Now, I use the compound interest calculator at MoneyChimp and find out that if I were to invest Rs. 25,000 every year and grow it at 6% – at the end of 7 years I will have about Rs. 2,20,000.

I also used the RD calculator to see how much I will get if I were to get a recurring deposit for 7 years with Rs. 2083 (25,000 / 12) every month for 84 months (years) and that gives me about Rs. 2,16,000.

So, let’s say using these conservative numbers you invest your money for 7 years. Then take Rs. 2,20,000 and do a fixed deposit at 6% for the remaining 8 years. The same calculator shows that I will get about Rs. 3,50,000 at the end of the term.

This shows me that even this conservative interest rate of 6% earns you enough to match the returns indicated by the ICICI Prudential Guaranteed Savings Plan, and in my opinion a cover of Rs. 1,75,000 is not a big enough amount to sway your decision.

Having come this far – the last thing to see is what happens if you want to cancel the policy mid way because that seems to happen a lot.

The brochure says that if you pay the premium for at least 3 years then the policy acquires surrender value, which I take to mean that if you cancel before that time period you don’t get anything at all.

Then to calculate the surrender value – you have to see the higher of the two:

- Guaranteed Surrender Value: This is 35% of the base premiums paid minus the first year premium. So if we go back to our example and say that we want to cancel after the 4 installment. Then 35% of 1,00,000 is Rs. 35,000 and if you reduce the first premium from that then you are left with Rs. 10,000 only.

- Non Guaranteed Surrender Value: This is the present value of the paid up sum assured discounted at the gross redemption yield at the review date immediately preceding the date of surrender, plus 2% annum. Quite frankly, I don’t know how to calculate this or even what this means, I can only hope its close to the money you have already paid but that’s probably not how it is.

I’ve covered all the features that caught my eye, and tried to be as comprehensive as my understanding permitted. If you’ve come this far going through the whole article – the decision makes itself.

If you see any inaccuracies or mistakes in understanding then please let me know, and of course as usual everything that you have to say is welcome.