What is a Demat Account?

I got an email last week from someone asking about opening a demat account, and in the SBI and IDFC thread you might have noticed that there are several people who don’t have demat accounts, but will have to open one soon because nowadays you need one even to invest in these bond issues.

Let’s start with what a Demat account is, and then we can move on to the several options currently available in India.

My grandpa used to have a black briefcase where he stored all his physical share certificates.

Eventually he dematerialized all his shares and moved them to an electronic briefcase, which is how he described his Demat account, and I think this is quite apt to understand the concept.

A Demat account is like a brief case where you store your shares and bonds electronically.

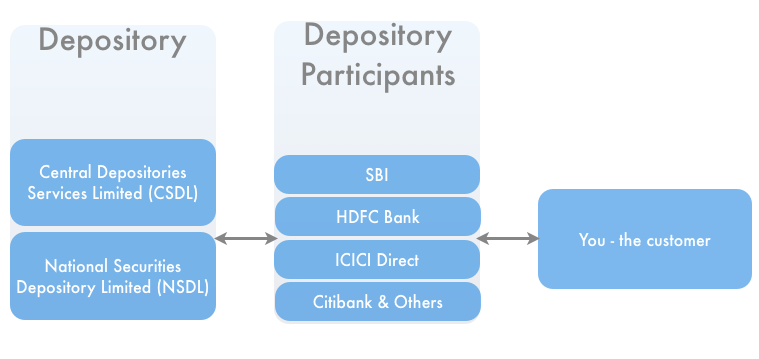

In India there are two Depositories – NSDL and CSDL – and you can think of these depositories as banks that hold your shares and bonds in electronic form.

A regular investor can’t deal with a depository directly, and you have to deal with their agents which are called Depository Participants (DPs).

There are hundreds of DPs in India, and you can open a demat account with one that suits you in terms of price and convenience. Normally, people open a Demat and a trading account with the same institution as it makes transactions cheaper, and is more convenient to get started as well.

So you could have a trading account and a DP account with SBI or ICICI Direct. It is in fact better to have trading and DP account with the same organization because in those cases you are waived off the DP transaction fees.

Effectively, you are using an agent in the form of a depository participant to avail the services of a depository which are storing your shares and bonds electronically.

There are hundreds of DPs in India, and NSDL provides a very comprehensive list of DPs along with their fees here and here (this data might not be up to date though).

Partial List of Depository Participants in India

If you clicked through the above links to the entire list of DPs then you’ll notice that there are a large number of DPs in India, so for this post I’m trying to create a list which has got some of the better known DP names with only their annual maintenance charges covered.

There are several other charges, but including all of them here will make comparison difficult. I have included a link to the source in this table so you can go check the details there. Since these prices are relatively low – you should think about convenience also, and see if your bank offers demat services, and if you can open one there.

| Name | Annual Maintenance Charge | Detailed Charges |

| SBI | Rs. 400

Rs. 350 for customers receiving statements by e-mail |

Link |

| ICICI Bank | Rs. 500

Rs. 450 for customers receiving statements by e-mail |

Link |

| HDFC Bank | Rs. 750 for less than 10 transactions

Rs. 500 for 11 – 25 transactions Rs. 300 for greater than 25 transactions |

Link |

| Citibank | Rs. 250 | Link |

| HSBC | Rs. 750 | Link |

| Sharekhan | Rs. 75 per quarter (300 annually)

Deposit of Rs. 500 |

Link |

| Axis Bank | Rs. 500 p.a. for customers authorizing Bank to debit DP charges from bank account maintained with Axis Bank, and 2,500 for others. | Link |

| Karur Vysya Bank | Rs. 250 per annum | Link |

| Sharekhan | Rs. 300 under two plans, and Rs. 500 under another | Link |

| Bank of Baroda | Rs. 350 per annum | Link |

How to open a Demat account?

Once you decide where you want to open your Demat account – contact their representatives, and they will get you started.

You will need the following documentation in order to open a Demat account, so keep this handy while contacting the DP.

Proof of Identity: This includes PAN card, driver’s license, passport, voter card etc.

Proof of Address: This includes the above documents and bank passbooks, identity cards issued by Centre or State governments etc.

Passport size photo

Pan card copy

You will need the following details while opening the demat account:

- Name of account holder

- Mailing address

- Bank account details

- Guardian details for minors

- Nomination declarations

- Standing instructions

When you contact the DP – their agent will let you know if they need any specific documentation, or if you need answers to any other specific questions.

It used to be that only equity investors cared about having a demat account, but with a lot of bond issues coming out in only demat form – I think more and more investors will need to open a demat account, and if you don’t already have one, then do think about spending this four or five hundred bucks per year to take advantage of electronic stock and bond holding.

This post should get you started on what a Demat account is, how and where you can open one, as well as the documents required to open it. Please leave a comment if you have any questions or other feedback.

Hi Rajesh,

Best wishes!

Your post is so helpful & thank you for a clear explanation.

Best regards,

Urgently I need your guidance, can I call you, if yes please provide me your contact details.

Would be grateful, if the number will be provided as soon as possible, please.

with regards

Neeru Arora

Hi Sir/ Mam, if any one interested to open demat account with low brokerage in chennai or in Tamilnadu contact me at 9500586561 / 9095421409.

please let me know anybody in kuwait to help me in opening demat and trading account?

hi,

Investing in share market is if intentionally pure investment then one can make wealth through stock market,for this it need knowledge ,time and dicsipline. a individual can do all these things but for a working common men its very difficult to do these things separately so firsly you need a platform where all these things available easily.

we at Motilal Oswal having world quality research under the team of well known person in the markets Mr. Ramdeo Aggarwal .

Online Aadhar Based Demat account opening in Just 15 Minutes.

Portfolio Management Services with 18% Return Record since Inception

Systematic Investment Plan (SIP)

All Platforms Including

Equities (Share Markets,Derivative,Nifty,Banknifty)

Commodities (Gold,Silver,Copper,Crude Oil)

Currencies (Dollar,Pound,Yen,Euro)

Contact : Farooq Ahmed 9015215476

Hi Manshu,

Demat account is used for hold securities in an electronic format. It is the access point for operating your share transactions.

Opening a demat account is the first step to online share trading.

With online share trading opening a demat account is just a click away!

Angel Broking is one of the top leading stock brokers in India. They also have a flat 20% off on opening a demat account. Here are the few most important things you neeed to check before you open a demat account http://www.angelbroking.com/demat-account/things-to-check-before-opening-a-demat-account

Anbody r interested to open demat AC in Bangalore jst call me free demo of share market provide then u can decide to open an AC call me or whatsapp same no. Is used 8892818407

Dear Sir/Madam,

Those who want to open Demat A/C or know about demat A/C Please contact or fill free of cost tomy mobile / email. & my mobile No. 8879793637.

I have a saving account in sbi in jharkhand, and now i want to open a demat account in delhi. can I open this account here, if yes please provide me the details how can i open and what i needed to submit and how much balance should be in saving and demat account.

Call me Raj my no.8892818407 i am working in Ventura securities ltdi help u which u need

Dear sir,

Please contact me for Demat/Trading Ac requirement , Can arrange in UAE,SAUDI ARABIA,QATAR ETC.

India Infoline has about 4000 business locations in about 900 cities. Apart from India we are present in 8 other countries – Singapore, Dubai, USA, UK, Switzerland, Hong Kong, Mauritius and Sri Lanka.

Regards ,Jatin

+91-9268372023

+91-9999948173(Whatsapp)

Best Private Banking Services Overall – India – Euromoney Private Banking Survey 2014

Best Wealth Management company in India – Wealth Briefing Asia Awards 2013

Fastest Growing Wealth Management Company – CNBC-TV18 Financial Advisor Awards 2013

Highest asset Growth Champion – The Wealth Forum Advisor Awards 2013

HI,

I am assistant manager in AMRAPALI AADYA TRADING CO.,anyone interested in opening a demat and trading account with AMRAPALI,which is a trusted brand in the market,please contact 9804056240