This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

It has been a very long time since Deepak suggested Manshu and me to cover a post having post-listing details of tax free bonds issued during last three financial years. Like a large number of investors, he too has been struggling to keep himself updated with different interest payment dates, scrip codes, scrip ids, ISIN numbers of these bonds, which of these bonds carry step-down feature and many such things.

This is what Deepak had to say:

Deepak October 28, 2013 at 4:28 pm

Hi Shiv, (I have given the same suggestion to Manshu. Please speak to him as well)

There are a number of tax free bonds in the market every year, for the past 3 years.

The interest rates are different for each bond in each year!

What makes it more complicated is that the interest rates are different for the same bond if you have got a direct allotment or bought it from the stock market.

Each one comes with a different date of interest payment.

With all this, it has become really difficult to track the interest payment. I also find it difficult to link the bonds to their Scrip ID and Code because of the long list of bonds in my statement.

I also don’t know in which month will I receive the interest of the bonds that I purchased last year.

Would it be possible for you to have a table with the following details as one of your articles?

Company

Year of Issue

ISIN

Scrip Id

Scrip Code

Rate of Interest (Direct Allotment)

Rate of Interest (If purchased later)

Due date of interest

And anything else that you find appropriate…

I’m certain it would benefit a lot of people.

Regards,

Deepak

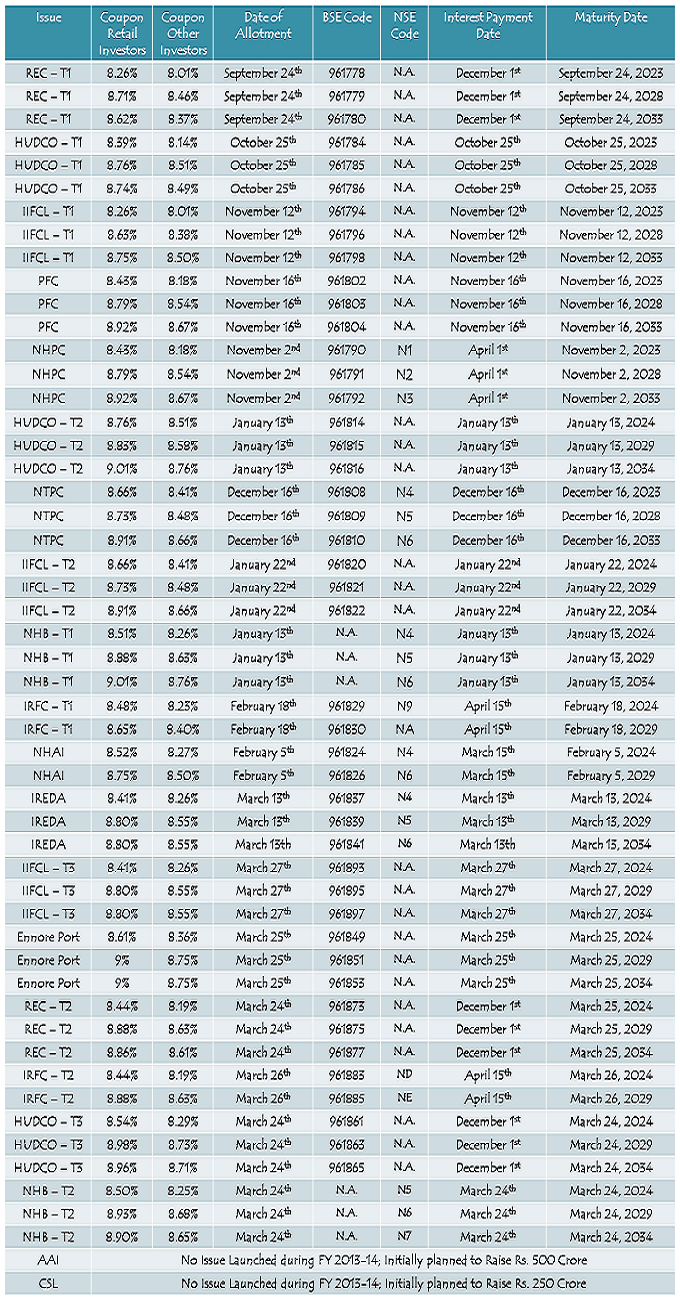

As both of us have been keeping very busy for the past many weeks, we were not getting enough time to cover this post and work on Deepak’s requirements. As I just got time to cover this post, here is the table which should help most of us to keep ourselves updated with the deemed date of allotment of these tax-free bonds, their interest payment dates, BSE codes, NSE codes, maturity dates and their respective coupon rates applicable to the retail investors as well as other investors.

Tax-Free Bonds issued during Financial Year 2013-14

(Note: Table updated on March 31, 2014)

Deepak wanted us to cover these details for all the tax free bonds issued during the past three years. But, to begin with, I have covered these details only for the current financial year i.e. FY 2013-14. I want to experiment this post with the current financial year and will cover the details of previous years’ tax-free bonds separately in two other posts. I’ll also keep updating this table as and when the remaining companies launch their respective issues and get these bonds listed on the stock exchanges.

I would also request you to share your views regarding this post and suggest some more ideas for the other two posts so that I can cover more such details about these listed bonds.

Dear Shiv,

Came to know IREDA is launching the TFB on 17-Feb with 8.41% interest (10 yr – retail). Please give us your valuable input on this bond.

Regards

Hi Debasis,

I am yet to get this news from a confirmed source, but I think the rate is lower than what investors would have liked it to be. I’ll review this issue as and when the prospectus gets filed.

Hi Manshu,

Can you please post your thoughts on the Engineers India FPO opening tomorrow?

Thank you!

Hi Sanjay,

It has been posted now, please check:

http://www.onemint.com/2014/02/06/engineers-india-limited-eil-fpo-rs-145-150-february-2014/

sorry i did not get the link of –

Tax-Free Bonds Issued During Financial Year 2012-13

Tax-Free Bonds Issued During Financial Year 2011-2012

how others on board got it ?

Got that link. Thanks

I think you’ve got the link for the tax-free bonds issued during FY 2011-12, right?

Yes, That has detail of 11-12 and 12-13 both.

Tax-Free Bonds Issued During Financial Year 2012-13

Tax-Free Bonds Issued During Financial Year 2011-2012

Oh yes, I completely forgot it. Here is the link for the interest payment dates of tax free bonds issued during FY 2011-12 and FY 2012-13.

http://www.onemint.com/2013/07/04/interest-payment-dates-of-tax-free-bonds-issued-during-fy-2011-12-2012-13/

Much needed detail at one place.

Thank a lot Shiv for this.

Can I request you to make this list much bigger by adding all previous years tax free bond detail.

Thanks

Deepak

Thanks Deepak!

I’ll do a post for the last year’s tax-free bonds quite soon.

Great Article Mr Shiv, very hard work indeed.

Can you also let us know same details for private bonds / NCD of this year..including =

muthoot

mannapuram

Edelweiss ecl finance

iihfl

srei

sriram transport

dhfl

any other ..

I divide my portfolio 75 : 25 (Govt : Private ) to get better yield on my investments .. this will be very beneficial to all of us.

Sure, I’ll try to do this post as well.

thank you . pl. include L & T , sbin , and other private companies who gives better rates then these safe TF Bonds. (possible monthly interest income)

thanks Shiv!!

You are welcome Chaitanya!

This is just I was about to search. Thanks Shiv. This is more than what I could have searched.

Great, you are welcome Kalpesh!

Thanks a lot, Shiv. This is too good!

The list with all the details, and my name & original post in the above article.

Just like Rama (above), I have completed updating my spreadsheet with these missing details. It was EXTREMELY helpful and time saving. I have also added a bookmark to this article.

P.S. I will reserve the “Thanks a TON” for the time you update the above list with the bonds of the past 2 years 😉

🙂 Sure Deepak, I’ll cover the last two years as well in a few days time.

interest payment date for rec bonds is given wrong on bse site.

link-http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=961780

Yes, you are right Puneet!

Dear Shiv, Many thanks for this compilation. I just now updated my XL sheet with this information. A labor of love from you – thanks once more for that.

Thanks a lot for your kind words Rama!

Rama

Can you please let me know how you have updated this info into an

XL sheet please?

Shiv, are there any previous years AAA issues that are giving similar or better yields (8.7 or above) if we have to buy from secondary market ?

Hi Raj,

This year’s bonds are giving higher coupon rates than the yield at which previous years’ bonds are trading. There is no bond which is yielding 9%+.

Thanks Ikjot, I am glad that people are finding it good, helpful !!

Oh thank you so much Shiv,was waiting anxiously for this. Really appreciate your hard work.

Regards

neglect my question. I saw the illustrative date in prospectus and thought it was in february.

ok

Can you check NHB interest payment date.

Can you please let us know the web site where the info given by you is available? If we know this source we need not bother you at all.

Hi Mr. Ramamurthy,

I’ve prepared this table on my own from various listing notices I have. I have no idea about any website where all this information is available at a single place.

Dear Sir,

I am able to see the interest earned in my portfolio on icicidirect.com, but the corresponding credit I am not able to see in my bank account in few case. Please guide how to verify the credit of interest in the bank account. In case of non credit of interest, how should we deal with it ?

Hi Manjunath,

You need to contact the respective Registrars for seeking the interest payments.

Shiv – This is indeed a very useful article , as is every other one from you. Great work !!!

Thank you Aditya!

Excellent Article….. will help me track my interest income and hence my expenses for the next 15 – 20 years depending on the Bonds invested

Thanks Leon!

Good article Shiv. Please also post about year 2012-2013 bonds.

Thanks Hemant! I’ll do that in a few days time.