This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

88% of India’s total labour force of 47.29 crore belongs to the unorganised sector, in which the workers do not have any formal provision of getting a regular pension payment on retirement. Moreover, due to increasing labour wages and better medical facilities, these people also face a risk of increasing longevity. So, this work force would require some kind of assured income guarantee to sustain itself in the coming years.

Launching Atal Pension Yojana (APY) from June 1, 2015

To encourage workers in the unorganised sector to voluntarily save for their retirement, the government of India will be launching a new scheme, called Atal Pension Yojana (APY), from 1st June, 2015. Finance Minister Arun Jaitley announced this scheme in his budget speech on February 28th.

This scheme will replace the UPA government’s Swavalamban Yojana – NPS Lite and will be administered by the Pension Fund Regulatory and Development Authority (PFRDA). The benefits of this scheme in terms of fixed pension will be guaranteed by the government and the government will also make contribution to these accounts on behalf of its subscribers.

Under this scheme, a subscriber would receive a minimum fixed pension of Rs. 1,000 per month and in multiples of Rs. 1,000 per month thereafter, up to a maximum of Rs. 5,000 per month, depending on the subscriber’s contribution, which itself would vary on the age of joining this scheme.

The minimum age of joining this scheme is 18 years and maximum age is 40 years. Pension payment will start at the age of 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

The Central Government would also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not income tax payers. The existing subscribers of Swavalamban Scheme would be automatically migrated to APY, unless they opt out.

Who is eligible for Atal Pension Yojana?

Any Citizen of India, aged between 18 years and 40 years, who has his/her savings bank account opened and also possesses a mobile number, would be eligible to subscribe to this scheme.

Government Funding – Indian Government would provide (i) fixed pension guarantee for the subscribers; (ii) would co-contribute 50% of the subscriber contribution or Rs. 1,000 per annum, whichever is lower, to eligible subscribers; and (iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Who is eligible for Government Co-Contribution in Atal Pension Yojana?

Subscribers of this scheme, who are not covered under any other statutory social security scheme and are not income tax payers, would be eligible for the government’s co-contribution of up to Rs. 1,000 per annum.

Social Security Schemes which are not eligible for Government Co-Contribution

- Employees’ Provident Fund (EPF) & Miscellaneous Provision Act, 1952

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security scheme

Minimum/Maximum Pension Payable – This scheme will pay a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 5,000 per month, depending on the subscriber’s own contribution per month.

Minimum/Maximum Period of Contribution – As the minimum age of joining APY is 18 years and maximum age is 40 years, minimum period of contribution by the subscriber under this scheme would be 20 years and maximum period of contribution would be 42 years.

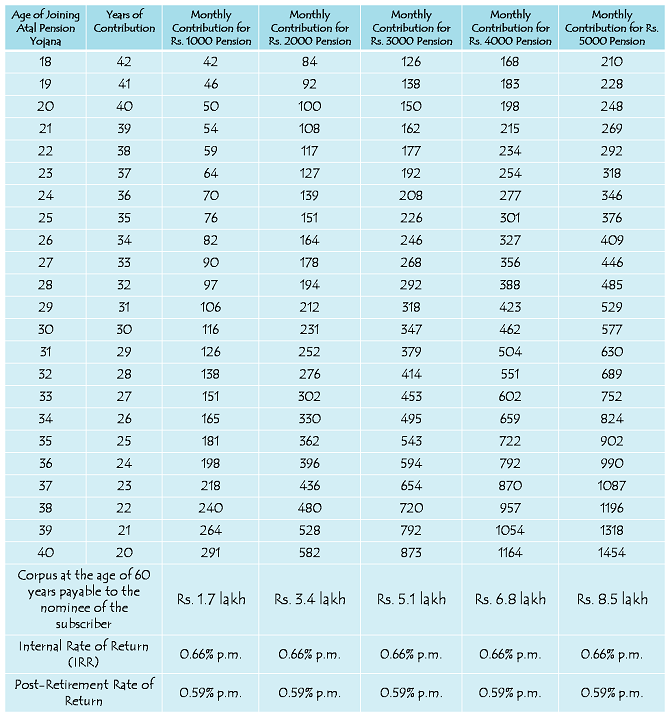

Atal Pension Yojana – Contribution Period, Contribution Levels, Fixed Monthly Pension and Return of Corpus to the Nominees of Subscribers

Internal Rate of Return (IRR) – Thanks to the government funding of Rs. 1,000 per annum per subscriber account for 5 years, your account would generate an IRR of approximately 0.66% per month or 8% per annum. This pension amount per month is fixed and the government has made it clear that if the actual returns on the pension contributions are higher than the assumed returns, such excess return will be credited to the subscribers’ accounts, resulting in enhanced pension payment to the subscribers.

Minimum Contribution – A subscriber aged 18 years will have to contribute a minimum of Rs. 42 per month in order to get Rs. 1,000 pension per month starting 60 years of age. For a 40 years old subscriber, his/her minimum contribution would be Rs. 291 per month. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Maximum Contribution – A subscriber aged 40 years will have to contribute Rs. 1,454 per month in order to get Rs. 5,000 pension per month starting 60 years of age. For a 18 years old subscriber, his/her contribution for Rs. 5,000 monthly pension would be Rs. 210 per month.

Can I increase or decrease my monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided only once in a year during the month of April.

What will happen if sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re. 1 to Rs. 10 per month as shown below:

(i) Re. 1 per month for contribution upto Rs. 100 per month

(ii) Rs. 2 per month for contribution upto Rs. 101 to 500 per month

(iii) Rs. 5 per month for contribution between Rs. 501 to 1,000 per month

(iv) Rs. 10 per month for contribution beyond Rs. 1,001 per month.

Discontinuation of payments of contribution amount shall lead to following:

After 6 months account will be frozen.

After 12 months account will be deactivated.

After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Post-Retirement Rate of Return – Considering a retirement corpus of Rs. 1.7 lakh and monthly pension of Rs. 1,000, this scheme is going to generate a return of 0.59% per month or 7.1% per annum for its subscribers. I think this return is also on a lower side.

Nomination Facility – This scheme will also provide the nomination facility to its subscribers. In case of the subscriber’s death after attaining 60 years of age, the whole corpus generating the pension income to the subscriber would be returned back to the nominee of the subscriber. In case of untimely death of the subscriber before 60 years of age, the balance would be returned back to the nominee of the subscriber.

Where to open APY Accounts – You need to approach points of presence (PoPs) and aggregators under existing Swavalamban Scheme. These agencies would enrol you through architecture of National Pension System (NPS).

Points of Presence & Aggregators

Application Form – Here you have the links to the application form for subscribing to Atal Pension Yojana – Application Form in English – Application Form in Hindi

I think a subscriber should opt for a minimum monthly contribution of around Rs. 167 or so, which would make it approximately Rs. 2,000 annual contribution. 50% of Rs. 2,000 i.e. Rs. 1,000 would be contributed by the government as well. So, the subscriber will get the maximum benefit of government funding.

As mentioned above, the scheme would start from June 1, 2015. So, interested people will have to wait till then to open an account. If you have any other query regarding this scheme, please share it here.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

atal pesion yojana

where this scheme can be opened in bank or post office please let me know i want to poened this scheme and and what are its procedure to get this scheme

Hi Abhijit,

You need to approach banks or other service providers which are registered as points of presence and aggregators for this scheme. Here is the list of all those PoPs and aggregators – https://npscra.nsdl.co.in/download/subscriber-corner/entities-in-NPS/POP-POP-SP/POP-SP%20–%20Details%20–%2017.03.2015.zip

Sir

As per the Govt.decleration under caption”GOVERNMENT FUNDING IN iii). that will engage agency to promoted the scheme of APY for collecting the customer on incentive basis, I myself like engage for the said job and also interested for getting FRANCHAISEE .So let me know where and to whom I will apply to the govt. Body for the same and also like to know the financial involvement

Thanks

With regards

Amal Biswas

Pls let me know whether its possible to withdraw partially whenever the subscriber need as a loan…

No Chiranjib, it is not allowed to withdraw any money before 60 years of age nor any loan is allowed to be taken. Money can only be withdrawn in exceptional circumstances i.e. in the event of the death of the subscriber or any terminal disease.

where this scheme can be opened in bank or post office please let me know i want to poened this scheme and and what are its procedure to get this scheme

You can open the account Preferably in Bank after 1st Jun 15. Application for APY is already published in PFRDA website under News & Events section on 10th April. You can download the application by visiting website http://pfrda.org.in, fill and keep it ready for submission on 1st Jun 2015.

Sir I want to know how I become an agent and take agency of apy

provided agency apy

contact : 0120-6999093

Dear all

Request for you all

please do’t give any amount to any agent for become an authorization, affiliation, or agent

you can apply to agreegator or Pop’s to become a agent ou affiliation

it’s has no fee.

Regards

Yasin khan

09179955550

APY ATEL PENSION YOJNA

sir,

I request to pls new AOY maigratte the older swawlamban pension for NPS joined. all PRAN account attech the all saving bank account.all indias citizen benefits long time,& than not attech saving account big loss govt. & all indians citizen.

regard,

kapil

What if I become a tax assesse after joining the APY? Kindly clarify.

Hi Ajitha,

Yours is a tricky query for me and I have no idea about it. I’ll try to figure it out.

pls let me know how can we become an agent in Post office to sell their accounts as well as Atal pension scheme………..

pls let me know how can we become an agent in L.I.C.I to sell their accounts as well as Atal pension scheme………..

Dear sir,

1) APY ke liye bhi PRAN card banana hoga kya?

2) Agar swavalamban yojna ke logoko APY me convert kiya gaya to unko APY ke antargat penssion kam milegi, kyuki swavalamban me 1000/- to 12000/- per year bharneki suvidha thi aur 1000/- anudan per yr 2017 milne wala tha. fir APY me to aisa nahi hoga.

fir ye to sarasar DHOKHA hua logoke ke sath.

kal chalke APY me bhi aap badal karenge aur kuch naya layenge.

Aisa hote raha to Govt. ki Yojna pe bharosa kis buniyad par karenge log?

3) APY me jo paisa bharna hai wo koi bhi bank deposit legi kya, ya uske liye bhi logoko bhatakna padega.

4) Aaj BJP ki sarkar hai isliye UPA ki swavalamban yojna ko APY me convert kiya ja raha hai, Agli bar Sarkar Badal Gayi to kya Firse APY badal ke koi aur penssion yojna banai jayegi kya?

Aisa Kabtak Khilwad kiya jayega logo ke sath.

Kuch To Ek Fix Karke Banao.

Confuse Nahi Confirm Yojna Banao taki logka bharosa tika rahe..

I am join new utal pension yojna

sir abi jo nps card aa rahe h. ab jo naye card aayege un card par atal pension ka naam aayega ya card hi nahi aayege

SIR , MERY DATE OF BIRTH 01-07-1975 HAI. AUR MUJE AFTER 60 YEAR 15000 RS. KI PENSION CHAHIYE… TOH PLZ BATAYE KI MUJE PER MONTH KITNA INVEST KARNA HOGA.

I am pran card holder in private sector with swavalamban active position. And my age is 41 year old .if that marged that with APY and how?

NPS swavlamban band ho jayegi kya

Sir Abi NPS swavlamban chail rahi h.

Ab naye atal ka form bharege kya wo aggregater se hi milega kya .or NPS ka 1000 to bank wale to jama hi nahi karte asi yojna ka fayda sir

hello sir

this is yasin khan now I have pop branch of nps by abhipra capital dehli

pleaes tell me that all pran card will be murged on APY or not. is it compulsory ?

and which is beneficial to people NPS Or APY ?

Yasin, not all PRAN cards will be merged to APY. Only PRANs pertaining to NPS Lite Swavalamban will be migrated and merged with APY unless subscriber doesn’t opt out. NPS regular (i.e., NPS all citizen module, NPS of govt. employees) will all remain intact without any change or migration or merger. Migration and merger applies only to NPS Lite Swavalamban accounts.

I am enrolled in NPS Lite. Here I have the freedom to deposit lumpsum or at any time as per my convenience. But from the chart of APY, I figure that it can possibly be Monthly deposits /fixed contribution. Also, I am assuming that Swawalambhan is more market oriented than APY. So, my question is that can I still voluntarily choose NPS Lite after APY comes into force, or will it become mandatory to either choose or Leave. I opened NPS Lite in December, 2015, and should be getting Govt. contributiton for three years. Is it possible that the govt. contribution will be also ceased, if I do not change to APY.

I know its too early to ask till we get full Plan of APY, but all the subscribesrs must be having this query.

Also, Can I apply for Online Facility for Swawalambhan Scheme, and do I have the right to change my PFM and my share in E,C, G Pattern as in NPS Regular or am I subjected to Govt. Plans.

I am 30 Years and I want that I continue 50 % in Equity for 10-15 years, or As and when I feel.

It is too early to assess the probabilities of APY unless complete details are spilled out by government. All NPS Lite swavalamban account holders have to wait fingers crossed till government comes out with details on terms and conditions with which it will migrate Swavalamban accounts to APY.NPS Lite module is purely/entirely off-line for subscribers as of now and you can neither login to your PRA to find SOT (statement of transaction) nor make any online contribution to account. You are entirely dependent on your aggregator (NL-CC,NL-AO & NL-OO) and you have to approach your aggregator for each and every information you seek on your account. With respect to PFM and choice of investment, it is all pre-determined by your aggregator while they were becoming aggregators to the NPS Lite module and you will not have any individual option to make choice like in normal NPS account.

SIR,

Today Morning, I had visited my Branch to Deposit for NPS Lite and to get my Statement, but the Bank Manager told that they cannot give the statement.It will be mailed to address by July-August. Or I can ask for a statement through registered mail or phone.

Can you please shed some light on what procedure to follow and how to check whether the amount deposited has been collected and track the performance for the Scheme.

PFRDA has issued a circular in the month of February to all aggregator wherein it has granted NL-CC access to CRA system. All NL-CCs are required to acquire their access to CRA system through their NL-AO or NL-OO. Once they get access, they can login to CRA system and generate SOT (i.e., statement of Transaction) to subscribers upon request. Most probably your aggregator NL-CC office (Branch where you opened your a/c) may not be aware of this. Please take a print-out of the circular either from PFRDA or NSDL website, show it to them and make a demand for the statement. They are obligated to honour your request.

Where I open APY ?

Any Bank or Post office?