This is a guest post by Priyanka Khandelwal, who is heading eBusiness vertical at MediManage, a specialist health insurance advisory service for Individuals, Families and Corporates. Know more about Medimanage’s free advisory services here.

A quote that is often attributed to the Taxman goes like this: “We have what it takes to take what you have”. And Albert Einstein – the smartest human ever – once lamented, “The hardest thing in the world to understand is the income tax”. Benjamin Franklin goes a step further and says, “In this world nothing can be said to be certain, except death and taxes”. Singer Kishore Kumar is known to have major income tax problems, he said in an interview he used his tax record files as pesticides, because the moment a rat bites on them they would die immediately!

We all share a love-hate relationship with taxes. We know it has to be paid, we know it is used for the benefit of society as a whole, we know its role in the economy, but we still are uncomfortable paying it. As our income increases, the discomfort with rising taxes also goes up. This is where tax saving investments come in. There are a plethora of schemes available, that help you save taxes. Traditionally, Insurance has been known as an important medium to save taxes. So, where does Health Insurance fit in? Let’s see.

Health Insurance and Taxes

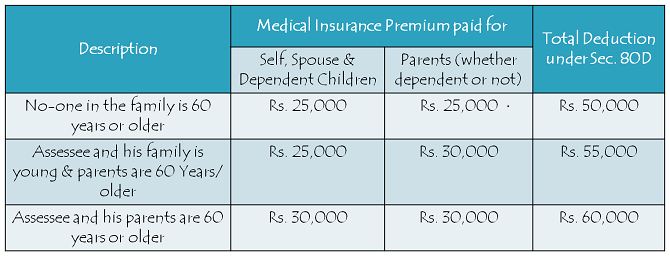

The tax exemptions available to Medical Insurance schemes is summed up in Section 80D of the Income Tax Act. For any health insurance policy bought, a policyholder can claim deduction on premium paid for up to Rs. 25,000 (according to Budget 2015). The deduction for senior citizens is Rs. 30,000.

For those very senior citizens (80 years and above) to whom health insurance is not available, any payment made on the account of medical expenditure for such people shall be allowed as a deduction under Section 80D, subject to a maximum limit of Rs. 30,000. This deduction will be given subject to the fact that any premium towards any health insurance is not being paid for such person.

However, total deduction for health insurance premium and medical expenses for parents shall be limited to Rs 30,000.

Section 80D allows for tax deduction from the total taxable income for the payment of medical insurance premium paid by an individual or a Hindu undivided Family (HUF), in any mode other than cash. This deduction is over and above the normal deduction of Rs. 1,50,000 allowed under Section 80C.

The deduction under Sec 80D is allowed for making a payment towards maintaining an insurance policy which:-

In case of an Individual:- Is for the health of the self or the spouse, dependent parents or dependent children, or

In case of HUF:- Is for any Member of the Family.

Amount of Deduction Available

The deduction is to be claimed while filing income tax returns. The deduction is the sum of the following amounts –

In case the payment of medical insurance premium is for self, spouse, dependent children or parents (dependent or not) – Rs. 25000. In case the person insured is a Senior Citizen, the deduction allowed should be Rs. 30,000.

So, the total deduction that can potentially be claimed by a family under Section 80D is as below:

Criteria for claiming deductions

The criteria for claiming deductions under Section 80D by way of health insurance premiums is as outlined below:

* The said policyholder/ tax payer is an individual or HUF (Resident or NRI)

* The insurance premium paid is in accordance with the schemes framed by General Insurance Corporation of India & approved by Central Government.

* The premium has been paid by any mode other than cash.

* It is paid out of taxable income

Proof of payment

As proof of payment, mediclaim receipt has to be furnished while claiming the deduction.

Illustration

During a financial year, a policyholder/ tax payer pays medical insurance premium as below:-

- Rs. 24,000 as premium on his own health policy &

- Rs. 29,000 as insurance policy premium on the health of his parents

In the above mentioned scenario, the assesse would be allowed a deduction of Rs. 49,000 (Rs. 24,000 + Rs. 25,000) in case neither of his parents is a senior citizen. However, if any of his parents is a senior citizen, he will be allowed a deduction of Rs. 53,000 (Rs. 24,000+ Rs. 29,000).

The importance of having a judicious Health insurance cover cannot be emphasized enough. Even if the premiums seem like too high an expense, one should also keep in mind that these premium payments not only help save lives but income tax as well! The limits of deduction by age has to be understood properly before claiming such deduction while filing for returns.

As illustrated above, Health Insurance can also be an important instrument for saving taxes, and should be an inseparable part of one’s tax planning. Albert Einstein would approve. And apparently, so would Kishore Kumar.

If you want to speak to Priyanka’s team of expert advisors for a one-to-one discussion on your requirements, post your inquiry here.

Hello Mam

Can you tell that if an application is rejected by a company, then will that company share this data with others?

thanks

I have attempted an article on personal accident insurance.

Why road safety week is the right time to draw attention to personal accident insurance?

http://www.mymoneystreets.com/2017/01/why-to-buy-personal-accident-insurance.html?m=0

Your article is informative. I have also attempted an article on personal accident insurance.

Why road safety week is the right time to draw attention to personal accident insurance?

http://www.mymoneystreets.com/2017/01/why-to-buy-personal-accident-insurance.html?m=0

Thank you for your kind response.

Perhaps one more thing may be relevant and that is, all 3 family members need to get TAX BENEFIT of the premium paid.

Hence, your advise will greatly appreciated.

Thank you.

Regarding this PREVENTIVE HEALTH CHECKUP, who is eligible, will this amount be reimbursable from Insurance company, or are we to pay it ourselves and simply show it as deduction if Rs. 5000? Please provide more information & oblige.

Dear Sir,

This amount will only be a deduction for the Tax rebate. You will have to spend the same & show the receipts. For more information, we suggest you check with a Tax planner.

Mr. S K,

u will also get reimbursement from your health insurer subject to their conditions like 3 claim free years continuous premium payments etc., yes , after lot of persuasion with them I have claimed and got it from NICL, so get it u too, if of course as per the insurer’s conditions.

hemant.

Kindly provide most competitive Health Insurance Cover Premium charges amounts for the following 3 individuals:Amount of Health Cover needed: Rs. 10L+ Additional Top-up Cover Amount: Rs. 10L) Father: Adult: date of birth:18.02.1958 (Age: 57) (Already covered)2) Mother: Adult: date of birth:10.02.1962 (Age 53) (Already covered)3) Son: Adult: date of birth:17.04.1985 (Age 30) (Already covered)4) Grandmother: Senior Citizen: date of birth: 21.02.1931(Age 84) (Not covered so far)Alternatively, please provide premiums for family floater of Rs 20L overall coverage for all the adults, if such Family Floater Policy is possible.Please also provide your claim settlement ratio figures.Lastly, I wish to port/shift from UNITED INDIA INSURANCE COMPANY whose cover will come up for renewal next year. Currently, only 3 above nuclear family members have a basic cover of Rs 5L for which we pay an premium/tax of around Rs. 26,500 + Top of Rs. 15L (Threshold Amount Rs. 5L) for which we pay an additional premium/tax of around Rs. 20,500. That is tital outho us Rs. 27,000. Will you suggest such portability considering our ages? Will any special offer/discount be available on portability? Thank you.

Dear Sir,

Please find the responses below:

• There is currently no health insurer that will be able to provide any health insurance cover for the Grandmother, as the risk is very high and the age bracket too is on the higher side.

• There are two options for the members who are aged 57, 53 and 30.

1. A floater policy for all the three members with The oriental health insurance or the New India assurance. (average premium will be around Rs.45,000 for a 10 Lacs policy)

2. Individual policies for all the members as they come in a different age bracket. (Average premium for 10 Lacs policy for the ages – 57 – Rs. 20,0000; 53 – Rs. 18,000; 30 – Rs. 7,000)

• We wouldn’t suggest portability in the above ages because the chances of something showing up in the medical test for the age bracket of 50 above is very high. Therefore, porting isn’t a good option.

• Lastly the cover can be enhanced for all the three members by taking three individual super top up policies with L&T with 5 Lacs threshold and 20 lacs sum insured.

you can contact me on expert@medimanage.com

dear sir,

isnt there an additional deduction of rs 5000 for preventive health checkup

Dear Mr. George,

As per the Section 80D of the Income Tax Act, Rs. 5000 is available for preventive Health check up.