This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

CPSE ETF issued by Reliance Mutual Fund in January this year has already given around 10% returns to its investors and is currently trading at Rs. 27.70 a unit on the stock exchanges. The issue received subscriptions worth Rs. 13,726 crore and the government garnered its targeted amount of Rs. 6,000 crore. Buoyed by these high subscription numbers, the government has decided to launch the third tranche of CPSE ETF this year itself.

The issue is getting launched for the Anchor Investors from today, March 14. For the Non-Anchor Investors, including Retail Investors, Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs), the issue will open from Wednesday, March 15. It will remain open for these four days to close on Friday, March 17. However, the issue size is much smaller at Rs. 2,500 crore, which I think would be insufficient to cater to the retail investors demand this time around.

Going by the time taken by Reliance AMC to list the units of its second tranche, I think this time it would take it even shorter time to do that. I expect the units to get allotted and listed on or before March 27.

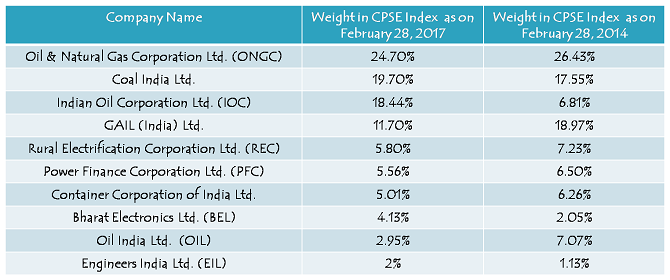

CPSE Nifty Index – It is one of the indices of the National Stock Exchange (NSE) carrying 10 public sector undertakings (PSUs) in which the central government has more than 55% stake and these companies have more than Rs. 1,000 crore in market capitalisation. All these companies are profitable and are either Maharatnas or Navratnas.

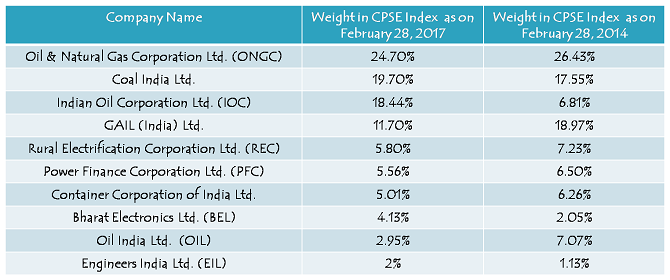

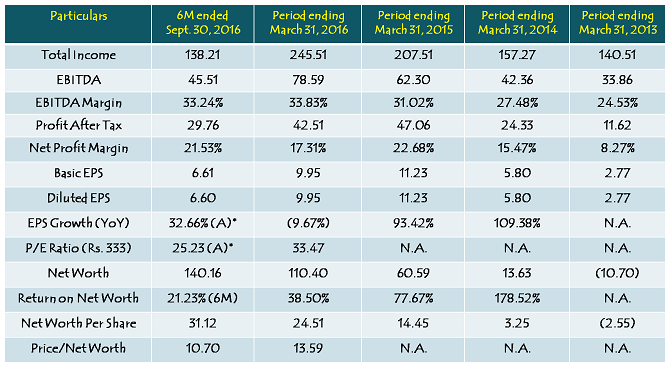

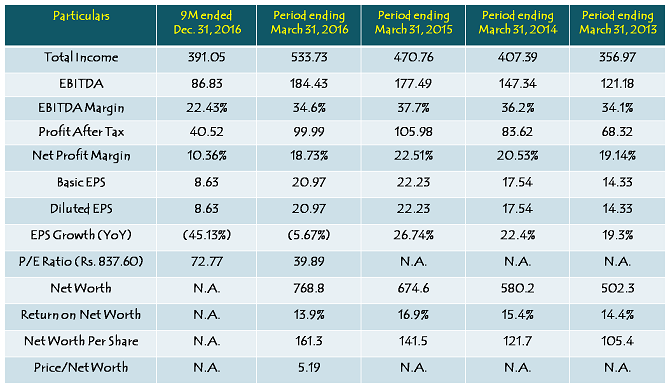

CPSE Index Composition as on February 28, 2017 & February 28, 2014

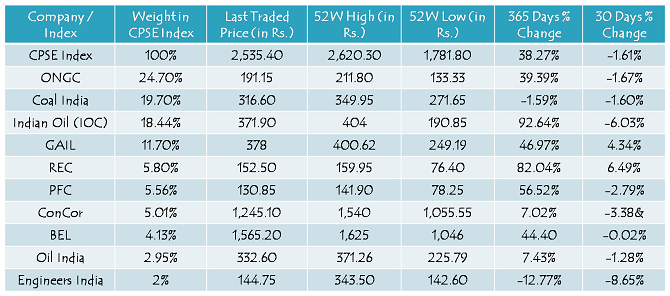

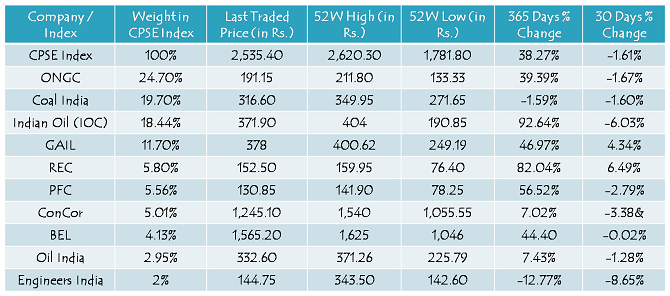

CPSE Index Composition as on February 28, 2017 & Trade Data as on March 10, 2017

CPSE ETF or Central Public Sector Enterprises Exchange Traded Fund – This ETF got launched in March 2014 by Goldman Sachs Asset Management Company and listed in April 2014 on the stock exchanges. While the retail investors got its units allotted at Rs. 17.45, it quickly touched a high of Rs. 29.82 in less than 2 months in May 2014 when there was a euphoria after Mr. Modi took charge to serve this big nation as the PM. It is currently trading at Rs. 27.70 a unit and likely to touch its new highs very soon.

Features of CPSE ETF Further Fund Offer (FFO)

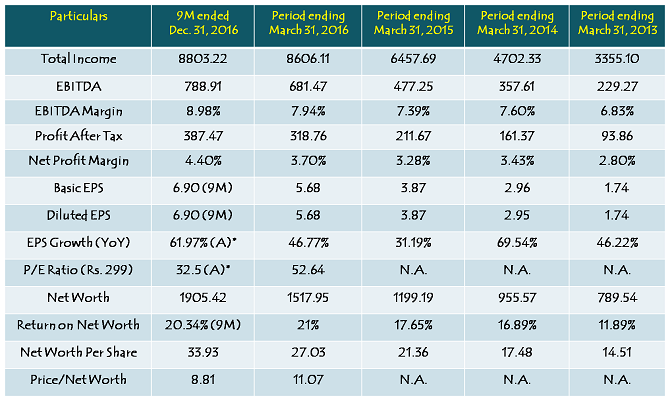

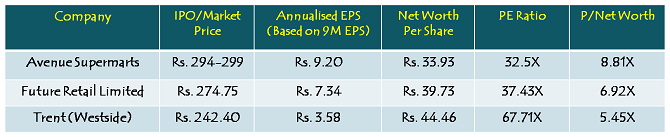

High Dividend Yield & Reasonable Valuations – All these listed CPSEs mentioned in the table above are profitable and pay relatively higher dividends on a regular basis. High dividend yield stocks have historically carried lower volatility in returns. So, you can expect a relatively stable performance from these stocks. Moreover, with years of underperformance, I think these CPSEs are set for a rerating going forward.

3.5% Discount for Investors – To attract more and more investors, the government is offering a discount of 3.5% on their investments. This 3.5% discount will be calculated on the “FFO 2 Reference Market Price” of the underlying shares of the Nifty CPSE Index and will be passed on to the CPSE ETF by the government of India.

Reference Market Price/NAV – As mentioned above, CPSE ETF is currently trading at Rs. 27.70 on the stock exchanges. This is also its reference market price or NAV. As the investors get allotment and FFO units get listed on the stock exchanges, market price of each unit of this ETF will be linked to the Nifty CPSE Index and its returns would be quite close to the returns generated by the CPSE Index.

Investment Objective – The scheme intends to generate returns that closely correspond to the total returns generated by the Nifty CPSE Index, by investing in the securities which are constituents of the Nifty CPSE Index in the same proportion as in the index. However, the performance of the scheme may differ from that of the Nifty CPSE Index due to tracking error, scheme expenses and the initial discount of 3.5%.

No Loyalty Units/Bonus in FFO 2 – Like its previous tranche, no loyalty/bonus units will be issued in this issue as well. With a reduced discount of 3.5% this time as against 5% in the previous issue, nobody could have expected of any such loyalty units.

Maximum Amount to be Raised – This ETF would target to raise Rs. 2,500 crore during this 4-day offer period. However, in case of oversubscription in the non-anchor investors category, partial allotment will be made to the investors.

Minimum/Maximum Investment Size – Individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000 and there is no upper limit on the investment amount. However, retail investors investing upto Rs. 2 lakhs will be given preference in allotment in case there is an oversubscription.

Allotment & Listing – As per the offer document, units of this ETF will get allotted within 15 days from the closing date of the issue and listing on the NSE and BSE will happen within 5 days from the date of allotment. However, I expect the allotment and listing to happen a lot sooner than these indicative times.

Demat Account Mandatory – Investors need to have a demat account to apply for CPSE ETF. Applications without relevant demat account details are liable to get rejected.

Tax Saving u/s. 80CCG – Budget 2017 has proposed to end the benefits of Rajiv Gandhi Equity Savings Scheme (or RGESS) and tax exemption u/s. 80CCG from FY 2017-18. However, as this exemption is still available for the current financial year, this could be one of the last options we have to avail this tax exemption. CPSE ETF FFO 2 is in compliance with the provisions of Rajiv Gandhi Equity Savings Scheme and thus qualifies for a tax exemption of up to Rs. 25,000 under section 80CCG.

You need to fulfill two most important conditions to avail this tax exemption – one, your gross total income should not exceed Rs. 12 lakh in the current financial year and two, you must be a first time investor in equities. As maintained earlier as well, it is quite difficult to satisfy both these conditions simultaneously. Hence, only a few people would be able to qualify for it.

Lock-In Period with Tax Exemption – Investors, who seek tax exemption u/s. 80CCG, will be subject to a lock-in period of 3 years – 1 year of fixed lock-in and 2 years of flexible lock-in. The fixed lock-in period will start from the date of your investment in the current financial year and will end on March 31st next year i.e. 2018.

The flexible lock-in period will be of two years, beginning immediately after the end of the fixed lock-in period i.e. beginning April 1, 2018 till March 31, 2020.

No Tax Benefit Availed – No Lock-In Period – Investors who do not avail any tax benefit out of this ETF, would not be subject to any lock-in period. They can sell their units whenever they want.

Entry & Exit Load – This scheme is not subject to any entry load or any exit load.

Categories of Investors & Allocation Ratio

Anchor Investors – Maximum 30% of Rs. 2,500 Crore i.e. Rs. 750 Crore will be allocated to the anchor investors.

Retail Individual Investors – After the anchor book gets over on March 14, retail individual investors are allowed to take up all of the remaining portion of this FFO i.e. Rs. 1,750 crore.

Qualified Institutional Buyers (QIBs) & Non-Institutional Investors (NIIs) – QIBs and NIIs will have nothing reserved for them in this FFO. They will be allotted units only if the subscription numbers of the retail investors and/or anchor investors fall short of their reserved quotas.

Should you invest in Reliance CPSE ETF FFO 2?

This is what I had to say in January when the second tranche of this CPSE ETF got launched:

While many factors have turned in favour of these CPSEs and in a way the CPSE ETF investors and we also have a reasonably strong government at the centre with a clear majority, I think we are yet to have desirable results for our investments. I think there is still a lot of scope of making these companies truly competent and add a significant value to their stakeholders. I strongly feel that it is not the job of the government to run many of these businesses and hence most of these companies should be sold to the private players strategically.

This government has recently taken a decision to sell its 26% stake in BEML, after which the government’s stake will come down to 28%. I think it is a great move by the government and I strongly wish to see many such decisions get taken after the upcoming elections in five states. If this government succeeds in increasing the pace of reforms in the last two years, then I think it would not be difficult for these CPSEs to generate 50-100% returns for their investors in the next 2-3 years.

Election outcome in Uttar Pradesh and Uttarakhand is likely to work as a shot in the arm for the NDA government as well as for the stock markets. I think these are one of the best times for the Modi government to take desirable actions to take this country to the next levels. With a majority in Rajya Sabha going ahead, the government will have a free hand to carry out and implement some of the long awaited economic reforms, including the land acquisition bill, bankruptcy and insolvency code, real estate bill, labour law reforms and strategic divestment in PSUs.

As mentioned above, strategic divestment in some of the CPSEs would be one of the top priorities of the government going ahead. If carried out in an efficient manner, I think we can expect high returns from these companies and CPSE ETF in the next 2-3 years.

Even with a lower discount of 3.5%, it makes sense to invest in this ETF. But, not for listing gains this time around. I think with a gap up opening of stock markets on Tuesday, our markets would enter an uncharted territory and probably an overheated zone of valuations. With such a euphoria around, investors with a shorter investment horizon could face a volatility in returns. So, I would advise investors to invest in this ETF only with a medium to long term horizon in mind.

Application Form – CPSE ETF FFO

For any further info or to invest in the CPSE ETF Further Fund Offer (FFO), you can contact us on +91-9811797407 or mail me at skukreja@investitude.co.in