This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Godrej Agrovet Limited, a 62.61% subsidiary of Godrej Industries, is all set to get listed on the stock exchanges with its initial public offer (IPO) of Rs. 1,157 crore getting opened for subscription today onwards. The IPO is a mix of fresh issue of equity shares and an offer for sale (OFS) by its promoter Godrej Industries and existing shareholder Temasek.

As always, the issue will remain open for 3 working days to close on October 6. The company has fixed its price band in the range of Rs. 450-460 a share. The offer would constitute up to 13.13% of the company’s post-offer paid-up equity share capital.

Here are some of the other salient features of this issue:

Size & Objective of the Issue – As mentioned above as well, this IPO is a combination of an offer for sale (OFS) by its promoter Godrej Industries and Temasek, and a fresh issue of shares worth approximately Rs. 292 crore. This would make it a Rs. 1,157 crore IPO at the upper end of the price band.

The company will use the money raised to repay its debt obligations availed for working capital purposes, repay its commercial paper investors and for other general corporate purposes.

Price Band – Godrej Agrovet has fixed its price band to be between Rs. 450-460 a share and the company has decided not to offer any discount to the retail investors.

No Discount for Retail Investors or Employees – The company has decided not to offer any discount to the retail investors or its employees.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservation for Employees – The company has decided to keep its shares worth Rs. 20 crore reserved exclusively for its employees.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 32 shares and in multiples of 32 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,720 at the upper end of the price band and Rs. 14,400 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 32 shares each @ Rs. 460 a share i.e. a maximum investment of Rs. 1,91,360. At Rs. 450 per share also, you can apply only for 13 lots of 32 shares, thus making it Rs. 1,87,200.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on October 6th. Its shares are expected to get listed on October 16th.

Here are some other important dates as the issue gets closed on October 6:

Finalisation of Basis of Allotment – On or about October 12, 2017

Initiation of Refunds – On or about October 13, 2017

Credit of equity shares to investors’ demat accounts – On or about October 13, 2017

Commencement of Trading on the NSE/BSE – On or about October 16, 2017

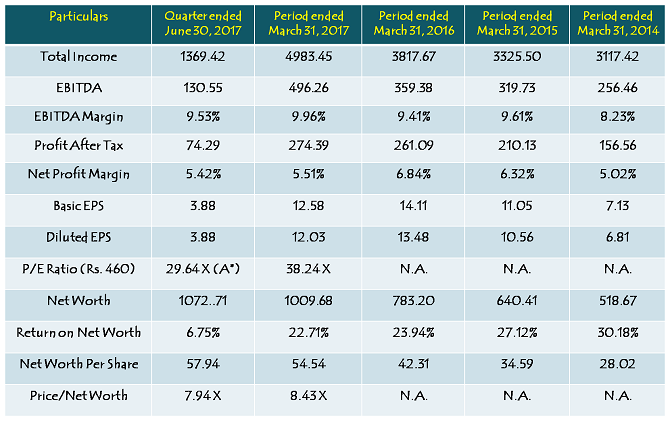

Financials of Godrej Agrovet Limited IPO

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

During the financial year 2016-17, Godrej Agrovet reported a total income of Rs. 4,983.45 crore and profit after tax (PAT) of Rs. 274.39 crore as against Rs. 3,817.67 crore and Rs. 261.09 crore in the previous financial year, thus generating a net profit margin of 5.51% in 2016-17 vs. 6.84% in the previous year. At Rs. 460 a share, the company is valued at 38 times its reported diluted EPS of Rs. 12.03 for the financial year 2016-17 and 29-30 times its estimated annualised EPS of Rs. 15.52.

Despite a decent growth in its topline, the company has not been able to improve on its profit margins. In fact, its profit margins have fallen from 6.84% in FY 2015-16 to 5.51% during FY 2016-17 and 5.42% during the first quarter of the current financial year. Moreover, at Rs. 460 a share, it is valued at a price to book value of 8 times based on its net worth of Rs. 57.94 a share as on June 30, 2017.

I think these valuations are on a higher side for me to invest in it as there is very little scope of any significant capital appreciation in the short to medium term. I think it will require the company to deliver a consistent improvement in its financial performance in order to justify such high valuations. I would avoid investing in this IPO at this juncture and wait for it to correct 20-30% to get fairly valued and justify its valuations for the long term investment.

Hi Shiva,

can be please provide details regarding upcoming 3 IPOs

MAS Financial Services,

Indian Energy E,

General Insurance.

In advance thanks,

Awaiting your reply.

How to invest. Help me sir

@Dollar Advisory

Day 1 (October 4) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.27 times

Category II – Non Institutional Investors (NIIs) – 0.10 times

Category III – Retail Individual Investors (RIIs) – 0.87 times

Category IV – Employees – 0.07 times

Total Subscription – 0.52 times

I read lot of other analysts recommendation but only believe in Shiv’s unbiased advice.

Thanks Ishan!

Again Shiv you save us money:) I dont read any other analysts recommendations yours are the best.Godrej overall at present doesn’t build confidence as a company.

Thanks Harinee for your kind words! 🙂

I don’t have any problem with the management. They are not as aggressive as one would like them to be, but they are not cheats. So, I’m fine with that. However, it is the valuations, low margins and inconsistent growth which is bothering me in this case.

Yes that is true, many vendors are suggesting to apply this IPO, so now I’m also wondering how they were suggesting to apply.