This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at shivskukreja@gmail.com

Manappuram Finance Limited is going to launch its public issue of secured non-convertible debentures (NCDs) from today, October 24, 2018. The company plans to raise Rs. 1,000 crore from this issue, including the green shoe option of Rs. 800 crore.

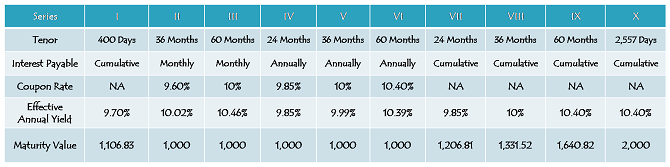

These NCDs will carry coupon rates in the range of 9.60% to 10.40%, resulting in an effective yield of 9.70% to 10.46% for the investors. The issue is scheduled to close on November 24, unless the company is able to raise the desired amount before that and decides to close the issue prematurely.

Before we take a decision whether to invest in this issue or not, let us first check the salient features of this issue.

Size & Objective of the Issue – Base size of the issue is Rs. 200 crore, with an option to retain oversubscription of an additional Rs. 800 crore, making the total issue size to be Rs. 1,000 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 10.40% p.a. for a period of 60 months, 10% p.a. for 36 months and 9.85% p.a. for 24 months. These rates would be applicable for annual interest payment and cumulative interest options only. Monthly interest payment option is available only with 36 months and 60 months tenors, and coupon rates for these periods would be 9.60% p.a. and 10% p.a. respectively.

There are two more options – one is for 400 days offering 9.70% effective yield and the other offers to double your money in 2,557 days, i.e. approximately 7 years, giving an effective yield of 10.40%.

ASBA Mandatory – Like IPOs, SEBI has made ASBA mandatory to apply for these debt issues also effective October 1. So, no cheque would be required to apply for these NCDs.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AA’ and ‘AA+’ respectively with a ‘Stable’ outlook. Moreover, these NCDs are ‘Secured’ in nature.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 100 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 100 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 300 crore

Category IV – Resident Indian Individuals including HUFs – 50% of the issue is reserved i.e. Rs. 500 crore

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

Listing, Premature Withdrawal – These NCDs are proposed to get listed on the Bombay Stock Exchange (BSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these NCDs on the stock exchange.

Demat A/c. Mandatory – Demat account is mandatory to invest in these NCDs as the company is not providing the option to apply for these NCDs in physical or certificate form.

No TDS in Demat Form – Interest income with such NCDs is taxable in the hands of the investors and you will have to pay tax on the interest income while filing your income tax return. Moreover, as demat account is mandatory to invest in this issue, no TDS would get deducted from your interest income on NCDs held in demat form.

But, in case you decide to close your demat account and keep these NCDs in a physical form, then the company will deduct TDS on the interest payable on the interest payment date. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000.

Minimum Investment Size – The company has fixed Rs. 10,000 as the minimum amount to invest in this issue. So, if you want to invest in this issue, you need to apply for a minimum of ten NCDs worth Rs. 1,000 each.

Application Form of Manappuram Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Manappuram NCDs, you can contact us at +91-9811797407

From Tax perspective, these are not advisable as Investors will have to pay tax on the interest income so if you are in 30% bracket, the net interest in your hands would be only 7.28 %. It is very important to do proper tax planning to reduce tax outflow and keep more income in your hands.

Name: M N and Associates Chartered Accountant CA

Address: 100 Divya Gunjan, Bandar Pakhadi Road, Kandivali West, Mumbai, Maharashtra 400067

Phone: 9082514106

Email: mitesh@mnpartners.in

We Mumbai CA specialise in TDS, Income Tax Filing, Tax Planning, HUF, NRI Taxes, TDS Sale of Property & Financial Advisor

Thank you for sharing your information

How many previous NCD issues has this company had?

Thank you for the article. I have been reading your articles and they are really very helpful information for the Malappuram-finance. Thanks for the sharing.

Kindly suggest, what is the subscription status for Mannapuram NCDs. A link to check it will help.

no update yet on whether to subscribe or not

Kindly send me link to check subscription status. Thanks.

whats the latest subscription status in Manappuram finance NCD

Thank you so much for the sharing article. I have been reading your articles and they are really very helpful for me.

Hello:

I see that the stock price of the company has taken a severe beating since past six months. Any views as to how the consistent fall in stock price of this company relates to or impacts the profitability of this debt issue? Aren’t we simply bailing out the shareholders and the management by providing them with this extra capital to boost their balance sheet?

Thanks.

Day 1 (October 24) Subscription Figures:

Category I – Nil as against Rs. 100 crore reserved – 0 times

Category II – Rs. 0.30 crore as against Rs. 100 crore reserved – 0.003 times

Category III – Rs. 0.23 crore as against Rs. 300 crore reserved – 0.0008 times

Category IV – Rs. 6.39 crore as against Rs. Rs. 500 crore reserved – 0.013 times

Total Subscription – Rs. 6.92 crore as against total issue size of Rs. 1,000 crore – 0.007 times

sir, what is ur advice about investing in this issue?

Mannapuram is rumoured to have been bankrupt.. please exercise caution..

Mannapuram is rumoured to have been bankrupt… Suggest to excercise cautious while applying for this NCD Issue

How are these NCDs secured? Against assets including the gold security/ deposits they take while issuing loans.

Also, does one get any indexation benefit on capital gains for cumulative options of 3 plus years?

Subscribing to comments

sir, what is ur advice about investing in this issue?

Will share my view soon.

Sir, Is closing date not declared?

Mentioned in the post as Nov 24th unless they get the required amount before this date and pre-close.

Thanks Vikash for your inputs.

Sir,

Are they give any extra%interest for senior citizens.What is your suggestion for this investment.Kindly guide us and oblige.

With kind regards.

natarajan

Hi Natarajan,

There is nothing extra for senior citizens. It is same for all the investors.

I’ll update the post above with my views about this issue by tomorrow.