Tata Motors Fixed Deposit Plan has aroused a lot of investor interest and people have been quite interested in getting more information about this FD plan.

One of the things that I had missed about the Tata Motors FD plan when I wrote about it earlier was the increased rate of interest you get, if you are a shareholder.

Additional 0.25% for Shareholders, Employees and Senior Citizens

You get an additional 0.25% if you fall under the following three categories:

- You are the company’s shareholder

- You are an employee of the company or its subsidiary

- You are a senior citizen. (Over 60 years old)

You just get an additional 0.25%, even if you fall under more than one category. So, if you are a 61 year old employee who happens to be a shareholder of Tata Motors — you still only get an additional 0.25%.

Since, you can’t age overnight and it’s not that easy to become a Tata Motors employee — you could buy a few Tata Motors shares; become a shareholder and increase the rate of interest by 0.25%.

What If I Break the FD?

If you invest in the Tata FD and have to break the FD or withdraw your money prematurely — the investment form says that the withdrawals will be allowed on the sole discretion of the company.

The form goes on to say that there will be a reduction in the interest rate to the extent permissible by the Companies (Acceptance of Deposits) Rules, 1975. And finally, that Tata Motors will deduct the brokerage they paid at the time of issuing the debt.

Here is what the form says:

Premature withdrawal will be permissible at the sole discretion of the Company. All such prematured refunds shall be subject to such terms, including reduction in the rate of interest as prescribed in the Companies (Acceptance of Deposits) Rules, 1975, as applicable. Further any Brokerage paid by the Company at the time of acceptance/renewal, will also be deducted on any premature repayment .

I looked up the Companies (Acceptance of Deposits) Rules, 1975, and it says that if someone breaks a fixed deposit after six months (at least) — the company issuing the fixed deposit can reduce the rate of interest by up to 1%.

So, there are three things you should remember, in case you break the fixed deposit plan before its maturity:

- Tata Motors holds the sole discretion to allow you to withdraw your funds.

- They will deduct the brokerage they had to pay for setting up the fixed deposit.

- They may reduce the rate of interest by up to 1%, if you have at least completed six months with the fixed deposit plan.

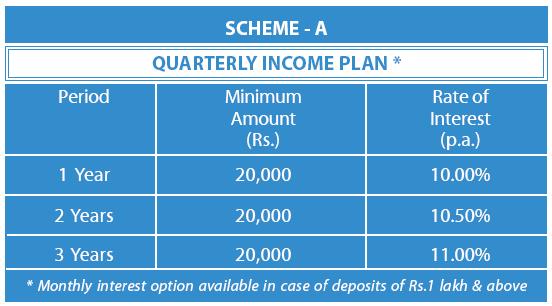

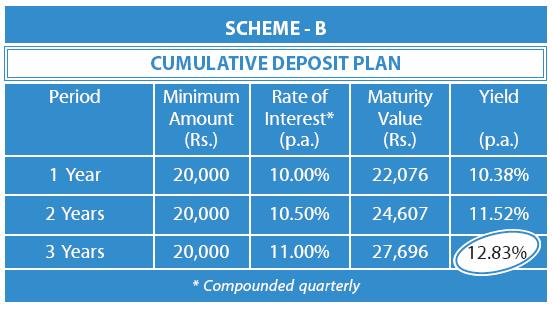

These were two questions that I found interesting about this scheme and was interested to find out what the form said about them. You can read the basic details about the plan in a post that I wrote earlier and can be found here.

This site has regular features about IPOs, FDs and other investment ideas, if you would like to get that content by email, please click here.Â