The dollar has risen rapidly in the past few weeks. In fact it has risen constantly in the wake of the global financial crisis. There are two major reasons for the climb of the dollar these past few weeks:

- Deleveraging: As banks and hedge-funds deleverage their positions around the globe, the demand for dollars go up. The hedge funds that bought assets in emerging economies, are selling these assets and demanding dollars for them. This creates a massive demand for the dollar and helps push the price of the dollar upwards.

- Flight to safety: The dollar continues to be the currency of choice for the entire world. It is still considered to be one of the safest investments that exist today. That is the reason why a lot of institutional investors and even governments bought into the US dollar and the US Government T – Bills. This flight of safety created a demand for the dollar.

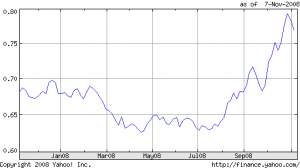

These two factors alone, created such conditions that the price of the dollar kept rising steadily. A look at the five year chart of US Dollar vs Euro, shows how sudden the spike of the dollar has been.

Will this rise continue?

The main factors that have led to the rise of the dollar are short-term in nature and have nothing to do with the fundamental strength of the US Economy (the underlying economy of the dollar).

This means that when hedge funds have sufficiently deleveraged and the flight to safety has stopped, the rise of the dollar will also halt.

Will the dollar collapse?

The value of the dollar in real-terms is declining due to two factors.

- Low interest rates: The Fed has lowered the interest rates to as low as 1%. Low interest rates mean that cheap money is available in the economy. That means that price of “money” itself goes down and inflation sets in the economy. The current financial crisis has ensured that the interest rates remain artificially low for quite a while and therefore the real value of money will go down with that. This factor will push down the dollar in the days to come.

- Increased US Trade Deficit: The US runs a pretty big trade deficit that goes to finance its consumption. A trade deficit is a good thing for a growing economy if it helps it to install factories and other agents of production. However when it goes towards financing consumption, it can be disastrous. The US has not shown any sign of curbing down consumer spending and investing in assets. At about 10 trillion dollars the US National Debt is already quite a humongous figure. If spending does not go down in the years to come, the interest payment on this debt will gnaw at the economy and weaken it quite a bit.

These two factors make me feel that the value of US Dollar is going to go down substantially in the years to come when we compare it to the highs that it stands at, today.

The other side of the story is that most emerging and developed nations hold their forex reserves in US Dollars. Japan has over a trillion US Dollars, China about half a trillion and India, one quarter of a trillion. This is representative of the forex reserves of the whole world. Therefore it is in the interest of the world at large to prop up the dollar and any time the dollar takes a big beating, these economies will come to rescue it.

The emerging economies have also grown quickly based on export earnings and a loss of those earnings will mean large scale joblessness.

All these factors make the dollar collapse a little hard to imagine.

Hey there I’ve just posted a little something similar related to Will the dollar collapse in the next four years? on my web log this morning. How smaller is the internet 🙂

Hello, love the blog, but can’t figure out how to pull your RSS feed. Did you have one?