Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

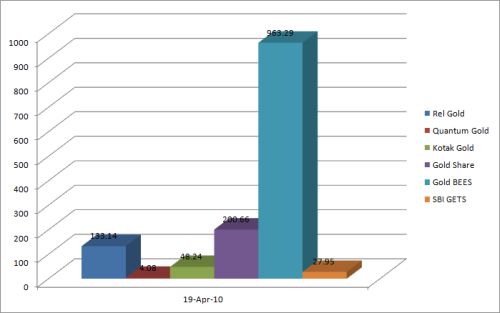

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

heloo,

i want to know that is there iny risk in gold etf.

how can i invest and what is the profit.

Hi Aditya, I just realized that I wrote an entire post responding to your comment but didn’t actually leave a link here, so here goes:

http://www.onemint.com/2010/09/21/is-there-any-risk-in-a-gold-etf/

I’ve invested a small amount in Gold ETF. I just want to know what is goldbees and quantum gold. And also want to know the growth of it. Wher will I check these informations ?

Goldbees and Quantum Gold, both are kinds of Gold ETFs. The unit considered in Quantum is approx. half-gram while in Goldbees the unit considered is one gram and hence Quantum’s NAV is roughly half of Goldbees NAV. Like today on the website of moneycontrol, NAV of Goldbees is Rs.1869 while NAV of Quantum Gold is Rs.927 on NSE.

Hi I want to invest in Gold ETF, what are the condition in investing in.

If I buy ETF through my trading account, do I have to pay the service charges to my broker as well? So, for an Indiabulls account , I pay 1% other than the fund house’s expenses, right?

Right.

I would like to open gold etf account any body help me, and give me some good broker details,

I would like to undergo free training. Please let me know what next ?

What are the expense for investing in Gold Etf? Are there any exit expenses or any recurring expenses annually?

Why there are different entry expenses for gold etf by different companies?

I want to invest in gold but not inerested in purchasing a phicical gold…..

then which gold market can i invest????????????

your option is to buy E-Gold and E-Silver which are traded on NSEL.

can iI convert Gold Etfs into physical gold ?

No, I don’t think that’s possible.

No as ETF is not Gold itself. Its a kind of share which you buy. Don’t get confused it with the Gold certificate you use to buy from Banks.

Does ETF value also depends on other aspects? or is it totally depended on the Gold rate.

It depends on other factors like how much expenses the fund is charging investors (the lower the better), and the tracking error, which is how efficiently the fund is tracking gold prices.

Which are the 2 best performing Gold ETFs now? is it a good idea to invest in Gold ETFs by SIP plans? Is it possible under Indian system?

There is no direct way of investing in ETFs through a SIP. This post tells you about some indirect ways in which you can set up a gold ETF SIP.

I would like to invest in Gold ETF. But i am very new to this. Can i do the investment with my existing trading account or i have to open a new one. Also want to know that Gold ETF rate is exactly the 10% of GOLD market price. Please revert me on this

Yes, you can invest using your existing trading account – there is no need to open a new account just for this. One ETF unit often represents 1 gram of gold, and that’s why you see the price being about a tenth of the quoted rate which is quoted for 10 grams.

Manshu, that means considering expense ratios and other administrative charges of ETFs direct investment in gold is always give more returns, if we keep aside worry of storing gold.

Sarika,

when you sell physical gold to goldsmith they deduct a charge of 10-20% of gold value. That is a much bigger amount in comparison to return. that means if you earned 20 % gain in a year and sell that gold after two year then you will get only 15.2 % return if you sell it to goldsmith. Further, there is always a chances of less pure gold. You can purchase gold coins from bank and post office. but you can not sell them back your gold coin purchased. Thus i think gold etf is much liquid and safe investment.

Why to invest in Gold ETF when i can directly buy gold from goldsmith ?

What is the benifit of Gold ETF?

If you are able to buy and sell gold coins directly from the goldsmith, and get a good rate, then that is a good option for you. Some people prefer the convenience of electronic trading and like the fact that they don’t have to worry about storing gold, so they buy it in the form of ETFs.

one factor that we must be aware of while buying from a goldsmith is the purity of the gold. gold in form of jewelery bought from goldsmith WITHOUT the BIS Hallmark certification is most likely to be below the carat you are paying for. also there will be a 11-15% “making charge” that is a straight loss when you want to liquify the gold jewelery.

in all, a sure cost of 11-15% of the cost of gold and also the cost of holding physical gold adds to the attractiveness of Gold ETFs.

Interested in goldETF.Is there anyone who could helep me?I am from Chandigarh.

DEAR SIR,

I WANT TO KNOW ‘MARKET CODE’ OF GOLD ETFS IN BSE & NSE BOTH. YESTERDAY I TAKEN PRICE OF GOLD ETF IT WAS SHOWING ABOUT 1995/- PER UNIT APPROX HOWEVER MCX GOLD WAS SHOWING VERY HIGHTER RATE. WHY THERE IS MAJOR DIFFERENCE.

THANKS

Here are the codes of ETFs on NSE

* GOLDBEES

* GOLDSHARE

* KOTAKGOLD

* RELGOLD

* QUANTUMGOLD

* SBIGETS

* RELIGAREGOLD

* HDFCMFGETF

* IPGETF

* Axis Gold ETF

You can search these tickers on BSE’s website, and get the tickers there as well.

I think you were looking at a future contract on MCX Gold which is about 10 grams whereas most of these ETFs represent just one gram of gold, and that might be the cause of the difference. Can you tell me what were you looking at specifically?

Hi Sir,

i am new to this ETF market, i have an online demat account, i would like to invest in silver , please suggest how can i buy some silver (invest in silver) and sell it when i want to sell.

i came to know that there are no Silver ETF in india,

can i do trading on any of the foreign exchanges using indian online Demat account ?please advise

regards

vamsi

Vamsi here is a post that tells you about silver alternatives in India:

http://www.onemint.com/2010/11/16/silver-etf-alternatives-in-india/

Dear Vamsi,

Yes there is no Silver ETF as of now. You can buy E-Gold and E-Silver which is safe and secured and better than even holding of Physical metal. You can buy and sell anytime and the rates are available online on NSEL site.

You can buy through us if you want.

update of all getf funds

Hi,

I am new to the world of ETFs and I was looking to invest in the best Gold ETF when I came across this useful post. As you say Goldbees is best having lowest expense ratio of 1% and Quantum Gold the second best, having expense ratio of 1.25%. I notice while Gold ETF has the NAV of Rs.1800 + , Quantum Gold has the NAV of Rs. 900+. Interestingly, % returns from both the funds are more or less the same. So, shouldn’t I choose Quantum over Goldbees as former is available at half the price of the latter thereby being more affordable? However, I also observe that volume traded in Quantum Gold is much less than that of Goldbees. I hope to hear from you. Thanks!

@Chhavi: The unit considered in Quantum is approx. half-gram while in Goldbees its 1 gm- hence Quantum’s NAV is half of Goldbees …

Dear Kiran,

Thanks for clearing my doubt. That was very helpful indeed. Thanks again!

hai kiran i seen your reply it is nice suggestion, now i am new to invest gold etf funds i am planing to invest monthly 5000 in gold etf few are recomanded SBI ETF this is beter than Goldbees pl give me reply

Gold and silver jewelry. Maybe a good investment too. There are many other items for sale on my site. If you get your own site, sign up throught my email and get double enhancement credit.

s i like to invest.

You can invest in an ETF just like you do in a stock. Do you have an account with a broker?