I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

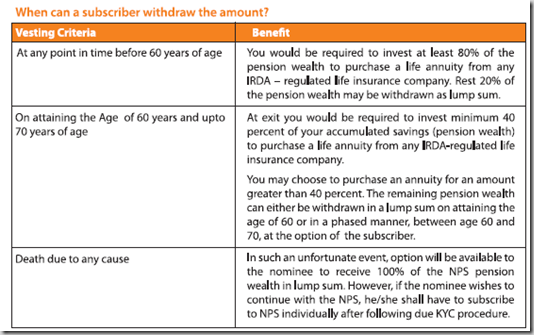

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

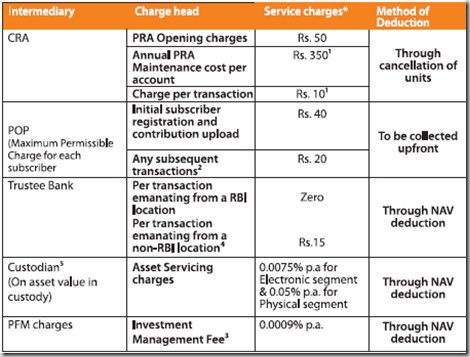

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

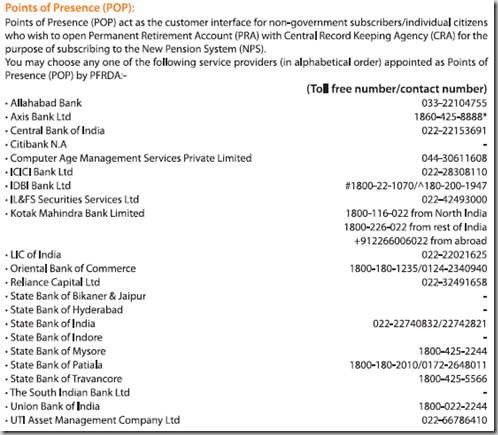

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

dear sir,

i just want to know that, i am a Pran card holder…

i just wanted to close the A/c. is it possible??? What are the charges ???

Can i withdraw my Tier-I A/C.

so, need help…

Sorry, there’s no provision to close the account in between.

The employer’s contribution towards NPS was supposed to be non-taxable from 1st Apr 2012 as was announced in the last budget. See link below:

http://articles.economictimes.indiatimes.com/2011-03-07/news/28665804_1_deduction-pension-scheme-nps

I don’t see any mention of it in this budget. Is this proposal still on or has been given a burial ?!

I didn’t see anything either so I guess they didn’t make it non taxable. Will keep you posted if I read otherwise.

My company has given us an option for NPS now.

So this proposal is still on. Probably, your other readers can suggest the same in their companies to reduce the taxable income.

It is true. U/S 80CCD(2) it is applicable wef 1st april 2012.

Thus from this year one may negotiate on the salary break up with employer and reduce the tax outgo.

Nice article Manshu!!!

Am making a presentation on NPS … this has helped a lot!!

Thanks and keep up the good work!!!

Warm Regards,

Schneider

Awesome to hear man – thanks for leaving the comment!

Dear all

I am a pran account holder, which i got when i was working in central govt. Recently I have resigned that job, joined in state govt job. I want to know whether i can transfer or cancel my pran number.I have not changed my job through proper channel.Could some one guide in getting out of that?

dear sreenu

mere sath bhi apki jesi problem h , so plz.. agar aap ko is k bare m kuch jankari h to meri help kare

I don’t understand , what you meant by proper channel. But regarding NPS, PRAN remains same always and does not change with the change of employer. As many state governments also opts for NPS, then i think you just have to inform your accounts department with your current PRAN, and everything else will be taken care by them.

Can Iopen an NPS ac..with the local Post-Office too?Are the PO..not authorised as was earlier claimed?

NPS is a excellent scheme but what about after maturity??

today LIC is offering pathetic pretax 7% (immidiate annuity jevan akshay)and HDFC 6.5% in immkidiate annuity their annuity plans

although NPS returns may be good later on it just SUCKS your money in sky

and one is left with pathetic returns

THINK TWICE

Dear Sir,

This is inform you that I G Thanigai Selvam have New Pension Scheme account through your service provider(Alankit Assaingnment) at M/s JSW, Bellary. But at present i was resigned the job & Joined TATA Consulting Engineers Ltd. at Jamshedpur. I want to continue the New Pension Scheme so please suggest to me what to do for continue the same without any disturbance. So I kindly request to you, provide any Assignment company address or Contact details for the same or tell me other facilities.

My PRAN NO: 111001169571

You don’t have to do anyting specific, just keep on contributing to the same account. It doesn’t need any kind of transfer and thus operative with the same PRAN all over the country.

hi

i couldn’t get my pran card… employer send me via post but it couldn’t reach at me.. how can i get another one..

Raise the query with employer or call up CRA call centre at 1800222080 , alternatively if you have IPIN allotted you may register your grievance at https://cra-nsdl.com

Sir,

Which one very beneficial NPS lite or NPS regular?

Rupjyoti…NPS lite is meant for economically disadvantage section of society and is another effort by government on the way of financial inclusion. NPS lite can be subscribed through a specific entities appointed by government termed as aggregators.

So NPS lite is not available to all

If i take VRS when can i take what is the minmium

Mere Gross salary income me government contribution jo mere contribution ke baraabar hota hai, add hoga ya nahi? Agar add hoga to uska deduction milega ya nahi? Agar milega to kis section ke tahat milega?

Hi I am state govt.employee from 2006. If i want quit the job than will i get the full amount that i have saved till now or what ?

I think you won’t get anything till retirement but better make sure by talking to someone at your office who looks after these things.

If i take VRS when can i take

Sir/madam

I am central govt.employee and I am regularly paying my own contribution for NPS from 2005.I want to withdraw some refundable amount for one year from this account .Please tell me can I get it easily.

how do applied for pran kit? please details for the new pension schme , then how do you calculation of (% how much percentage)new pension schme ? which is the invested of share markat?

hi,

can govt employees invest in NPS. if they can invset which tier ?

Yes, both.

my age 33. If i pay 1000 Rs per month how much i can get at my age of 60?

Unfortunately there are a lot of ifs and buts in that and no straight answer can be given because first of all you don’t know at what rate the money will grow, and secondly you don’t know what annuity rate you will get later on.

Where should I contact to get an NPS scheme in Delhi?

Dear

PRAN Account open hone per mujhe PRAN Card mila tha jiski sahayta se main apni PRAN account mein login karke invested amount ke bare mein jankari le sakta hun.

Abhi PRAN ka login password bhul gaya hun. mujhe kya karna chahiye ke mera password reset kiya ja sake?

Another Query:

Tier II type ke PRAN amount withdraw kab kar sakte hain aur at that time required documents kya hogi?

Sir,

NPS scheme me retaiment ke bad kitne persent amount cash milta hai or kitne persent amount ki pension banti hai. Kiya NPS scheme me loan ki suvidh hai ?

i am central govt servant my account maintain cda nevy mumbai.

appoinment april-01-2004

no pran card and my account details not coming

my officers told coming coming any time told

please my details reply.

Sir,

kiya koyi unemployed log NPS kar sakte hain ? Or iska details kindly sort me batayeinge.

Jishu – A/C to open kar sakte hai but dusre tarikey hai save karne ke jaise RD jama karna ya FD karana jisme zyada control rahega paisey par.

Please give me some details as to (i) Partial withdrawals after some years; (ii) Death of the subscriber before attaining the age of 60 years.

I’m afraid I don’t have info on that. There was someone who recently faced problems in withdrawing money from NPS, and after that comment I’ve been a bit circumspect on the process of practically getting your money back from the NPS scheme.