I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

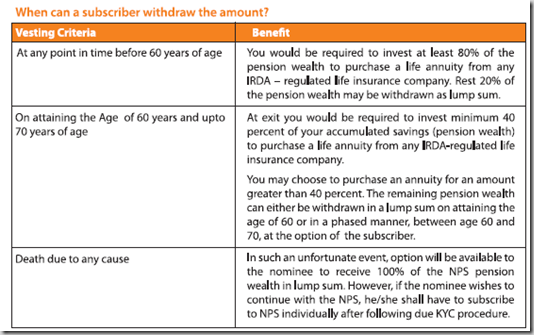

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

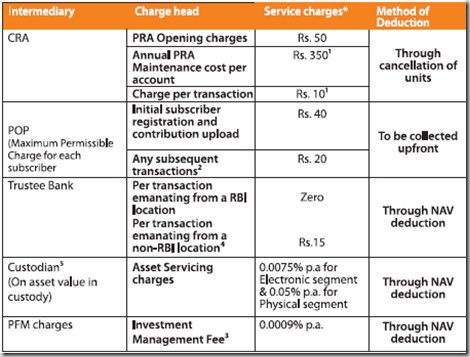

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

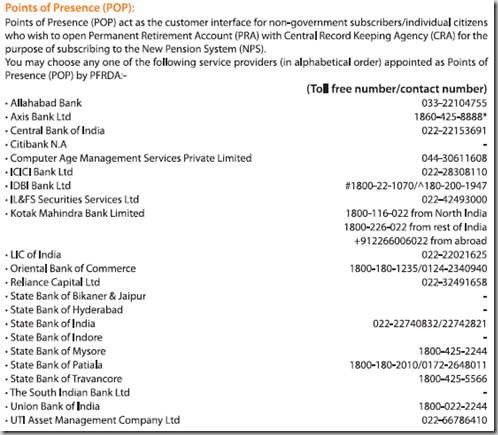

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

if we dont pay money for 2 years what will happen??????????

who is managing the India Cricket team pension fund? may i have their contact details or website

Interesting question – I don’t think there is a pension fund for Indian cricketers, never heard or read such a thing.

ASSUME THAT AM WORKING{CURRENTLY WORKING} BUT DUE TO SOME CIRCUMSTANCES I LEAVE THE JOB AND START DOING A BUSINESS OR ANY WORK FOR THE SAKE OF MY LIVING,THEN WOULD THIS EFFECT MY NPS.

i am a central government employee. joint in service on 8/9/2008. i have already PRAN. how can activate tire 2. is it individual risk or government process.

Yes, you will have to open it yourself. Check with wherever you have the account and request them to open it for you Sabiq.

If you loose your Job or change your Job can this scheme still be continued ??

Is it required that only the employer deposits the money , incase we are not working can we continue the same ?

Yes, you can continue it Shashidhar

Hi Manshu, i have some question regarding NPS

1- can i access nps a/c online?

2- any tax benefits for tire 1 and tire 2 a/c?

3- any difference between tire 1 and tire 2 a/c , regarding charges and returns?

4- will charges increse in future or its constant for any amount invested?

5- in nps has compounding rate of return?

6-maturity benefit taxable or not ?

7- in tire 2 a/c what nominee will get incase of death?

8- what documents will required for nps a/c opening?

kindly reply as soon as possiable

You will find answers to all these questions in the article or in the 250 odd comments already present in the post. It has been said all too often.

to check you account status online go to https://cra-nsdl.com/CRA/

Sir,

i want to ask about the implication of this payment on my Income Tax.

And also if my employer contribute to my National Pension Scheme, what is the exemption i will get and is the amount paid by him is deductable from his income.

Please reply Fast.

Regards

Manoj

sir,

iam 52 yrs if i want pension 10000 at the age of 62 how much i have to invest now

Here is a post that gives you the details:

http://www.onemint.com/2011/04/04/how-much-pension-will-i-get-from-the-nps/

if the popsp lost their password then what can he do? is there any solution

whats documents requared for nps a/c opening???

Sir,

Thank you for your reply!

Mera NPS Account Office ki taraf se khul gaya hai jiska NPS (A/c No.) Mujhe mil gaya hai. ab mujhe apni NPS Account ki kuch detail check karni ho toh mein kaise check kar sakta hu. aur mujhe apne NPS ka Ref Id aur Password bhi nai pata. plz help me for check my Account Detail for NPS.

Thanks

Manish Kumar

Ye to aapke office vale hi batayenge – I’m sorry I don’t know about this.

Sir , my DOB is 25.04.1963 , we work in a private sector, present salary is about 20K p.m,

we are married , we live with our family (wife,and two children ) in our own house at Haryana and work in Delhi. Both children is study in 2nd class and exam of 10th class in f.y 2010-11 but now result out.

sir, we want minimum received rs 25000/- p.m as a pension

please tell me what amount deposit p.m,/where deposit/ whose a/c, /and if mishapping with me please tell me whose amount withdrawn (due to my wife is housewife)/what amount total withdrawn etc.etc.etc

Thanks

M.G.Gupta

to get monthly pension of 25000 you will require a corpus of about 30 lakhs in year 2023

(which will earn you 10% returns, 10 % is approximate and not guarented) to get 30 lakhs you will have to invest 10800 permonth for next 12 yrs . in case of any mishappenings to you your wife can continue corpus built up in her name till she is alive

Sir, mera Name Manish Kumar hai. Meri age abi 25 year ki hai. aur mera NPS mein Rs. 1100/- per month cuta hai. mujhe yeh bataye ki 60 year ki age mein mujhe kitna return milega aur kitni pension mil sakti hai. kya hum NPS mein se withdraw kar k kuch amount nikle sakte hai.

Manish – NPS mein koi guaranteed return nahi hai to tumhe kuch return assume karke calculation karna hoga. You can assume a 10% return and is calculator se dekh lo kitna amount total hoga.

http://www.camsonline.com/PensionSystemServices.aspx

NPS mein 2 part hai – Tier 1 & 2 – 1 se withdraw nahi kar sakte, 2 se kar sakte hai.

MANSU ABHI MERI AGE 31 HAI AUR MAIN NPS SCHEME MAI 20 SAL TAK MONTHLY 500 RS/- JAMA KARANA CHAHATI HOON TO MUZE 20 SAL KE BAD KITNA RETURNS MILEGA? AUR MERI INCOME MONTHLY 4500 HAI TO MUJHE NPS KI KONSI SCHEME NIKALANI CHAHIYE?

THANX W8ING UR RPLY

Sunita – NPS ka final amount kaafi cheezo par depend karta hai & you can’t be sure ki kitna milega. I’d suggest ki aap dusre safe avenues jisme return fixed hai vo try karo like Bank RDs ya Post Office Schemes. Jitna zyada save kar sako utna achcha & be careful agar koi aapko guaranteed return promise kar raha ho. There are many frauds like that.

I want to join NPS, my dob 4.10.1966, I want to join for next 15 years. How can I open this a/c

To open an NPS account you just need to visit your nearest Head Postoffice and get the account opened.

Hi, I want know, whether i have to invest the money the service provider of NPS or do i have the option to invest the money with any of the insurer who provide pension. eg : LIC or HDFC Standard Life or Birla Sunlife Insurance who sell pension fund also

I’m not entirely sure what you’re referring to but if it is the annuity then that has to be one that has been approved by IRDA.

Manshu,

Need your take on the following…. as to what would be the strategy to invest in NPS, or one needs to wait for more information…

Clearly Tier2 account is the way to go if all the features like % return, auto active investment options are same as in tier 1 account, not sure whether if i make a premature withdrawl in Tier 2 will i be taxed ? if thats not the case then one can park 6000 minimum in Tier1 and put all funds in tier 2 to get a health govt backed guranteed 9% return….

However i dont like the forced annuity option, of that too of 40% why does the IRDA enforce that on us…. all pension products have that serious limitation… say if i manage to save 10L as corpus at the end of 60 yrs, i will be only entitled to 6L, now in case i am in need of more funds for a major operation that i am going through i will not be able to access that 4 L despite me having the money… i also dont know at what % return will the “forced annuity” give me… if i had access to that 4 L i would have invested in a post office MIS at 8% return and 5%maturity bonus or got a MIP MF, or an FD or a new electric car 😉 for me and wifey…

but alas that wont be possible right…

need your expert inputs….

regards

Sorabh

Yes Sorabh – your analysis is right, and I’d go with waiting if I were in your position. The annuity is forced because they want this to be a pension option for most people and develop a sort of a social security net with people’s money. I’m not an expert on this but I’d be surprised if they make any significant change to that rule. And what you get as an annuity rate 30 years from now is anybody’s guess.

The main advantage of this scheme is the low cost it offers along with the ability of investing in safe instruments, but that won’t be incentive enough for everyone to get in on it, and based on what you’re saying I think it’s not much of an incentive for you too.

Thanks Manshu .. i will wait may be 6 months… as time lost is money lost.. 😛 but i sure will put some funds in this to have a balanced porfolio, for others information the 9th March issue of outlook money has a great article on NPS.

i also would like to hear anyones inputs on pension plans where there is some flexibility with the annuity, i feel the annuity should be optional and should be allowed to be taken out as lump sum if one wants to.

regards

Sorabh

my age is thirty one and if i invest Rs 1000 per month in tier -1 how muuh approx amount i will get on attaining age of 60years and how much pension will i get throughout my lifetime?will i get anything after my death?

Please go through this link to understand how to calculate NPS pension better:

http://www.onemint.com/2011/04/04/how-much-pension-will-i-get-from-the-nps/

It is not a straightforward answer.

D /Sir,

please send me NPS scheme details.