This post is written by Shiv Kukreja

If you have taken a home loan and have been paying your EMIs quite regularly without even a single default, then it is highly likely that the next time you require any car loan or a credit card, you may be able to secure any of them with quite an ease, that too at a lower rate of interest and probably get your bank to waive the processing charges also. Why is it so and how is it possible? I’ll try to share all of that with a series of posts about it.

What is a Credit Information Bureau and how it functions?

A Credit Information Bureau (CIB) is a repository of credit information of all the customers of bureau’s members, which includes banks, financial institutions, non-banking financial companies, housing finance companies and credit card companies. Members share this credit information of their customers with CIBs on a monthly basis so that their database gets regularly updated.

CIBs collate only credit information i.e. information on loans such as home loans, automobile loans and personal loans and information on credit facilities such as overdraft facility and credit cards. They do not have any details of customers’ savings accounts, fixed deposit accounts or other such investments which constitute the liability portfolios of banks or financial institutions.

At the same time, CIBs disseminate the information to these same lenders, as per their requirements, helping their credit underwriters to make effective credit or lending decisions. These lenders use this information to generate Credit Information Reports (CIRs) and Credit Scores.

CIBs are also also known as Credit Information Companies (CICs). In India, RBI regulates these bureaus. In 1999, RBI proposed setting up such kind of CIBs and start operating. First of such CIBs – CIBIL was set up in 2000. In November 2008, RBI allowed FDI of up to 49% in credit information bureaus, with a ceiling of 10% of the total voting rights for any single investor group.

What is CIBIL and which other CIBs are there in India?

Credit Information Bureau of (India) Limited, or popularly known as CIBIL, became the first such organization that started collating credit information contributed by its members and maintaining records of an individual‘s payments pertaining to loans and credit cards.

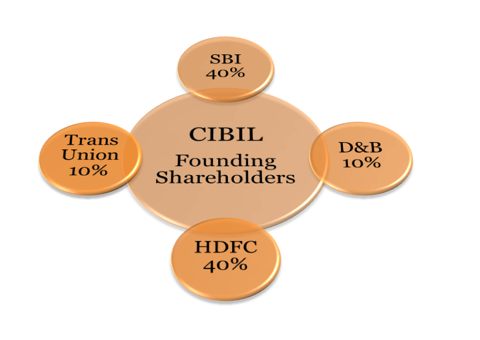

CIBIL was incorporated in 2000 with State Bank of India (SBI), Housing Development Finance Corporation (HDFC), TransUnion and Duns & Bradstreet (D&B) acting as its founding members and in a due course, the shareholdings got diversified to include many other banks and financial institutions. It started with a paid up capital of Rs. 25 Crores.

Founding Shareholding:

Current shareholding pattern.

Apart from CIBIL, there are three other credit information bureaus operating in India at present – Equifax, Experian and High Mark. But a large chunk of market share is with CIBIL only as it started collating data quite early and this is the reason I have decided to focus on the working style of CIBIL and the parameters it uses for this purpose.

What is a CIBIL TransUnion Score and what is its significance?

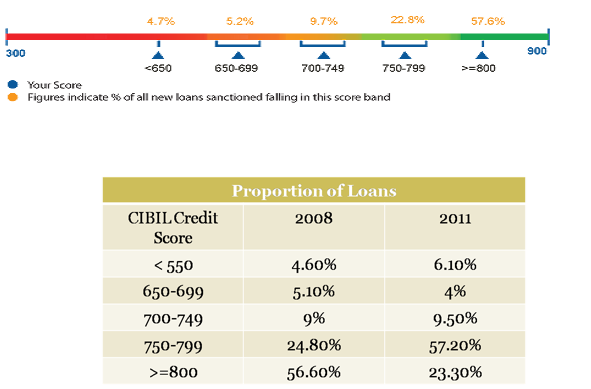

CIBIL TransUnion Score is a score measured out of 900 which provides a lender with an indication of the â€probability of default†by an individual based on their credit history. This score suggests lenders the pattern of an individual’s credit usage and loan repayment behaviour.

Your CIBIL TransUnion Score is like your marks in any competitive entrance exam, say like CAT entrance exam for MBA. A higher score in the exam (credit score) do increase your chances of getting admission into a good B-school (getting a loan approval) but doesn’t guarantee it unless you do good in your interview, group discussion and Ex tempore (your income, years of employment, debt burden, age etc). All these things should fit with a lender’s internal credit policy before one’s loan application gets the final approval.

CIBIL TransUnion Score ranges from -1 (or NH) to 0 (or NA) and 300 to 900. Loan providers used to prefer a credit score which was greater than 700 and over the years their preference has gone past 750 now. The closer the borrower’s CIBIL TransUnion Score is to 900, the more confidence the lender will have in borrower’s ability to repay the loan and hence it becomes more likely that the loan application will get approved and the better would be the terms offered by the lenders.

Without a Score, the lenders would treat all loan seekers equally, probably charge a higher rate of interest to all the borrowers. In other words, the entire class of students (borrowers) getting a punishment for the mischief played by a few (defaulters).

Though I did not find anywhere what ‘NH’ or ‘NA’ stand for in CIBIL TransUnion Score terminology, I assume the full form of NH to be “No History†and NA to be “Not Applicableâ€. An applicant gets a score of NH or -1 when he does not have a credit track record at all and a score of NA or 0 when his credit track record is less than 6 months.

As per CIBIL, a credit score of NA or NH is not a bad thing at all. These mean one of the below:

1) One does not have a credit history at all or enough of a credit history to be scored, i.e. the applicant is new to the credit system.

2) One does not have any credit activity in the last couple of years.

3) One has just add-on credit card(s) and no direct credit exposure in his/her own name.

If a person has never used a credit card or taken a loan, then there will not be any relevant credit score for a lender’s reference. The eligibility for a loan, in that case, will be based on one’s income, years of employment, age, etc. That means, if you did not appear for the CAT entrance exam then the B-schools will judge your abilities and give you the admission on the basis of your marks in 10th, 12th or college exams and other factors such as interview, group discussion, Ex tempore etc.

This was the first post on CIBIL Credit Score system and Credit Information Report. I’ll soon come back with some more details to throw some more light on this unique system of keeping record of an individual’s credit history.

Coming Soon:

- What is a CIBIL Credit Information Report (CIR) and what is its significance?

- Â How to check your Credit Score and purchase the Credit Information Report?

- Factors affecting your Credit Score and Can a Credit Score be improved?

- How to get the discrepancies corrected on my CIR? and some cases of customer disputes.

I have recently got my cibil report which shows 837 scores, but One credit card amount shows written off, can I eligible for home loan? pls. help…..

loan file problem my files civil statmante

Hello,

Recently I applied for HDFC credit card and later CITIBANK credit card, but both of the application was rejected. I asked for the reason for the same, HDFC stated that I have bad CIBIL history while CitiBank also stated the same and forwarded my CIBIL report to mail Id.

My total score was 772 , as I heard most the bank wants score above 750, so why my credit card application got rejected. Also its shows that presently I dont have any ACTIVE TRADE line, which affects my CIR. Please help me as I have an intense need of credit card.

REPLY

Dear Sir,

As an industry practice, a score of 750 and above is considered to be a good score, but having said that, lending institutions would also consider their internal credit policies and will have their own credit score cut off.

Therefore, it could have happened that the internal scoring of the bank would be low because of which the loan application was rejected.

Also, as you have mentioned you do not have any active tradeline, we would suggest, you to also opt for a secured credit card and build your credit history over a period of time. Your timely repayments against this card and over a period of time your credit score could improve.

Improving the credit score is slow and gradual process, you need to have a disciplined behaviour in managing your credits – timely repayments, maintaining a balance between secured and unsecured loans, utilizing up to 35-40% of the limit on your credit cards and not making random applications for new credit facilities will help improve your credit score.

Regards,

Credexpert

http://www.credexpert.in

Thankyou for your reply

I will surely apply for secured credit card now and should build my CIR. Can you please suggest which bank secured credit card is the best to choose

Dear Sir,

You can opt for secured credit card from any bank which will give you the best deal.

Regards,

Credexpert

http://www.credexpert.in

Dear All

I have a query few months ago I went abroad and met with an accident and unfortunately was hospitalized for almost 4 months and it took me around 7 to 8 months to recover completely.. Because of this I was not able to make the payment of my amex & hdfc credit cards for almost a year therefore now I m planning to clear my dues by paying all the pending amount on one go but just wanted to clear my few doubts ..

Will I get loan / credit card’s in future?

Will my late payment will be reflected on my cibil report ?

How can I remove it ? If it’s gets reflected

What exactly I need to do now:?

Dear Expert

I wanted to know few months ago I went abroad and had met with an accident and was hospitalized for almost 4 months and it took me around 7 months to recover .. Since I was in hospital I couldn’t make the payment of my hdfc & amex credit cards now the bank has blocked my card & I want to make the full payment nownow of my dues but I just wanted to whether it has hampered my cibil score or not? Will it be reflected on my civil? Previously I had a cibil score ofof 780.. Will I get any loan/credit card in future after clearing my current credit dues? How can I improve it now. Is it too late now?

Hi,

can i get personal loan because having cibil score is 780 and bad report in CIR ( personal loan is setteled as OTS and vehicle loan payments is not completed just 4 emi’s. my vehicle was took by lender).

Dear Sir,

We suggest you to check if there are any negative remarks or delinquencies other than the settled account you mentioned. If yes, please get it rectified ASAP and do not make any further application before the issues are resolved as this would only increase the number of enquiries appearing on your credit report.

As an industry practice, a score of 750 and above is considered to be a good score, but having said that, lending institutions would also consider their internal credit policies and will have their own credit score cut off.

This remark is viewed negatively by banks as it indicates your inability to fully service a credit facility. This could possibly prove to be a significant hindrance for your future loan applications. Therefore, if you want a personal loan, we would suggest to directly discuss about your credibility and credit report with the branch / credit manager of the bank from which you wish to avail the loan.

Regards,

Credexpert

http://www.credexpert.in

Hello,

Recently I applied for HDFC credit card and later CitiBank credit card, but both of the application was rejected. I asked for the reason for the same, HDFC stated that I have bad CIBIL history while CitiBank also stated the same and forwarded my CIBIL report to mail Id.

My total score was 772 , as I heard most the bank wants score above 750, so why my credit card application got rejected. Also its shows that presently I dont have any active trade line, which affects my CIR. Please help me as I have an intense need of credit card.

Thank you for your prompt reply.

I want to ask you. If I would apply for any credit card then it might possible they would reject my application because of minus one CIBIL score. Or they will approve it?

I find your opinions are so helpful. Kindly help me so that i can apply for credit card and which bank credit card should I apply for?

Dear Sir,

Availing an unsecured credit card can again be possibly be a rejection.

We would suggest to personal inquire with the bank about availing a credit card, and inform them about your credit score.

Do not make too many applications as this would reflect as inquiries on your credit report which will affect your score negatively.

Also, for improving your score in mean while, you can opt a secured credit card from any banks, this credit facility will be against a fixed deposit. Make regular payments for this account, which will help you build a better score.

Regards,

Credexpert

http://www.credexpert.in

Dear Sir,

A credit score of (-1) or NA or NH (No History) is not viewed negatively by a lender, however some lenders’ credit policy could prevent them from providing loans to an applicant with Scores of “-1” or “NA” or “NH” (applicants with no credit track record).

We would suggest that you opt for a secured credit card and build your credit history over a period of time. Your timely repayments against this card would help minimizing the rejections of having no history.

Regards,

Credexpert

http://www.credexpert.in

My CIBIL score is minus one and I did apply for a 30000 loan for a mobile phone and they (bajaj finance) rejected my application and just gave me the reason tht because of CIBIL minus 1, I cant apply for loan. What should I do? I never applied for a loan before.

Please help!!

Dear Ma’am

As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off.

As you have informed that you have one credit card, and you require a personal loan. We would suggest you to keep your utilization on the credit card between 30-35% and also not to make minimum payment towards the credit card, though this would not have any impact on your score, it definitely would impact your budgets and could lead to a potential debt burden.

Make timely payments on any or all credit facility before due date, as it is considered as a negative remark in your report and also hampers your score.

Also check if there are any other credit facilities reflecting in your credit report with negative remark, if yes then you need to get a resolution for the same.

Credit Bureaus require few credit activities to analyse your credit health, therefore mixture of secured as well as unsecured credit lines is required. We would suggest you to opt for a secured credit card and make timely payments for the same and maintain the usage between 30-35%

This will help you improve your score over a period of time.

Do not make any credit applications resulting in increased enquiries, these reflect a credit hungry behavior and could be viewed negatively by lending institutions, while evaluating your credit worthiness for the personal loan.

Postpone your personal loan application until your credit score improves. This is to ensure that your application is not rejected by the lending institution.

Regards,

Credexpert

http://www.credexpert.com

Hi I have Hdfc card but my score is 500 and I wanted personal loan are there any chances of me getting loan and with whom should I apply. please help me with that

Dear Ma’am

As an industry practice, a score of 750 and above is considered to be a good score, but having said that lending institutions would also consider their internal credit policies and will have their own credit score cut off.

As you have informed that you have one credit card, and you require a personal loan. We would suggest you to keep your utilization on the credit card between 30-35% and also not to make minimum payment towards the credit card, though this would not have any impact on your score, it definitely would impact your budgets and could lead to a potential debt burden.

Make timely payments on any or all credit facility before due date, as it is considered as a negative remark in your report and also hampers your score.

Also check if there are any other credit facilities reflecting in your credit report with negative remark, if yes then you need to get a resolution for the same.

Credit Bureaus require few credit activities to analyse your credit health, therefore mixture of secured as well as unsecured credit lines is required. We would suggest you to opt for a secured credit card and make timely payments for the same and maintain the usage between 30-35%

This will help you improve your score over a period of time.

Do not make any credit applications resulting in increased enquiries, these reflect a credit hungry behavior and could be viewed negatively by lending institutions, while evaluating your credit worthiness for the personal loan.

Postpone your personal loan application until your credit score improves. This is to ensure that your application is not rejected by the lending institution.

Regards,

Credexpert

http://www.credexpert.com

Dear Sir,

625 is not considered to be a good score. As an industry practice, a score of 750 and above is considered to be a good score – the higher the better. However, each lending institution will have their own internal credit policies on score cut-offs and negative remarks, based on which the decision to approve your loan will be taken.

It is advisable that you consider improving your credit score before applying for a loan. We would suggest that you obtain your credit report and clear all the negative factors impacting your score. Once, your credit report is free from all the negative factors, you need to build and maintain a good credit behaviour which in turn will lead to improvement in your score.

Also, we would suggest that you do not make any further applications for any credit facility until there is an improvement in your credit score. The rejection would only increase the number of enquiries appearing on your credit report which indicate a credit hungry behaviour and is viewed negatively by lending institutions.

Using a secured credit card is one option you could look at to build your credit history and score. Since these credit cards are secured against “Fixed deposits”, you would possibly get one without any hindrance. Make timely repayments against it to improve your score. Monitor the increase in your score before applying for any credit facility.

Improvement of credit score is a time consuming process and eventually your score will improve once you have built a good credit history. It is difficult to say how much time this will take and to what extent will it improve. However, it is important that you continue to maintain good credit behaviour.

Regards,

Credexpert

http://www.credexpert.in

Dear Sir,

Can i get a loan from any bank with 625 credit score?.

kindly help me.

Hello sir,

Can i get a mortgage loan from icici bank with 500 credit score?.

My income is 45k and value of my property is 30 lakhs.please tell me any other possibilites for getting loan..

Dear Swyritha,

500 is a low score. As an industry practice, a score of 750 and above is considered to be a good score – the higher the better. However, each lending institution will have their own internal credit policies on score cut-offs and negative remarks, based on which the decision to approve your loan will be taken.

It is advisable that you consider improving your credit score before applying for a loan. We would suggest that you obtain your credit report and clear all the negative factors impacting your score. Once, your credit report is free from all the negative factors, you need to build and maintain a good credit behaviour which in turn will lead to improvement in your score.

Also, we would suggest that you do not make any further applications for any credit facility until there is an improvement in your credit score. The rejection would only increase the number of enquiries appearing on your credit report which indicate a credit hungry behaviour and is viewed negatively by lending institutions.

Using a secured credit card is one option you could look at to build your credit history and score. You could opt for a “secured” credit card. Since these credit cards are secured against “Fixed deposits”, you would possibly get one without any hindrance. Make timely repayments against it to improve your score. Monitor the increase in your score before applying for any credit facility.

Improvement of credit score is a time consuming process and eventually your score will improve once you have built a good credit history. It is difficult to say how much time this will take and to what extent will it improve. However, it is important that you continue to maintain good credit behaviour.

Regards,

Credexpert

http://www.credexpert.in

is this cibil report required for NRI’s also to avail Home loan in india?

Dear Sir,

CIBIL score is considered to be one of the most important tools used by lending institutions to evaluate an individual’s credit worthiness. Hence, when you apply for any credit facility in India, the lending institutions will invariably obtain your credit report to evaluate your credit behaviour. In order to check your credit history, it may also ask you to obtain and submit your credit report from one of the credit bureaus in your current residing country.

Regards,

Credexpert

http://www.credexpert.in

I am a central Govt employee having a gross monthly income of Rs. 150000/- and net monthly income of Rs.110000/- after Tax,PF & Other allied charges.Recently I had applied for SBI credit card which was not approved due to inadequate CIBIL score . This prompted me to check my CIBIL score for the first time as till date there had never been a problem of this nature. Now I got my CIBIL Transunion score which is 681as on 11 Sept 2014. I found that on three occasions in last 36 months my citi Bk cc payment was delayed max by a week .It also reflected that Rs.150000/-as high credit against credit card limit of Rs.200000/-, which happened only once in last 3 years. I have taken 40 lacs home loan from SBI in 2010 for 20 years & paying Rs.42000/-EMI ,which is more than the EMI actually worked out by the Bk.There has been No delay/default in EMI till dt however in CIBIL report in No. Of months it shows ” XXX ” which means for those months bk has not provided information to CIBIL. Does this reflects as negative while preparation /calculating CIBIL score? I am planning to take car loan of 5 lacs I.e. only 70% of on road cost of car from SBI for a pd of 7 years. Will there be any problem with present CIBIL score, & if answer is YES then how CIBIL score to be improved to a desire d level & in how much time?

Dear Mr. Naidu,

“XXX” appearing on your CIBIL report means that the bank has not provided your credit details to the credit bureau for those months. If you have been paying on time on this account, the good payment history, if reported, will have a positive affect on your score.

However, using up to 75% (1,50,000/2,00,000) of the credit card limit is not good since it increases your credit utilization which is one of the factors involved in calculation of scores. Ideally, one should use up to 35-40% of the card limit. Please ensure that you use the card judiciously, do not cross 30 – 40% of the credit limit issued to you and make payments regularly.

681 is a score which can be improved upon by showing disciplined credit behaviour over the next few months. As an industry practice, a score of 750 and above is considered to be a good score – the higher the better. However, each lending institution will have their own internal credit policies on score cut-offs and negative remarks, based on which the decision to approve your car loan will be taken.

The DPDs in the recent past may affect your loan application. However, when applying for the car loan, the reason for the 3 late payments, given that you have no other negative remarks on your credit history, can be explained and discussed with the bank.

Improvement in your credit score is a time consuming process and eventually your score will improve once you have built a good credit history. It is difficult to say how much time this will take and to what extent will it improve. However, it is important that you continue to maintain good credit behaviour.

Regards,

Credexpert

http://www.credexpert.in

Actually i was applied a new kotak mahindra credit card but the card status was REJECTED

purpose mentioned like with yours CIBIL score we are not satisfied so rejected…can u help me regarding CIBIL score because i dont know what is exactly….?

Dear Sir,

It is a possibility that your CIBIL score was low and hence did not meet the bank policy or rejection can also be a factor of negative remarks on your report.

You can ask them for a copy of your report or you can obtain your own report from the CIBIL website to understand the exact reason for rejection.

Regards,

Credexpert

http://www.credexpert.in

If you are serious about losing weight and living a healthier lifestyle, it is about time that

you look more into the HCG hormone diet. This has however been made easier thanks to HCG

supplements that come loaded with vitamin B12, minerals and amino acids that are likely to be absent in most diets for quick weight

loss. The benefits from HCG diet are proven; it knocks down weight from the

body faster than other diets available in the market.

Yesterday I got my civil report! In which it was mentioned “NA” Since 7 months I m using 2 credit cards of HDFC & American Express. I have always made the full payment and never done any late payments but last month I paid only minimum amount of both cards. And couple of weeks ago I had applied for personal loan from ICICI Bank & Fullerton India For 2 Lakhs Each But Both The loan Got rejected. I don’t know why? Is it because of my “Minimum Payment” which I did for the first time? And why I don’t have any credit history after using 2 cards?? Also I would like to highlight 1 thing that I have never applied or filled any only application from the venders like Bajaj Finance ‘ FICCL, SCB , SBI CARDS but all these names are mentioned in my Enquiry Information Sheet? Which I think will hamper ! How can in remove those names? I m earning 26000 per month and has owned house .. Working in PVT Ltd… From 3 years! Will I get loan ? of 2 lakhs

Dear Jordan,

Your CIBIL report may have showed “NA” because of the unavailability of enough credit history to assess your score. This is not necessarily bad. However, based on this, it will depend on the bank’s risk assessment to either accept or reject your loan application.

Also, only paying the minimum amount due increases your debt burden and hence should be avoided. The high outstanding balances will also be viewed negatively by lenders.

If you have not made inquiries from the banks you have mentioned, you should raise a dispute with CIBIL for correcting the information.

Regards,

Credexpert

http://www.credexpert.in