I was really surprised to read today that the government has banned the duty-free import of high-end flat screen (LCD/LED) plasma television sets effective August 26th in a bid to save the falling Rupee.

From about the middle of July when the RBI introduced unusual steps to squeeze out liquidity from the system, the Rupee has been falling even more rapidly, and it is clear to anyone watching that none of these steps are working. The Rupee has fallen about 5.50% from that time and is surely headed towards 65 to a Dollar if they continue with these measures.

Most of the steps the government or the RBI has taken since July have had unintended consequences, and these problems are only going to be exacerbated if they don’t decide to dump this approach.

Disallowing people from bringing in televisions as a piece of luggage would hardly put a dent in the Current Account Deficit, but it will give an incentive to find ways to work around the system which is similar to the fears about gold smuggling that have risen recently.

These are all regressive steps that take us back to the pre 91 era that brought India to its knees and will do the same thing again if we don’t give up this path.

The problem with India’s CAD and Fiscal Deficit (Read: What are the twin deficits?) are not new, and the problems are not caused by something going wrong in the global economy or the work of speculators against India. I wrote about this more than a year ago, and the same holds true now.

All the steps that have been taken so far are aimed at somehow stopping USD from going out of the country but nothing is being done to promote exports or tourism.

I’ve met a lot of European tourists in Goa who find it extremely difficult to follow complex Indian visa laws and have to shorten their stay as a result of that. Easing visa laws is a very easy way to encourage tourism and get more money coming in the country. This is just one example, but there are surely others too.

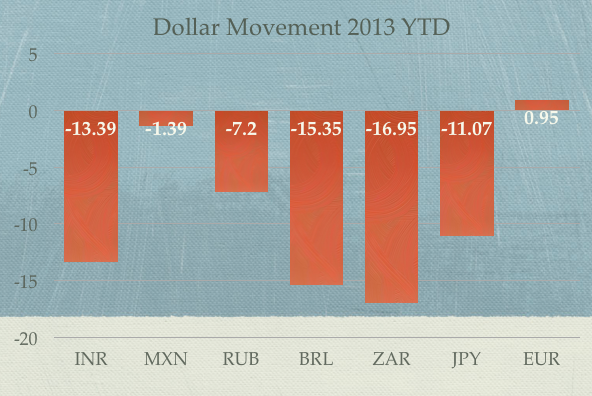

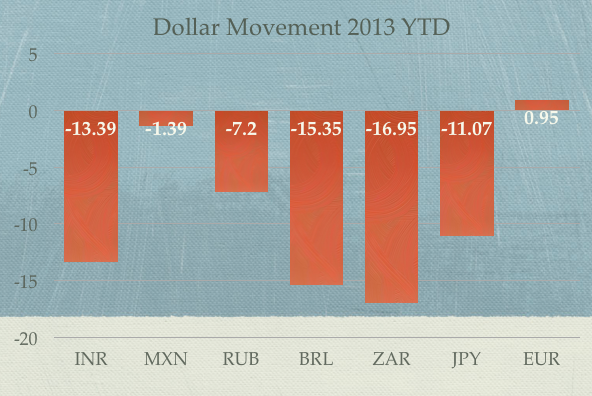

Another key thing for the central bank and the government is to look at the global markets and compare the steps they are taking with the situation overall. I made a chart of how various currencies have behaved against the Dollar since the beginning of the year, and you can see that most of them have not done very well.

India is not an isolated case, and taking these knee jerk measures makes it look like the government and RBI is running out of ideas and will take no time to go back to the pre 91 era and that will surely scare away both FDI and FII investments.

A look at the present steps makes it feel like we are creating a crisis where there is none.

Of all the ridiculous moves, Plasma TV! If we really want to improve CAD we should seriously look at ethanol or any other alternative to petrol/diesel. That will in one shot bring down inflation also. Oil is what the focus should be on, Not Gold or least of all TVs.

I thought LCS/LEDs come more from SG ,TW or Middle East than US.

Yeah that is my understanding too that they come more from Singapore, Thailand and other countries like that but when you go out for a holiday to any of these countries the person still takes USD and then that USD is converted into local currency so that’s why they want to stop this flow as well.

One of my friend was planning a trip to Thailand in October, with a view to buy an expensive LED TV, which costs Rs. 90,000+ there and some Rs. 1,45,000+ here in India and enjoy the holiday also. With this move, he is rethinking his decision. Thailand economy is in trouble !! 🙂

What the heck kind of TV is this that costs that much money?! If I paid that much money for a TV, I’d want to see Tendulkar come out of the screen and hit a six in front of me.

🙂 🙂

India is a country where we drive Rs. 1.5 lakh Tata Nano and we drive Rs. 5.80 crore Maybach as well. I am sorry Manshu, even if you spend Rs. 5.80 crore on a TV, Tendulkar would never be able to do such an act for you. He is a cricketer and a human… 🙂

I think technology is getting developed very fast these days. Wait for some more time and you’ll have such Smart 3D TVs with advanced technologies which will definitely make you feel satisfied with such a desire.

I don’t see the point of spending that much money if Tendulkar can’t come out of the screen 🙂

🙂

Whether any of such items we import from US or Singapore or China or any other country, it is still counted as an import. So, we’ll have to count it while counting our deficit (CAD). USD is just the currency in which we do the final counting and show the whole world our achievements !!

Its a silly move, may be its sentimental to show that hi-end costly goods will be taxed more. I wonder if we have figures on imports of Flat screen TVs/brought by travellers. Would not be significant. When major contributors to CAD are essentials like Crude Oil, Edible oils, Gold (argubly essential considering silly mindset of Indians) you cant do much even if you tax TVs. Next will be doubling of import duties on mobile phones!!

The Government/RBI shouldn’t fight the market, I am of the opinion that it is what is to blame for all the chaos.

No one (i.e. media) stops to think that we had 5 years of rising inflation and no (major) effect on the currency, because global growth was in sync. Now the demand for the INR has reduced and it’s price is catching up to it’s value.

They don’t have the firepower to fight the market and they should focus on structural issues instead of tinkering with these silly TV type measures.

I agree that duties on TV panels are not going to make CAD come down. The solutions to these problems are not temporary like tightening liquidity or raising import duties, which in turn have far worse impacts on killing growth and fueling inflation. Long term solutions which were supposed to have be taken much before could have helped. Relaxing FDI norms has no meaning when MNCs face multiple hurdles with land allotment, unrest and govt hassles. (POSCO and Arcelor mittal ran away their billions of dollars of investments).

I was very disappointed to read Arcelor Mittal pulling away as it is a great reflection on the current state. If someone like him is unable to navigate the red tape in India then you can be sure that other businessmen will surely not be interested.

Another thing I find disturbing is that very often people blame the businessmen for such decisions when they are really the victims. They want to do business in India when they have the whole world open to them and they are simply unable to do so and it is not their fault at all.

Thats a good point you made that even if someone like Lakshmi Mittal could not navigate the red tape, it shows the extent of problem. Actually problem is not only central government, state government (orissa here) is answerable to a large extent. A good state govt like Gujarat, immediately invites Tata to come and set up plant when Mamta Banerjee plays people’s politics. So much noise about retail FDI, I dont know whats status on Ikea, they made their life difficult. How will the dollars come.

You are right. Govt is trying to busy people to make understand that they are doing many things to control the situation. But I think its already decided by few mastermind people that Rupee has to touch 70 this time for their individual benefits and it is progressing well towards that target.

There is conspiracy by any masterminds my friend – it is all because of poor policies, if the government gets its act together the market will reward them.