This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

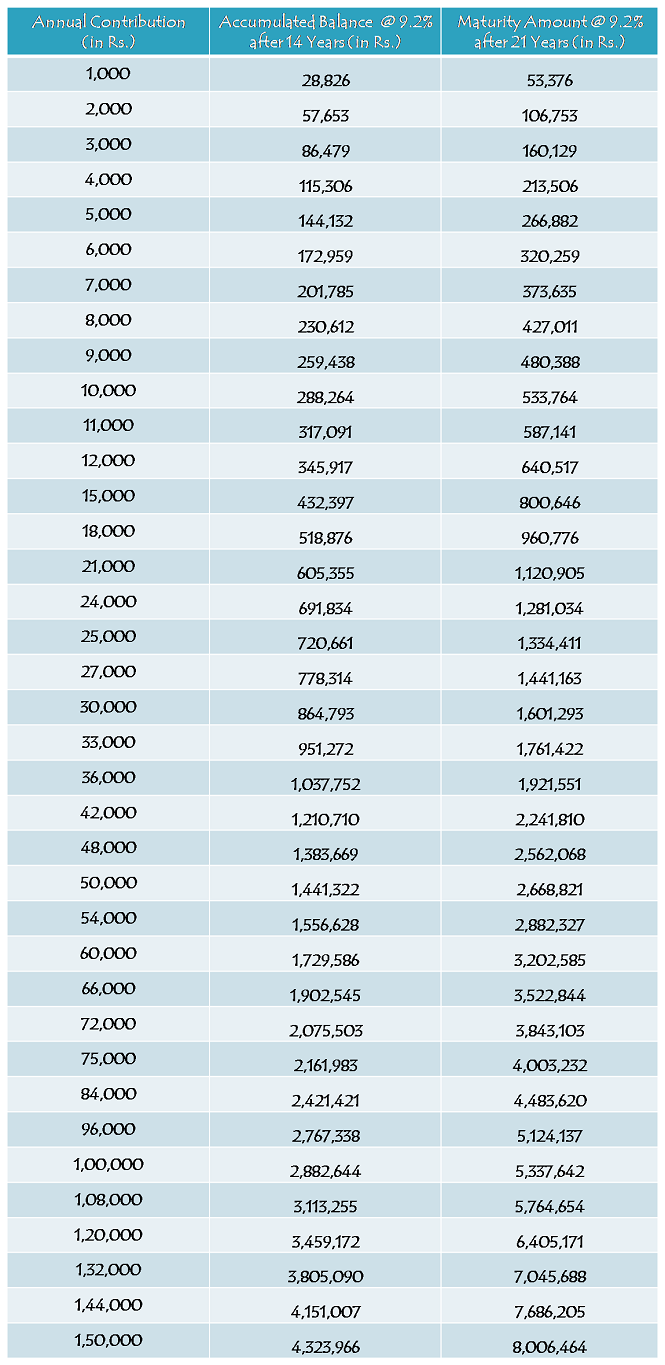

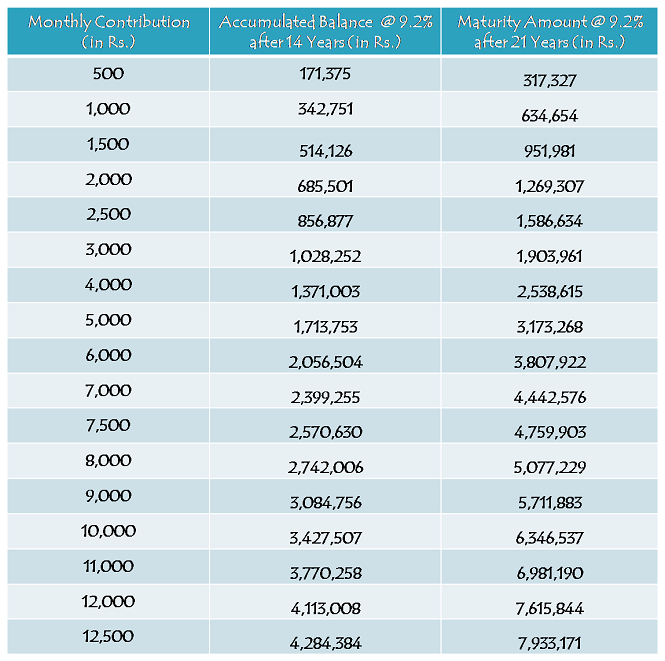

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

Sir in both the table you have given I could not understand how did you get the amount could you please explain me how did u get the middle row figures….I’m totally confused

What’s the confusion Swapna? Middle row figures are calculated with yearly/monthly contributions earning interest @ 9.20% for 14 years.

sir, I have one one year old girl.

I already deposited 1,50,000 for the first year .If I deposit only 1000 per year for the remaining 13 Years, What would be the total amount after maturity

Sorry, we do not entertain such individual calculations.

Sir,my daughter is 6years old. I Invest Rs 18,000 yearly tell me in which age get maturity and If I withdraw in age of 18 , I get only 50% of principal

amount or 50% with interest.

Your daughter’s account will mature when she turns 27 or when she gets married, whichever is earlier. At the age of 18 years, you can withdraw 50% of the balance amount (principal + interest).

sir my daughteris old 4 years and i am contrebutsan 12000 per anum

Sir thnx

Sir mane bank se pucha tha par vo bolte hai ki post office se pta kre . Ab mai kya kru

Vasudevji, SBI ne ye accounts kholne shuru kar diye hain – https://www.sbi.co.in/portal/web/govt-banking/sukanya-samriddhi-yojana

But, agar aapki branch abhi ye accounts nahin khol rahi to aap post office mein account khol sakte hain aur baad mein SBI mein transfer karwa sakte hain.

Sir

I have two accounts in favour of my daughters in Post Office.

May I transfer above accounts from post office to bank? Kinly inform.

That is what you need to decide Deb. Some people are comfortable with post offices and some with banks. But, you can transfer your accounts from post offices to banks.

My daughter birthdate is 01 01 2003 can she get the benefit of this scheme

No Praksah, your daughter is not eligible for this scheme.

Dear sir

Sir meane apni ek bacchi ka post office mai ye police kera rekhi par mai ek SBI DSP account holder hu kya mai apne account ko bank mai transfer kr skta hu or kase. Or sir kya mai us installment ko direct apne account se credit kr skta hu kya

Hi Vasudev,

Iski jaankaari aapko apne bank se milegi.

Sir,Kindly clarify my doubt.My daughter born on 27 January 2004 is already 11 years old.

How long do I need to pay the premium and what will be the maturity date of the scheme?

How do I go about to optimise the investment and gain the maximum yield?

Hi Naveen,

You need to deposit money for 14 years from the account opening date or till the time your daughter gets married, whichever is earlier. Your daughter’s account will get matured in 21 years from the account opening date or whenever she gets married, whichever is earlier. To get maximum return, one should deposit lump sum money as early as possible in a financial year.

My daughter in 5 yrs old and I want a maturity value of approx 5 lakhs. Can you please let me know, what monthly amount do I need to deposit for this?

Hi Abhilasha,

As the rate of interest would change every year, a fixed per month contribution cannot be determined. But, I think the amount should fall between Rs. 500 to Rs. 1000 per month.

DEAR SIR

HDFC OR ICICI BANK KE E YOJNA KAB SURU HOGI

POST ME DEPOSITE KARNE ME PARESANI HOTI HE

Hi Rangani,

Aapke question ka answer ICICI ya HDFC Bank de sakte hain, mujhe iska idea nahin hai.

If the account holder of ssy dies? Then how the ssy will be conducted?

Legal guardian of the girl or the girl herself would have the option to either close the account or fund it.

Dear Sir,

My Daughter 10years old & want to deposit 2500/- per Months After that what i will get total maturity value after 21 Years.

Also suggest me whats relevant document required for Birth Certificate.

Kindly advise…………

RGDS

Naveen Parmar

Hi Mr. Naveen,

At 9.20% rate of interest, you’ll get approximately Rs. 15,86,634 by depositing Rs. 2,500 per month for 14 years. For date of birth proof, birth certificate is required.

Hi sir,

My daughter born in 26 september 2003,can i join her “sukanya samridhi Yojana “account in her name

Hi Kavitha,

Your daughter is not eligible for this scheme.

Mary beati ab 1.6 years old monthly 1000 bartha hu to after 21 years ke bad kithna amount melega

Hi Ambresh,

Rs. 1,000 per month contribution karne pe aapko 9.20% rate of interest se approximately Rs. 634,654 milega.

Maturity amount b kya tax free hoga?

Yes Vikas, maturity amount bhi tax-free hoga.

Dear sir,

My daughter is 8 yr. old, if I will deposit 12000 thousand every year what amount I can get after maturity.

Hi Pramod,

At 9.20% per annum, your daughter will get approximately Rs. 640,517 after 21 years from the account opening date.

sir meri ladki 9 sal ki thi jab mene khata khola sar mene socha ki 21sal sal ki hogi to mil jayege par ab 21 sal bad milege mene 2000 rupye dal diye hai ab me 1000 sal dal sakta hu kya koi pareshani to nhi ayegi please reply

Ghanshyamji, Rs. 1,000 deposit karne pe koi problem nahin hogi.

Sir,

Mujhe ye jaana hai ki kya main pahale hi upcoming children whether it is girl or boy koi aisi hi similar scheme hai ,then please inform me.

Nahin Surendraji, aisi koi scheme nahin hai.

Sir, 1000 thousand/month ki rate se 14year me total jma 168000 hoga. Jo 9.2% se 21 sal tak 341000 hoga to kase 631000 some thing rate post office uale bata rah hai.

Ajayji, aapki calculation incorrect hai. 9.20% rate of interest se maturity value 21 saal mein Rs. 6,34,654 hogi.