This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Having gained 20-30% on their investments made in tax-free bonds a couple of years back, investors’ hunger for tax-free bonds has grown considerably. With IRFC issue worth Rs. 4,532 crore getting 2.38 times oversubscribed on the first day itself, there seems to be no slowdown in the subscription demand for these bonds.

To cash-in on this huge demand and ending a long wait for its tax-free bonds, NHAI, which filed its draft shelf prospectus in the first week of October, will be launching its first tranche of tax-free bonds from the coming Thursday i.e. 17th December. As the issue size is considerably quite big at Rs. 10,000 crore, I hope most of the retail investors are able to get their share of bonds allotted at least this time around. The issue is officially scheduled to remain opened for two weeks and will get closed on December 31st.

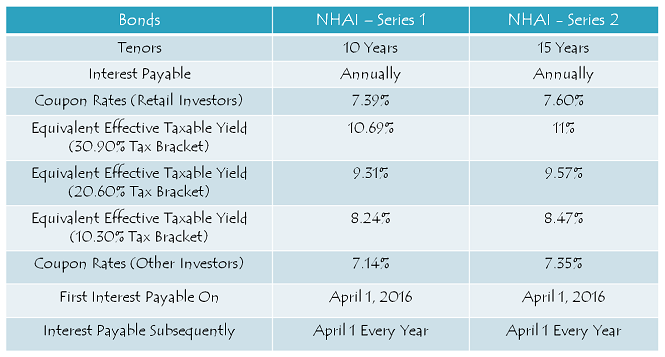

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – NHAI is authorized to raise Rs. 24,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 3,872 crore by issuing these bonds through a private placement. Out of the remaining Rs. 20,128 crore, the company will raise Rs. 10,000 crore in this issue.

Coupon Rates on Offer – With rising G-Sec yield, earlier IRFC and now NHAI, both have been able to offer higher coupon rates as compared to PFC and REC. While IRFC offered 7.53% for the 15-year period and 7.36% for the 10-year period, NHAI is offering an even higher rate of interest at 7.60% for 15 years and 7.39% for 10 years.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment NOT Allowed – Unlike PFC, REC & IRFC issues, Non-Resident Indians (NRIs) won’t be able to make investment in this issue. Qualified Foreign Investors (QFIs) are also not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 4,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NHAI has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.39% p.a. for 10 years and 7.60% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NHAI will make its first interest payment on April 1st next year and subsequent interest payments will also be made on April 1 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

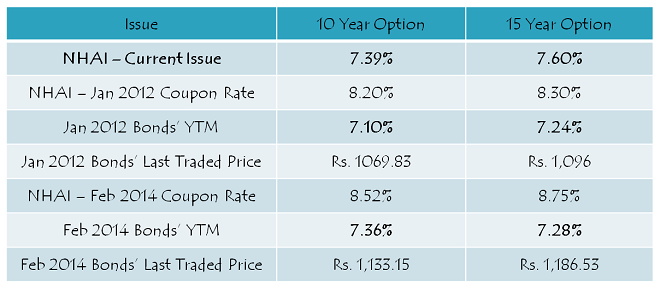

NHAI tax-free bonds issued in February 2014 are quoting at a yield to maturity (YTM) of 7.28% with the closing market price of Rs. 1,186.53. Also, bonds issued in January 2012 are carrying 7.24% yield and last traded at Rs. 1,096 on Friday.

Taking a clue from these already listed bonds, I think subscribing to the 15-year option makes more sense. Risk-averse investors with a long term view should definitely invest in these bonds. In the short-term as well, you can expect some listing gains with these bonds.

Application Form for NHAI Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHAI tax-free bonds, you can contact me at +919811797407

Hello, Shiva, Last year Dec 2015 I got some Tax free NHAI bonds. I got some interest on 1st April 2016. Now on 1 st October 2016 I got some credit. Is it dividend? Whether dividend is paid in tax free bonds? If not what is the credit received? Can you please explain to me.

This is awesome article.I get many useful point through this post. I would like to thanks for providing these information. Thank you for sharing it.

Carebaba

Thanks Shiva for answering my queries on NHAI TAx free bonds.

Hi Shiv, can you provide your expert comments /article on the following topics: 1) Investments advice in the current circumstances / post BREXIT era. 2) Real estate investments pros and cons post budget 2016.

Hello Shiv

I have the following questions on the NHAI Tax Free bonds

1.) Can i buy the tax free bonds as they are listed in NSE/BSE stock.

2.) if i purchase it from open market say mid year how will the interest be calculated.

3.) Since these bonds are traded in the open market what happens if i sell in the middle of the year say sep will i be paid the interest from April to sep of the year

4.) Assuming i hold onto these 1000 Face value bonds till the maturity date of 2030 december and at the time of maturity say the face value of this bonds is quoting at 1200 does that mean on maturity will be paid 1200* number of bonds or will i be paid still at the rate of 1000rs per bond on maturity Thanks in advance

Hi Satish,

1. Yes, you can buy tax-free bonds from the stock exchanges.

2 & 3. Interest for the whole year will be paid to the bondholders/buyers on the Interest Payment Date (as per the record of bondholders on the Record Date). Record Dates usually fall 15 days prior to the Interest Payment Dates. Sellers will not get any interest payment.

4. It has never happened in the history of bond trading that such a bond got traded at a premium of 20%, or even 10%, on the date of maturity. That is because no sensible buyer would pay a premium for a bond for which he is going to get only the face value from the issuer. So, as the date of maturity approaches, market value of these bonds automatically gets merged with the face value of the bonds.

Thanks

Hi Shiv. Is the interest earned on the investment made in these bonds by NRIs through their NRE Accounts in india, taxable? Please advise, and are there any official links giving this specific information? Thanks.

AJIT

I think you are talking about NHAI tranche 1 Dec 2015 bond of which Intt got credited on 2nd April ( 1st being holiday)

For IRFC Tranche 1 as well as 2 2015 bond , intt payable date is 15 Oct.

Dear Shiv, kindly confirm

Hi Shiv, As per the article, interest should be credited by 1st of Apr every year. But as of now, no interest is being credited to my account for IRFC tax free bonds tranche 1. Please advise.

got the credit. please ignore my query. Thanks.

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore oversubscription