This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Having gained 20-30% on their investments made in tax-free bonds a couple of years back, investors’ hunger for tax-free bonds has grown considerably. With IRFC issue worth Rs. 4,532 crore getting 2.38 times oversubscribed on the first day itself, there seems to be no slowdown in the subscription demand for these bonds.

To cash-in on this huge demand and ending a long wait for its tax-free bonds, NHAI, which filed its draft shelf prospectus in the first week of October, will be launching its first tranche of tax-free bonds from the coming Thursday i.e. 17th December. As the issue size is considerably quite big at Rs. 10,000 crore, I hope most of the retail investors are able to get their share of bonds allotted at least this time around. The issue is officially scheduled to remain opened for two weeks and will get closed on December 31st.

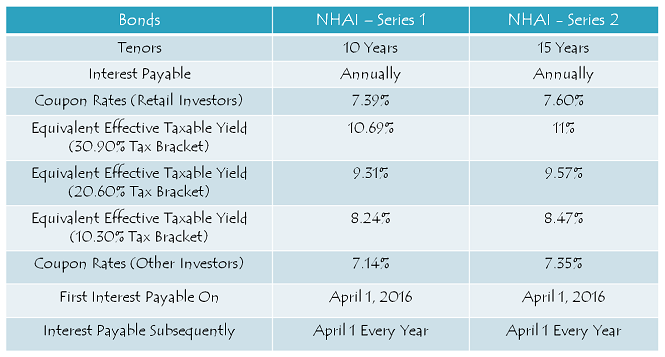

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – NHAI is authorized to raise Rs. 24,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 3,872 crore by issuing these bonds through a private placement. Out of the remaining Rs. 20,128 crore, the company will raise Rs. 10,000 crore in this issue.

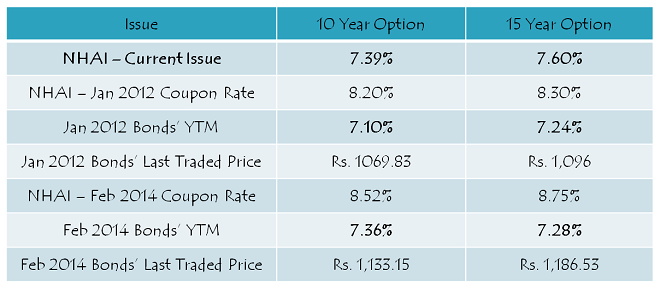

Coupon Rates on Offer – With rising G-Sec yield, earlier IRFC and now NHAI, both have been able to offer higher coupon rates as compared to PFC and REC. While IRFC offered 7.53% for the 15-year period and 7.36% for the 10-year period, NHAI is offering an even higher rate of interest at 7.60% for 15 years and 7.39% for 10 years.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment NOT Allowed – Unlike PFC, REC & IRFC issues, Non-Resident Indians (NRIs) won’t be able to make investment in this issue. Qualified Foreign Investors (QFIs) are also not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 4,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NHAI has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.39% p.a. for 10 years and 7.60% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NHAI will make its first interest payment on April 1st next year and subsequent interest payments will also be made on April 1 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

NHAI tax-free bonds issued in February 2014 are quoting at a yield to maturity (YTM) of 7.28% with the closing market price of Rs. 1,186.53. Also, bonds issued in January 2012 are carrying 7.24% yield and last traded at Rs. 1,096 on Friday.

Taking a clue from these already listed bonds, I think subscribing to the 15-year option makes more sense. Risk-averse investors with a long term view should definitely invest in these bonds. In the short-term as well, you can expect some listing gains with these bonds.

Application Form for NHAI Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHAI tax-free bonds, you can contact me at +919811797407

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

Hi Shiv,

Any information on when the NHAI and IRFC TFB tranche II Issue opens?

What will be the issue size for these two ?

Thanks,

Amit

IRFC will raise an additional Rs. 3,500 crore by issuing tax-free bonds this financial year – http://www.financialexpress.com/article/economy/indian-railway-finance-corporation-gets-rs-3500-crore-more-tax-free-bond-limit/211014/

I agree with SK, one must wait for 2nd tranche as buying from secondary market is a costly affair. Assuming that there will be no further issues this FY, I bought 300 NHAI sr II 7.60 11Jan31 @ Rs.1010.50 + brokerage at ICICI Direct.com. The total with all charges worked out to Rs.306700/- bringing down the effective YTM to around 7.40% p.a.

Hi Satish,

Was this the tranche 1 bonds that you bought (that was released in Dec 2015)? Also can you help to clarify how you worked out the effective YTM (what is the formula?). It looks like you paid Rs 6,700 extra for the entire lot of 300 bonds, which works out to 2.23% more.

(6700/3,00,000)*100 = 2.23%

Thanks,

Melwyn

Dear Shiv,

Since I missed to apply for this TFB, I want to purchase it now through my ICICI direct brokerage account. However when I searched for NHAI I got multiple entries. Do you know what is the official name of this TFB?

By the way, does it make sense to purchase this from the market, or it is better to wait for the 2nd tranche?

Hi Melwyn,

I don’t know how to search it in ICICI Direct account, but these NHAI bonds have the following BSE/NSE codes:

7.35% 10-year bonds – BSE Code – 935582, NSE Code – N9

7.60% 15-year bonds – BSE Code – 935584, NSE Code – NA

You can search NHAI bonds using these codes. Also, I would personally like to wait for the tranche II to invest in these bonds rather than buying them from the secondary markets. Different investors might have different opinions about it.

Thank you for the data and your opinion. I think I will wait for the 2nd tranche as well. Thanks.

Sure, thanks Melwyn!

Hi Shiv,

Any idea , whether there will be any further issue of Tax Free Bonds this Fin Year , if so which one?

Hi Viswanathan,

3 more issues are expected – NHAI Tranche II, HUDCO Tranche II and NABARD.

Hi Shiv,

Thanks for the information.

You are welcome Viswanathan!

Hello Shiv

I had applied for NHAI bonds in the names of 4 family members. The application was made for physical form. We have recd physical bonds for 3 while the 4th one is still not recd. I had applied thru karvy brokerage which says it must be in post and they suggest me to wait. Now that its over 2 weeks since the other bonds were delivered to me, my discomfort is growing. Is there any place where i can directly contact NHAI and check the status of my missing bods???

Hi Krunal,

You should contact Karvy Computershare at 1800 3454 001 to know the whereabouts of your bond certificate.

When can one expect the allotment/refund of HUDCO TFB?Whether retail investors will get full allotment if they applied on the first day itself?

Hi Viswanathan,

HUDCO refunds would get credited on or before February 8. But, around 49% allotment would be made.

dear shiv I think will get 11400 interest on 150 bonds on 2nd of April because of bank closing date isn’t it correct because I am receiving regularly interest of sbi n5 bonds on 2nd of April am I correct shiv

Yes, that is possible Nitesh.

Hi Shiv,

Thank you for keeping us updated.

I got 1000 NHAI bonds, but I haven’t received interest. By when can I expect that to be credited to my bank account?

Thanks!

Hi Santosh,

By now, it should have got credited.

Thank you for the reply Shiv, it got credited in my Dmat linked account.

Thanks!

That’s great Santosh!

HUDCO 7.64% Tax-Free Bonds Review – http://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.

Shiv, with this kind of performance of NHAI & IRFC, who would like to put money in these Tax Free Bonds ???

If anyone wants to put money in TFB, he can Buy 76NHAI31 anytime from the market, which is trading at Par and will always hav better liquidity because of its size.

George, your comments pls.

Hi Rohit,

Not only speculators, but investors also invest in these bonds. So, I am 100% sure that this issue will also get oversubscribed on the first day itself. People, who so not have demat accounts, can’t buy these bonds from the secondary markets.

I agree with Shiv. This will also get oversubscribed. I am waiting eagerly for the refund from IREDA though not applied for full retail quota. I would like to buy some in the secondary market. No waiting required. Having said that many will be comfortable to apply for the public issue where no brokerage is there. The current situation was there even when the last time they issued TFB at the rate of 8.6% to 9% levels. There are many who sold at par after allotment. Even I have sold some of them to make sure that the portfolio is diversified. Any way I have emptied all those High yeilding bonds from time to time and invested part of the amount in the recent issues. Though I paid Capital gain and brokerage, I found better returns options.I have decided not to part with current TFB unless there is such urgent need of money or good premium available.

At present, I feel comfortable buying the recently issued bonds from secondary market.

Dear Mr. George,

Could you throw some more light on the other investment options which provided better returns than the earlier high-yield TFB’s which you sold off.

Your kind advice will be appreciated by the many readers of Mr. Shiv Kukreja’s blog.

Thank you.

SK, I have sold the bonds when YTM was in the range of 7% to 7.5% and there was FD investments available at 9% interest with Annual yield of 9.3%. I have moved some of the fund back to FD with 3-5 yrs locking and also to GILT funds. May not be better return, but when you look at 15 years 20 years locking moving to 3 or 5 years locking with taxable 9.3%, I see some benefits there. It all depends on how you look at it and individual requirements. Hope it answers your question. Again like share market, some time it is important to look at the right time to switch between investments. Some time you get it correct.

Shiv ji – enjoyed reading this line : “Not only speculators, but investors also invest in these bonds.” Well said. I will be applying for HUDCO, even though I got allocated IRFC, NHAI, REC, NTPC. I had skipped IREDA because of the rating downgrade concern. My thinking is we should be broadly diversified across different companies across different sectors..

Yes Bhaskar, it should be reasonably diversified.

Thanks for the update Shiv.

Is HUDCO rated AAA this time (I think it was AA earlier). The interest rate for HUDCO is marginally better than NHAI tranche 1 which was 7.6% for retail investor for 15 years

Thanks Shiv for the update. Hudco is rated AAA this time (isn’t it)?

Yes RS, it is ‘AAA’ rated this time as compared to ‘AA+’ last time.

hi Shiv, read this today… so does that mean NHAI tranche 2 will not happen? http://www.financialexpress.com/article/industry/banking-finance/nhai-surrenders-rs-5k-cr-tax-free-bond-limit-to-govt-say-sources/197649/

Hi RS,

It will happen, but with a reduced issue size of Rs. 5,000 odd crore. Remaining Rs. 5,000 crore, which NHAI is surrendering, will be allocated to other companies, like IRFC, REC, PFC or NTPC.

Thanks Shiv.

Any idea when is the announcement(s) expected for the remaining tax free bonds in this FY.

We are expecting HUDCO issue announcement any time this week.

As expected NHAI traded in large volumes and very low premium. Not sure why retail investors sell soon after allocation even when there was very minimum premium not even good enough to meet the brockerage charges. Possibly these are people who may be getting the commission for bidding and makes money that way and sell for no loss no gain.

But, why Old NHAI bonds are not trading at rate new one is Trading i.e. 7.50%.

Old Bonds are still trading at yield of 7.30%. (NHAI-N2, NHAI-N6).

One can say liquidity as one of the factor, as both had volume around 20 lacs, but difference of 20 bps does not fully justify that.

What could b other reason ??? and for this company what should be the 10-15 yrs yield to be considered ??? 7.30% or 7.50% ???

Hi Rohit,

Can you think of any other reason for this difference?

No, I m not able to think any other reason.

I don’t know which yield to tell anyone if he ask, how much NHAI 10-15 years bond Trades at ???

You are right in your assessment and the same with anyone. 3500 Crore retail bonds, naturally 10% are going to make it money immediately. It is the liquidity and for the same reason any day this bond is better than others. If you have to sell for some reason, you will get reasonable price. You will find it very difficult to get the right price for bonds which issued 1000 crore where retail is just 400 Crore.

I think 7.30% should be called as the fair yield because it does not have any artificial supply/demand to be factored into its price.

hello, did this bond get over-suscribe ever before 31st dec’15 at retail investor zone?

Hi Sandhya,

Retail portion got subscribed 0.85 times or 85% of the overall portion reserved for them. So, all successful applicants got full allotment.

NHAI tax-free bonds to get listed on the BSE & NSE on January 14th i.e. Thursday – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160113-4

Here are the BSE & NSE codes for the same:

7.35% 10-year bonds – BSE Code – 935582, NSE Code – N9

7.60% 15-year bonds – BSE Code – 935584, NSE Code – NA

Deemed date of allotment has been fixed as January 11, 2016. Interest will be paid on April 1st every year.

the limit for retail investor is 10 lakhs, but will it appear in the AIR transaction in 26AS if one invests.

Yes, It will appear.

Yes Viswanathan, there is a high probability that it will appear in Form 26AS.

NHAI Tax-Free Bonds allotment is complete now, you can check the allotment status from this link – http://kosmic.karvy.com:81/ipotrack/

listing date please

NHAI Bonds will get listed tomorrow.

Hi, Shiv,

Have u recd circualr for the smae

what is bse code of 15 year retial bond

Hello Shiv,

Its great to read your posts.

Regarding NHAI bonds, I have applied 1400 bonds and have got 100% allocation. I had initially thought that i would get just 40-50% allotment and hence applied double of what i needed. Now I just wanted your opinion, at any future date:: generally if I wish to liquidate the bonds@listed prices, how long can it take??? A friend opines that TFS are tough to sell as often there are no buyers? Is it realistic?

IREDA being a AA+ has got higher application compared to its issue size. Is there anything wrong with NHAI that it dint even get fully subscribed?

thanks in advance.

Thanks Krunal!

1. It is slightly easier to liquidate your bond holdings which are reserved for the retail investors. But, it is not difficult to sell your bonds to the non-retail investors either. So, you should not be overly worried about it.

2. There is nothing wrong with the NHAI bonds, except of the fact that NHAI issue was a relatively bigger issue. NHAI received bids worth Rs. 2,508.10 crore in Category IV on the first day as compared to IREDA which got bids worth Rs. 1,262 only.