This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In the last 10 trading days or so, some major stock markets all over the world have plunged more than 10%. I think this could be the worst fall for the global stock markets since 2008-09, when the US economy was badly hit by the subprime mortgage crisis. In India also, stock prices across sectors have fallen 20-40% in a very short span of time to touch their lowest levels since August 2013.

Investors are scared to check their stock portfolios as there is a big value erosion out there and margin calls have started to get triggered. As the situation is turning from bad to worse, investors are looking for safe havens to protect their hard-earned money. In such a scenario, what could be a safer place to park your money than ‘AAA’ rated tax-free bonds issued by a government company.

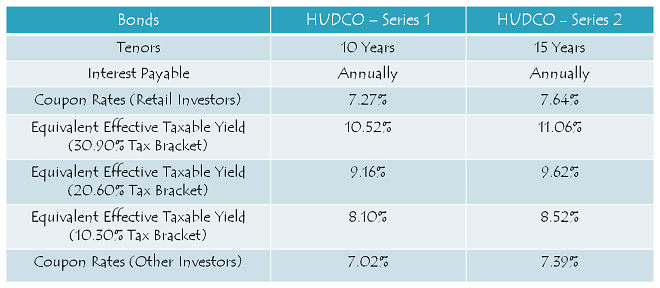

HUDCO will be launching its public issue of tax-free bonds from January 27, offering a coupon rate of 7.64% for 15 years and 7.27% for 10 years. The company will try to raise Rs. 1,711.50 crore in this offer, including the green-shoe option to retain oversubscription to the tune of Rs. 1,211.50 crore. Though the issue is scheduled to close on February 10, I think it should get oversubscribed on the first day itself in all the four categories of investors.

Before we analyse it further, let us first check the salient features of this issue:

Size of the Issue – HUDCO is authorized to raise Rs. 5,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,288.50 crore by issuing these bonds on a private placement basis during July-October period.

Out of the remaining Rs. 3,711.50 crore, the company will try to raise Rs. 1,711.50 crore in this issue. However, it is still not clear whether HUDCO would raise the remaining Rs. 2,000 crore this financial year or surrender the allocated amount back to the government.

Rating of the Issue – CARE and India Ratings have assigned ‘AAA’ rating to the issue, thus suggesting that these bonds carry highest degree of safety regarding timely payment of financial obligations. Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

Coupon Rates on Offer – NHAI, which was the last ‘AAA’ rated issue this financial year, offered 7.60% coupon for its 15 years option and 7.39% for 10 years. As 10-year G-Sec yield has fallen and 15-year G-Sec yield has risen since then, HUDCO bonds will carry 7.64% for the 15-year option and 7.27% for the 10-year option.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

NRI/QFI Investment Not Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue as well.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 684.60 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – Bombay Stock Exchange (BSE) is the only stock exchange where HUDCO bonds will get listed. The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical/certificate form as well. Whether you apply for these bonds in demat or physical form, the interest amount will still get credited to your bank account directly through ECS.

Also, even if you get these bonds allotted in your demat account, you will have the option to rematerialize your bond holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.27% p.a. for 10 years and 7.64% p.a. for 15 years on their application money, from the date of realization of application money up to one day prior to the date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – HUDCO will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced as the company allots its bonds to the successful applicants.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Global crude oil prices have plunged to their lowest levels since May 2003 and are currently trading at $26.76 per barrel as I write this line. Commodity prices are also falling sharply as China has suffered from its slowest GDP growth in 25 years. 10-year treasury note yield in the US has fallen below 2%, even as the US Fed has announced its decision to hike interest rates there. All these events suggest that there is a major demand slowdown out there which could potentially push some of the major economies back into some kind of recessionary environment.

Amid such a cruel slowdown, I am surprised (and disappointed also) how India is still having a high CPI inflation and why the RBI is still reluctant to cut interest rates when the economy badly requires low levels of rates in order to keep floating for survival. I strongly believe that there is an urgent requirement for the RBI to cut interest rates and not to wait for its next monetary policy on February 2nd to take any such action.

I think HUDCO issue is an opportunity for the risk-averse investors to invest their money for a healthy tax-free return for a long period of time. This could be one of the last couple of issues available for the investors this financial year to earn a risk-free income. Moreover, if the RBI obliges with a 25 or 50 basis points rate cut, we could see coupon rates falling sharply in the next bond issue by NHAI.

Application Form for HUDCO Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in HUDCO tax-free bonds, you can contact me at +919811797407

240 thoughts on “HUDCO 7.64% Tax-Free Bonds – Tranche I – January 2016 Issue”