This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In the last 10 trading days or so, some major stock markets all over the world have plunged more than 10%. I think this could be the worst fall for the global stock markets since 2008-09, when the US economy was badly hit by the subprime mortgage crisis. In India also, stock prices across sectors have fallen 20-40% in a very short span of time to touch their lowest levels since August 2013.

Investors are scared to check their stock portfolios as there is a big value erosion out there and margin calls have started to get triggered. As the situation is turning from bad to worse, investors are looking for safe havens to protect their hard-earned money. In such a scenario, what could be a safer place to park your money than ‘AAA’ rated tax-free bonds issued by a government company.

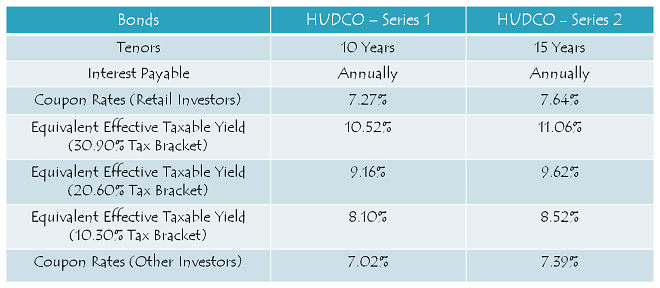

HUDCO will be launching its public issue of tax-free bonds from January 27, offering a coupon rate of 7.64% for 15 years and 7.27% for 10 years. The company will try to raise Rs. 1,711.50 crore in this offer, including the green-shoe option to retain oversubscription to the tune of Rs. 1,211.50 crore. Though the issue is scheduled to close on February 10, I think it should get oversubscribed on the first day itself in all the four categories of investors.

Before we analyse it further, let us first check the salient features of this issue:

Size of the Issue – HUDCO is authorized to raise Rs. 5,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,288.50 crore by issuing these bonds on a private placement basis during July-October period.

Out of the remaining Rs. 3,711.50 crore, the company will try to raise Rs. 1,711.50 crore in this issue. However, it is still not clear whether HUDCO would raise the remaining Rs. 2,000 crore this financial year or surrender the allocated amount back to the government.

Rating of the Issue – CARE and India Ratings have assigned ‘AAA’ rating to the issue, thus suggesting that these bonds carry highest degree of safety regarding timely payment of financial obligations. Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

Coupon Rates on Offer – NHAI, which was the last ‘AAA’ rated issue this financial year, offered 7.60% coupon for its 15 years option and 7.39% for 10 years. As 10-year G-Sec yield has fallen and 15-year G-Sec yield has risen since then, HUDCO bonds will carry 7.64% for the 15-year option and 7.27% for the 10-year option.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

NRI/QFI Investment Not Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue as well.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 342.30 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 684.60 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – Bombay Stock Exchange (BSE) is the only stock exchange where HUDCO bonds will get listed. The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical/certificate form as well. Whether you apply for these bonds in demat or physical form, the interest amount will still get credited to your bank account directly through ECS.

Also, even if you get these bonds allotted in your demat account, you will have the option to rematerialize your bond holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.27% p.a. for 10 years and 7.64% p.a. for 15 years on their application money, from the date of realization of application money up to one day prior to the date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – HUDCO will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced as the company allots its bonds to the successful applicants.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Global crude oil prices have plunged to their lowest levels since May 2003 and are currently trading at $26.76 per barrel as I write this line. Commodity prices are also falling sharply as China has suffered from its slowest GDP growth in 25 years. 10-year treasury note yield in the US has fallen below 2%, even as the US Fed has announced its decision to hike interest rates there. All these events suggest that there is a major demand slowdown out there which could potentially push some of the major economies back into some kind of recessionary environment.

Amid such a cruel slowdown, I am surprised (and disappointed also) how India is still having a high CPI inflation and why the RBI is still reluctant to cut interest rates when the economy badly requires low levels of rates in order to keep floating for survival. I strongly believe that there is an urgent requirement for the RBI to cut interest rates and not to wait for its next monetary policy on February 2nd to take any such action.

I think HUDCO issue is an opportunity for the risk-averse investors to invest their money for a healthy tax-free return for a long period of time. This could be one of the last couple of issues available for the investors this financial year to earn a risk-free income. Moreover, if the RBI obliges with a 25 or 50 basis points rate cut, we could see coupon rates falling sharply in the next bond issue by NHAI.

Application Form for HUDCO Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in HUDCO tax-free bonds, you can contact me at +919811797407

#stockmarkettips::

Merger of the State banks and its associates would be a good synergistic effect on SBI as a whole. All the banks books and treasuries would be merged together and thus it can save some cost of managing treasury accounts going ahead for the bank. Also size of the assets will increase significantly as a whole entity. SBI is already the largest bank and after this again it will be by far the largest bank of India. Once the NPA issue of the overall SBI and Associates are on place which will be in next 2-3 quarters it will start performing. Good time to invest in SBI at current levels and buy on any dips is good strategy for next 2-3 years time horizon.

Stock Market Tips

Hi Shiv,

Would it possible for you to publish the interest payout dates for all the Tax free bonds issued in FY 15-16. It will be of great help.

Markets End on a flat note ahead of long weekend:

Markets recovered in late afternoon session today to close on a flat note. Sensex closed at 25,337 just 7 points up and Nifty closed at 7,716 only 1 point up.

Metal stocks such as Hindalco and Tata Steel were up in today’s trade. While PSU banks such PNB, Bank of Baroda were on the downside. Reliance also was on a downside.

In the morning trade session, there was profit booking seen and late afternoon session again saw a recovery.

Aviation stocks, Jet Airways, Indigo and Spicejet were on significant upside today. Indigo posted 10% gain today and again saw some profit booking and closed at 5-6% gain.

Till RBI policy meet now, markets are expected to remain in narrow range now.

Hi,

Can someone let know the subscription status for NABARD in the retail segment?

Regards

Praveen

Hi Praveen,

It has got subscribed by 0.74 times in the retail category i.e. Rs. 1,551.32 crore as compared to Rs. 2,100 crore reserved.

Thanks Shiv for the info.

You are welcome Praveen!

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

Shiv,

You wrote in your post that interest payment on HUDCO will be on anniversary which is likey to be March every year, but the prospectus states First interest on 15-Dec-2016 and subsequent on 15 Dec every year and last on date of maturity from 15-Dec- to date of maturity.

Can you please clarify.

Thanks

Hi Mahesh,

I made the required changes in my post yesterday itself, please check – http://www.onemint.com/2016/02/27/hudco-7-69-tax-free-bonds-tranche-ii-march-2016-issue/

Thanks Shiv.

It is amazing that you attend to all comments with a very positive attitude. I sometime wonder where do you get all energy and time from.

Thanks for your constant support. Please accept my sincere compliments.

Thanks Mahesh! Such encouraging and motivating compliments give me all the energy to work harder !! 🙂

Dear Shiv,

I applied for the HUDCO TFB issue on the first day only and was hence allocated the same.But I only heard that the HUDCO TFB issue was allocated even for the second day applicants.Now you have confirmed that what I have heard is false.

If it is not fully subscribed on First day, one gets full allotment if applied on First day and gets proportionate allotment on second or subsequent days for the balance amount of issue size. So, others might have got some allotment on second day also and may get it till last day if not fully subscribed. The proportion depends on date of upload of application.

One can monitor this status.

Shiv, is this correct?

That is correct Mahesh.

Dear Praveen,

Thanks for your response.In the HUDCO TFB issue,I think that those who applied on the second day were also allocated.Hence,I am crossing my fingers on the NHAI tranche II TFB retail issue though I applied on the second day.Shiv and George,what is your speculation or update on this?

Hi Dr. Sharma,

I don’t know how you got the bonds allotted in the HUDCO issue when you applied for it on the 2nd day, but I don’t think you would get the NHAI bonds allotted.

HUDCO Tranche II update:

Issue opens – 2nd March, 2016

Issue closes – 10th March, 2016

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Shiv and George,I have followed your advice of investing in retail investor category with regard to NHAI TFB issue today on February 25,2016.Is there any chance of securing allotment as I have invested on the second day of this issue since I missed internet out of station for a few days until today afternoon?

Hi,

NHAI got subscribed on the first day itself.

So I think if you applied on 2nd day you would not get it.

Regards

Praveen

Thanks Shiv.

How easy is it to sell these Tax Free Bonds?

Are there buyers if we want to sell them at a later date if need arises?

And what is the tax treatment for the sale proceeds and also the past interest credited in earlier years?

At present my TFB is being credited into my DP account associated with India bulls. So if I want to sell should I transfer it to another demat account and then use zerodah or icici securities to sell them?

Thanks in advance

Praveen

Hi Praveen,

If sold after holding for more than 1 year, LTCG tax is payable @ 10% flat. If sold before completion of 1 year, STCG tax is payable as per you slab rate. Please check the ‘Turnover’ column in this link – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Thanks Shiv for the links. It helps.

Can you clarify below as well:

At present my TFB is being credited into my DP account associated with India bulls. So if I want to sell should I transfer it to another demat account and then use zerodah or icici securities to sell them?

Regards,

Praveen

Hi Praveen,

I didn’t get your your query. Why do you want to transfer it to some other demat account?

Hi Shiv,

Now I have a trading account with India bulls which provided a Demat account associated with trading account.

I was told that I cannot trade say using Zerodah from demat account associated with India bulls demat account where my TFBs are parked.

Basically Indiabulls trading and demat account are tightly coupled.

Is this assumption incorrect?

Please let me know.

Regards

Praveen

Hi Praveen,

You can use your Zerodha account to sell your bonds, but you need to contact Zerodha to know the exact procedure.

Thanks Shiv for the info.

What is the difference between “Cumulative Bid Details” and “Cumulative Demand Schedule”?

REgards

Praveen

Cumulative Bid Details carries ‘Series’ wise bid details, whereas Cumulative Demand Schedule has ‘Category’ wise break up.

Hi,

http://economictimes.indiatimes.com/markets/stocks/news/nhai-tax-free-bonds-oversubscribed-2-75-times-all-categories-see-heavy-demand/articleshow/51124925.cms

Looks like NHAI got over subscribed by 2.75 times

Based on details available on BSE page, retail sector subscription is only 1299 crores approximately as below:

Series4 1,29,93,881

While alloting the bonds when it has been over subscribed will they follow limits set for each category..

For eg, if category 4 has been reserved 40% will they allot based on 40% of 3300 crores which is equal to 1320 crores and hence all the retail investors who invested on first day gets their bonds they applied for?

Regards

Praveen

Hi Praveen,

Yes, retail investors will be allocated these bonds based on their reserved quota of Rs. 1,320 crore. But, the retail category is oversubscribed by 1.15 times i.e. Rs. 1523.36 crore as against Rs. 1,320 crore reserved. Please check this link – http://www.bseindia.com/markets/publicIssues/EODCumlativeShedule.aspx?ID=1067

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

I also heard today that NHAI issue is opening on 22 Feb.

Hi Shiv,

I received Hardcopy Hudco bonds but applicant name showing as Nominee, how and who can i approach to correct this?. Is it going to be problem later?.

Appreciate your kind advice on this..

Regards

Nagarajan

Hi Nagarajan,

You need to contact Karvy Computershare on 1800 3454 001 to get it corrected.

Thanks lot Shiv,

I have contacted them and they have requested me to drop email about this.

Karvy Email ID : einward.ris@karvy.com

may be useful for others.

Regards

Nagarajan

Thanks Nagarajan!

Shiv, Just wanted your opinion on an issue: Can a NRI buy some of the Tax Free bonds in secondary market which were earlier disallowed in the primary issuance by the issuer like NHPC or IIFCL bonds in 2013. also will be it allowed if they are held in NRO dmat account, which are non repatriable. would appreciate your expert views,

Hi Ashish,

NRIs can invest in tax-free bonds, but only those in which it is allowed. You need to check it with your broker which companies have allowed NRIs to make investments.

Dear Shiv, Refer mail from Mr Nitish,

Link is

http://www.bemoneyaware.com/tax-free-bonds-of-fy-2015-16-ay-2016-17/

Forthcoming Tax Free Issues-Tentative:

NHAI-3300cr/22-2-16,

IRFC-2450cr/29-2-16,

HUDCO-2000cr/29-2-16

NABARD-3500cr(Mar-16)

How true it is -is open for blog.

Shiv, Let us know if you were able to validate if this is right..

Thanks Pankaj for this info! I am not sure about the exact dates, so cannot really comment on that. But, issue sizes should be around these figures only. HUDCO issue should be of lower value though as 30% of the allocated amount has to be through private placements.

IRFC will raise an additional Rs. 3,500 crore by issuing tax-free bonds this financial year – http://www.financialexpress.com/article/economy/indian-railway-finance-corporation-gets-rs-3500-crore-more-tax-free-bond-limit/211014/