The following is a guest post by The Weakonomist from Weakonomics.com

Back in 2007, banks were starting to realize that the loans they were making and selling were possibly going to become a problem. As borrowers started to default into the beginning of 2008, banks began to evaluate their portfolios and project losses. Things didn’t look good. In short, all the banks were going to run out of money unless the government bailed them out. We all know that towards then; end of 2008, the government did just that.

Even though the government loaned the finance industry almost $1 trillion, this was only enough to keep them afloat. Imagine being given just enough medicine to keep you alive, but you’re still bedridden. This is what the banks were dealing with over the course of the year.

Congress gave the banks all of this money, and were shocked to learn the banks were not lending it out to you and me. They asked the banks why they weren’t lending it out. They’re response: “you won’t let us.†Congress told the banks to be more careful with their lending. Because of layoffs and people already borrowing too much, there’s no one out there worth the risk to loan money to.

So the banks do have a little bit of money to loan, but they can’t loan it to us because we’re too risky. What are they doing with all that money? Well they’re loaning it to someone. Businesses? Nope. Investors to buy securities? Nope.

They’re loaning it to the government. Well why does the government need to borrow money? They need to borrow billions of dollars to bail out the banks, thus giving them enough money to loan to us. The problem is, when Congress decided to give the banks this money, they didn’t require that they do anything with it.

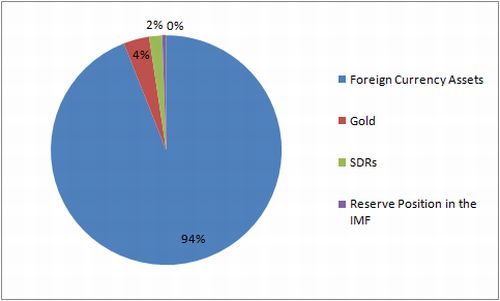

The banks are investing in treasury securities. These are sold by the government to raise money. So the government is raising money, by borrowing from banks, to bail out banks. A mess is an understatement.

Congress still doesn’t quite understand that even this is going on. They are still grilling bank executives for not loaning out money, but blaming the recession on them for loaning too much.

If you were looking to invest some money in a safe place to ride out a recession, the government is the place to do it. Generally speaking, the rates at which the government issues their debt are referred to as “risk free†due to the low risk of the government defaulting on their debt.

It’s very tempting to blame the banks for not loaning you money. But look at it from their perspective. They’d love to loan you money, but if they don’t think they’ll make a profit off of you, they aren’t going to loan you the money. So they look for safer investments where they do know they will get paid back. And since the government is loaning the banks money at a cheaper rate than the banks are loaning it back to them, the banks are making a profit.

Don’t blame the banks for doing exactly what they are allowed to do with the money. Blame your Congress who passed the laws allowing the government to loan the banks money, but not passing laws requiring them to loan it to you and me. Government issues their debt are referred to as “risk free†due to the low risk of the government defaulting on their debt.

It’s very tempting to blame the banks for not loaning you money. But look at it from their perspective. They’d love to loan you money, but if they don’t think they’ll make a profit off of you, they aren’t going to loan you the money. So they look for safer investments where they do know they will get paid back. And since the government is loaning the banks money at a cheaper rate than the banks are loaning it back to them, the banks are making a profit.

Don’t blame the banks for doing exactly what they are allowed to do with the money. Blame your Congress who passed the laws allowing the government to loan the banks money, but not passing laws requiring them to loan it to you and me.