I’ve received a few emails about when applicants will receive the IDFC infrastructure bonds, and since the company didn’t announce when this will happen before hand – people have been wondering when they will get the bonds.

Readers Ajay, Loney, Satish, Nageswara, Sandeep, Sangram, and Subhro (among others – it’s a really big thread so I couldn’t include all names) have left comments sharing their bond status, and that helped a great deal in getting an idea on what’s going on with this.

A big thank you to all of you for keeping everyone informed!

I don’t think everyone who applied for the IDFC Infrastructure bonds is subscribed to the comments on that post, so I thought I’d create a post from the information shared by these folks.

Let’s take a look at some of the more important points from that thread:

1. Allotment took about 3 weeks: The bond issue closed on 22nd October, and people have only started seeing the bonds credited to their demat accounts, so the time from issue closure to the actually seeing the bonds has been around 3 weeks. This will form a good reference for other infrastructure bond issues in the future.

2. Not everyone has received the bonds yet: There seems to be some mechanism by which bonds are being gradually credited across applicants, and not everyone has received these bonds yet. If your account has not been credited yet, then there is no need for alarm, as people have only recently started seeing bonds credited, and it might still take a few days for it to appear for you.

3. NSDL sent an SMS about credit of IDFC Bonds: The depository – NDSL – had sent a SMS letting people know that the bonds have been credited. However, the bonds were not visible in the account immediately. So even if you received the SMS that doesn’t necessarily mean you will see the bonds in your demat account as well.

4. No one has received the physical certificate yet: The people who have reported getting the bonds have all applied through a broker, and have demat accounts, and none of them have received the physical certificate yet. So if you have applied without a demat account, then it might take longer still for you to get the physical certificate.

Don’t press the panic button if you haven’t received the bonds yet because you are not alone, and there are several others whose money has been debited, but the bonds haven’t been credited yet.  My guess is that you should start seeing them in your demat account in the next few days.

Future Infrastructure Bond Issues

Some of you have also expressed dismay at the fact that you missed this and the L&T issue, but were interested to buy the bond for tax saving and other purposes.

The good news for you is that IDFC as well as other issuers have said that they are going to come out with more such issues towards the end of the fiscal year because that is when most people are actively looking out for tax saving vehicles, and they are likely to do a lot better at that time than now.

Finally, some people have written in asking if it’s better to wait out for a higher rate of interest than investing in this offer.

I honestly don’t know what issuers are planning for the future, based on the lukewarm response, they might sweeten the deal, but I have no way of knowing for sure.

I’d say don’t lose perspective of the fact that the primary benefit of this is of tax saving. If you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it. And once again – a big thank you to all of you fine guys who left comments and kept everyone informed!

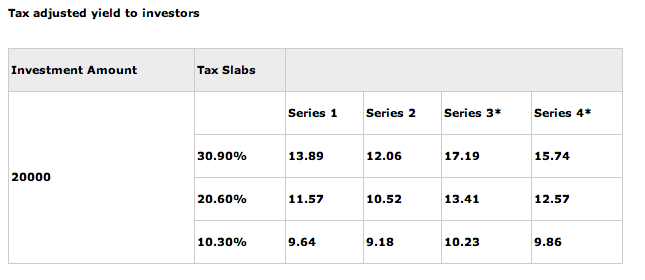

Whether the Bond will list at a premium because as per Bond Valuation theory Bond Value is a function of interest rate. So they are offering 9.5% which is 2% higher than the rate offered on FDs by Banks so we will get 2% higher for 10 years, which if we discount it @7.5% we will see its present value comes to around Rs 14 per 100. So I expect the bond to list @ 14% premium. So can anyone advise me whether I am write or wrong, because I have never invested in Nonds before.

REPLY