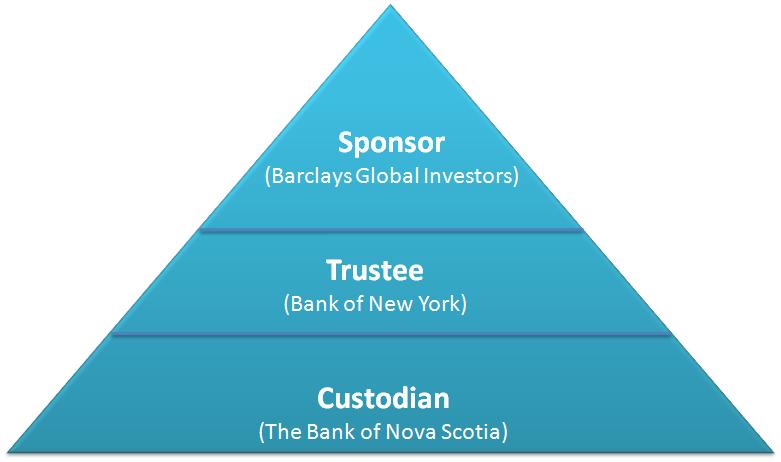

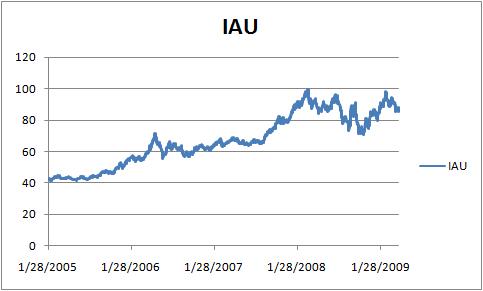

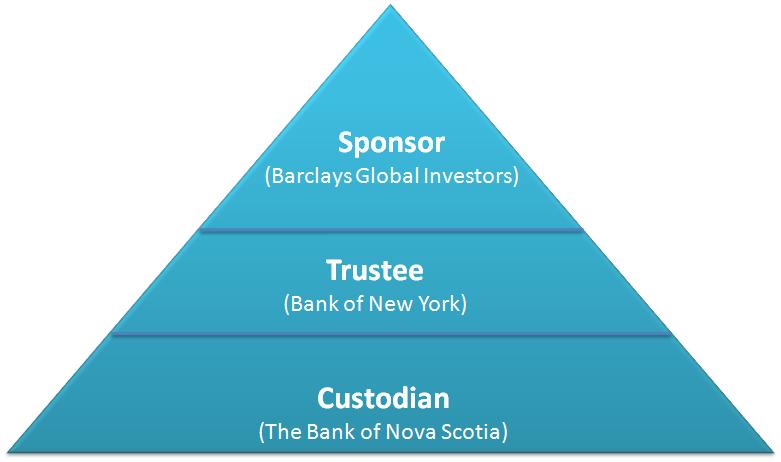

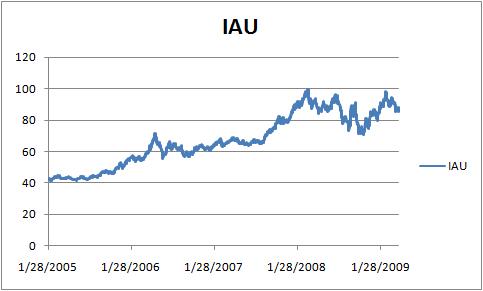

iShares Comex Gold Trust (IAU) is a Gold ETF, which holds physical gold as its underlying asset and moves in tandem with gold prices. The sponsor of IAU is Barclays Bank and it trades on the NYSE ARCA. As the sponsor — Barclays has appointed The Bank of New York as the trustee and it is responsible for the day to day administration of the trust.

The Bank of New York has further appointed The Bank of Nova Scotia as the custodian and it is responsible for the safekeeping of the gold owned by the trust.

IAU Backed By Physical Gold

IAU holds stock of physical gold which is held by the custodian near New York, Montreal, Toronto and London. There are different types of commodity funds — some that create future contracts to reflect the price movement in the underlying asset, others hold stocks of mining companies and some actually hold the underlying physical asset. IAU falls under this category.

IAU: Expense Ratio

IAU has an expense ratio of 0.4% and compares favorably to other gold funds and their expense ratios.

IAU is a Passive Investment Vehicle

IAU is passive in nature and it doesn’t engage in gold trading. To that extent — this investment should be strictly viewed as a proxy for buying gold. If you are looking for a gold mutual fund that actively engages in trading the commodity and earn profits — over and above gains in gold prices — then this is not the right investment vehicle for you.

Factors Affecting Gold Prices

Gold and the Dollar

Gold has rallied in the recent past with the anticipation that the Fed’s printing press will cause inflationary pressures and lead to a crash in the value of the dollar, and people have been buying gold to protect themselves from the dollar crash, as historically, there has been an inverse relationship between the value of the dollar and gold prices.

Gold: Demand and Supply

In 1998: 2,574 tonnes of gold were mined globally. This figure has slightly declined to 2,476 tonnes in 2007. So, in the last ten years or so — gold mining has been stagnant and even witnessed a marginal decline.

At the same time the total fabrication (major demand component) declined from 3,737 tonnes in 1998 to 3,072 tonnes in 2007. So, even though supply fell, demand fell at a faster rate.

This is an interesting trend, but since gold is a precious metal — the simple equation of demand and supply for fabrication is more of an indicator, than a decisive factor determining the direction gold prices. Other factors like dollar declines, stock market downturns etc. play a significant role in determining the price of gold.

On to IAU itself, it is a good vehicle for someone considering passive investment in gold but who doesn’t wish to hold physical quantity for whatever reason.

Disclaimer: I don’t own IAU at the time of writing