I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

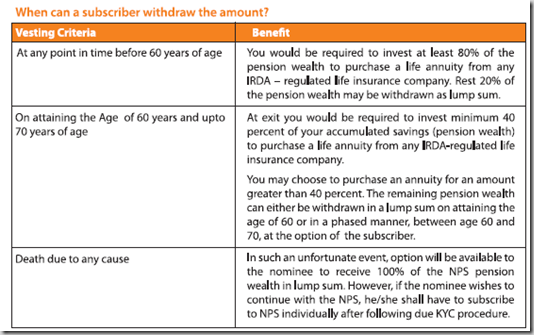

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

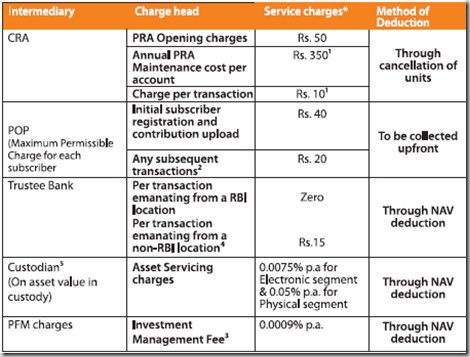

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

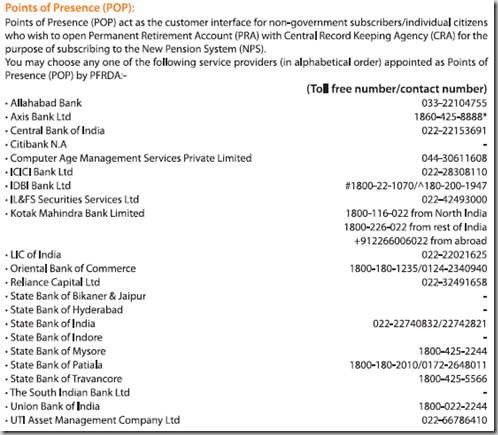

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

I am not to sure as to how can you withdraw the money as money invested in Tier 1 is strictly cannot be withdrawn. According to sources in Govt once the DTC comes into effect they would tweak around the NPS to make it more attractive and bring it on par with PPF and other instruments available currently just to increase the participation of general public. But I am not to sure how you can withdraw the money now. I think you can invest minimum amount of Rs 6000 per year as if the DTC comes into effect this amount will also come under (EEE Category) this will be beneficial in the year end tax claims….Hope this helps…..I am also investing in tier 1 scheme for the moment and not to sure how things will shape up 🙂

I was appointed as LDC in Central Govt on 22-9-2009, from 1-10-2009 they are deducting Tier.I contribution from my salary. The thing is recently I got another job and I resigned from my previous job on 6-12-2010. Now I want to close my Tier.I account and withdraw my amount . Pleas, let me know the procedure how to withdraw my 15 month contributed amount from my Tier.I account.

Hi,

Only once the DTC comes into effect will the NPS come under the (EEE) limit

Hi .. the original blog says “The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal.” – has the proposal been accepted??

my question is that govt contribution is also added while calcualting 80C. that is what they are doing in my dept

After how many days can I withdraw amount from my Tier 2 account and how much percentage

There is no limit on the number or amount of withdrawals.

can I change my tier-1 account of NPS to tier-2 account.

You need to have a Tier 1 account in order to open a Tier 2 account Shylaja, so you will have to keep the Tier 1 account, if you wish you can keep it with the minimum balance though.

a) what benefits accrue to the nominee in case of death of customer during the currency of the scheme i.e. when he is still subscribing towards the scheme. It may kindly be clarified whether a nominee will be entitled to any pension and lump-sum payment from the corpus fund accumulated in the name of such deceased customer.

b) It may also be advised if the nominee of a customer wil be entitled to any benefits after death of the subscriber, if such death occurs after the age of 60 years. If so, what are the benefits admissible to nominee. For example, if a subscriber subscribes for 30-35 years and starts getting pension at the age of 60 years but dies at 61, what will happen to the corpus he would have accumulated over 30-35 years? Will his nomees get it?

a) From what I’ve read – the nominee can withdraw 100% of the amount, and if they want to continue with the NPS then they will have to subscribe individually.

b) I couldn’t find any information about the nominee getting a pension. Doesn’t mean that it isn’t there, just that I have not been able to find it.

Hi,

The Tier 2 account of NPS is one of the Cheapest mutual funds you will ever get to invest in. When I say cheapest, i mean in terms of Management fees, costs and load. Every youngster who has access to open an NPS account should do this ASAP.

Transfer money into the Tier 2 account throug and ECS and beleive me in time you will see great growth and accumulation.

Regards

Venkat

Thanks for your views Venkat.

Hi Manshu

The very purpose that NPS is not well known to many of the investors is because of the low cost and NPS is not attractive for the fund managers. I had to talk to three or four fund managers of NPS and went to their office to open an NPS account whereas for a normal MF, the guys would come home to open the same.

Yeah, that’s right – it’s not really in anyone’s interest to push this product, but with time the pull for it is increasing and as more and more people demand for it, banks and other fin intermediaries will have to carry them and provide info on it.

http://www.licindia.in/jeevan_akshay_plan_009_features.htm

the correct link for the last comment

I think you can roughly compute the monthly pension by first estimating your total corpus when you are sixty and then calculating the returns you would get from a typical annuity.

e.g. if your total estimated corpus at the age of 60 is 10 lakhs, and you use all of it to buy an immediate annuity (let’s assume Jeevan Akshay from LIC with uniform payout for life option http://www.licindia.in/jeevan_akshay_plan_009_features.htm), you will get an yearly pension of INR 93500 or about INR 7800 per month.

To calculate the corpus, you can use some online calculator and assume a rate of return of 10-12%, which is reasonable for 50% allocation to equity.

Hi,

Currently there is an option of ECS and I have subscribed to it under the same option. It would be very difficult to say how much monthly pension will a person get as it has an equity angle to it…eg I have allocated 45% of my funds to the equity option so it will be difficult to put a figure to it.

Nice info I could get but the anxiety remains as to “How much monthly pension, one will get after completion of 60 years of age?” Any tabular chart will give an idea as well as clue to the General Public.

Devendu,

At present, contributions and other services can only be availed using services of POP.

In future, we will have option of ECS also.

Can a person operate the NPS (Tier -1 and Tier- 2 schemes online i.e. without going to any Agent or POP

I am reading it late… but very informative and useful article.. something thats true for every onemint article infact.

Thanks IT 🙂 very glad to hear that!

Thanks Manshu for the great posting. Once the DTC Kicks in NPS would be eligible for tax saving included in one lakh. So if one invests Rs 18,000 he/she can claim benefit on the amount. The added advantage is obv it will fall under the EEE category wherein the money at the time of withdrawal will also be exempt from tax.

Thanks Gaurav, that’s a great point. I think I need to either update this post with these thoughts, or write another mini post about them as they’re quite important.

For info and n.a

Very useful information indeed, and I think the NPS scheme does have potential and needs to be advertised much better.

However, I think the low fund management charges (0.0009%) is slightly misleading. For a person making minimum investment of Rs 6000, the charges for first year are almost 7% (Rs 50+350). It would be interesting to analyze how this compares with a private mutual fund and at what point the charges balance out. At first look, it definitely seems to me that one is better off investing in a diversified mutual fund for low levels of investment.

Also, it would be useful to get some details on how competently these funds will be managed. Will the equity portion be pretty much passively managed as an index fund, or can we expect better returns that diversified equity funds strive to provide?

Very good points Sandesh.

The equity portion of the funds will be invested in index funds, so the returns will be commensurate with index returns, and not anything over that. There are a few diversified funds in India that have beaten the index in the last 5 years or so, but whether they will continue to do so in the next 30 or 40 years (retirement time-frame) is anybody’s guess.

About the charges, the fund management fee is charged by all mutual funds, which is usually in the 1 – 2.5% range, so that’s the comparison. Your comment made me wonder if the equity part of this fund when it is invested in an index fund, will that pay the fund’s usual expenses….probably not, but I don’t know for sure. Do you know about that?

What do you think?

I believe that the fund management fees for passively managed index funds is typically 1% or lower. For NPS to beat this, the fund value invested in NPS should be larger than Rs 40000. For a smaller investment than this, private index funds seem a better choice. Correct me if I got the math wrong!!

Btw, from what I understand, the fund management expenses under NPS are capped at 0.0009%, no additional fees are payable (other than the fixed charges of Rs 350 p.a.).

There is more to it than meets the eye here, the CRA is the biggest part of the NPS cost at Rs. 350 annually today, but this is going to come down when the number of accounts cross 30 lakhs. At that time this will come down to Rs. 250. The 10 rupee transaction cost will also come down to Rs. 4 at that time.

So, that’s one thing that’s going on here. Secondly, we might be missing the forest for the trees here by focusing too narrowly on the expenses as costs, and by ignoring the tax implication of this, which, at least for now gives them an edge.

Then there is this whole issue of buying a mutual fund or an ETF from a broker where you have to pay distribution and demat account charges which add more to the expense and make it much more than 1%.

So, my take on this is don’t cling to the 40k number, but look at this more holistically, especially with respect to something that provides you a pension, and something you are in for the very long haul.

Of course if you are talking about a bigger investment corpus, and are looking relatively safer investment options, then this is quite good for you. On the other hand if you’re still quite young and want to invest a larger share of your savings in a diversified equity fund, then go for it.

Good discussion Sandesh, thanks for bringing up these points, I might make a mini post out of this.

Dear Sir,

We Are Running Simon Vadana Samaj Seva Sanstha.(N.G.O.) So We Are Thinking To Oppen N. P. S.Agency.

So Pls Give All Detals. Waiting For Your Anser.

My Cont No; 08085558377,8223933140