This is the first post based on the Suggest A Topic page that I created recently, and the title of the post is exactly what was written in the comment.

I’ve created that page to get suggestions on topics from readers, and have them organized at one place instead of the usual emails and comments I get. This way is better for me to keep track of the post suggestions as they don’t get buried in my email, and its better for the person suggesting it because the suggestion is out where everyone can see it. So, to me it is a win – win.

Now, to the post itself.

What is the Pre – Open Call Auction Session?

The NSE and BSE introduced the pre – open call auction (pdf) sessions from October 18 2010, and these sessions are intended to reduce volatility and provide better liquidity in the markets.

The pre-open session lasts for 15 minutes from 9 AM to 9:15 AM, and is divided into three parts:

- First 8 minutes: In the first 8 minutes orders are placed. They can be canceled or modified during this time period also.

- Next 4 minutes: In the next 4 minutes price discovery will be done, and orders will be executed.

- Next 3 minutes: The next 3 minutes are used to facilitate the transition from pre – open to regular session.

Right now, only the index stocks are included in this session, and you can place both market, and limit orders as part of the pre – open session. A price band of 20% is applicable on all securities in the pre – open session.

How does the Pre-Open Call Auction Session Work?

The way they go about doing this is instead of executing trades right from the get go, they take all orders, and then arrive at an equilibrium price.

The equilibrium price is the price at which the maximum number of shares can be traded based on the demand and supply quantity and the price.

Consider this example:

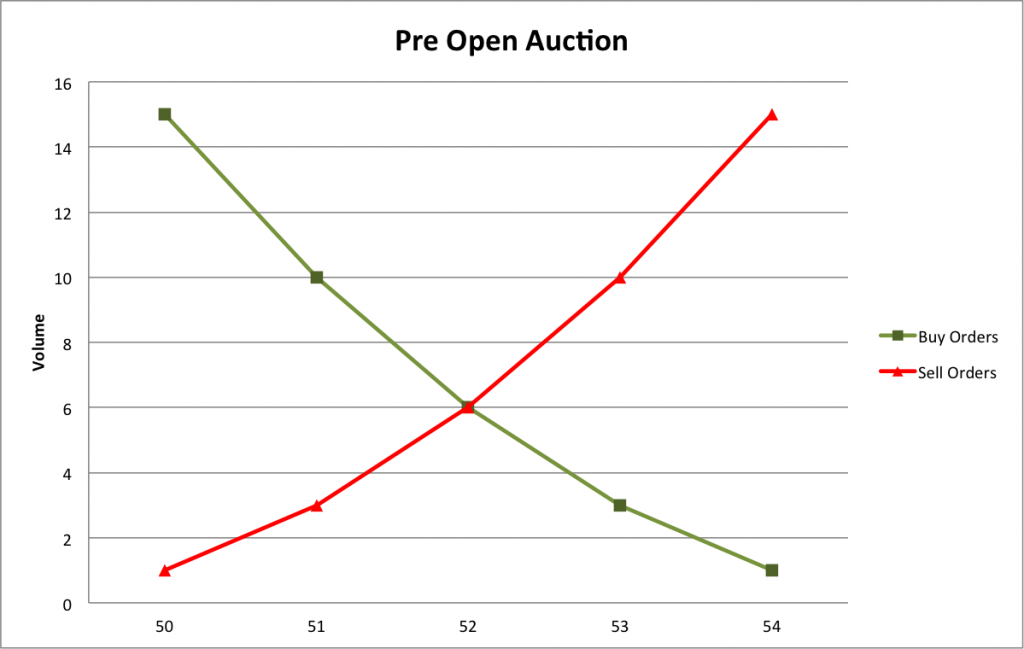

In this example you can see various buy and sell orders at different price levels.

The green side is the buy side which shows that there is a bid for 5 shares at Rs. 50, 4 shares at Rs. 51, and so on till Rs. 54 at which there is just demand for 1 share.

On the red side you can see that you can sell 5 shares at Rs. 54, but only 4 at Rs. 53, 3 at Rs. 52 and so on. There is a cumulative column at the end of both sides which shows you the total number of shares that can be bought or sold at any given price.

If you were to create a demand – supply curve based on the price and cumulative values, it would look like this.

The intersection of this curve is the price at which you can conduct the maximum transactions, and that’s the equilibrium price that comes out from this pre-open call auction.

You can see this for yourself:

- At Rs. 50 there are 15 buyers but just one seller so only 1 share will be traded.

- At Rs. 51 there are 10 buyers but only 3 sellers, so only 3 shares will be traded.

- At Rs. 52 there are 6 buyers and sellers so 6 shares will be traded.

- At Rs. 53 there are 10 sellers but only 3 buyers.

- And at Rs. 54 there are 15 sellers but only 1 buyer.

So, in our example at the end of the price discovery phase the price will be determined at Rs. 52, and the orders that can be executed at that price will be executed. The other orders can be carried forward to trade in the regular market.

In this example, if the normal method of determining price would have been used then some trades would have happened on Rs. 54, and Rs. 53 in our example, and by determining the price at an auction like this at least theoretically the exchange is smoothing out some of the volatility that occurs in the opening moments of the market.

If there are more than two prices at which the demand supply matches then they see which of them has the minimum imbalance, and use that as the price. If both the prices create equal imbalance, then they look at the price which is closest to the last closing price and make that the equilibrium price.

What is its significance on the market?

You will hear a lot of folks say that the exchanges have implemented this change, which takes away from the fact that this was something that SEBI had asked the exchanges to look into, and implement, and is used in other countries as well.

I guess until we see a day with a lot of volatility and the market opening with a big gap, and then that day is studied for impact from this change we will not know for sure how this is working, but in theory this sounds like a better system than the one we had earlier.

For retail investors – it is always a good idea to place a limit order instead of a market order so that if the market moves violently you don’t lose out any money, especially in a one off black swan type of event. You could just keep a limit order close to the currently traded price or closing price if you don’t want to wait for your transaction to go through, but developing this habit will hold you in good stead in the long run.

Also, there is some excellent material and a great video by BSE on this topic, and those of you who want to explore further can check them out. All the details for this post has been gathered from that material itself.

Here are the links:

Introduction to Call Auction Trading

YouTube Video on Call Auction Trading by BSE

CAN I PLACE EQUITY ORDERS IN PRE OPENING SESSIONS?

Very well explained.Thankn u Manshu.

Explained technically in a simple way! Thanks for the post….

Excellent post, i was clueless about pre-open till now, thanks.

By the way, retail investors are not allowed to place orders during pre-open right?

Who and all take part in trading in pre-open?

Anyone can take part in the pre-open session by placing bids before the market opens.

Stumbled upon this very late , better late than never. Liked your keep it simple and short way of writing.Kudos.Thanks again

Hi Manshu, I silently wondered what is happening during these 15 minutes till today when my son asked me about it. You have explained it in a very very self explanatory way. May god give you happiness always.

Thanks!

Very well explained… Was looking for an explanation related to market pre open for long… Thanks..

Great – thanks!

Very well explained!

Hi Manshu, Thanks for publishing this piece. But still in my view the way of price determination-reduction of volatility in the market seems a war between the technical advancement of exchanges Vs psychological & news related triggers or traders.

This seems like a step forward to me, of course nothing can ever remove volatility completely – that’s the whole point of the market in some ways.

Excellent post Manshu!

Thanks..

Thanks Parth. Did you notice any difference because of these changes yet? I know it’s early days, and anyway it is not supposed to have much of a visible impact during regular days, but still wondered if you noticed anything.

Hi

I liked the way of your writings. Good compilation, I was little bit confused about Pre-open session but now its almost clear.

thanks…..

khalid

Thanks Khalid.

Is there any part that is not so clear? I can try and see if I can elaborate on a point that’s not clear.

Very useful and explained very well as well.

Thanks, I’m glad you found it useful. I was trying to look up some studies on how this has impacted other countries who implemented it but couldn’t find anything, so will try to hunt that up, and see if that can point to how effective this is going to be.