I read that HDFC is coming out with a new gold ETF, so I thought I’d check out how the existing ones are doing, and see what is the difference in returns between the gold ETFs that are already present in the market.

I went to the NSE website, and looked up the closing prices for all 7 existing gold ETFs for the past couple of years.

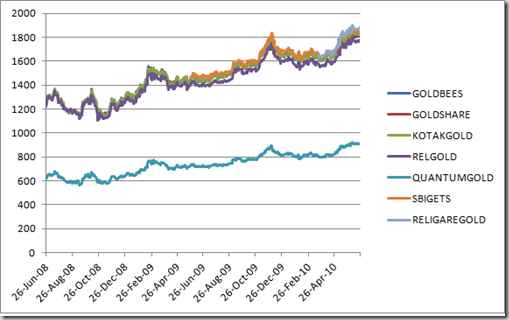

Here is how they have moved over the past two years.

As you would have probably expected, the prices move quite close together, and you can hardly notice any difference between the ETFs.

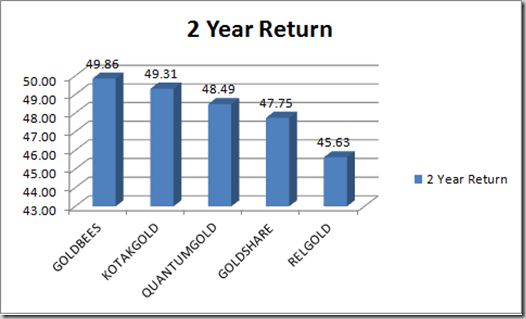

Next up, I did a chart of the absolute returns of the gold funds that have been in existence for the entire two year period.

Here is how that looks.

GOLDBEES does the best (and it does quite well in volumes also, as I mentioned in my best gold ETF post), and that is due to the fact that its expenses are lower than the competitors. More competition is always good for the customer, but unless someone comes up with an ETF with expenses lower than GOLDBEES, I can’t imagine them to be the best on this chart.

Hi Manshu,

First of all, I would say thanks for sharing your knowledge and educating us on Gold ETFs.

I am reading your blogs on gold ETF and is really useful and full of information. Even i found the questions posted by investor are very useful.

I am looking for investing in Gold ETF. Can you post the link showing the compression between all gold ETFs till recent data as i understand that above one is till 2010.

Where can i find the expense ration charged by various ETFs? Do you have some comparison for same.

Thanks in advance and Keep up the good Job.

Regards,

Tejas

Hi Manshu,

Thanks for the wonderful post on Gold ETFs.

After looking at the query from Gopal and your reply.. I was just curious of some calculations.

Seems like gopal paied an extra 4% to have the gold.

If we go in for Goldbees and planning to hold it for more than 4years (Note atleast 4% would have been paied to the fund house in terms of expenses)

So can I safely assume that if we are planning to hold to the gold investment for a long time it would be better in terms of physical gold?

Thanks in Advance

Madhu

Hmmm, well not entirely, they do have some liquid investments also which earn money for them so its not always a 1% reduction. And the other thing which you have to consider is how easily will you be able to sell physical gold. That’s the big thing in my mind because of the kind of comments I’ve seen here.

you can look at this comment thread to get an idea of what I’m talking about.

http://www.onemint.com/2010/04/14/how-to-buy-gold-coins-in-india/

Manshu,

Yesterday i invested in 10g of 22cr gold by buying a gold coin at 2126/gm. On top of this the jeweller charged me 3% dying charge and 1% VAT , put together came upto 22110.4

If i went for say GoldBees ETF to buy same 10g gold , Is there any extra charges i should pay ? Also once i decide to redeem the ETF worth 10g of gold to get cash – what will be the charges for it ?

This is like a stock so you will have to pay commission that your broker charges on any share transaction. Outside of that you don’t have to pay anything – on sale or purchase. Theoretically, a gold ETF unit represents approximately 1 gram of gold, and not exactly 1 gram of gold because there are expenses that the fund charges which gets deducted. These are to the order of 1% per year.

Manshu

Hi i am a salaried person and i want to invest in Gold ETF .

I want to know that they are giving units if we invest in SIP and can we take gold instead of withdrawing money for that i have to invest in physical gold .in which ETF sholud i invest Kotak or gold bees

Pankaj – You can’t get physical gold in return of gold ETFs. You will get money in return for it. In my opinion GoldBees is a better option and I have a full post on that here too.

Hi,

For the past 6 months, I have purchasing the direct gold coins(22 karat 916) from the local jewellers with the 3% of wastage and 1% of VAT in addition to the standard gold rate. For every purchase of gold coin, I am paying 4% extra.

It could be much better if you provide me the best answers for my below few queries.

1)Is above method is the right and safer approach for the investment?

2)Is the % value which I am paying is reasonable?

3)For investment and for future use, which is the best and why? either 22 karat or 24 karat.

4)What is the main difference between ETFs and Direct Gold?

5)What is the advantage of ETFs over Direct Gold?

6)What is the disadvantage of ETFs if any?

Both have pros and cons – with Gold ETFs its liquid and you can sell it any time – the pricing is transparent. Per tax – ETF is more efficient. On the other hand physical gold is something devoid of counter party risk – it also gives you the peace of mind to have something tangible in hand. You can get jewelery made if that’s your ultimate goal.

So, it depends on what your purpose with this investment is, and how comfortable you are with the idea of paper gold. It’s not for me (or might I add anyone else) to say that one is definitely better than the other without fully knowing what you intend to do with and how big a part it is in your portfolio. If you have too much of it then someone might even advise you against buying more gold and diversify into other assets.

hi friend,

thanks a lot , as per ur advice i started buying gold bees , i am very happy to see its moving like anything, but i feel now i cud have bought more:)

will there be any chance for this gold bees to come below 2050 again? what your views on it, what should be the investor/traders approach this time.

I have 10 gold bees at the aevarge of 2012 should i sell or sell half of it? and buy on dips again?

I have no input or in fact idea on how gold prices will behave. Personally, I have stayed away from gold all this time because I don’t like all the retail interest that’s built into it.

If people decide to buy gold then I say GoldBees is a good way to do that, but I don’t know how gold prices will behave in the future. They may crash like real estate stocks or keep going northwards – unfortunately I don’t have any insight on that.

If you look at all the other comments you will notice that people coming here have already made up their mind on gold prices moving upwards, and that’s their decision really.

With that in mind, I can’t provide you any answers to your questions 🙂 .

Dear Manshu

Thanks for your reply. I have decided to invest in paper gold regularly.

Thanks for your reply – all the best to you!

Dear Manshu,

Thanks for your kind answer. 99% doubt of my question solved because of only you thanks for that once again. Final thing I didn’t understand your last comment

“””””If you are looking to hold it for such a long term then you can think about buying physical gold from a jeweler of repute, and store it in a locker”””””””

WHY?

So, can’t I invest in gold etf if it is for long time…..

With Regards,

AhhA

Chennai

What I mean is in the end you’re going to use it as jewelery and you have so many doubts now that you will probably not sleep well if you have this paper gold.

If you’re going to use it as jewelery anyway then might as well start off with buying physical gold and have the peace of mind now itself. Even in the case of gold ETFs you will sell them and buy jewelery for your daughter, so might as well buy the physical gold from a reputed jeweler and spare yourself the trouble of worrying about what will happen if the fund goes bankrupt etc.

I would suggest buy direct Gold and Silver in the form of E-Gold and E-Silver where you will have the option of exchanging with the metal as and when you want in terms of metals or even jewellery

Dear Manshu,

First of all thanks for your comments. I still didn’t get clarified on gold etf.

I understood the following very well because of your website:

Q: How to buy gold etf?

A: With the help of Demat account (I mean DP)

Q: What would the fund house do with our money?

A: They buy gold and manage it.

Question:

1. As I requested you earlier I have fear on how many years they might maintain our gold etf?. Example: If I buy gold jewellery I knew that I can keep with me as long as I can until I sell. but

A) What happens if my bank closes who helped me to invest in goldbees?

(where can I go and ask????)

or B) What happens when fund house shut down or bankrupt?

(where can I go and ask????)

Might be the above asked questions are irritates or silly I want to know this clearly because I repeat that am going to invest in gold etf everymonth for my daughter’s future (Just Born).

Please Please help me!!!!!!

As gold etf price is going high I think must take decision soon.

Thanks,

With Regards,

Ahha

I’m not sure what happens if the fund house shuts down or becomes bankrupt because that hasn’t happened yet. They are supposed to keep gold as underlying of the fund units so theoretically even if they go bankrupt you should have underlying gold to back up that investment.

However such a thing has never happened so I can’t say for sure what will happen if a fund were to go bankrupt.

If the bank closes then that doesn’t affect you as you just carried the transaction through them and the fund house still exists.

If you are looking to hold it for such a long term then you can think about buying physical gold from a jeweler of repute, and store it in a locker.

Hi,

Is it better to invest to invest in Gold ETF or Gold Mutual Funds.

Regards,

Immanuel Lawrence.

Bangalore.

In my opinion buying gold ETF is better because that’s a more direct way of investing as gold mutual funds ultimately invest in gold ETFs also. Only if you’re thinking about opening a Demat account for this purpose or want a convenient way to do a SIP would it merit looking at the gold MF way Immanuel.

Hey Manshu,

Today, I noticed your website through Google search. What a website dude….!!!. Good Really Good.. Keep it up

I am seeking for good idea in gold etf, I have planned to invest every month (1 gram) but I worried about what to be noticed before starting to invest as am going to continue investing throughout the year until I decide to redeem it.

Yes, I have started analyzing expensive ration on each gold etf but still I have fear who will provide best returns compare to other fund houses?

Again I ask you which Gold etc is the best on all perspective because I am going to invest continuously…..

What happens when the fund house closes their deal after a long time? still confuse.

Thanks in advance,

I await for reply. Whatever the comment/suggestion I never blame anyone. So, please help me.

Not much has changed since I first wrote the post, and GoldBeeS still get a lot of the volume and are the lowest cost, so I’d stick to my earlier thoughts about them being the best.

Dear Manshu,

I’ve been in to stock tradinf for the last one year. Now I would like to invest in Gold, silver ETFs. I’m having a demat account with sharekhan. Is this demat account is enough to buy ETFs in gold, silver? yes means what are the ways of doing it?

Yes that’s enough. You don’t need a second demat account. There are right now no silver ETFs in India, but you can invest in this NSEL product that gives exposure to silver.

Here is a link to that:

http://www.onemint.com/2011/01/13/e-gold-and-e-silver-from-nsel/

I would like to invent 1 lakh on Gold ETF in a weeks time. Kindly let me know which has least expense ratio currently out of all ETFs.

Benchmark GOLDBeeS is the lowest.