This is another post from the Suggest a Topic page, and today we are going to look at why the Indian Rupee has fallen in recent times in terms of the US Dollar.

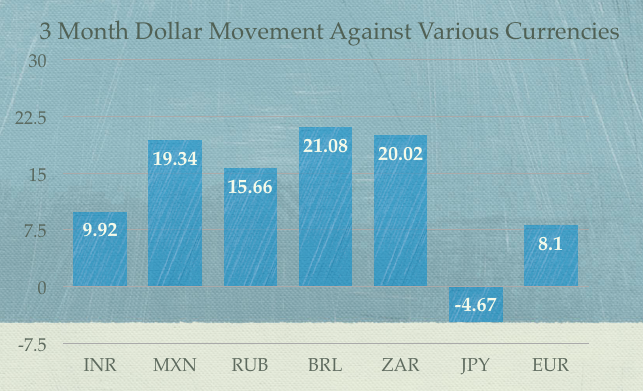

The Rupee has depreciated or fallen by about 10% in the last three months, and while it may seem like a lot – you’ll be surprised to know that it has actually done quite well when compared with currencies of other emerging countries.

The currency that’s done the worst in the last three months is the Brazilian Real which has fallen about 21% against the USD.

Here is a chart that shows the currencies of some of the main emerging economies and a few developed ones and how they moved in the last quarter.

The INR is the Indian Rupee, MXN is Mexican Peso, RUB is Russian Rouble, BRL is Brazilian Real, ZAR is South African Rand, JPY is the Japanese Yen, and EUR is the Euro.

As you can see – except for the Japanese Yen, the US Dollar has risen up against every other currency in this chart, and that too by some significant percentages.

Even the Canadian Dollar has had quite a fall in the last quarter dropping by as much as 9%.

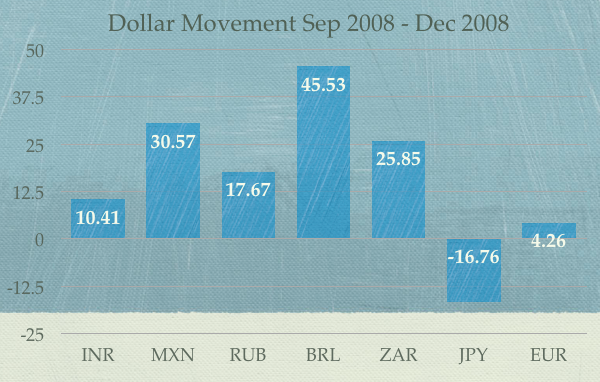

This is what happened during the 2008 crisis as well, but the fall that time was a lot more ferocious than it has been until now, and in general that has been true for the stock market as well.

Here is how these currencies fared against the US Dollar during the 2008 crash.

The above chart is for four months so it’s not strictly comparable, but it does illustrate how badly currencies fall against the USD in times of crisis.

So, what’s going on in here? What can you make out of it, and what’s the reason for the fall of the Rupee?

As you can see from the two charts above – it’s not so much that the Rupee has fallen as it is that the US Dollar has appreciated.

Dollar is a safe haven asset and global investors with billions in assets move their money in the USD in the form of US Treasuries and bonds when times become rough, and the return of capital becomes more important than return on capital.

The US may have its problems but there is no one quite like the US to park your funds with. In the last recession – the Swiss Franc and Japanese Yen did quite well as investors moved their money to those assets but Japan has been intervening in the forex markets quite regularly, and when recently the Swiss Central Bank capped the Swiss Franc to Euro rate – the market got quite a shock and a lot of traders must have lost quite a bit of money then.

In conclusion – in times of crisis the USD tends to rise against all other currencies, especially emerging market currencies, and this is not so much the Indian Rupee falling but the USD rising against most currencies it trades against.

Above comment is not my won comment it is taken from below link

http://www.rsinsight.com/why-rupee-is-falling-against-dollar/

here is correct answer :-

Rupee falls by 1 against dollar..What it means ?

It simply means that if earlier we had to pay 49 for a dollar, now we ll have to pay 50 for the same.In simple words, loss of 1 against every $1 transaction with fall of every rupee against dollar. So, if we buy a thing worth say , $1000 , then earlier we had to pay 49000 and now we have to pay 50000.So,1000 loss in just 1 day !

Why Rupee falling against Dollar ?

Well, there are many reasons for it….

•Dollar inflows into the Indian economy are falling because of global troubles such as Eurozone crisis (Greece with a debt more than its economy, making dollar strong) and high valuation of Indian companies.

•Due to falling Rupee rate against dollar ,FII’s pulling out their invesments from Indian market.Why so ? Say , a investor invests $500 in indian market.If market grows by 10%, his valuation becomes $550. But, talking in rupee terms, he invests $500 (25000 for 50per dollar).Now with 10% increase, it becomes 25000+2500 =27500.But, with falling rate of rupee, now rate becomes ,say 55 per dollar.

Now, when he wants his money back in dollars , he would get 27500/55=$500. That means no profits for foreign investor.

That’s why, FII( Foreign institutional investors) are withdrawing their money from indian markets and investing in more attractive destinations like china.This has lead to more decline in dollars in indian economy.

•India’s imports are increasing and exports are decreasing due to large population.That simply means that much more dollars are being spent , as compared to their earnings.Again a big factor for declining dollars.

•Restricted FDI policies.There are many sectors in which FDI is restricted such as retail, insurance, defence etc. Records show that our FDI inflows fell from $40billion (2008) to $25billion (2011).Due to relaxed FDI policies in China, FDI inflows in China are always above $100billion mark.

Impact on Indian Market :

1.Companies with foriegn debt would have to pay more for same debt.

2.Oil companies would pay more for lesser valued barrel.About 70% of oil needs of India is imported.And if we go on paying more for unending oil needs, it would adversely affect indian market and increase inflation.

3.With each international transaction, India is suffering mammoth losses.Till now , we have seen a very small scale losses with falling rupee.But, international trades are in values of lakhs of crores.With every falling rupee, India is in loss of hundreds of crores.

Just a small example.In 1947, $1 was equivalent to *1. So, for a transaction worth 5lakh crores, we had to pay 5lakh crores.Now, the rate is say, *50 per dollar. So, now for the same purchase worth 5 lakh crore, we have to pay 250 Lakh crore. Just Imagine !!!

Is anybody Gaining out of falling rupee?

1.Yes, everyone who is exporting something to international market like US is gaining.Biggets example is IT sector. IT giants like TCS, Infosys are gaining the most out of every falling rupee because their contracts are fixed at dollars but with falling rupee, they end up earning more in rupees.

2.Non-residential indians (NRI’s) are gaining the most in this situation.

Currency exchange rate does not determine the size of the economy .It is depended on the demand-supply dynamics of the market.

What is our Loss even if we don’t deal in dollars ?Well, because of growing differences in imports and exports, India needs to spend more and more.This is beacuse what we are selling are fetching less dollars and whatever we are buying, are demanding more dollars from us.This results in huge loss for Indian govt.So, to compensate for losses, govt increases tax or increase prices or any other way !!!! At last, common man is at loss !!

“Kuch bhi ho, marta main hi hun…The stupid common man “

I hope you like this post. Please do like the post or give your valuable comments to encourage us !! ..Thanks for reading at RsInsight.

I do not believe in the logic given in the article becuase of following

Selective data analysis – Issue is w.r.t. last 5 months and not 2 – 3 years

UK pound is missing on analysis because it does not support the flawed logic put forth in the article

RBI is still sitting on pile of FX (primarily $) so the demand logic is also not very valid

Can the reason be

Are there some currency cartels ?

Why is govt letting currency depreciate – does this have some fiscal / monetary benefit ?

The data is actually for three months from July 2011 – Sep 2011, and then for Sep 2008 – Dec 2008 – so it’s for three and four months in the times of crisis and not 2 – 3 years as you write.

GBP has more or less behaved in the same way in this period – the USD gained about 2% this year, and 24% in 2008. This data can be easily found in Google Finance or Yahoo Finance. You need to put in USDGBP as the symbol.

It may appear that reserves of $280 billion are a lot but the daily trading in INR is about $70B – that’s a huge huge market ,and I don’t think with the kind of reserves that RBI has – it could make any meaningful difference.

Was wondering why Euro fall was restricted? Read

Because the Swiss National Bank (SNB) and other Asian central banks will seek multi-reserve assets of, and striving to find a variety of alternative investments of U.S. $.

Reference:http://www.financial-ol.com/eurusd-does-not-fall-too-much-during-the-year-is-expected-to-hold-in-the-top-1-30.html

Thanks for sharing that – I don’t buy that argument, but anyway good to be aware of multiple angles.

Another reason for dollar being viewed as safe currency is :

Due to the recent increase in the price of gold over a very short period of time there are fears of a bubble building in gold and hence investors do not perceive gold as a safe investment alternative.

Question is : How does a depreciating rupee impact the common man and companies?

For consumers: Products that are directly imported, such as crude oil, fertilisers, pharmaceutical products, ores and metals, or use imported components such as Personal Computers and laptops, become more expensive following rupee depreciation.

For companies:

Companies who have taken foreign currency loans will be adversely impacted. Indian companies have resorted to borrowing in US dollars to reduce the effective cost of borrowing. Indian companies have raised $ 21bn loans through external commercial borrowings form Jan – July ’11 as against $ 18bn for the entire year 2010.

For instance, if a borrower borrows $100 when the exchange rate was Rs 45 to a $, his original borrowing stands at Rs 4,500. After rupee depreciation to Rs 50 to a $, the same loan amounts to Rs 5,000. The increased Capital Outflow is 5000 – 4500 = Rs 500 or $ 11.11 (500/45). If the interest rate is 10 per cent, the additional interest turns out to be Rs 50 (5000-4500 = 500, 500*10% = 50) i.e. 1.11 per dollar borrowed (50/45). The rupee depreciation results in an incremental outflow of $12.22 (11.11+1.11) for this borrower.

A depreciating rupee makes imports of component, capital goods and raw materials more expensive. As inputs and other equipment that are imported get costlier, margins get reduced to that extent.

Depreciating rupee spells good news for the IT sector

That was great! Thanks. Your made it very clear for me.

Thanks Arvind, makes commenting worth the effort. And it is great that we have forums like onemint where we can ask , comment 🙂

very true… While it cannot be denied that India has its own set of problems, the recent fall is primarily on account of USD appreciation.

yeah, and the only thing that surprises me in all this is that the Euro has held so well, i would have imagined them to do worse with all the problems in the Eurozone going on right now.

that the INR has not done too badly compared with other currencies is news for me. unable to say whether it is good news or bad.

but what i have surmised from what is (to me) a confusing state of affairs is this – the rupee used to be weak earlier because other developed economies were supposed to be stronger and growing faster than Indian economy (which was growing at what was derisively known as hindu rate of growth) and now the rupee is weaker because other developed economies are not growing but are rather shrinking compared to Indian economy (as also other emerging economies, which are growing at a rate higher than the developed economies)!

I am sure the situation must be much more complicated than this and there is much that i don’t know and don’t see, but to a lay person like me this is what is looks like.

😀

What it essentially means is that in times of distress, everybody flocks to the investment that is deemed to be the SAFEST bet. And that has been the US dollar for the last few decades and will be for a few more decades.

I think it is a measure of the trust the US government and its political, legal, and social system has in the eyes of the investors. Though US is not doing well economically recently , everyone bets that given some more time they can bounce back, given their political and economic institutions.

Forex markets are really complex, and I for one don’t understand them as well as I would like to, however as a rule of thumb – strong countries with strong economies that export more than they import will have a stronger currency and vice versa.