After creating the Nifty Index Funds list, it was only natural to create a Sensex ETF and Index Fund list. For some reason, there are a lot less Sensex funds than there are Nifty Index funds.

I could only find a couple of Sensex ETFs, and 5 Sensex Index funds as opposed to over 15 Nifty Index funds.

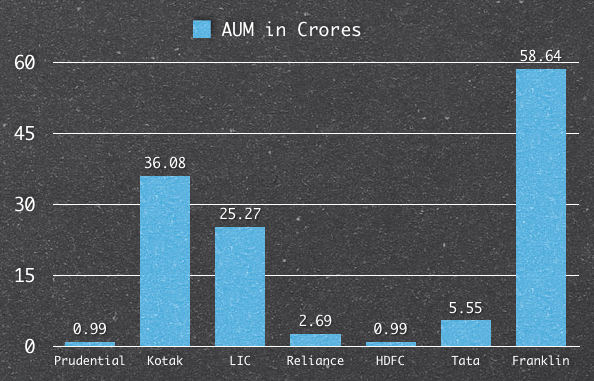

Of these funds, Franklin Sensex fund is the biggest with about Rs. 58 crores in asset under management, and Kotak is the next with Rs. 36 crores, LIC has 25 crores, and after that all of the funds are fairly small.

Here is a chart that shows the asset under management of these Sensex funds and ETFs.

It’s clear from the above chart that Nifty Index funds are a lot more popular than Sensex funds and the biggest Sensex fund – Franklin doesn’t even have a tenth of the assets that the biggest Nifty fund GS Nifty BeeS has.

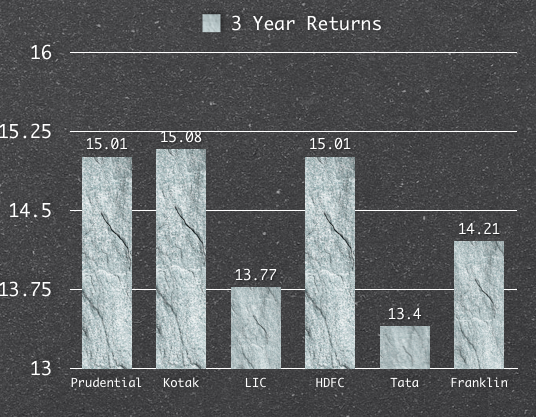

Now, here is a chart that shows their performance in the last 3 years.

Kotak is the best performing of these funds, and even when you look at the one year return data it has fallen less than the other funds. That combined with the fact that it has a low expense ratio of 0.50% makes it a good option among these funds.

Here is the table that shows the 1 year returns, 3 year returns, AUM as well as expense ratios of all these funds.

| S.No. | Mutual Fund | 1 Year Return | 3 Year Return | AUM (In Rs. Crores) | Expense Ratio |

| 1 | SENSEX Prudential ICICI ETF | -15.34 | 15.01 | 0.99 | 0.80% |

| 2 | Kotak Sensex ETF | -15.8 | 15.08 | 36.08 | 0.50% |

| 3 | LIC Nomura Sensex | -16.46 | 13.77 | 25.27 | 1.37% |

| 4 | Reliance Index Sensex | -17.12 | — | 2.69 | 0.40% |

| 5 | HDFC Index Sensex | -17.06 | 15.01 | 0.99 | 1% |

| 6 | Tata Index Sensex – A | -16.75 | 13.4 | 5.55 | 1.50% |

| 7 | Franklin India Index BSE Sensex | -16.31 | 14.21 | 58.64 | 1% |

Looking at these numbers, and data I feel that if I had to take a position in a Sensex fund – I would get into the Kotak Sensex ETF, but then if I had to take a position in an index fund at all – I’d probably choose a Nifty Index ETF or fund rather than one on the Sensex because of the higher liquidity and volumes on those.

Hello, can anyone tell me the direct taxation on non-gold ETFs and Index funds in India? Manshu, would you know?

Equity ETFs have the same tax treatment as the shares or equity mutual funds Shreyansh.

Sbi sensex etf is it worth or should I avoid

hi Sanjay, thanks. I realized my error rimmediately after it got published, but there was no provision to correct an error.

As transactions at Sensex are less than at NSE but myGTS is available only at Sensex, buying Gold ETF at Sensex at a lesser price should not matter as long as you can sell it at NSE Or BSE later. how do transactions affect a purchase if the price is less?

there are many stocks listed both in nifty and sensex. so we have a choice. similarly gold etfs at Goldman sachs is listed both at sensex and nifty.

so which one should we buy? is price the only criteria?

now Gold etfs my GTS at iccidirect is available only at sensex. Any cons buying my GTS?

if you buy a stock at sensex, can you sell the same at nifty?

Though I get what you are asking, you should start using correct terms.

stocks are listed on stock exchanges. nifty and sensex are not stock exchange. NSE and BSE are stock exchange. So in your earlier post you should have used NSE word instead of nifty. Along the same lines, you should have use BSE instead of sensex.

To answer your first question : You might have to look at volumes of transaction of gold etf on BSE.

To answer your second question : I think it doesnt matter from which stock exchange you have bought the sotck; you can sell it in any exchange. I haven’t tried that. May be author of the article knows it better.

The full form of Sensex is Sensitive Index or Bombay Stock Exchange(BSE) and of NIFTY is National National Stock Exchange Fifty.An index is basically an indicator.

S&P CNX Nifty is a well diversified 50 stock index accounting for 24 sectors of the economy. While Sensex has 30 component stocks representing large, well-established and financially sound companies across key sectors.

Though a number of other exchanges exist, NSE and the Bombay Stock Exchange are the two most significant stock exchanges in India, and between them are responsible for the vast majority of share transactions.

I feel Nifty is more popular than Sensex because:

1. While both have similar total market capitalization (about USD 1.6 trillion), share volume in NSE is typically two times that of BSE.

2. The number of scrips. As Nifty has 50 scrips compared to Sensex investing in Nifty will give an investor extra diversification.

Few reasons for why there are more Nifty trackers than Sensex trackers

Derivative markets are far wider and far far deeper in Nifty than Sensex (donno particularly for India, but in world markets, many ETFs are synthetic and hence they depend on derivatives to have exposure to the underlying index)

Nifty is more liquid than Sensex

For EFT investors, primarily institutions (which anyways are the major investors in trackers), hedging in Nifty is far lot easier than for Sensex, hence the demand

I know for sure that these ETFs own stocks and not derivatives – all of them. The hedging point is a good one.

Good article! But I still believe that choice of good standalone stocks will give better than a diversified fund like this. One may counter this argument saying that diversification will lower the company specific risks, but market risk is a bigger factor in today’s market.

I invest in Kotak sensex fund because of one particular reason. I use icicidirect broker and they have a order type (called as myGTC) which can remain alive for 30 days if the script is present on BSE. This order type is valid only for BSE. So I can put a order for Kotak sensex ETF with price of 140 and the order will be valid for next 30 days. I dont have to worry about missing a buying opportunity because of work schedule.

Are there any other brokers which give this facility on NSE as well? I dont think there would be. Because if there would have been, then icici would have surely offered this order type on NSE as well.

I wasn’t even aware that ICICI Direct has this feature, and have certainly not heard of it on any other broker.

Hi Sanjay

Are you aware of any other broking house who provides this type of feature on BSE

Thanks

Umesh

Hi Umesh,

I don’t have any idea about offering of other broking houses.

I am not a trader and hence don’t keep track of features available at other broking houses.

In fact, myGTC offering was a surprise for me. Why not there is much innovation of this type?

I am still surprised that icicidirect charges 100 Rs for mutual fund transaction whereas I have heard that sharekhan or some other broking house doesn’t charge for mutual fund transaction.

Thanks for the article. I agree to your last statement “choose a Nifty Index ETF or fund rather than one on the Sensex because of the higher liquidity and volumes on those”.