Chauhan left the following comment on the Suggest a Topic page recently.

Chauhan March 17, 2014 at 1:26 pm [edit]

I’m keen that we somehow start a theme that compares keeping your money abroad (in say USD, GBP or SGD etc) vs sending it to India for investment purposes. Which is to say, how do foreign currency gains v the Indian rupee compare with high interest rates (on a/c of high inflation) in India.

My first impression was that it was indeed futile for most NRIs to send their money back home for investing because of how fast the Rupee has depreciated recently, but further digging revealed that it wasn’t really the case.

NRE accounts were made tax free, and the interest rate was raised to domestic savings rate on them in December 2011, and at that time there was quite a lot of excitement about them, and a lot of money did find its way to Indian NRE accounts.

The USD to INR rate was about Rs. 51 at that time, and right now it is about Rs. 62, which is a depreciation of about 17%.

So, roughly speaking, if you were an American NRI who were thinking of opening a NRE bank account back in December of 2011, but didn’t do anything yet (28 months) you had a 17% return.

However, if you had invested your money in a NRE account at that time then you would have made about 25% on your money. This is assuming the NRE rate was 10% for 28 months, which is the rate several banks were offering at the time, but none are offering today. The rates are around 9% right now.

So, if you were in the US then it was obviously better for you to have sent money home, and opened a NRE account, but what about other countries?

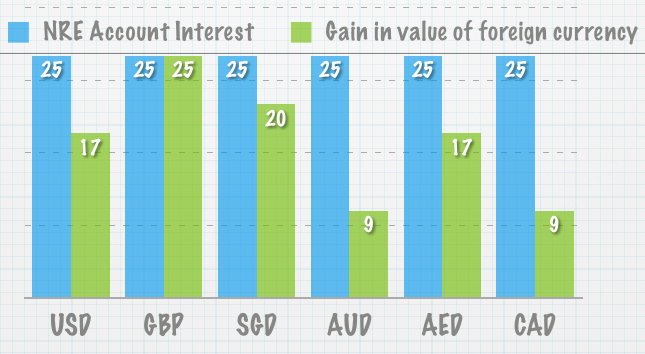

I plotted the same data for some other countries UK, Singapore, Australia, UAE and Canada and here are the results.

As you can see, only GBP has been able to keep up with the Indian interest rates, and the rest of them have been lagging behind, some considerably so.

I feel it is a function of the high domestic interest rates, and the fact that most of the global economies aren’t doing that great that has resulted in these numbers.

Will these results continue to hold up in the future? I’m going to say, probably yes because the interest rates are still high at about 9% right now, and that results in a gain of about 54% in 5 years , and I think the probability of the Rupee losing half its value against these currencies in the next five years is probably lower than that.

You are assuming interest rates are zero in these countries?. One should compare the Net return in dollar terms : NRE Int rate minus currency depreciation with the Return on foreign currency deposits (FCNR would be best bet can give upto 3-4%). If you compare story could be different.

I personally think NRI’s investing in India is a win-win situation. It will get foreign exchange and boost the economy. It will help investors get good returns out of the investment. My friends recently invested in Antheia, Mahindra Lifespaces and they were very facilitating, they offer distinctive NRI services which is great. I would invest in India when I get back, I don’t see why it should be doubtful, and even if the currency values change it will still garner profits.

Hi sir,

I am NRI I want to sell old house to build new house. Or shall I take house loan or shall I invest the old house money in to new property. House is more than 5 year old. I can able to complete house loan within 3 years.

pl gv ur email id mr manshu

This is the question that every NRI has, so did I. I was very reluctant about investing my hard earned savings in India as the scenario in India was quite skeptical. But this was some years ago, after Mr. Narendra Modi taking over, I now have decided to divert 45% of my investments in India. Right Horizon manages my investments in India. I must say, they are really good. They returned me more than what I could ever imagine.

Hello, i had the same question as Arun above, “If an NRI takes up NRE FD for 10 years but returns to India for good after 3 years. What shall be the status of the FD and income tax liability? Please advice.” Thanks

Hi Manshu

I think, its more about returns in equity which Indian markets are giving. Even the SIP returns for last six months are greater than 12% .

If an NRI takes up NRE FD for 10 years but returns to India for good after 3 years. What shall be the status of the FD and income tax liability? Please advice.

Hi Manshu. First of all, thank you for taking up the request and then following up with all of these other queries. I was travelling and am therefore late to acknowledge. I’m also glad so many of us have a keen interest in this subject.

I find the analysis thorough and it clearly indicates that for someone who wants the money in India eventually, the best way is to go for either the NRE deposits or the recent tax free bonds @8 – 9% etc (or even taxable NCDs @ 12 – 13%, if you are in a lower ‘weighted average tax bracket’ than ~ 20% in India). So in that sense my question has been answered.

That said, I know some of us think of ourselves as being ‘global citizens’ (me included) and have surplus funds (after taking care of commitments and liabilities in India) that we want to deploy where it is attractive to do so. The problem that I see with the ‘send to India’ approach (except for NRE deposits, which are limited to our foreign assets – and even this, an FCNR likely beats when combined with currency gains) is the seeming inability to then take the money out, given strong forex regulatory controls and limitations on how much per year etc.

So for example, if one wants to participate in the real estate market, it becomes very hard as then taking profits (if high) out of India is not realistic.

My summary from reading the posts above (especially the dialogue between you and Tran on Mar 28 above) is that as long as one ‘parks’ funds in an NRE deposit (or an FCNR), it works well. But for any other ‘investment’ in India, if the money is later desired abroad, this is not worthwhile dabbling in.

Or is my understanding of currency controls in India incorrect?

Fcnr is boon for dollar return seeking investor. Ppl planning children education abroad; dont want risk up or down. If u are india return mindset investor with rupee in your heart, nre is best

Thanks Ankur – I have to admit that before seeing your response, I was a little confused as what Khiriya was trying to say, and how the pathetic 0.72% return came to be.

You are assuming interest rates are zero in these countries?. One should compare the Net return in dollar terms : NRE Int rate minus currency depreciation with the Return on foreign currency deposits (FCNR would be best bet can give upto 3-4%). If you compare story could be different.

I know for sure interest rate is zero in the US, not sure what the rate is in other countries, but can’t be a lot higher than zero. And I don’t believe FCNR is the best way to give in the current situation, NRE is simply better because of the tax free status.

Surprised on this coming from you. FCNR enjoy same tax treatment as NRE but is any day better that NRE if the foreign currency has historically enjoyed continuous appreciation against INR.

Allow me to illustrate

———————————————————————————————————

| USD/INR (APR/2012) | | At 9% compounded | USD/INR (APR/2014) |

| 50.87 | | quarterly | 59.92 |

——————————————————————————————————————-

| USD Invested(2012) | Value in INR | Maturity value | USD Returned (2014) | APY |

| $ 10000 | Rs. 508700.00 | Rs.607810.60 | $10143.70 | 0.72% |

——————————————————————————————————————–

A pathetic 0.72 APY over a period of 2 years. Please note that when INR was at 68, it would have looked a lot worse.

SBI offers 4.27% APY on FCNR deposit of 5 years or more (https://www.sbi.co.in/user.htm?action=viewsection_opennew2&lang=0&id=0,16,387,388).

There are risks in all investments. However, in current scenario, an FCNR deposit trumps all other if you have $$$ and want to put it in an investment vehicle which is same in nominal term.

So, there is a fundamental difference between your illustration, and the question posted by the reader and Ankur has already pointed that out below, and I’ll do it again here.

The reader has asked what makes more sense – send money now, or later, but in both cases the money ends up in India.

In your illustration, the foreign currency is sent back to the US which is a different question, and come to think of it a good topic for another post.

Thank you!

Hi Manshu,

If you can throw some light on this part of article.

“However, if you had invested your money in a NRE account at that time then you would have made about 25% on your money. This is assuming the NRE rate was 10% for 28 months, which is the rate several banks were offering at the time, but none are offering today. The rates are around 9% right now.”

Because as far as my understanding it seems to be an loss making proposition for NR, assuming a person had invested into FD @ 10% for 28

months.

a) Currency conversion Rs.51 at present Rs.62

b) Global Income Tax.

c) Inflation

In my opinion an NR can looked forward to invest in India, if he is not planning to take back money overseas.

Yes, which is what my conclusion is as well.

Thanks Manshu.

I think the return on investment is reasonable and we will have to live with both inflation and FE risk if any and hope for the best.

Thanks for the comment!

NRIs in USA have to pay taxes on their global income. NRE FD accounts though tax free in India will incur 15-28% IT in USA depending upon ones global income!

inflation levels in USA are muc less.

Can you recalculate the final gain for NRIs in USA who deposit in NRE accounts including also the FE risk?

That’s true for US, but not for other countries thankfully, and you can simply account for it by reducing your interest rate by say 20% or whatever the appropriate rate is. So, say instead of 10% a year, 8% a year, that is still about 47% gain in five years.

Inflation should be ignored from this calculation because you are ultimately using your money at the end of say 5 years either in the foreign country or the India whatever the price levels at that time may be.

I don’t know of a way to include foreign exchange risk except to say what I did in the last paragraph viz. the probability of the Rupee depreciating by half in the next five years is low in my opinion, I don’t know of a way to assign a number to this, and I doubt that anyone else does either.

Does this explanation make sense?

How about we take into account the effect of taxes and inflation?

NRE accounts are tax free and I think tax rates are anywhere from 15% to 30% on interest income for other countries.

Also need to take into account the inflation rate (assume a 9% rate in India) I think the high inflation rate will make these differences less drastic as other nations only have inflation rates of 2 to 3 %.

Thoughts?

Inflation should be ignored because you are looking at one number at the end of say 5 years or 10 years and that one number can be converted to USD or AUD or INR or whatever, so it doesn’t matter what the inflation rate is in the two countries.

For tax rates, I’d say that I’ve made an assumption that people in developed countries can’t invest this money at even 2 or 3% so there is no question of income or tax on that income. But if that assumption is not correct, and you do indeed have ways to get interest income which is say about 5% in Canada or Australia or Dubai then yes, include that income in your calculation, and reduce tax. I don’t think any developed country really does give any meaningful interest income though.

Makes sense?

I think the original poster- Chauhan? was asking about investing this money in India. I dont know why inflation would not matter if you are looking at investing. Especially with a high rate of inflation (like in India) the purchasing power is halved in Eight years or so. Pretty much any savings account in India today is loosing money after inflation. I am not saying it is any different in the US or other places. This is all thanks to Central bankers who want us to take risk in the stock market or other speculative assets. At a 9% inflation rate (the real rate based on my own observations of food and other things is more like 15%) the compounding would be disastrous. This is such a big hidden tax on everyone. My point is net of taxes and inflation you are in the same boat whether it is in India or other countries.

No that can’t be your intent if you are taking a decision whether to keep money in say USD or save it in INR. I don’t think that was his intent.

I think his intent was what I answered.

I think your question is different, and quite honestly, I think I don’t understand your question in the context of this article.

Can you phrase your question independent of this article please?

Sorry for the confusion. The question I had in my mind (and what I was trying to answer) is this

Where is the best place for an investor to park cash in a fixed deposit (or CD in the US) and more importantly between Jan 2012 and March 2013 what would be the return (net of taxes and inflation) for such an investment? I understand that taxes are a bit complicated so I am willing to see/discuss returns just after inflation?

My point is that I dont see where (India or US, the two places I looked at) such an FD would return a positive value after subtracting inflation

Okay, so let’s do this, let’s assume there are two people who had $10,000 each on Jan 1 2012, and one of them put that in a US CD, which had 0% interest, and the other put it in an Indian NRE account which had 9% rate of interest.

Person A has $10,000 at the end of the year, and doesn’t owe any taxes on this since he didn’t earn anything. Inflation, let’s say 1% so $9,900 at the end of the year.

Person B transferred that money to India and that converted to Rs. 5,30,000 at Rs. 53, and then 9% on that amounts to Rs. 47,700 and the total comes out to Rs. 5,77,700 at the end of the year. This is tax free in India, but say the person pays 20% tax which is about Rs. 1,000 in the US. Let’s say inflation is 10% in India for that year, so what you really have is 5,19,030.

The exchange rate at the end of the year was Rs. 54.75, so if you had to bring this money back to the US then you would have $10,533.

So, these are the numbers, you can draw the conclusion yourself. In terms of real returns, bank deposits are the safest mechanism and your real returns will be barely positive to negative if you just had FDs or CDs as your investment, but this question is not about respective real returns, but about the two choices and which choice is better, and in that respect, I’d say that for NRIs who have use of money in India, it is better to have some sent back to India, and invested in tax free deposits there.

Thanks for the reply. I dont want to get into an argument but I have the following comment that I think will make the difference less stark

Person B’s return will be $9480 at the exchange rate of Rs 54.75 . Right? So that actually puts person A ahead.

In either case its a loss and as that compounds over 1,3,5 years etc the loss increases.

I fully agree that bank deposits are the safest vehicle around. But like you said you would be lucky to sneak out a positive return after inflation and taxes. If this money is needed in the next 1-3 year time frame in my opinion it is best to put it in India to take advantage of historic exchange rates. But lets not be fooled by the high interest rate in India to think that we are getting a great return.If you need the money beyond that stocks or index funds would fare better (not certain but atleast there is enough data to show that over longer periods stocks tend to outperform all other asset classes)

I like your blog very much and you do a great job of posting relevant material and responding to comments etc. Thanks again!

Thank you for the wonderful comment – much appreciated!

I want to highlight to you that Person B’s return is not $9,480 but $10,533 because that’s the money you have after you have earned the interest, and not 5,19,030 which is the amount I adjusted for inflation, but that doesn’t mean you just have 5,19,030 with you, in reality you have 5,77,700 with you but because of the inflation 5,77,700 in 2013 is equal to 5,19,030 of 2012.

I hope I have clarified this point?

And now from that it follows that Person B is ahead because of the slight advantage that would cumulate over time et cetera.

Does that make sense?

good point!

Thanks

How did u make this chart? In excel? Excel charts don’t look so cool & casual !?

This is Keynote on Mac.