This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Muthoot Finance Limited will be hitting the streets again next week to raise Rs. 500 crore in the public issue of its non-convertible debentures (NCDs). The company will be issuing its secured and unsecured NCDs across eleven different interest payment options. This will be Muthoot’s first public issue in the current financial year.

The issue will open on May 26 and is scheduled to remain open for a month to close on June 26. Like always, the company has the option to either close the issue earlier or extend it further depending on the response to the issue.

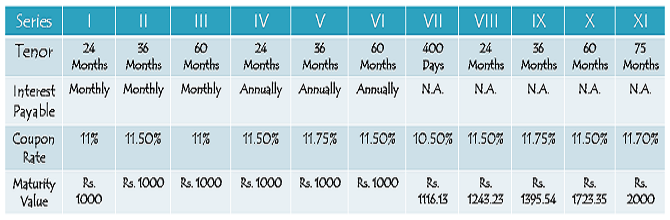

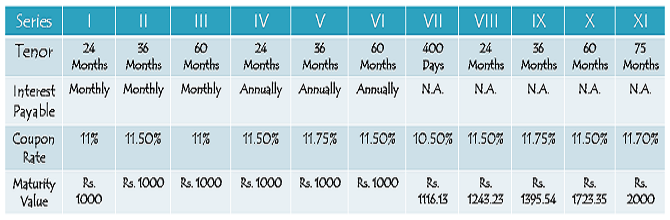

Here are the issue details for you as an investor to consider:

Interest Rates on Offer – Muthoot has decided to cut its interest rates by 50 basis points or 0.50% per annum across all the options over the interest rates it offered in its last issue. Also, the company was offering to double your money in 72 months till its last issue, which it has increased to 75 months this time around.

Credit Rating – ICRA has rated this issue as ‘AA-’ with a ‘Stable’ outlook. The outlook was ‘Negative’ till the last issue as there were many uncertainties that the gold loan industry was facing due to some tough measures taken by the finance ministry as well as the Reserve Bank of India.

Also, these NCDs are ‘Secured’ in nature, except those which promise to double your money in 75 months.

Minimum Investment – To invest in these NCDs, you need to invest a minimum amount of Rs. 10,000 i.e. 10 NCDs of Rs. 1,000 face value.

Listing – Muthoot will get these NCDs listed on the Bombay Stock Exchange (BSE) within 12 days from the date the issue gets closed.

Demat/Physical Option – Though the investors have the option to apply for these NCDs in the physical form as well as the demat form, this option is limited to NCDs under options I to VI. Applicants will not be able to apply for allotment of these NCDs in physical form under options VII to XI i.e. these NCDs will be allotted only in dematerialised form under options VII to XI.

Taxability & TDS – Interest earned on these NCDs is taxable as per the tax slab of the investor and if the interest amount exceeds Rs. 5,000 in any financial year, then the company will deduct TDS on the interest amount.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and the maximum portion has been reserved for the retail investors:

Category I – Institutional Investors – 5% of the issue is reserved

Category II – Non-Institutional Investors, Corporates – 5% of the issue is reserved

Category III – Retail Individual Investors including HUFs – 90% of the issue is reserved

NRI Investment – Like in the past issues as well, Non-Resident Indians (NRIs) are not allowed to invest in these NCDs.

Gold prices have started to decline here in India. There are various reasons for that – a stronger rupee against the US dollar, the RBI easing the import curb norms, low demand due to high import duty and the US economy improving steadily. With an inevitable cut in import duty sooner or later, the gold prices are all set for a further decline.

With higher risks of gold prices coming down and concentrated business model, gold financing firms are set to face some riskier times ahead. I would personally avoid making any investment in gold financing companies, be it equity investment or debt investment.

Also, Religare and Edelweiss’ ECL Finance are planning to launch their respective NCD issues in the first fortnight of June. I would rather wait to check the interest rates and other features of those issues before I advise my clients to invest in any of these issues.

Application Form of Muthoot NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Muthoot NCDs, the investors can reach us at +919811797407

dear mr shiv.

what difference for small investors like us for ECL earlier NCD which were secured & these new Ncd which are un-secured ?? does this make any difference for us ?

ECL Finance issue is opening from June 17th, offering 12% p.a. rate of interest payable monthly, annually or cumulative, tenure of 70 months and rated ‘AA’ by CARE & Brickwork Ratings.

Hi shiv,

can u plz update ecl start date and rate of interest as u cum to know d same.

Hi Rajan,

Sure, I’ll do that as soon as I come to know about it.

I already have ECL finance, should i still go with ECL finance NCDs?

or Buy someother NCDs from the market?

Hi Rajkumar,

It is always better to diversify your investments. If you’ve already invested in ECL Finance NCDs, then it is better to go for some other NCDs. But, I would say the investors should wait for some better issues as compared to these Muthoot NCDs.

dear shiv.

is the date published – ?

Religare and Edelweiss’ ECL Finance issue .

thanks

SK

Dear Dr. Agarwal,

ECL Finance has filed its draft prospectus with the SEBI on June 2nd, so I think its issue should get opened on or around 16th of June. There is no confirmed news on the Religare issue as yet. I’ll update you on this post as soon as I get some confirmed info about these issues.

Very well explained again, thank you so much Shiv. I always check your advice before investing money, best wishes.

Thanks Ikjot for your wishes & kind words !! 🙂