This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

“Beti Bachao, Beti Padhao” is the mantra with which Prime Minister Narendra Modi launched Sukanya Samriddhi Yojana on January 22nd this year. Later on, the government issued a notification to allow 80C exemption equal to the amount invested in the scheme up to Rs. 1,50,000, which is also the maximum amount one can invest in this scheme in a financial year.

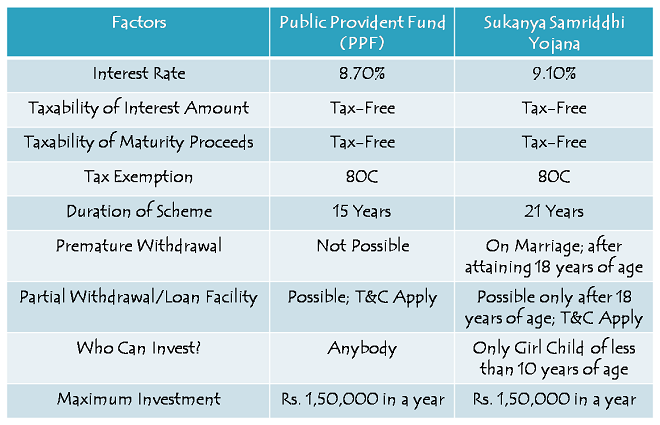

Now, the Finance Minister in his budget speech has proposed to make the interest component as well as the maturity proceeds as tax-free. I think this proposal has made this scheme to be the best small savings scheme available to the Indian investors. Yes, even better than our golden scheme of Public Provident Fund (PPF). So, what is this scheme all about? Let’s check.

Sukanya Samriddhi Yojana is a small savings scheme which can be opened by the parents or a legal guardian of a girl child in any post office or authorised branches of some of the commercial banks. The girl child is called the “Account Holder” and the guardian is called the “Depositor” in this scheme.

Before I compare this scheme with PPF, let us first check the important features of this scheme.

Salient Features of Sukanya Samriddhi Yojana

Who can open this account? – Parents or a legal guardian of a girl child who is 10 years of age or younger than that, can open this account in the name of the child. For initial operations of the scheme, one year grace period has been provided to make it 11 years of age. With this one year grace period in age, which is valid up to December 1, 2015, you can get this account opened for a girl child who is born between December 2, 2003 and December 1, 2004.

9.1% Tax-Free Rate of Interest – This scheme has been flagged off with a 9.1% rate of interest, higher than that of PPF which stands at 8.7%. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year like all other small savings schemes, including PPF.

Prior to the budget announcement, 9.1% annual return seemed unattractive, but not anymore, as it has been made tax exempt now. Interest amount gets added to your balance amount in the account and compounded either monthly or annually, as per your choice. Monthly interest compounding will be done only on your balance amount on completed thousands.

Duration of the Scheme – The scheme will mature on completion of 21 years from the date of opening of the account. If the account is not closed on maturity after 21 years, the balance amount will continue to earn interest as specified for the scheme every year. In case the marriage of your daughter takes place before the maturity date i.e. completion of 21 years, the operation of this account will not be permitted beyond the date of her marriage and no interest will be payable beyond the date of marriage.

Deposit for 14 years only – Though the scheme has a duration of 21 years, you are required to make contributions only for the first 14 years, after which you need not deposit any further amount and your account will keep earning the interest rate applicable for the remaining 7 years.

Premature Closure – The account can also be closed prematurely as your daughter completes 18 years of age provided she gets married before the withdrawal. As the maximum permissible age of the girl child is set as 10 years, the scheme effectively carries a minimum duration of 8 years i.e. 18 years of exit age – 10 years of entry age.

Partial Withdrawal – It is also allowed to withdraw 50% of the balance standing at the end of the preceding financial year, but only after your daughter attains the age of 18 years. So, effectively it has a complete lock-in period of at least 8 years, before which you cannot take out any money for any purposes.

Minimum/Maximum Investment – You need to deposit a minimum of Rs. 1,000 in a financial year to keep your account active. Failure to do so will make your account inactive and it could be revived only after paying a penalty of Rs. 50 along with the minimum amount required to be deposited for that year, which currently stands at Rs. 1,000.

Also, you can invest a maximum of up to Rs. 1,50,000 in a financial year. You can make your contribution to this account in as many number of times as you like.

How many accounts can be opened? – You can open only one account in the name of one girl child and a maximum of two accounts in the name of two different children. However, you can open three accounts if you are blessed with twin girls on the second occasion or if the first birth itself results into three girl children.

Nomination Facility – Nomination facility is not available in this scheme. In an unfortunate event of the death of the girl child, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Documents Required – Birth Certificate of the girl child, along with the identity proof and residence proof of the guardian, are the mandatory documents required to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

Sukanya Samriddhi Yojana vs. Public Provident Fund (PPF)

Budget 2015 has made this scheme quite attractive for the investors. If you’ve already exhausted your PPF deposit limit, want to save for your girl child’s marriage or higher education and have spare money to invest in this scheme, then this scheme provides you one more excellent avenue of safe investment with high returns. You can wait for the next financial year’s rate of interest to get announced anytime this month, if it remains higher than PPF, just go for it.

Application Form to open a Sukanya Samriddhi Account

List of authorised commercial banks where you can get this account opened

Hi Shiva, Happy to know this news have a query; could I invest 1 lakh at once instead of months 2 go

Yes Suma, you can deposit Rs. 1 lakh in one go.

Shiv sir my daughter date of birth21-2-2015 my sukanya samrufdhi yojanya my daugter ya scheme ah sakthi ha ka

Ji Imran Bhai, beshak aap is scheme mein invest kar sakte ho.

Sir, any scheme available for male child. Pls tell me

You can opt for PPF for your child.

Hi Shiv…thx for all the useful info…can you please share the calculation part..i.e. of 52,000 when invested Rs. 1000 per year.

Hi Priyanka,

Rs. 1,000 invested every year would result in Rs. 28593, which would compound to Rs. 52,605 on maturity.

I won’t open my baby and dotar ppf and ssa

Don’t you find these schemes attractive?

Great job sir..

meta ek sawal h sir ..agar mai is yojna me 1000 annually invest krun to policy mature hone par kitna dhan mile ga.

If you consider the interest rate 9.1% for next 21 years, then it will be around 52,605. But remember that interest rate will not be 9.1% every year, it may increase or come down as it is not fixed in case of SSA account.

Really this is a good scheme with the highest secured interest rate which helps the persons to save money for their girl child. Is it possible to deposit money daily 0r weekly or intermittently as per the availability of money for the benefit of daily wages people.

Yes it is possible. Consider it as a bank savings account only. After opening this account you will get a passbook like bank account. After that as you want you can deposit money. But the maximum deposit limit in a year is 1.5 lakh.

Meri beti

18/04/2015 me two year ki hogi kya uska account open ho sakta h.

Please reply .

Thanks

Yes, aapki beti ka account open ho sakta hai.

Can you please tell me whether hdfc bank n icici bank support this schem? I have a girl child who was born in 24 Sep 2011… I think she is eligible but need to check which all banks support this apart from post office.

Hi,

Even we are not sure whether HDFC Bank and ICICI Bank will service this scheme or not. We’ll have to wait for more information to pour in before confirming it to you.

Want to know more abt this scheme

If you have any specific query, please share it share. There is already enough info shared on this page.

Dear sir

Kindly tell us 9,01% is just because it is a new scheme ir it will be continue it will be remain us.

Hi Rajiv,

9.10% is applicable for the current financial year only. It will be reviewed again this month itself for the next financial year and there will be a revision every financial year. The revised rates will be effective from April 1 every year.

Sir, if for one year I will deposit 10,000/- , next year should I invest 20,000/-….. Pls reply

Hi Pinkesh,

You can deposit any amount between Rs. 1,000 and Rs. 1,50,000 in a single financial year.

Hello Sir,

We live in abroad, and very much interested in this scheme, my daughter is born here but her nationality is indian. canyou please advice if we can open an account for her?

Thanks.

Hi Shivika,

You’ll have to provide these documents to open an account – Birth Certificate of the girl child and the identity proof & residence proof of the guardian for KYC process. KYC stands for Know Your Client.

If the government doesn’t allow NRIs/OCIs to open this account, then I think you might not be able to get through the KYC process for residents.

sir my sister in law born on 18-11-2003 is she eligible for this scheme

As your kid born before December 2, 2003, I think she is not eligible. Although the max age of opening the account is 10 years, but this year people will get a grace period till Dec 1, 2015. But your case is not passing that also.

No, she is not eligible for this scheme.

sir my bro’s daughter born on 18-12-2015 is she eligible for this scheme

Hi Rakesh,

I think you mean 2014 and not 2015, right? If it is December 18, 2014, then yes, it is possible to open an account in her name.

Can NRI citizen can also do investment for their daughter’s. even though they are not looking for any tax benefits from the scheme and can they pay from NRI accounts.

Hi Mahesh,

So far there is no option for NRI’s to open this account. We have to wait for few more time as this is too early to expect many things.

It is still not clear whether NRIs can invest in this scheme or not. So, you’ll have to wait some more time for your investment. I think NRI investment will not be allowed as it is not allowed in PPF as well.

Hi Shiv,

What is a better option in terms of intrest to pay the full 1.5 l or monthly ?

Hi Vishal,

It is better to invest the full 1.5 lakh in one go to get higher maturity value.

What vl be mature amount my daughter vl get if I deposit rs5000 yearly….

Hi Harish,

It is not possible to calculate the maturity amount in this manner as it’ll really depend on the rate of interest and time of your investment every year. But, based on certain assumptions and 9.1% rate of interest, it should be Rs. 2,63,025 after 21 years.

Very nice scheme & good initiative by H’ble PM Modi.

To boost “Beti Bachao, Beti Padhao”, along with a/c holder contribution, government should also contribute the equivalent amount (as done in EPF schemes)

Yes, it is a great scheme. EPF is for the employees & not for the general public, an employer contributes to EPF and not the government. I think the government should focus only on efficient implementation of its policies and generation of jobs/income for its citizens. We do not require subsidies/contribution from the government for our day to day living. God has given all of us enough opportunities to move our bodies and earn our livelihood.

Hi,

Quick question?

Do i need to invest max of 1.5 L per annum or for the whole tenure the investment should be 1.5L

Hi Shekar,

It is maximum 1.5 lakh. You can deposit any amount between Rs. 1,000 and Rs. 1,50,000 in a financial year.