This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

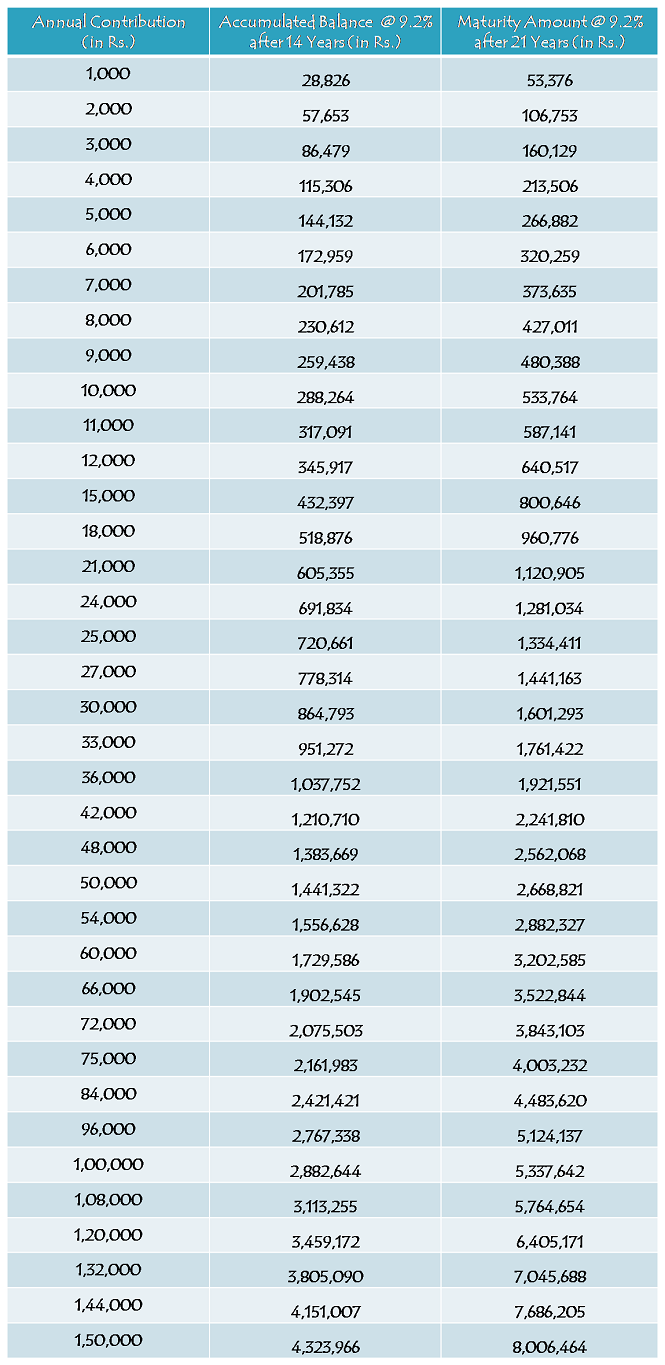

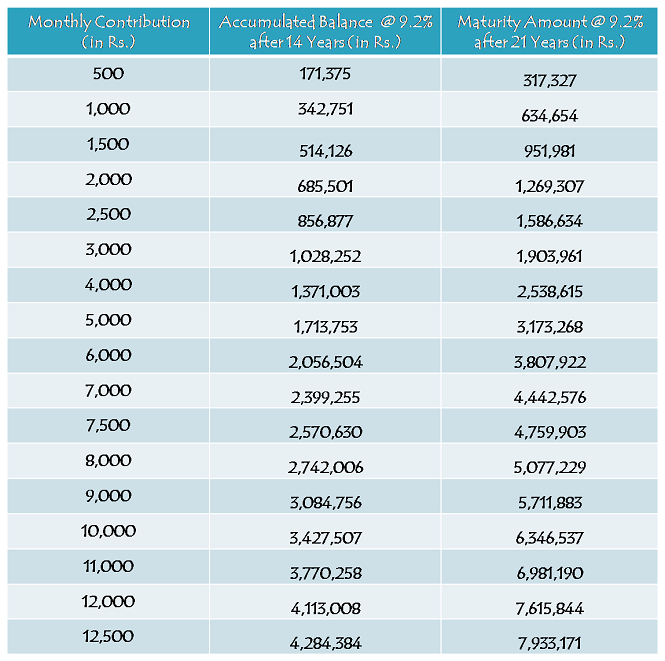

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

If a girl child don’t have natural gaurdians….and legal gaurdian want open this account….what proof he/she has to submit as a gaurdian. …a court order or afdidavit…?

Dear sir,

I want to know if the depositer has been die unfortunately, so in this situation what to do you & status of SSY Acct. holder.

Sair Meri beti ka account ssy se open karna hai to sal me 1000 bhar ke khulwa sakte hai kay

Isme koi insurance hai !

Dear Sir,

Good Afternoon,

Sir mery beti ka SSY a/c khulwana chahta hu usky liye aap mujhy btaye ki kya m monthly deposite krwa skta hu ji.

my baby name moulya patil bangalore

when modiji came to pm post its good decision for our indain country

some people are staying happyly i support modiji

Meri beti 26 jan. 2017 ko jana li thi kya ssy kholwa sakta hu aur kya schem hai kaise jma karna parega

Sir,plz.. Iski calculation ek bar 9.1 rate se details main smjhaye by give an example…plzzzz

Thank you

sir, mein 02 saal se premium pay nahi kar paya hu kya me abhi deposit karwa sakta hu

Hi sir,

Meri beti dob:-8.12.2015 hai to ssy ka ac open kar sakta hu or main agar uska 20 sal me sadi karta hu to kya a/c deposit interest ke sath loutega ya 21 sala bad hi. please notify me sir

Sir l deposited only 5000 in 2015 . If iam not continue this scheme is it possible to with draw this amount?

Sir 1year may kitana amount bharnese Kitna milega monthly bharna ya fir sal may bhi bhar sakate hai

1500 monthley ha 14 ya 21 yers ka ketina Malaga

Sir mara monthely 1500 ha 14 ya21 years tak pasa Malaga

Sir meri daughter ka14 Dec 1016 ka birthday h Kya m uska ye account khulwa sakta hu

My daughter is 3yr old can I open account on this policy

I deposit monthly Rs 1000 and what will the total amount after maturity.

My daughter is six years old. If i pay yearly 24000.00 .How much I got at maturity time.Have any life insurance in this scheme. Please call me 9938307207.

year by year bharne hoge amount

Hello sir meri do baetiya hai ek ka birth 07. 02. 2007 ko hai wo 10 complete hai kya wo sukanya samriddhi ka account kulwa sakti hai. Please meri help karo.