This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

IRFC 7.64% Tax-Free Bonds Issue – Tranche II – March 2016 Issue

It has been a very long time since NHAI filed the draft shelf prospectus for its tax-free bonds issue in the first week of October. Investors have been desperately waiting for a bigger issue as all the previous issues by NTPC, PFC and REC have left them fairly disappointed.

All these issues were of smaller sizes of Rs. 700 crore each and got hugely oversubscribed on the first day itself. But, before NHAI could make it, IRFC has taken the lead to launch its tax-free bonds from the coming Tuesday i.e. December 8th.

As the issue size is quite big, I hope it does not get oversubscribed on the first day itself and the retail investors get full allotment at least this time around. The issue is scheduled to get closed on December 21st.

Before we analyse it, let us first quickly check the salient features of this issue:

Size of the Issue – IRFC is authorized to raise Rs. 6,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,468 crore by issuing these bonds through private placements. The company will raise the remaining Rs. 4,532 crore in this issue.

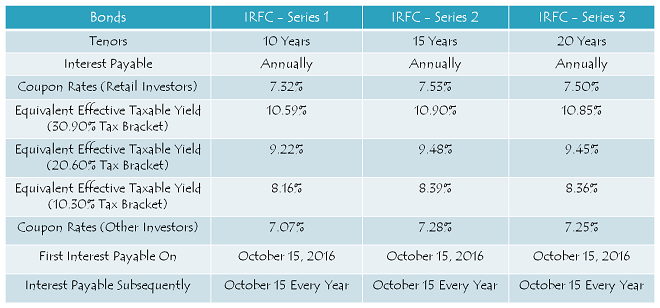

Coupon Rates on Offer – REC offered 7.43% as its highest rate of interest for the 20-year investment period. Due to a sharp reversal in G-Sec rates, coupon rates for this issue have risen by 0.07% to 0.19%. IRFC will offer yearly rate of interest of 7.32% for its 10-year option, 7.53% for the 15-year option and 7.50% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As always, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

Rating of the Issue – CRISIL, ICRA and CARE consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Allowed – Non-Resident Indians (NRIs) are eligible to invest in this issue, on a repatriation basis as well as non-repatriation basis. Unlike earlier issues, Qualified Foreign Investors (QFIs) are also allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 15% of the issue is reserved i.e. Rs. 679.80 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 906.40 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 1,133 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 1,812.80 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 next year and subsequent interest payments will also be made on October 15 every year.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Long-Term Potential – While the sentiment for real estate and gold investments has already been pretty negative, stock markets are once again testing risk appetite of the retail investors. Conservative investors can do nothing but invest in fixed deposits or explore some other relatively safer options like debt funds or tax-free bonds.

A sharp reversal in the G-Sec yield has again given an opportunity to the investors to invest at higher coupon rates. I personally think that India should have a relatively lower inflationary scenario in the next 3-5 years as compared to the previous few years. If you also have the same view and if you want to earn tax-free interest on your investments for the longest possible period of time, then I think you should opt for the 20-year bonds which carry 7.50% rate of interest. The 15-year option with 7.53% is also equally attractive with a relatively shorter investment period.

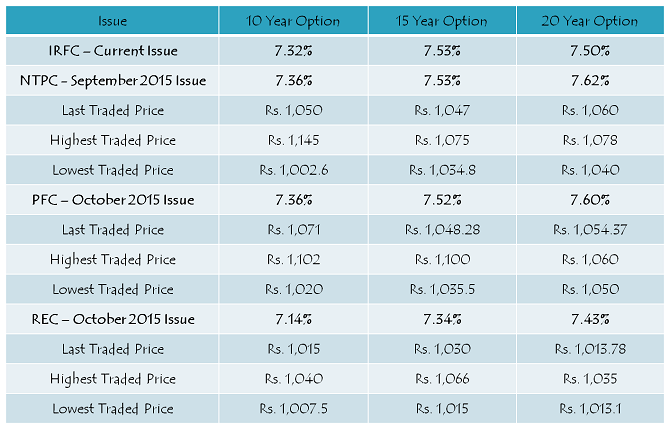

Listing Gains – IRFC is offering 7.53% rate of interest for its 15-year option, which is also the highest rate of interest for its bonds across all three options. NTPC issue also carried the same 7.53% rate of interest for its 15-year option. As you can check from the table above, NTPC 15-year bonds last traded at Rs. 1,047 on Friday on the NSE i.e. a 4.7% premium to its issue price. Even if I consider Rs. 12-15 premium to be the accrued interest for the 2-month period since listing, these bonds are still earning a natural premium of approximately 3-3.50%.

Even the REC 15-year bonds, which got listed on November 5th on the BSE and carried a lower rate of interest of 7.34%, got traded at Rs. 1,030 on Friday i.e. a premium of 3% including one month’s accrued interest. This observation makes me believe that there is a scope of making some quick short-term listing gains with IRFC bonds as well.

Application Form for IRFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC tax-free bonds, you can contact me at +919811797407

Day 3 (December 10) subscription figures:

Category I – Rs. 3,375.02 crore as against Rs. 679.80 crore reserved – 4.96 times

Category II – Rs. 3,024.27 crore as against Rs. 906.40 crore reserved – 3.34 times

Category III – Rs. 1,991.54 crore as against Rs. 1,133 crore reserved – 1.76 times

Category IV – Rs. 2,444.59 crore as against Rs. 1,812.80 crore reserved – 1.35 times

Total Subscription – Rs. 10,835.42 crore as against total issue size of Rs. 4,532 crore – 2.39 times

This issue stands closed today – http://www.bseindia.com/downloads/ipo/Early%20Closure%20Advertisement_101220151028.pdf

subscribing to comments..

Day 2 (December 9) subscription figures:

Category I – Rs. 3,375.02 crore as against Rs. 679.80 crore reserved – 4.96 times

Category II – Rs. 3,023.27 crore as against Rs. 906.40 crore reserved – 3.34 times

Category III – Rs. 2,038.79 crore as against Rs. 1,133 crore reserved – 1.80 times

Category IV – Rs. 2,426.58 crore as against Rs. 1,812.80 crore reserved – 1.34 times

Total Subscription – Rs. 10,863.66 crore as against total issue size of Rs. 4,532 crore – 2.40 times

Hi Shiv,

The previous two tax free bonds alloted the bonds in pro-rata basis. Will this bond also do, or it will do FCFS? If FCFS, then we cannot apply now, as retail portion is already oversubscriped, right? Please help to clarify.

Hi Ashish,

Bonds will be allotted on a pro-rata basis only to those applicants who applied for it on the first day itself. Investors who have applied for these bonds today will not get any allotment. So, even though you can still apply for these bonds, you will not get any allotment.

Shiv,

You’ve been providing nice and useful information.

Many thanks.

Rakesh

Thanks Mr. Rakesh for your kind words!

Day 1 (December 8) subscription figures:

Category I – Rs. 3,375.02 crore as against Rs. 679.80 crore reserved – 4.96 times

Category II – Rs. 3,023.96 crore as against Rs. 906.40 crore reserved – 3.34 times

Category III – Rs. 2,039.29 crore as against Rs. 1,133 crore reserved – 1.80 times

Category IV – Rs. 2,358.03 crore as against Rs. 1,812.80 crore reserved – 1.30 times

Total Subscription – Rs. 10,796.30 crore as against total issue size of Rs. 4,532 crore – 2.38 times

Great response to this issue as well. NHAI should be encouraged with such a response.

When the issue was so highly oversubscribed on 1st day itself, that everyone will get allotment for only 50%, why did it remained open on 2nd day ???

Though, I m not sure if it was open Today.

Hi Rohit,

It remained open today and will remain open tomorrow as well because the company (IRFC) is required to officially announce the closure of the issue and get an ad published in the newspaper before closing it. So, the ad will get published tomorrow and the issue will stand closed.

Thanks Shiv.

We Retail Investor are classified as Category IV (application less than Rs 10 lacs).

Its shown as oversubscribed to 6.07 times, which effectively means 1.33 times (6.07/4.53), so we will get allotment equal to 75% of our application.

Is this correct ???

Hi Rohit,

Allotment will be made on the basis of the first day’s subscription. It was oversubscribed by 1.30 times on the first day, so 77% allotment will be made to each retail investor.

Thanks Shiv. You are a genius.

Best of luck, in all your work.

Thanks a lot Rohit for your kind words & wishes! 🙂

Can you please update on subscription status for today?

Hello Shiv,

What is the final % of allocation ? Thanks !

Hi KK,

It is approx. 77% allocation to the retail investors.

has 4500 crores been exhausted today?

Yes SB, the issue has received subscription worth Rs. 10,796.30 crore, 2.38 times of Rs. 4,532 crore.

Congrats to all those applied 🙂

Thanks Chaitanya! 🙂

Retail category investors can expect the allotment @77%. (approximate)

Thanks Shubh for accurate info!

why do you think later issues will have better rates?

The TF Bonds coupon rate is fixed based on GILT. Gilt coupon rate is quoting high.

What is the subscription status? how much % allotment one can expect?

As things stands you will get 100%

Hello George,

Which link we should use to see this ?

Also reserve some fund for next issue which will have better coupon rates.

looks like it will will be 90+%

Even after 4PM also bid is happening which means 80-90% allotment only expected.

It should be around 80-85%.

Is that for 1000 cr or 4,532 crores?

It will be for Rs. 1,812.80 crore in the retail investors’ category.

Hi Shiv,

I have already invested 10 lakh in 2013 IRFC bond. Can I invest more in this round under retail investor category or now I will not fall under retail category?

Hi Amd,

Even if you invest Rs. 10 lakh in this issue, you will still be considered a retail investor.

Thank you Shiv. Is investing < 10L considered as a retail investor?

Hi Vikas,

Yes, Rs. 10 lakh or less investment is considered to be a retail application.

I already invested 10 Lakh in previous trenches of IRFC. If I invest another 10 Lakh – will I still be considered as Retail investor? Is each trench considered as separate instrument for determining retail investor status?

Thank you Shiv ! How come IRFC got AAA this time, last time I remember they were AA ?

Thanks !

they had always been AAA

Yes KK, as Dr. Puneet correctly pointed out, IRFC issues always carried ‘AAA’ rating. Here is the link to its last issue covered here on OneMint – http://www.onemint.com/2013/12/28/irfc-tax-free-bonds-8-65-january-2014-issue/

Ok.. Thanks to both of you.

Thanks for the information given in details. Please let me know by mail, can

a investor may apply more then one application.(total sum of multiple form

is less then 5 lac).

Kindly let me know as early as possible.

THANKS……..

TH

Yes Mr. Sain, an investor can submit multiple applications and still get considered as a retail investor if his/her total investment amount is less than or equal to Rs. 10 lakh.

I am considering to invest a very small amount in fixed deposits, just have dilemma to choose between corporate bonds (aware that they are taxable) vs tax free bonds.. any suggestion on this?

Hi Raj,

Risk & return go hand-in-hand. No low risk fixed income investment would give you more than 10% return. Personally, I would go for safer tax-free bonds for my safe investments. For riskier investments, I would go for direct equity investment or equity mutual funds, as compared to corporate NCDs.

Thanks for detailed info Shiv, looking forward to investing in them & hope we get full allocation considering the issue size.

Hi Ikjot,

I too think 100% allocation should happen this time around. But, demand will be high this time as well.