This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Tax-Free Bonds, which carry coupon rates as per the G-Sec yield in the market, have suddenly become more attractive post this year’s budget. Finance Minister Arun Jaitley in his Budget speech announced his target to contain the government’s fiscal deficit at 3.5% of GDP in 2016-17. This lower than expected fiscal deficit has resulted in a sharp fall in bond yields in the past one week or so.

Moreover, these bonds will not be available in 2016-17 and probably afterwards as well. This will increase demand for these bonds multifolds. So, before these bonds become part of history, we have two such issues left – one is from NABARD and the other would be from IRFC. I will cover the IRFC issue in another post, let’s have a look at the salient features of the NABARD issue.

Issue Opening & Closing Dates – The issue is opening for subscription on 9th of March, the coming Wednesday and will get closed on March 14.

Size of the Issue – NABARD is authorized to raise Rs. 5,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,500 crore by issuing these bonds through a private placement. NABARD will raise the remaining Rs. 3,500 crore in this issue.

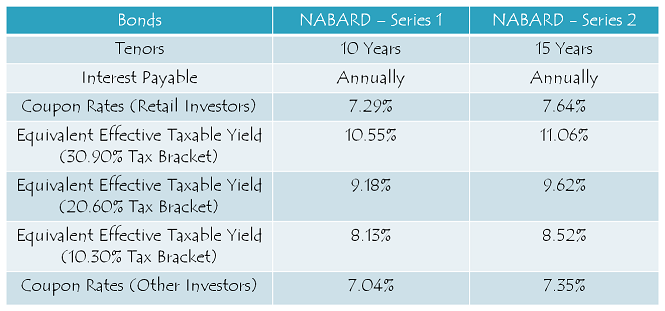

Coupon Rates on Offer – 10-year and 15-year G-Sec yields have fallen in the last few days, which has resulted in a fall in the coupon rates of these tax-free bonds as well. This issue will carry 7.29% for 10 years and 7.64% for 15 years.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category III – High Net Worth Individuals including HUFs – 10% of the issue is reserved i.e. Rs. 350 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 2,100 crore

60% Issue Reserved for Retail Investors – This is something very unique to this issue. As we all know, the retail investors were getting 40% of the bonds reserved in all previous issues. This will be the first issue in which the retail investors will be allotted 60% of the total issue size. I think this is a good step in favour of the retail investors.

NRI/QFI Investment NOT Allowed – Like most of the past issues, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue as well.

Rating of the Issue – CRISIL and India Ratings consider investing in these bonds to be safe and that is why they have assigned ‘AAA’ rating to the issue. Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

Listing & Allotment – NABARD has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the Bombay Stock Exchange (BSE).

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. To apply in physical or demat form, the applicant is required to fill the physical form and attach the KYC documents along with the investment cheque. KYC documents include a self-attested PAN card copy, a self-attested address proof copy and a cancelled cheque.

Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS. Moreover, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – After these bonds get listed on the stock exchanges, these tax-free bonds are freely tradable and do not carry any lock-in period, the investors can sell them at the market price whenever they want.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.29% p.a. for 10 years and 7.64% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NABARD will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced as the company allots its bonds to the successful applicants.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

60% of the NABARD issue i.e. Rs. 2,100 crore is reserved for the retail investors. Not 100% sure, but I think it should take at least a couple of days for this issue to get subscribed in the retail investors category. I think many investors would have got the NHAI refunds credited by then.

As the Finance Ministry has a view that these tax-free bonds create some kind of imbalance in the market, especially for our commercial banks, they have decided not to extend such support to these issuers from the next financial year onwards. That makes this issue and the IRFC issue to be the last two opportunities for the investors in the higher tax brackets to make their investments. Such issues will not be available for at least next 18 months or so, even if the government decides to allow their issuances in Budget 2017. So, if you want to invest in these bonds and earn tax-free income, you need to act now and fast.

Application Form for NABARD & IRFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NABARD or IRFC tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

record date of nabard 7.64% having isin-ine261f07032

Hello Shiv, there is a news that NHAI might come up with a Tax Free Bond this year – how true is it? If so, what would be the timeline?

Any insider’s info? 🙂

News article: http://economictimes.indiatimes.com/news/economy/finance/nhai-may-raise-rs-5000-crore-more-from-epfo-via-bonds/articleshow/53626383.cms

Hi Praveen,

No such info I have received from my sources. I don’t think tax-free bonds will be issued/allotted by NHAI to the general public.

Sir,

AMC charge will be there for Zerodha. For the first year, I think they take it as application fees only. If you are not a frequent investor/trader then I think you should remain with your existing broker and negotiate to reduce brokerage. Zerodha is a new player and trying out new services. Sharekhan website is very reliable and I had no issue with them for the last 8 years.

One thing you should do is to make sure you register in NSDL Ideas or CDSL myeasi ( depending on which your existing broker uses ) and get the portfolio holdings periodically.

https://eservices.nsdl.com/

https://web.cdslindia.com/easieasiest/

Dear Mr. Bhaskar,

Thank you for responding. I understand ShareKhan charges for an additional ‘Subscription Plan’ & only if you pay a lump sum upfront for the subscription, will you be entitled to low brokerage charges which will be debited from that annual subscription amount. Please provide more clarity on how ShareKhan works.

Thank you, again.

The following all brokerages will charge –

exchange transaction charge NSE: 0.00325% | BSE: 0.00275%

service tax (14% of brokerage and exchange transaction charge)

swatch bharat + krishi kalyan cess

security transaction tax 0.1%

sebi turnover fee 20 Rs / crore

stamp duty 0.01% – max Rs. 50/day

For Zerodha

DP charges: Rs 8 + Rs 5.5 (CDSL) per scrip on sell side for equity delivery trades. AMC of 300/- and zero brokerage for delivery.

Sharekhan I get 0.15% on delivery buy/sell and AMC of 500/-

DP charges are waived in Sharekhan

Check https://zerodha.com/charge-list for further details

Thank you, Mr. Bhaskar, for your kind response.

But, I read that ZERODHA does not charge AMC charges (Rs.300) at all.

So, between the two brokerages used by you, which one is transparent, honest & cost effective, especially for only delivery based Equity trades & TAX FREE BONDS buy/sell. I only have few transactions and am not a regular trader/investor.

Your valuable response will be appreciated.

Hi Shiv, I’m seeing the market rate of the NABARD Series IIB 7.64% (face value INR 1,000) shoot up to over INR 10,000 in my ICICI direct portfolio. Similar trends for HUDCO IIB (7.64%) and IREDA IIB (7.74%). Unable to understand this – can you pls throw some light?

You should write to ICICI Direct and point out this discrepancy. But ICICI does not rectify it’s mistakes easily! In many cases, ICICI DIRECT displays incorrect information. In many cases, even the column ‘INTEREST EARNED TILL DATE’ displays incorrect amounts.

Ha Ha … good answer, sk …”But ICICI does not rectify it’s mistakes easily! ” … and true as per my personal experience too. As an account holder I have awful experiences of their senseless and frequent “marketing” calls … somebody (mostly different person each time) will call up and say “Sir you have not traded for a long time on your account” … Sometimes I reply sensibly and say “but I am not Trader ..why should I trade?”. Some times when in a irritable mood (often now at my sr. citi. age) I say “I will start trading 6 months after I stop getting your stupid marketing calls” … but, I am sure, before 6 months a new RM is bound to call and say “Sir, you have not traded for a long time on your account”

Good one sir. Next time they call, tell them you have moved to Zerodha since they are offering zero brokerage for delivery. Try to negotiate and bring down your brokerage. I did this with another broker successfully.

Dear all, thanks for your replies. Much appreciated.

Yes, you are right! Have noticed some cases if incorrect MARKET PRICES if Tax Free Bonds in my portfolio today.

Can readers share their multiple experiences with other low cost brokers like ZERODHA, SHAREKHAN, ANGEL BROKING etc & their transparent brokerage & charges.

Even today itself, ICICI DIRECT has sent a new revised tariff list!

Hi,

My question is regarding currently available instruments which offer tax free returns in debt market.

Apart from the tax free bonds… Is it possible to invest in liquid debt funds which offer dividend on regular intervals.

I wish to specially ask if amounts can be invested for a shorter period of time and having full liquidity.

I received 2 different opinions on the tax treatment. One said that the complete dividend even if invested for small period of 2-3 months is tax free. The other said only if period is more than 3 yrs the returns are tax free or else tax of 28.25 percent will be levied.

Can someone throw light on this matter?

Regards ,

Chirag Gandhi

Hello Mr.Shiv,

Can you pl.tell me who is the registrar for NABARD Tax free bonds.

Hi Mr. Hari,

Link Intime is the Registrar for NABARD tax-free bonds – http://www.linkintime.co.in/publicissues/default.aspx

Could you kindly share the contact emails of the parties responsible for non-crediting the TDS deducted for NHAI & IRFC TFBs on the INTEREST PAID ON APPLICATION/ALLOTMENT AMOUNTS. The TDS amounts deducted are not shown in our online FORM 26AS. Can you clarify the possible reasons for the undue delays?

Hi S.K.,

Not sure who is actually responsible for such TDS deposits, but I think these companies or their Registrars take time to deposit such TDS. So, I think you should wait some more time for TDS figures to get reflected in your Form 26AS.

Thank you. Please share email addresses of NHAI & IRFC Co’s Tax Free Bonds related departments.

Thank you. By which date do you think our Form 26AS will be updated?

Please share email addresses of NHAI & IRFC Co’s Tax Free Bonds related departments.

I have still not received the refund of the amount paid for NABARD Bonds. Nor are the bonds credited to my demat account. What should be done?

Hi Mr. Shankar,

You should contact Link Intime for the same – http://www.linkintime.co.in/publicissues/default.aspx

I applied for these bonds after reading about them on your blog. I think the interest you earn on NABARD bonds are the best you can get in India. Are there any other comparable bond issue currently taking place ?

Hi Abhay,

No public issues of tax free bonds will get launched in the current financial year.

Hey shiv

How to get updates about the release of these tax free bonds? And is there any upcoming tax free bonds.

Hi Anubhav,

No public issues of tax free bonds will get launched in the current financial year. You should explore the secondary markets.

Dear Shiv

Thank for all your valuable information.

Can we have a consolidate table for all the tax free bonds issued in this financial year with their interest payment dates.

Regards

Piyush

Hi Piyush,

Here you have the consolidated table for the last financial year – http://www.onemint.com/2016/04/12/interest-payment-date-bse-code-nse-code-allotment-date-maturity-date-tax-free-bonds-issued-in-fy-2015-16/

NABARD tax-free bonds got listed on the BSE today at Rs. 1,035, hit a low of Rs. 1,030.26, a high of Rs. 1,035 and finally closed at Rs. 1,032.85 per bond – http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=935690

Dear Shiv,

Today’s closing price of this bond -15y- is only Rs. 109.25 on BSE website with 1240 nos. quantity traded. Why is the price so low.

bse link where nabard 7.64 is listed please

NABARD tax-free bonds to get listed on the BSE on Tuesday, March 29th – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160328-8

Here are the BSE codes for the same:

7.29% 10-year bonds – BSE Code – 935688

7.64% 15-year bonds – BSE Code – 935690

Deemed date of allotment has been fixed as March 23, 2016. Interest will be paid on March 23rd every year.

Just Posted – Should You Invest in NPS Post Budget 2016? – http://www.onemint.com/2016/03/25/post-budget-2016-should-you-invest-in-nps/

Excellent Article – Thanks Shiv – Yes, it helped me validate my decision to go for the 50K extra NPS contribution 🙂

That’s great Praveen! 🙂

dear shiv ,i have not received interest for NHB tx fr bonds due on 24 th march?? what should i do?

Hi Dr. Puneet,

As March 24 was a public holiday, you’ll have to wait for the next working day to get your interest paid and that is March 28.

thanks for your response dear shiv.

actually 24th and 25th march were working days in madhya pradesh banking sector,hence the doubt.(i am from mp)

Dear Mr. Shiv & Other Contributors to this valuable Blog.

1) Request you to kindly advise best 5-6 Debt Mutual Funds Growth Option where we can safely invest retirement savings for few years and which lend to safe companies. Also please advise MF DEBT FUNDS Short term & long term Capital Gains & suggest which option to choose.

2) Please advise best TFB’s buys in secondary market from earlier lots which are available at favorable prices, good yields & above all GOOD LIQUIDITY.

has any body received interest payment for 893 nhb? it was due on 24 th march.