This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

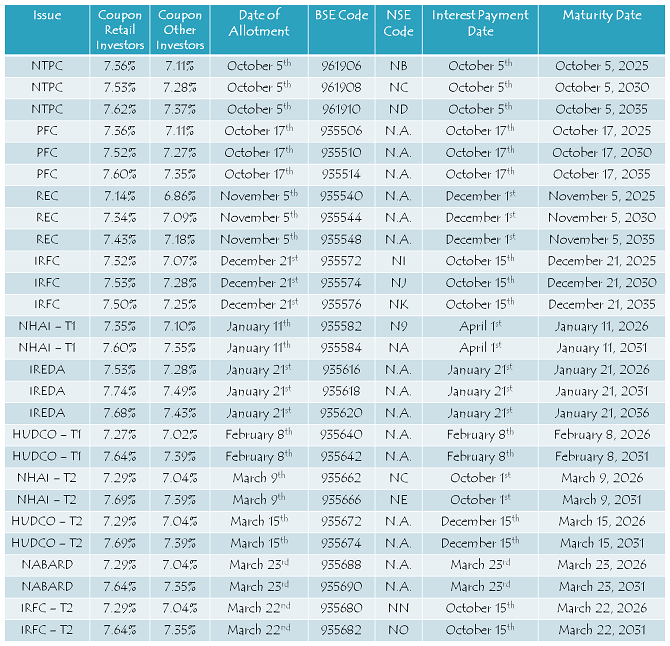

Tax-Free Bonds issued last financial year have all been allotted by now and as many of you wanted to get their basic details, like allotment date, maturity date, interest payment date, BSE Code, NSE Code etc. all at one place, here you have the post covering all such details required. The table pasted below also carries the coupon rates applicable to the retail investors as well as non-retail investors.

Tax-Free Bonds issued during Financial Year 2015-16

Bonds listed on the National Stock Exchange – NSE Link

Bonds listed on the Bombay Stock Exchange – BSE Link

These BSE and NSE links carry all the bonds, tax-free as well as taxable, and non-convertible debentures (NCDs) which get traded on these exchanges on a regular basis. NTPC, REC, PFC, IRFC, NHAI, IREDA, HUDCO and NABARD were the eight companies which issued these tax-free bonds during the previous financial year.

If you require any other info regarding these bonds or have any suggestion to improve this table, please share it here.

I want to know investment in what field for annually return I should invest I am in 30 percent bracket kindly advise me Virender gupta

Mr..shiv..gm..

Hny 2017.

I purchased tfb in my deemat account.

Which was intrest rates coming to next 10 dates..i have paid heigher rates of premium. .will i receive intrest in my deemat account. If yes..when..?

Hi Shiv,

I was looking for dates of interest payment for tax free bonds and was led to this site. Amazing that search for most of the finance related queries lead to you be it bonds, NCDs or IPOs. Thanks a lot for your efforts.

However in the table provided above for tax free bonds interest payment dates, there is some anomaly. I looked for IRFC 7.53% bonds at BSE site http://www.bseindia.com/markets/debt/scripwise_tradereport_new.aspx?pagename=di&Scrip_ID=935574&isin_no=INE053F07835&scripcode=935574

The interest payment date mentioned here is 21st December whereas you have mentioned October 15th.

Thanks anyway for the information.

Regards,

bhushan

Hi Mr. Bhushan,

Interest Payment Date mentioned on the BSE link you have pasted above is incorrect, please ignore that and check this link – http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=935574

These bonds will get ex-interest on 29th September and interest will be paid on 15th October – http://corporates.bseindia.com/xml-data/corpfiling/AttachHis/2FCE4639_0BAE_4724_B49F_318EC9AECECD_110217.pdf