This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Indiabulls Housing Finance Limited (IHFL) has announced the basis of allotment for its non-convertible debentures (NCDs), which opened on September 15th and closed on the second day itself on September 16th.

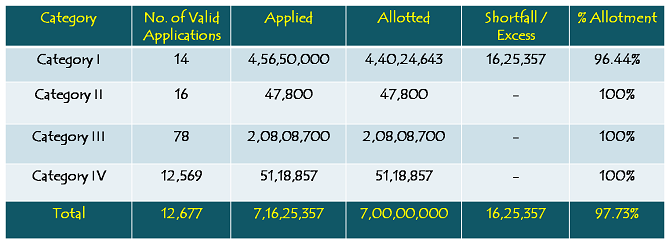

Here is the Basis of Allotment among all categories of investors:

Category IV (Retail Individual Investors Portion) – In the case of allotment in Category IV, 12,569 valid applications for 51,18,857 NCDs received on September 15, 2016 and September 16, 2016 have been allotted 51,18,857 NCDs (100%), against the allocated bucket of 2.10 crore NCDs as per the prospectus. The unsubscribed portion of 1,58,81,143 NCDs spilled over to Category I.

Category III (High Net Worth Individual Investors Portion) – In the case of allotment in Category III, 78 valid applications for 2,08,08,700 NCDs received on September 15, 2016 and September 16, 2016 have been allotted 2,08,08,700 NCDs (100%), against the allocated bucket of 2.10 crore NCDs as per the prospectus. The unsubscribed portion of 1,91,300 NCDs spilled over to Category I.

Category II (Corporates Portion) – In the case of allotment in Category II, 16 valid applications for 47,800 NCDs received on September 15, 2016 and September 16, 2016 have been allotted 47,800 NCDs (100%), against the allocated bucket of 1.40 crore NCDs as per the prospectus. The unsubscribed portion of 1,39,52,200 NCDs spilled over to Category I.

Category I (Qualified Institutional Investors Portion) – In the case of allotment in Category I, 14 valid applications for 4,56,50,000 NCDs received on September 15, 2016 have been allotted 4,40,24,643 NCDs (96.44%), against the allocated bucket of 1.40 crore NCDs as per the prospectus. Excess demand for 3,00,24,643 NCDs has been satisfied with unsubscribed portions from Category II, III and IV.

If you want to check the allotment status, here is the link of Link Intime – http://linkintime.co.in/bonds/SelectClient.aspx?mode=allot

Link Intime is the Registrar for this issue and if you have any query related to your application, allotment process or refund of application money, you can contact them at 022 – 2594 6970 or write a mail at bonds.helpdesk@linkintime.co.in

Sir,

Please share your thoughts on Reliance home finance NCD

Thanks.

Sir,

Please share your thoughts on Reliance Home Finance NCD

If anyone looking for personal loan in Axis bank:

http://www.personalloan-bangalore.com/axis-bank.html

If anyone looking for personal loan in HDFC bank:

http://www.personalloan-bangalore.com/hdfc-bank.html

Hi Shiv,

I have a question but not related to this post. I recently read about dividend declaration of NSE (national stock exchange) for existing share holders and also read about IPO of the same in 2017. I did look for this stock, but couldn’t find. Is it possible to buy this stock in the secondary market? If yes, do you know where/ how to buy the same? Please let me know. Thanks,

Sundar.

Hi Sundar,

NSE is still not listed on the stock exchanges, that is why it is planning to launch its IPO in 2017. Only after its listing, you’ll be able to buy this stock.

Please refer to this

http://timesofindia.indiatimes.com/business/india-business/NSE-to-pay-795-dividend-to-go-for-bonus-stock-split/articleshow/54722301.cms

Yes I understand that NSE goes public next year, but how it can issue dividend now and is it possible to buy this stock now? Thanks

Hi Sundar,

NSE is not listed on the stock exchanges, but it is still a company with existing shareholders. It is going to give dividend etc. to its existing shareholders. You can buy its shares from the existing shareholders, if they are willing to, but not from the stock exchanges.

Dear Shiv,

From where can I get information about how many NCDs of each series have been issued by the company ?

Thanks

Hi TCB,

Please check the link pasted above. There is an annexure in the pdf form. You’ll get the required info from this annexure.

Nice analysis

Thanks Irshad!

Indiabulls Housing Finance (IHFL) NCDs to get listed on the BSE & the NSE today i.e. September 28th – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160927-24

Here are the BSE and the NSE codes for the same:

8.70% 3-year NCDs – Annual Interest – BSE Code – 935846, NSE Code – N3

8.70% 3-year NCDs – Cumulative Interest – BSE Code – 935848, NSE Code – N4

8.90% 5-year NCDs – Annual Interest – BSE Code – 935852, NSE Code – N6

8.90% 5-year NCDs – Cumulative Interest – BSE Code – 935854, NSE Code – N7

8.65% 10-year NCDs – Monthly Interest – BSE Code – 935856, NSE Code – N8

9% 10-year NCDs – Annual Interest – BSE Code – 935860, NSE Code – NA

9% 10-year NCDs – Cumulative Interest – BSE Code – 935862, NSE Code – NB

8.79% 10-year NCDs – Monthly Interest – BSE Code – 935864, NSE Code – NC

9.15% 10-year NCDs – Annual Interest – BSE Code – 935868, NSE Code – NE

9.15% 10-year NCDs – Cumulative Interest – BSE Code – 935870, NSE Code – NF

Deemed date of allotment has been fixed as September 26, 2016. Annual interest will be paid on September 26th every year. Monthly interest will be paid on 26th of every month starting October 26th, 2016.