This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

HDFC Life IPO Review – Should You Invest or Not @ Rs. 275-290?

After tepid listings of SBI Life and GIC Re, it is now the turn of HDFC Life to get itself listed on the stock exchanges with its initial public offer (IPO) of Rs. 8,695 crore. The issue is getting opened for subscription from tuesday, November 7 and will remain open for three days to close on November 9.

Like most of the IPOs in bull markets, this IPO too involves sale of stake by its existing promoters. HDFC is selling its 9.52% stake and Standard Life (Mauritius Holdings) is selling its 5.4% stake in this IPO. Post this issue, HDFC’s stake in the company will fall from 61.21% to 51.69% and Standard Life’s stake will fall from 34.75% to 29.35%.

The company has fixed its price band in the range of Rs. 275-290 a share and no discount has been offered to the retail investors. The offer would constitute 14.92% of HDFC Life’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size & Objective of the Issue – HDFC and Standard Life (Mauritius Holdings) are collectively selling their 14.92% stake in HDFC Life in this IPO to raise Rs. 8,695 crore. HDFC Life will not get any proceeds from this offering.

Price Band & Retail Discount– HDFC Life has fixed its price band to be between Rs. 275-290 a share and the company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservation for HDFC Shareholders & HDFC Life Employees – HDFC Life has reserved 2.998 crore shares for the existing shareholders of its parent company HDFC, 21.45 lakh shares for the HDFC Life employees and 8.05 lakh shares for the employees of HDFC.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 50 shares and in multiples of 50 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,500 at the upper end of the price band and Rs. 13,750 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 50 shares each @ Rs. 290 a share i.e. a maximum investment of Rs. 1,88,500. At Rs. 275 per share, you can apply for 14 lots only of 50 shares, thus making it Rs. 1,92,500.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on November 9. Its shares are expected to get listed on November 17.

Here are some other important dates as the issue gets closed on November 9:

Finalisation of Basis of Allotment – On or about November 14, 2017

Initiation of Refunds – On or about November 15, 2017

Credit of equity shares to investors’ demat accounts – On or about November 16, 2017

Commencement of Trading on the NSE/BSE – On or about November 17, 2017

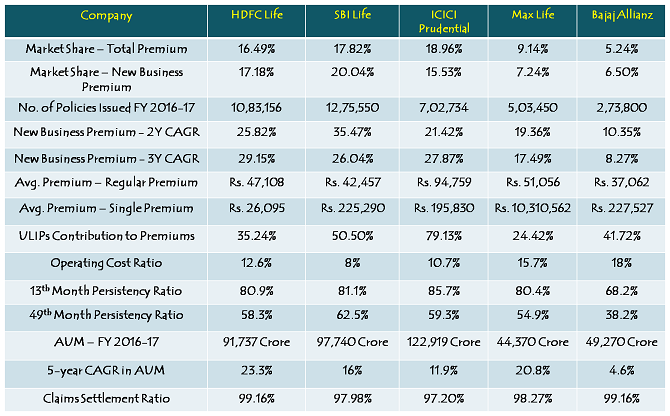

Peer Comparison

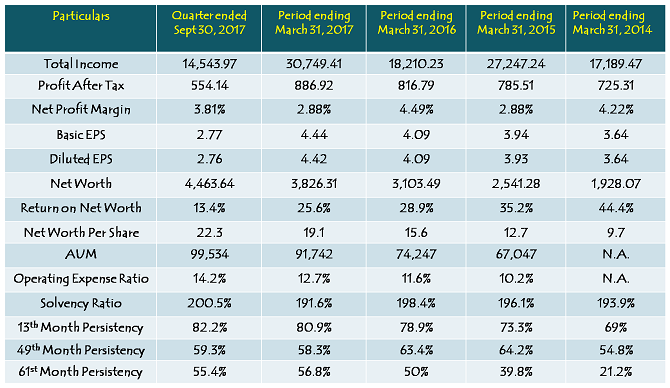

Financials of HDFC Standard Life Insurance Company Limited

hey

great stuff….keep writing.

thank you

Awaiting your comprehensive review please!

thanks for very simple and clean way to express for the HDFC

but a single line is very much IMP from such market guru should a retail investor should invest in it or not. your suggestion make lot of small investor helpful

At this time, my feeling is: it is extremely overpriced; significant jump in overall valuation compared to what was recently done when discussion with Maxlife for merger was on; GMP is low and reducing by the day. Not worth investing. The only positive is: HDFC brand.

I look forward to your valuation analysis and my guess is you would recommend ‘avoid’. Thanks