Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

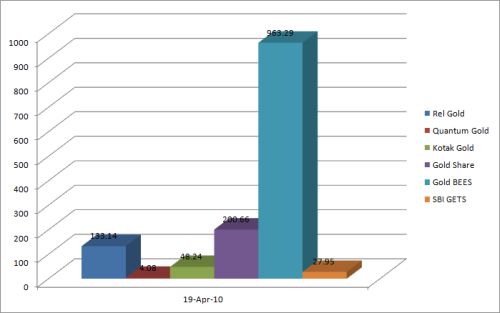

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

Hi Manshu,

Thanks for your early response.

Actually, this is a first time I am trying this type of investment.

Hope I am going on right way.

What are the formalities to start the same by Benchmark GoldBees?

There are no special formalities, you just have to get a trading and Demat account like you would do for shares, and you are set.

Hi Concern,

I just want to invest on monthly basis in GOLD.

can u please help me to invest in GOLD and also confirm how can i invest?

What is GOLD EFT, is it best option to invest in gold?

Sunny,

You can invest in gold ETF just like you invest in any other shares. Have you ever done that? Benchmark GoldBees is a good one that you can try out.

HI Manshu,

The post is really useful. I have also read your post here http://www.onemint.com/2009/09/07/gold-etf-in-india/.

In your research you mentioned the expense ratio of Gold Bees is less(1%) compare to other ETFs. I have gone through the document in the following link and it indicates the expense ratio of Gold Bees is also 2.5% – http://www.benchmarkfunds.com/Documents/SID_ETFs.pdf

There is no link to sebi site in the post “http://www.onemint.com/2009/09/07/gold-etf-in-india/”. Hence I have gone through their website. It looks like some ETFs like Nifty Bees, Bank Bees alone have 1% as expense ratio.

Please clarify, Regards.

Hi Karthik – I think that document is dated; if you go to their page here you will see the rates.

http://www.benchmarkfunds.com/Products/GoldBeES/Overview.aspx

Hi,

Can you pls help me out how to buy GOLD ETF ( Reliance …)

Mahesh – it’s done just like stocks, if you have ever bought shares and have a Demat and trading account, you can buy ETFs in the same manner. Have you ever bought shares?

I do not want to buy physical gold but to buy through exchanges on monthly basis.

What is the way ? Can you name a few broking houses who can help ?

I already have a dmat account.

Do you have a trading account as well? If you’ve ever bought shares, then you can buy ETFs in the same way through the same trading account. There’s no need to go to a special broker for that Sukumar.

If i hv to invest in Gold EFT where should i invest

GOLDBEES is a decent option.

Hi

I’m planning to invest on gold, can u give me a projection of hike in gold price the next 5 years. is it safe to invest on gold today. also suggest us wether to purchase on ornament or gold coins/bis’ts.

thx

I’m afraid I don’t know what will happen to gold prices tomorrow, let alone 5 years from now.

I dont know more about this gold funds or gold bonds, want to invest if got clear all concepts.

You can read this link and see if you understand. It’s a broad topic so difficult to explain in a comment, but you can get started here:

http://www.onemint.com/2009/10/23/what-is-an-etf-2/

Can you please explain why there is a difference in per unit value of various Gold ETFs even if they are representing (say) 1 gm unit of gold? Is it only because of the expense ratio?

Secondly, based on today’s data (20-May-2011), price of Axis Gold ETF is Rs. 2175 but price of Gold Bees is Rs 2137. Why is there so much of a difference? Does it also mean that apart from gold, the funds may hold other assets like bonds, etc?

Based on above, would Axis ETF be the best gold ETF to buy?

Regards

Tarun

Tarun – I have an entire post on the topic that should clear your doubts. It can be found here:

http://www.onemint.com/2011/02/15/why-do-different-gold-etfs-have-different-prices/

Can you tell me what the expense ratio is. Suppose, I have Rs. 1,00,000 in hand. And at the end of 5 years, let’s say gold price is doubled. If I invest in physical gold through trusted jewellers, I will be getting back Rs. 2,00,000 roughly. But I am not sure how much will I get through ETF. Can you calculate the effect of expense ratio, which is 1% for most of the ETFs.

Thanks.

The expense ratio is expressed as a % and if you have 1% expenses then at the end of 5 years – 5% will be reduced from the returns. I’m still to see a comment here from someone who has had no problems or deductions while selling their gold back, so personally I won’t feel very confident about getting double the money if the spot gold prices doubles.

it’s true that jewellers don’t offer exactly the price of the gold,when u go to sell it.

Firstly,they often deduct the weight and you cant challenge thm on tht.

secondly, if u sell coins they are nt willing to purchase coz, they wont make mch out of it,they say that if u want to purchase or make jewellery they have say price(current rate) whereas if u want cash they deduct around Rs.200-300/gm

thirdly, you cant be sure whether 10 yrs from nw the same jeweller will be available.May be he shuts his shop or his children don’t wish to continue as jeweller. Other jeweller wont pay good enough for jewellery or coins purchased from someone else.

@Amit,

Buy Gold coins from Reputed Jewellers like Khazan Jewellers or Reliance Jewels. They will buy back gold coins from you and also exchange for jewellery. You can also take cash incase of Reliance Jewels. I happen to have invested in 12 months montly gold purchase scheme of Reliance and I have a Chance of buying jewellery or coin. Beware of the rising gold prices.

regards

Hi,

if some body can help – I hold 06 gold coin of SBI and now i want to sell. whom / where should i contact to sell those gold coin

You will have to sell it to a jeweler – go to a few near your place and see who offers you the best rate.

@Am:

Accepted that gold has risen by over many many times over the past decades, but isnt it all in hindsight that we are making decisions for the future? If one can connect the dots looking fwd, then one’s genius. Its like saying that “today’s education system is gonna prepare kids in their careers for the next 30 years(while we dont know whats gonna happen inthe next 5 years” (Courtesy: Sir Ken Robinson))

We are speaking of a trend across 60 years..but the lifespan of an average investor(atleast one who is risk-averse) I guess would be about 30 years? And during that period, a single huge drop or even a few drops can erase a lot of capital which may not go back to the previous levels over the lifespan of the investor (The Gold, Silver crises in the 1980s, The Japanese index(Manshu hasa post on this I guess), the sub-prime crisis are all cases in point) Also to be considered is “when” the investor will need the money to reach goals and not the other way round(cashing in during bull runs or fleeing during bear phases)

Am not a proponent of any one asset, but to keep all eggs in one basket(even if its spread across a large time period like SIPs ) is kinda risky I suppose. Dwelling on this aspect in a few chapters is Taleb’s book “Fooled by Randomness” which is a good read .

Just wanted to share a few thoughts.

risk is always a factor for physical gold

@Manshu

Gold Rate 1950 – 50/gm

Gold Rate 1975 – 500/gm

Gold Rate 2002 – 5000/gm

Gold Rate 2011 – 22000/gm

On what basis are you saying that Gold rate has “stagnated”????

Show me another asset that has grown by 50000% in the last 60 years??!!

People, forget etf and other shares/stock junk these people get you to buy, only 3% ordinary people make money in it, the other 97% are the companies and these agents who cash in.

Buy gold every month, as much as you can afford, when you have enough in a few years, buy a flat ANYWHERE in the city, you cannot go wrong, you will be giving the greatest returns to your children.

Simple story – My grandfather bought a Rs. 2,00,000 house in Bandra Reclamation (One of the costliest suburbs in Mumbai today) in 1984, today, the flat’s price is a staggering Rs. 4,500000!!

What stocks, What shares?? Forget the gobbledygook stuff. Instead buy actual gold, save enough, and then buy land/flats.

Those 2 things will only and only increase in price and demand, but not in supply!!!!

And one last thing, now that you people will blast me with comments, let me just state one last benefit of land and actual gold. It is in my hands!!!

Your etf’s, shares, your money and other “portfolio items” are in the hands and control of someone else, someone who is beyond my control! 1 scam, 1 hack and all my money is gone!

Regards,

Am

yes reply i give value 2 your suggestion.

I really agree with you.

I have online account for buying and selling of shares. buy this same account can we buy the gold. shall i get gold or amount after selling the gold thru online dmat account.

thanks & Regards

Yes you can use the same account for gold ETF & when you sell it you will get cash, not gold.

Thanks Puneet for the advice!

btb any suggestions rgding preferred brokerages for a passive investor.

Thanks Manshu! Might have to go the Fund of Funds way but again expense ratio climbs up there as well:)

Hi Nav

They are many brokers who are offering lifetime trading + Demat AMC free by just paying an amount much lesser than Rs 800.

Also you can apply for an IPO and FPO through ASBA, however if you want to sell those stocks you need a trading account.

Funds of funds has always been an expensive and a complicated product worldwide.

Also the infra bonds you have invested in have an option of selling in secondary markets in case you need money before the maturity date.

Having a online trading account would be beneficial as in future all the financial products including insurance also would be bought and sold through trading accounts only

Might seem very trivial. I have a demat account(opened only for getting the 80CCE infra bonds credited). Now I’d want to buy a gold ETF, cant I do so without a trading account?

Reason is I wouldn’t use the trading account for anything so why pay up another Rs800p.a. on that while any direct investment (IPO, FPO – actually even this is possible through ASBA; only secondary market buying may not be possible without a trading account) in the stock markets by me would only be passive

Nav – As far as I’m aware you can’t buy this without having a trading account. There may be an option that I’m not aware of but I have never heard of something like this.

Quantum offers the best ETF when looked upon holistically.

They have one of the lowest charges.

They have got the GOLD stocks checked phycically by an independent company (which is BV certified) and have the cert updated on the website as well.

I have invested myself in that and I have done my homework before that, I just wanted to shed some light over these facts and wanted to help you in making an informed choice.

Dear Manshu,

I am new to gold etf.

I purchased 1 unit of reliance gold etf last month.

I have a doubt about the selling of these etf

1.can i get cash or gold against selling this ?

2.how much tax or charges i have to give at the time of selling?

1. Yes, you will get cash, and that’s the only thing you will get. You can’t get gold against it.

2. If you make capital gains on it and you’ve sold it within a year then its taxable at 15%.