Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

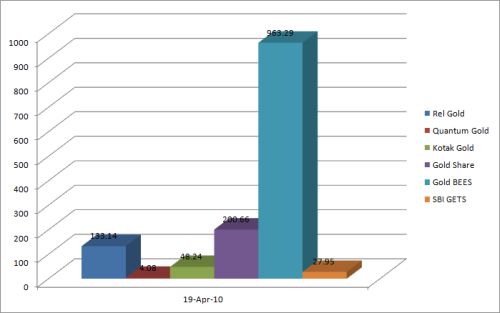

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

hi mansu

cud u plz clarify whether expense ratio is annual or one time only

thanks nd regards

It’s annual Pawan.

I am going to invest gold mutual fund through SIP. let me know the advantage and disadvantage.

Its September now and Gold has again reached new summits. At this price, are ETFs (or physical gold for that reason) still a good buy? I think Yes, because the world economies are plunging day by day. At the same time, sceptics say there’s a Gold bubble forming.

Please share your views on a fresh investment at this stage.

I’m afraid I don’t have a clue on what’s going to happen Conan. I have been staying away from gold since 2008, and have missed the 100% price gain, so I’m certainly not the right person to say what’s going to happen in the next few years with gold prices. I have chosen to stay away myself because of the huge run up in prices, and interest, and that scares me as it reminds me too much of the real estate stocks or the IT stocks before them.

I have found your articles and Blog very informative. I have never invested in Gold Fund / ETF so far, and mostly invest in MFs through SIPs.

Please tell me is it worth investing subscribing in SBI gold Fund NFO which is open right now,? Or is it better to invest in Gold BeeS / Quantum fund?

Here is a detailed review of SBI gold fund that I did some time ago and you can read the post to get a perspective of how these things work.

http://www.onemint.com/2011/08/24/sbi-gold-fund-review/

I am going to start Gold mutual fund Through SIP, let me know adavantages and dis adavantages of this. Kindly advice.

Plese adivse hoe to invest in gold etf in current market senario.

Hi Mansu,

I have monthly SIP of 16,000/- Rs. in MF and I would like to invest in GOLD ETF @ 10,000 Rs./month.

Is it write time to open SIP for Gold ETF?

Other then Term plan/PPF investment, my total investment through SIP route only which fulfill my goals of education fund for my son and retirement funds after 20years. I am 38years old and i have started my SIP 11,000 Rs. since June 2008 and additional 5,000Rs from June’11.

Please give comments and investment plan if better then this.

no time is bad to invest in gold. I feel one shud be clear as to wat for is he investing and hw mch can he hold.gold has not dissapointed investers even during recession times

Hey Mansukh,

I would like to invest in physical gold and want to purchase 100 gms of gold bar, do feel this the rite time to invest or you suggest me to wail for few days.

Regards,

Monish Agarwal.

I really have no clue on what a good time to buy gold will be. I wish I knew, but I don’t. Sorry.

http://www.nationalspotexchange.com/Investment%20Products%20in%20Commodities-%20A%20New%20Paradigm.pdf – The slide titled ‘Alternative Assets Comparison’ lists the Return Potential of Gold as ‘Medium’. Any comments from users here on what the historical rates of return have been or what’d be a realistic return to expect in the short/long term?

Hi Mansukh

I like you blog very much, it gives us lot of knowledge.

I was confused in one thing, I read somewhere that one gold etf of goldbees is equal to one gram of gold. Correct me if I am wrong.

But when I see goldbees current rate is Rs 2209.30

Where as the gold MCS Rate is Rs 2308.2

Which means the goldbess is Rs 98.9 discounted as compared to the MCX rate. Why is it so ?

Can you kindly guide me for the same.

topic very informative

hey there i have a question regarding gold etf . in 2007 my uncle had invested in UTI Mutual Fund – UTI Gold Exchange Traded Fund.he purchased 41 units.now my uncle passed away last month. my aunt has no knowledge of stock markets and neither do i . i want to know if my aunt should sell it or not and if yes how much does she get by selling it

Hi Samir – Gold ETFs follow the price of gold, and move up if gold prices go up, and move down in gold prices come down, so people who think that gold will go higher in the days to come won gold ETFs.

Hi Manshu,

Hope u dng good..

Heard Gold man sachs have taken over GOld bees now..from 14th july..I have invested in Gold bees & wanted to continue with it..but now since GoldMan Sachs has taken over, wat would be the impact on Gold bees..Gold Man sachs is Investment banking & their stock would not always reflect the gold price..as Gold Bees would invest 100% in Gold.

Please provide an update if u have on this..or do i need to diversiy my portfolio in SBI gold etfs..

Hi Rohit,

I’m good, how are you doing?

Goldman Sachs taking over Benchmark won’t impact the price of GoldBees. The gold ETF will continue to be priced according to the gold stocks it has. So, you don’t need to make any change in strategy just due to this ownership change.

Manshu,

Thanks.

what do u feel is better, SIPing into reliance gold savings fund/kotak gold fund OR buying into gold ETF through my online portal. My time frame is 10 years and I want to buy gold worth 5k every month. I seek advice in terms of cost incurred and security of purchased units.

Pankaj – In terms of cost Benchmark Gold ETF is the cheapest for expenses. You can look at how much brokerage your broker charges, and if it’s not a whole lot then buying the gold ETF and avoiding fund of funds is definitely better.

In terms of security, since mutual funds also eventually buy gold ETFs (something which many people aren’t aware of) so you don’t get any additional security by buying a gold mutual fund.

manshu,

on online trading acct, gold etf fall in eq segment, but they also have an expense ratio which is the feature of mf. so if investing in gold etf we end up paying expense ratio of 1 % as well as brokerage. at the same time if we try to invest in fund of fund like reliance gold savings fund, we end up paying expense for this gold fund as well as underlying gold etf. so, expensewise investing in gold etf or gold sip is far more expensive than shares. is my observation correct.

Pankaj

Pankaj,

Your description of costs is accurate though comparing mutual fund / ETF costs to transaction costs is like comparing apples to oranges to me. I feel that way because MFs, or ETFs are products that charge expenses to allow individuals the ability to buy a whole host of stocks or commodities that they ordinarily can’t buy themselves.

Hi Manshu

is it possible for you to update the graph on this page to show data as per 2011 ?

thanks

Sure, will try to get it done this weekend.

Excellent work Manshu. I was researching for info on gold ETF and your articles saved me a lot of time.

That’s awesome! Thanks a lot for your comment! Look at some of the other stuff here and it might just be of interest to you as well. If it is then you can subscribe to the free daily newsletter using the box at the top right. Thanks again for your comment!