What is a Demat Account?

I got an email last week from someone asking about opening a demat account, and in the SBI and IDFC thread you might have noticed that there are several people who don’t have demat accounts, but will have to open one soon because nowadays you need one even to invest in these bond issues.

Let’s start with what a Demat account is, and then we can move on to the several options currently available in India.

My grandpa used to have a black briefcase where he stored all his physical share certificates.

Eventually he dematerialized all his shares and moved them to an electronic briefcase, which is how he described his Demat account, and I think this is quite apt to understand the concept.

A Demat account is like a brief case where you store your shares and bonds electronically.

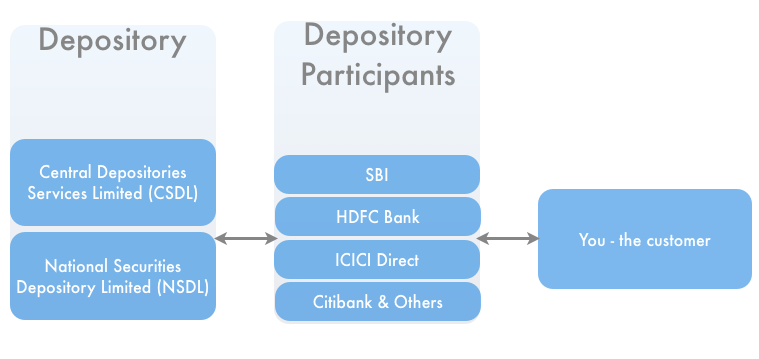

In India there are two Depositories – NSDL and CSDL – and you can think of these depositories as banks that hold your shares and bonds in electronic form.

A regular investor can’t deal with a depository directly, and you have to deal with their agents which are called Depository Participants (DPs).

There are hundreds of DPs in India, and you can open a demat account with one that suits you in terms of price and convenience. Normally, people open a Demat and a trading account with the same institution as it makes transactions cheaper, and is more convenient to get started as well.

So you could have a trading account and a DP account with SBI or ICICI Direct. It is in fact better to have trading and DP account with the same organization because in those cases you are waived off the DP transaction fees.

Effectively, you are using an agent in the form of a depository participant to avail the services of a depository which are storing your shares and bonds electronically.

There are hundreds of DPs in India, and NSDL provides a very comprehensive list of DPs along with their fees here and here (this data might not be up to date though).

Partial List of Depository Participants in India

If you clicked through the above links to the entire list of DPs then you’ll notice that there are a large number of DPs in India, so for this post I’m trying to create a list which has got some of the better known DP names with only their annual maintenance charges covered.

There are several other charges, but including all of them here will make comparison difficult. I have included a link to the source in this table so you can go check the details there. Since these prices are relatively low – you should think about convenience also, and see if your bank offers demat services, and if you can open one there.

| Name | Annual Maintenance Charge | Detailed Charges |

| SBI | Rs. 400

Rs. 350 for customers receiving statements by e-mail |

Link |

| ICICI Bank | Rs. 500

Rs. 450 for customers receiving statements by e-mail |

Link |

| HDFC Bank | Rs. 750 for less than 10 transactions

Rs. 500 for 11 – 25 transactions Rs. 300 for greater than 25 transactions |

Link |

| Citibank | Rs. 250 | Link |

| HSBC | Rs. 750 | Link |

| Sharekhan | Rs. 75 per quarter (300 annually)

Deposit of Rs. 500 |

Link |

| Axis Bank | Rs. 500 p.a. for customers authorizing Bank to debit DP charges from bank account maintained with Axis Bank, and 2,500 for others. | Link |

| Karur Vysya Bank | Rs. 250 per annum | Link |

| Sharekhan | Rs. 300 under two plans, and Rs. 500 under another | Link |

| Bank of Baroda | Rs. 350 per annum | Link |

How to open a Demat account?

Once you decide where you want to open your Demat account – contact their representatives, and they will get you started.

You will need the following documentation in order to open a Demat account, so keep this handy while contacting the DP.

Proof of Identity: This includes PAN card, driver’s license, passport, voter card etc.

Proof of Address: This includes the above documents and bank passbooks, identity cards issued by Centre or State governments etc.

Passport size photo

Pan card copy

You will need the following details while opening the demat account:

- Name of account holder

- Mailing address

- Bank account details

- Guardian details for minors

- Nomination declarations

- Standing instructions

When you contact the DP – their agent will let you know if they need any specific documentation, or if you need answers to any other specific questions.

It used to be that only equity investors cared about having a demat account, but with a lot of bond issues coming out in only demat form – I think more and more investors will need to open a demat account, and if you don’t already have one, then do think about spending this four or five hundred bucks per year to take advantage of electronic stock and bond holding.

This post should get you started on what a Demat account is, how and where you can open one, as well as the documents required to open it. Please leave a comment if you have any questions or other feedback.

hello sir, can you please say me wats difference between face value and book value?

ans plz

Your presentation is awesome about demat a/c concept.

Dear friend

The information which you given was so good and simple even to understood by a layman

regards

Anil eaj

Thanks Anil!

hello sir, can you please say me wats difference between face value and book value?

i wated to know that when i do any transaction life buying or selling share any tax will be applied on that or bank will charge any amount every time i buy or sell the share

Dear Manshu,

Can you inform how we go about opening an E-Gold account and their related charges like you have given for stocks demat?

you can mail me the details

shwethakamath1989@gmail.com

Thanks,

Shwetha

Shwetha, I have a detailed article on that topic here that you can read: http://www.onemint.com/2011/01/13/e-gold-and-e-silver-from-nsel/

Dear manshu,

is there any possibilities buying currency through demat / trading account as investment.

please advise as iam new to demat / trading.

thanks in advance.

Thanks dear,

I want to buy some shares on the upcoming ONGC FPO. Till date I date I don’t have DEMAT account. Plz tell me how and from where I can get DEMAT account as soon as possible and How much time I can take. If till FPO auction I couldn’t get DEMAT acc, can I participate in FPO.

Are u want to make investment in share market just contact me i will give u full detail and also i will open your account with very less brokerage. This is contact no. 09591772138

Dear Manshu,

Thanks for the information. ans i want to know what is the minimum share value that we can buy? what will be the probable disadvantages of opening demat account?

I want to open another demat Account,

I want to open another demat account Please show me all center for opening demat account. and details of maintenance charge and opening charge.& procedure of share transfer

I don’t have that and I have never seen that information anywhere else so I am not very optimistic that you will find that kind of information at one place.

The good thing perhaps is that a lot of these costs are similar across brokers so you can talk to wherever you bank and see what the costs are.

hi manshu

thanks for broadning our horizon on demat. i wanted to know whether i can open 2 demat a/c with 2 different DP’s??

Yes, you can but you will have to give your PAN and pay for the second account as well. What benefit are you looking for from opening a second account?

Thank you sir.

hello sir,

can you please say me that, class B shares means which type of shares?

Sometimes companies issue shares which have lesser voting rights than their main shares, these are called class B shares.

Sir,

The information given by you very useful to the newer for Demat Account. Thanks for your detailed description and the links. I am from a middle class family and my earnings are very low. I want to see my luck in the share market, So please guide me step by step for the minimum investment in the share market and earn profit.

Regards,

Pankaj Rajput

9424796636

It’s not a casino where you can try your luck and see if you win or lose Pankaj – in my opinion you should stay away from shares and invest in ultra safe instruments like bank fixed deposits. Lot of people lose a lot of money in shares and if you have low savings then that can be very bad for your finances Pankaj.

sir,

I have sbi demat account.

I dont know how to invest through online?

so give me idea about share trading

hello sir,

please can you say me that what is P/E ratio?

That’s the price earning ratio and there are plenty of good articles already on that. You can read one here:http://www.investopedia.com/terms/p/price-earningsratio.asp

From Axis bank and HDFC Bank, who is better for demat & trading a/c? please advice