This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

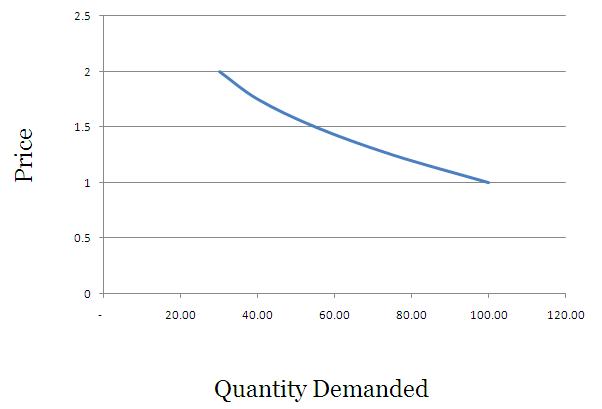

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

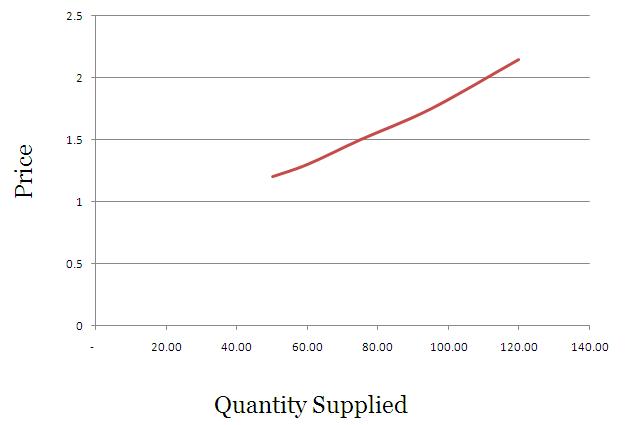

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

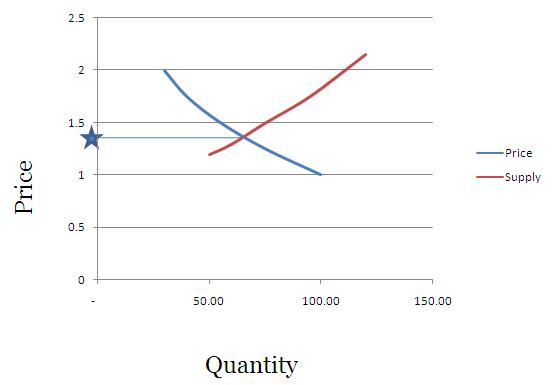

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

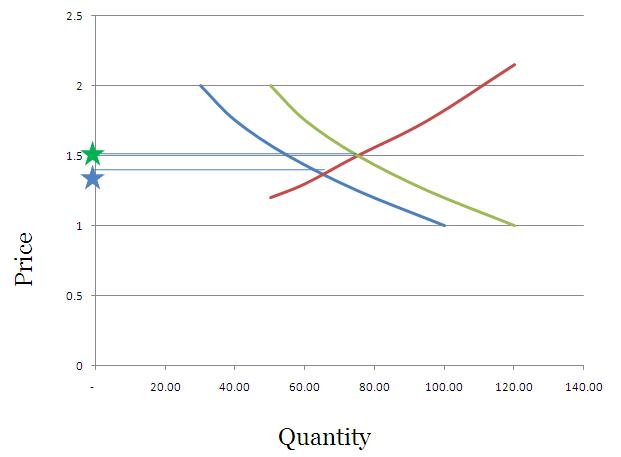

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

i find this ariticle very informative ….Manshu you solved my misconception….thanks a ton for that enhance!!!!

i find this ariticle very informative ….Manshu solved my misconception….thanks a ton for that enhance!!!!

I disagree with you that if you have more money your consumption or demand of certain things also rise. No one buys the same thing again and again if not required.

Bank are primarily involved in Usury, Money is deliberately kept out of reach of the masses so that handful of can use it and become more rich.

Some vested interest create artificial demands to increase prices of their products such as builders in Bombay.

Govt should print money as much as it is required by the common man. Keep prices fixed and allow 20% as a profit to be added to the final price of the product. There will be no inflation for a long time to come. all people will be rich and happy.

my question is

if a government can print more money,then why a government talks about debt?

print more money and clear all the debt.

one more question .,,

what is the need of forex? please explain briefly

The government can’t print money on its will that’s the reason they need to reduce debt by other means.

Forex is required to carry out trade with countries who won’t accept INR for payments like Saudi Arabia won’t accept INR for the oil they export to India.

Nice article on supply and demand.

My question is, what happens in reality with Quantitative Easing?

If the new money printed goes into only a little percentage of the population, are they richer now?

The new money comes into banks, and theoretically they should find it easier to lend out to other individuals so terms of credit should become easy. However, in reality, this may not always happen. As during the last credit crunch American banks didn’t lend out the money since their own balance sheets were in trouble, and they were worried about further bad debts.

Here is a post about QE that you may find useful Marco.

http://www.onemint.com/2008/11/26/what-is-quantitative-easing/

Thanks for the lucid explanation Manshu.If a country’s currency is not backed by the gold it holds,then what decides the amount of currency a country can print?

It’s based on several factors particularly the economic conditions of the time. In times of credit crunch and low economic activity – governments reduce interest rates to promote lending, and will “print” money through things like Quantitative Easing to boost spending and aggregate demand.

great feedingg…………..

Hi Manshu. .

I have a doubt regarding what you have put forward. .

You said the following in quote:

‘So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.’

——————————————————————————————————-

My query is:

When actually your PurchasingPowerParity (PPP) increases, your spending power increases. So, for the product which you paid Re. 1 for 30 quantities, you will pay more for the same 30 quantities.

But you said people will demand 50 units for the same price. I think people will be willing to pay more for the same quantity (say Rs. 1.5 for the same 30 units).

Only when people pay more for the same quantity, the companies will take it as an advantage and increase the price which will then cause the inflation to increase.

Please correct me if I am wrong!!

PPP is the concept of exchange rates of two countries at which the purchasing power becomes the same in both the countries, so that’s not really applicable in what we are saying here.

In this scenario, it’s not the question of a single company, because everyone has more money for everything now. It’s not a case where Apple makes a hit product and there is a high demand for that.

Nice article Manshu. However, reading your article made me ponder about what happens if govt really gifts everyone Rs. 100 crores. Pure hypothetical exercise for brain.

Now that’s a kind of socialist action, where wealth is being distributed. Apart from super billionaires, everyone would be on same platform. While it sounds awesome in the first place, but would probably lead to massive loss of productivity. Something similar to what happened when Idi Amin made all Asian business owners leave Uganda, leading to total chaos and industrial collapse. Just makes me wonder. Just makes me wonder.

So in fact, this action would lead to loss of productivity due to hyper-inflation and forced, unproductive socialism.

Is it really “wealth” though? it’s just paper money.

Sorry, I meant ‘redistribution’ of wealth, not the distribution of paper money.

There’s another aspect to voluntarily printing money that the US has been exploiting to its advantage.

Let’s say there are 100 US dollars in circulation and the US Dollar : Yuan conversion rate is 7 Yuan = 1 USD. Now say that the chinese hold 50 USD (half of the entire circulation amount) as their trade surplus. US asks the chinese to revalue the Yuan upwards, which they dont. So, the US unilaterally prints another 100 USD and releases it into circulation. Now, since the chinese have fixed their rate of conversion, USA still owes them 50 USD, but these are now worth only one fourth of the new amount in circulation. Defacto, the Yuan has been revalued upwards while the USD has been devalued…and against the wishes of the chinese! The only way in which they can get out is by dumping the USD….but that would cause it to fall in value in any case…….

Very nice article, this was question which confused me all the time, but its very much clear. Till today I used to think that currency of any country is depend upon the gold base of that country.

Thanks for posting such a wonderful article.

Thank you for your kind words Khalid.

I think it also helps to know that it was not always like this, where a govt. could print as much money as they like.

In the yesteryears (around 40 years back), money was indeed tied to the amount of gold any country had. However, Richard Nixon (and the United States) unilaterally decided to get away from the gold standard in 1971 (its an offshoot of Bretton Woods agreement – http://en.wikipedia.org/wiki/Bretton_Woods_system). All other countries followed the US, and tied their currency levels to the US Dollar (fixed or floating currency level is a topic for another discussion).

Why did the US do it? Well, its an extremely interesting story. But in short, they wanted to control the world economy by billing Oil in Dollars and as a consequence forced other nations to follow suit (the US accounts for a large part of demand for Oil) (and in turn countries had to automatically peg their currency level to the dollar)

Thats interesting! I had assumed minting was tied to gold until I read this article. Even we were taught like this in our economics class. So is it the value of US dollar which we base our minting on?

Slight disagreement here Kiran. I agree that the original intention for Bretton Woods was to make dollar the world currency and bring stability to other currencies which could be pegged to the dollar. Dollar was convertible to gold and every other currency was convertible to dollar at a fixed rate.

The reason for closing the gold window was simply that U.S. was losing its credibility because it was unable to check its deficit and spending. Countries started demanding gold for their dollars and they simply did not have enough gold for that. So they simply broke their promise to convert dollars to gold.

@SmartSingh – I think we are on similar lines. The US couldn’t keep up with deficit and spending because of the spending on Oil. I read a book sometime back ‘The Life of Saddam Hussein’ published by the TIME magazine after Operation Desert Fox (1991 Gulf war). It was a brilliant book, not only giving insights into why US attacked Iraq after Iraq attacked Kuwait (short answer: they feared Saddam would go on and annex Saudi too, which was US’s main supplier of Oil) but also gave explanations on why Oil is the real currency in the world and every currency in the world, especially the dollar is dependent on Oil levels [I highly recommend that book – The rise of Oil giants like BP, Chevron etc, Saddam as a CIA asset, Moving away from the Gold standard, Saddam’s Iran war, Fears of Middle East and hence fear of US for its Oil and why US has a standing army in Saudi – everything explained lucidly. Brilliant read]. Therefore, US deficit = More spending on Oil = to get away from any limit on spending on Oil = Move away from the gold standard.

I think Manshu will say ‘Boss, this is not a political conspiracy/political history website. This is a financial website and I’d appreciate if you guys stick to the topic at hand’ 🙂 Sorry Manshu…just couldn’t help explaining the intrigue of Oil, Dollar and the reason for movement away from the Gold standard 🙂

As long as the discussion is civil – I don’t mind. I won’t engage in these though 🙂

Yeah, that’s why I said slight disagreement. I was just correcting the chronological and factual details.

I would not engage in the ‘intentions’ debate as well. 🙂

Good article.

A doubt though. If there is high demand for a product, woudn’t there be competetion between the suppliers which would bring down the price?

Regards

Arun

That’s true Arun, though usually there is a significant gap between increase in demand and increase in supply in case of goods that need some sort of a physical manufacturing capability. So, if Tata were to see great demand for Nano, they might increase the supply, but that will take long, and in the meantime you will see a price increase.

In this example though since everyone has got extra cash, demand for everything will increase, so there will be no motivation for a supplier to switch as each supplier sees an increase in demand in their own goods.

Nice article. As a child whenever I used to run out of pocket money and dad would refuse to give more, I used to wonder why govt doesn’t print more money so that ppl never run out of it. 🙂

So I’ll fwd this article to all youger generation of my family so that they understand this concept well in time 🙂

🙂 That’s funny now, and welcome back – haven’t seen you around for a while….is your monthly target post up already?

Not Yet but I’ll be doing a post soon to update abt me… life has been very hectic recently…

And guess what I am so amazed to know that so many ppl still think that gold forms the basis of printing money… or probably i am well read on this topic for a change 🙂

Will look forward to it – will show in my reader, though I’m unable to check it as regularly these days.

In this article you said gold is not the base for currency printing, I think it would be more value addition if you had elaborated on what is the basis of currency printing.

Thanks for your feedback Retvic, I’ll keep that in mind, and build on this article in the future.

Thanks Manshu, I am sharing here a link which describes little more in detail about the historical realtionship between Gold and prinitng of currency and the impact of delinking gold and currency after 1971.

http://www.zealllc.com/2003/infdef2.htm

Thanks for the link!

Dear Manshu,

Excellent Article. Thanks a ton for posting this. Believe me I have been baffled by this question for over 4 months now and this makes my thinking clearer.

Just a couple of questions:

1) If it is not Gold that drives the printing of money then, how does the country control the printing of money and decide when it needs to print and when not?

2) Why is there difference in the currency rates between the two countries like roughly Rs. 45 equals 1 dollar. Then will printing more money make this difference reduce and allow us to import goods at lower rate?

Thanks a lot for the post again.

Thank you AMS.

1. The general economic conditions determine if the country wants to tighten their purse strings or loosen them. For example, India is seeing hikes in interest rates which is due to the fact that inflation is high, and the RBI is trying to control inflation by increasing interest rates and discourage consumption. On the other hand countries like Japan and US are pursuing close to 0% interest rate policy in a bid to encourage borrowing and spending to stimulate the economy.

2. The difference is again due to demand and supply with respect to various countries and their underlying economy. So, a country like Zimbabwe saw it’s currency crash with it’s economy because no one outside (and perhaps inside as well) wanted any Zimbabwe dollars at all. The only exception is US which saw its currency strengthen even though its economy was weakening during the great recession, as everyone else was facing a crunch also and the USD became the ultimate safe haven for investors to stash their money in.

Hope this helps, thanks for your comment.

Yes, this definately helps Manshu.

Thanks a lot

Glad to hear that!

Dear Manshu

your explanation was brilliant, by setting very good simple examples which everyone

with a little knowledge of economics can understand better, hope you do same thing

in future, All the best.

That’s awesome to hear – I appreciate that – thank you!

Why can’t a country:

(a) print more currency and use it for trade with other countries;

(b) give the money to its citizens so that they can store or invest it?

Like if the country imports goods, the supply increases which meets the increased demands of the general public. So the prices don’t rise. Why isn’t this possible?

Why should a country print money and use the same to import goods from other country (Eg: for armed force)so printed currency will note make any effect in the nation ?

Nice article.

I always thought it was gold.

Thanks Ankit – that’s common. A lot of people think that, and I get 1 email from a friend every month who discovers this and baffled by this 🙂

Excellent article! However, there was one thing that I found to be a bit counter-intuitive. Here’s the two paragraphs I am referring to from your article.

“Your demand for a lot of things will increase since you have this extra money now, and you are rich.

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.”

I would have phrased the second paragraph as follows:

“So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 30 units at Re. 1.25 and instead of demanding 1oo units at Rs. 2 – you will now demand 100 units at Rs. 2.25”

The point I am trying to make is, when people feel prosperous, they are willing to pay more for the same quantity than they would have earlier. This has the effect of shifting the demand curve to the north-east (up and right). That, in my mind, is why

I hope I am not confusing your readers further!

Regards,

Swaroop

Hi Swaroop – In this context I wanted to highlight that even though the price of something remains the same, you will demand more of it when your income rises because relatively speaking that has become cheaper for you as your income rises.

Should have given a better example than the cellphone usage I guess 🙂

I agree with Swaroop. You need to change the figures to make it sound like at Rs.1 instead of demanding 100 units you will demand 150 units or any number greater than earlier number. Similarly at Rs.2 instead of demanding 30 units you will demand 50 units. However, in any case the demand at Rs.1 can not be lower than demand at Rs.2.

I got your point Mashu but you need to be a bit careful while puting in numbers and there is nothing wrong with your cell phone example. In fact, I love the kind of real and creative example you have put in here.

And yes Swaroop also made the same mistake of putting in a higher demand at Rs.2 than at Rs.1.

Demand at Rs.1 can never be lower than demand at Rs.2.

That’s not always right Gulshan – there is this concept of Giffen goods which are consumed more at higher prices, so you may want to read up on that.

Mashu,

I agree that Giffen or Inferior goods are consumed more at higher price as the income effects dominates the substitution effect. But here in you example I think its not apt to give example related to Giffen goods because in your first situation you have given example about normal good. So second case should also be that of normal good only.

I would like you to help me with this concept:

Situation 1 of you case:

At Rs 1= I demand 100 units,

At Rs2=I demand 30 units.

Situation 2 of you case:

At Rs1=demand 50 units instead of 30(earlier you had assumed 100 units at Rs.1)

At Rs 2=demand 120 instead of 100(earlier you had assumed 30 units at Rs2).

I am confused that it should be for a normal good:

Situation 1:

Rs1=100 units

Rs2=30 units( here demand at Rs2 is lower than demand at Rs1, which is correct for normal goods)

Situation 2 should be:

Rs1=120 units

Rs2=50 units.

What you have said for situation 2 is:

Rs1=50 units

Rs2=120 units(demand at Rs2 is higher than demand at Rs1, which should not be the case for normal goods)

So for normal goods demand at a lower price should always be higher than demand at a higher price. It is same as saying demand at Rs1 can never be lower than demand at Rs2.(demand at lower price can not be lower than demand at a higher price for normal goods).

Kindly help me clear my confusion.

I mentioned Giffen goods because I saw the word “never” used in your comment, and I thought I’d let you know about this. They have nothing to do with my post as you mention.

So, getting back to this point there are two things – movement along the demand curve, which is what you are describing, and shifting of the demand (or supply curve) which is what I’m describing.

When the demand curve shifts rightwards that is an indication that demand has risen due to factors other than price. These can be factors like income level for example. A great example of that is how you keep hearing noises about the increased demand for “protein rich foods” with the increase in income levels in India, and the consequent contribution to inflation etc.

In this case the price of pulses or milk didn’t fall but the demand increased due to external factors like rising incomes, and demand curve shifts.

I’d recommend reading more on causes of shifting demand and supply curves, and I’d imagine there is a lot of info on the interwebs on this topic.

Hope this helps 🙂

Thanks Manshu..and I really appreciate your prompt reply..I have got tonnes of knowledge about many complicated issues on this site.

great to hear that Gulshan, and it is a pleasure for me to interact with smart people such as yourself who engage in smart conversations.

Swaroop was saying something different.

I am actually doing what you have described I should do which is saying that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2. But then in the next line you go and say that demand can’t be lower which is contradictory to what you have proposed earlier.

As for your saying demand can’t be lower at a lower price apart from what I said about Giffen goods, you should also read about shifting of the demand curve rightwards which will better help understand this concept and develop a more holistic view of the subject. I’ll see if I can get some links for you.

you are correct.

Dear Manshu

That was an excellent article. When we speak of Zimbabwe, it was an epitome of Hyper-inflation. What would you say when a country prints 10billion dollar notes which cannot buy you anything. It fears me to think of a situation where prices of all commodities double in a matter of hours. To illustrate, Think that costs double in two hours…

Assume that an egg costs one dollar now.

Time….Cost

0(Now)..1

2…………2

4………..4

6………..8

8………..16

10………32

12………64

14………128

16………256

18……..512

20………1024

22………2048

24……..4096

You buy an egg for one dollar today. You wake up the next morning to find that the price has reached 4096 dollars. On the second day, the price of the same egg would be 16,777,216 dollars. This is what would happen if a country mismanages its finance.

The following is a good wikipedia link on the hyperinflation in Zimbabwe

http://en.wikipedia.org/wiki/Hyperinflation_in_Zimbabwe

Thanks Loney – you know it means a lot to me coming from you. I read that in those times in Zimbabwe traders didn’t accept checks unless you write them for a much higher amount than the price because by the time the check clears the prices would have risen quite a lot!

Hi

My earlier comment at another post would be more relevant here.

http://www.onemint.com/2010/11/27/moil-ipo-subscription-numbers/comment-page-1/#comment-113806