This article is written by Shiv Kukreja

Shriram Transport Finance Corporation will be launching the first public issue of Non-Convertible Debentures (NCDs) this financial year from July 26th. The issue size is Rs. 600 crore including a green-shoe option of Rs. 300 crore. The company plans to use the proceeds for various financing activities including lending and investments, to repay existing loans, for capital expenditures and other working capital requirements. The issue closes on August 10, 2012.

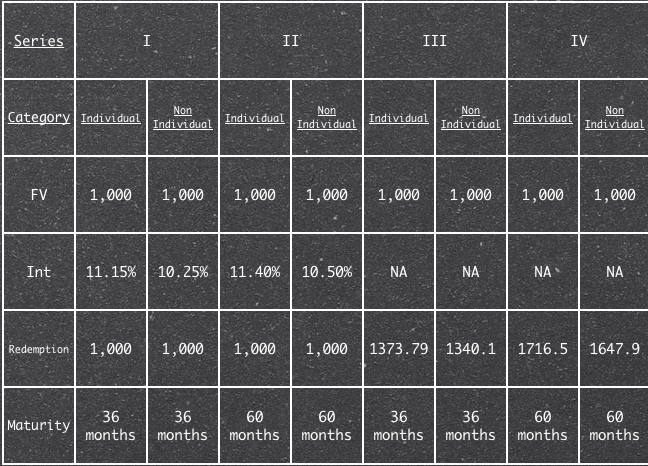

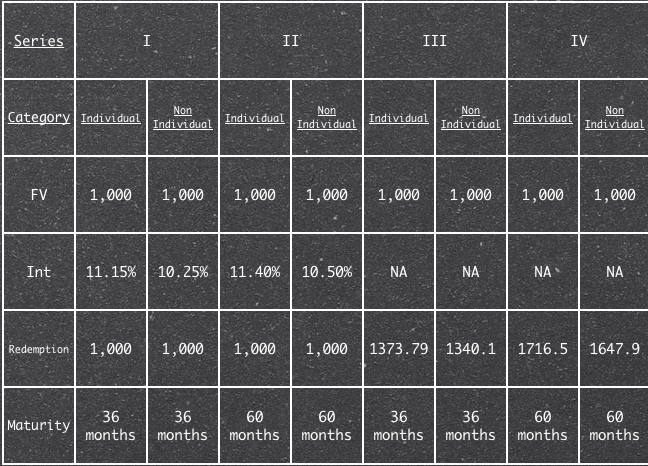

The bonds offer an annual coupon rate of 10.25% and 10.50% for a period of 36 months and 60 months respectively. What the company has done to make these NCDs attractive for the individual investors is that they will be offered an additional 0.90% p.a. making it an annual coupon rate of 11.15% and 11.40% respectively. This means even if an individual investor buys it from the secondary markets they are going to get 11.15% or 11.40%.

Many of you must have remembered that the company came with a similar kind of issue last year also. Bonds issued last year are currently yielding 11.07% under the 60 months reserved individual option and 12.23% under the 36 months reserved individual option. So, going by these yields, 11.40% and 11.15% is actually attractive for the individual investors.

The investors will have the option to get the interest either paid annually or at the end of the tenure along with the principal. Under the cumulative interest option, retail investors will get Rs. 1,716.15 after 5 years and Rs. 1,373.19 after 3 years for every Rs. 1,000 invested. For all other investors, these amounts stand at Rs. 1,647.90 and Rs. 1,340.10 respectively.

The interest earned would be taxable but the company will not deduct any TDS on it as is the case with all of the listed NCDs. The issue keeps a minimum investment requirement of Rs. 10,000 (or 10 bonds of face value Rs. 1,000) which seems reasonable from the small retail investors’ point of view.

These bonds will offer reasonable liquidity to the investors as they are going to list on both the stock exchanges – NSE and BSE. Unlike last year, the retail investors will have the option to apply these bonds in physical form also. All the remaining investors will have to subscribe these bonds compulsorily in demat form only.

40% of the issue is reserved for the Reserved Individual Category i.e. for the individual investors investing up to Rs. 5 lakhs and another 40% of the issue is reserved for the Non-Reserved Individual Category i.e. for the individual investors investing above Rs. 5 lakhs. 10% of the issue is reserved for the institutional investors and the remaining 10% is for the non-institutional investors. NRIs and foreign nationals among others are not eligible to invest in this issue.

A slew of NCD issues had hit the markets last year when companies like Shriram Transport, Shriram City Union Finance, Muthoot Finance, Manappuram Finance, Religare Finvest, India Infoline Investment Services etc. came with approximately ten such issues. I must tell you, except Shriram Transport NCDs, all other NCDs listed at a discount and that too at quite a deep discount of 5-8% in some cases. Many of them have still not been able to recover from those losses. They must be yielding higher than 13% even now.

But Shriram group is a quite stable group and the issue has been rated ‘AA/Stable’ by CRISIL and ‘AA+’ by CARE suggesting that these bonds are reasonably safe to invest. Unlike last year, there are no put/call options available either to the investors or to the company.

Hi Shiv,

Have a simple question, If I subscribe to this NCD through ICICI Direct then will I get any bond certificate to my mailing address ? If yes, does this certificate is needed at the time of maturity to reedem these bonds or the interest/principal amount will be credit to the respective bank account automatically ?

Hi Sandeep… If you subscribe for it online through ICICI Direct, you’ll get an allotment letter informing you all the details about your investment. People who apply for it in physical form get the Bond Certificates, which they need to surrender on maturity. For you, no certificate is required at the time of maturity and the interest/principal amount will be credited to your linked bank account.

Hi Shiv,

If I hold the NCD in demat form, what is the normal charge deducted in demat. Also while encashing after maturity, do I need to pay brokerage in demat?

Hi Sudip… There are no separate demat charges except the Annual Maintenance Charges (AMC). At the time of maturity, I think you’ll have to bear the transfer charges, if at all, thats it. I dont think there are any other charges applicable.

If I subscribe for these bonds on day 1 of issue through a demat account, my money will get debited on the same day. When will they allot the debentures ? Just in case if I don’t get D’s alloted, will they refund the money “with the interest”. Please clarify.

Hi Karthik… Have a look at the last year’s experience:

Issue Opening Date: June 27th, 2011

Issue Closing Date: July 9th, 2011

Allotment Date: July 12th, 2011

Listing Date: July 18th, 2011

Issue got oversubscribed on 1st day itself

The company will give 9% p.a. interest on the application money to the successful allottees subject to TDS and 2.50% p.a. on the refund amount.

Hi Manshu,

Here is an IMPORTANT NOTICE which investors should know. So, you can update post about this.

All Collecting Bankers will accept applications only up to 4.00 p.m. Any Application banked post 4.00 PM will be considered in next day. Banks will affix next days seal on the Applications.

E.g Application Banked on 26th July 2012 will be considered for the same day only if it is banked upto 4.00 PM. All Applications banked after 4.00 PM will bear bank seal of 27th July 2012

Thanks for the info – much appreciated.

I can definitely share their links with you which have details about them but they are good ones or not, it is up to you to decide.

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=1300MFL14

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=IIISL-N4

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=MFINNCD2D

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=MFLNCD3

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=MUTHOOTFIN-N6

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=RFLNCDO2C3

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=SHRIRAMCIT-N1

Shiv,

You mentioned that there are few NCD issues that are giving a yield of 13%, If you have the details can you share few good one with firm financial Background that we can invest, because 13% looks very good to me.

hi ! Shiv,

Great effort, but what is your take on the business environment of the company, Growth is tapering off declined from 22% last year to about 11% this year, NPAs are showing steep rise GNPA 3.1 % v/s 2 % (2011). Tata Motors is facing severe headwinds in its CV division. With company facing squeeze from all the sides viz. business, asset quality, sources of finacing, Corporate Governance issues errupted on some share swap. Do you think stability of the company is on the decline ?, Secondly with deluge of ncds issued by STFC the demand for its ncd will be inadequate to allow an exit without principal loss and finally how do you see it listing above face value or dip below for a day or two ??

Hi ANEK… Business environment has been tough for the auto industry as a whole and sentiment is not good either. Infrastructure space, on which the fortune of these companies hinges, is bleeding and calling for reforms.

But I think Shriram group is doing better than other NBFCs. Reason being it has a good control over its market share and its margins have been more or less stable. Though figures suggest marginal decline in the asset quality, it has been the case with most of the players in the industry.

Last year, 11.60% NCDs issued to the “Reserved Individual Category” listed at a good premium and closed at a price of Rs. 1031.44 on the listing day. I think the institutional interest this year would be lower as compared to the last year. It is very difficult to predict the listing price of this issue but I hope it lists at a premium this year also given the retail investors do not sell in a hurry.

I dont quite understand the excitement with this one. When we get 8.3% taxfree from the various bonds this 11.4% pre-tax is really not very exciting. Correct me if I am missing something.

i) 8.3% tax free is no longer available, current yield to maturity on tax free bonds is down to 7.6-7.9%

ii) tax free bonds are for longer duration 10-15 years. STFL bonds etc are for relatively shorter duration 3-5 years. So they suit investors with different time horizon

One thing you are missing here is that not all of the investors fall in the 30% or 20% tax bracket. It is 11.40% tax-free equivalent for people who dont pay tax at all and 10.23% tax-free equivalent for people in the 10.30% tax bracket. People invest in the name of housewives, their children and their parents in order to get a higher yield.

Also, where are the checks in place whether all 30% or 20% tax bracket investors are actually paying tax on the interest income? One can term it to be a negative thinking but this actually happens.

Shiv the <30% tax bracket makes sense. Good callout

Does it mean an instituitional investor cant get higher coupon by buying from ndividual secondary market? In this case, in the absence of institutional investors, the liquidity will be low on the exchange?

Hi Ankur… yes, an institutional investor (Category I), a non-institutional investor (Category II) and even an individual investor/HUF investing more than Rs. 5 lakhs will get a lower coupon of 10.25% or 10.50%. That is the case if these investors subscribe it in the public issue or even buy it afterwards from the secondary markets. It is definitely going to affect liquidity to some extent.

Thanks shiv..Any idea, what is the reservation % for Individual investors for currently listed bonds?

It was the same at 40% for the “Reserved Individual Portion” including HUFs investing up to Rs. 5 lakhs and 40% for the “Unreserved Individual Portion” investing more than Rs. 5 lakhs.

But last year, the story was a bit different. Firstly, the interest differential was quite less and in fact there were three slabs. The original coupon was 11.10% for 5 years and 11% for 3 years as against 11.60% and 11.35% respectively for the “Reserved Individual Portion” and 11.35% and 11.10% for the “Unreserved Individual Portion”.

So, this year, it is less attractive for the Category I, II & III investors to invest in these bonds and hence lesser interest from them on listing.

Issues to consider before investing

1. Credit quality – Shriram is one of the better credit quality NBFC’s hence investors can take a credit call

2. 11.15% and 11.40% – to invest money in the 3 yr and 5 yr segment for a investor check the post tax yield which would be around 7.40 – 8% depending on which tax slab u classify. If equity is not your choice (assuming ur gng to hold for more than 1yr) this bonds beat all FD and liquid MF returns. Hence good bet

3. SHIV mentioned about NCD’s trading at discount and not able to recover losses. For someone who would hold any bond till maturity would recover his entire principle and interest assuming the company is not defaulting. I would rather put it this way if you are holding bonds trading in discount from its purchase price specially shriram names just buy more in secondary and increase ur portofolio yield (price and yield have inverse relation)

For starters, thanks for the post !!

Just wanted to know where can I check the current rates for NCDs and even infra bonds (taxable as well as tax free).

Thanks in advance.

Hi Kunal… Infra Bonds are currently not trading as they have a lock-in period of 5 years. NCDs trading on the NSE can be tracked from this link: http://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

You can also check some of these NCDs (including those trading on the BSE) from this link: http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=SBIN-N5

just go to fimmda.org and under corporate bonds traded archive u will get trades over last 1 year

Moreover, how liquid this issue is going to be, in case , one wants to redeem it through stock market, before maturity.

I think liquidity under the “Reserved Individual Investors†category will be reasonable enough to encash your investment quite easily. Under other categories, liquidity remains an issue going by the last year’s experience.

Hi,

How to apply for this issue…is their provision to apply directly through bank or do we need demat account.

Hi Abc… “Reserved Individual Investors” (Individuals/HUFs investing up to Rs. 5 lakhs) have the option to apply either in physical form or in demat form. Like Fixed Deposits, you’ll get a bond certificate if you apply in physical form.

To apply in physical form, you need to fill an application form, attach the KYC documents along and submit it at any of the collection centres nearest to you. KYC documents constitute self-attested copies of PAN card and proof of residential address.

But if you want to invest more than Rs. 5 lakhs under the “Non-Reserved Individual Investor” category, then it has to be compulsorily in demat form only.

Hi,

You mentioned that some of the listed NCDs are trading at discount. So, doesn’t it make more sense to buy them from market (ofcourse if they have good rating and liquid in the market) than buying this NCD?

-Anup

Hi Anup… Hi Anup… If what you are saying made a practical sense then the bonds which are trading at a YTM greater than Coupon would have been trading at a YTM less than Coupon. These NCDs (YTM greater than Coupon) either dont belong to the Shriram group or have very low trading volumes if they belong to this group.

This shows Shriram group commands a brand credibility among these NBFCs in the investing community and its NCDs are relatively preferred as compared to the NCDs of other groups mentioned in the article.

If suppose Kingfisher Airlines NCDs are already listed and offer 20% YTM to you, will you buy KFA NCDs or subscribe to these NCDs ?? I dont know about you but I’ll definitely go for Shriram NCDs.

At the same time, I’m not saying Shriram Transport NCDs are going to list at a premium for sure and investors must subscribe to it. It depends on the demand and supply at the time of listing among various other factors. Investors should think long term, look at a bigger picture, should not speculate unnecessarily and take calculated decisions.

The yields on NCDs have already declined quite a lot. Even muthoot and manappuram NCD prices have risen, resulting in lower YTMs now. Another noteworthy thing, secondary market bond purchase entail transaction expense (brokerage), whereas primary market purchase entails transaction income (typically brokers share 1% commissions). So difference in yields narrows

Vikas, Please apply on the first day itself, otherwise you will not get allotment. It happened to me last year two times, where my application money was refunded in FULL.

I think this will not be the case with this issue but yes, if somebody has decided to go for it then it is best to do it as soon as possible.

The issue is open for about 2 weeks. I am thinking of applying in the 2nd week (maybe 2nd last day) so I can have my funds in my bank account and earn interest on it.

Is my thinking correct or is there any advantage to applying as early as possible?

:-)… your bank will give 4% interest on your money (some banks might give a tad higher than 4%) but here the company is giving 9% on the application money to the successful allottees subject to TDS and 2.50% on the refund amount.

Also, applying early would make you better placed as far as the allotment is concerned as it would happen on a “first-come-first-served” basis.

You wont get allotment. The issue would be oversubscribed on day 1 and 2 for retail. Rate cut in offing so investors would like to lock in higher yields. Invest on day 1 if u plan

Dont you think there is high supply of bonds in the market after Gold NBFCs hit the market?. The interest rates are attractive, albeit 20 bps lower than last year. Whereas credit spreads should actually widen as STFL’s business growth has weakened.

Thanks Shiv for this post. I am thinking of applying for this issue. As I do my own taxes, I want to keep my taxes simple.

If I go for the cumulative option, how would I handle the taxation of the interest? Would I estimate the annual interest and pay tax on it every year or pay it just once at the time of maturity?

Thanks VikasG… I think 100% clarity on the taxability of interest is still not there. My take on this is that if an investor opts for the “cumulative option” of any listed taxable bonds then he/she should pay the applicable tax either on maturity or when the bonds are sold on the exchanges.

On maturity, interest would be taxable as “Income from Other Sources”. But, if the bonds are sold on the exchanges, then the “Capital Gain” tax would be applicable, either short-term or long-term as the case may be.

This is just my view and there is a possibility that my view is considered incorrect by the tax authorities. So one should consult his/her tax advisor before coming to any conclusion.

hi, Hw safe are these NCD’s??

Is it a good option for a 63 yr old with a 3 yr lock in period?? I am still having active income. So it is worth to invest in it, or rather i opt for the safety of fixed deposit??

Hi Mr. Amit… nobody can comment on the safety of these NCDs with 100% confidence, not even rating agencies. As mentioned above, these NCDs have been rated ‘AA/Stable’ by CRISIL and ‘AA+’ by CARE, which shows this issue is reasonably safe. HUDCO tax-free bonds were also ‘AA+’ rated but I think they are more safe than these bonds.

There are a few banks which must be giving around 10.5% rate of interest to the senior citizens. Banks (or particularly bank FDs) are generally considered safer than these issuers but FDs dont offer some benefits which these bonds offer. Listed NCDs have a scope of capital appreciation if interest rates fall, do not attract TDS if taken in a demat form and offer liquidity also. There are certain trade-offs which you need to evaluate based on your financial goals and how you perceive risk and return.

thanks Shiv…really informative…

You are welcome! 🙂

Would advice you stick to tax free bonds which IRFC, HUDCO, NHAI and PFC issue. Or invest in FD considering your age and requirements

Hi Shiv,

How about doing a post on the NCD’s which are currently listing at a discount ?

Regards

Hi MangoMan… sure, I’ll definitely try to give it a shot. As I mentioned, there are approximately ten different issues with various options from about six different companies will be a challenge but I’ll try.

Hey Shiv,

Does the individual catagory include HUFs?

Hi Siddhant… yes, HUFs are clubbed with “Resident Indian Individuals” to categorise them into ‘Individual’ category and will be eligible for 0.90% additional incentive on coupon.