This article is written by Shiv Kukreja

Shriram Transport Finance Corporation will be launching the first public issue of Non-Convertible Debentures (NCDs) this financial year from July 26th. The issue size is Rs. 600 crore including a green-shoe option of Rs. 300 crore. The company plans to use the proceeds for various financing activities including lending and investments, to repay existing loans, for capital expenditures and other working capital requirements. The issue closes on August 10, 2012.

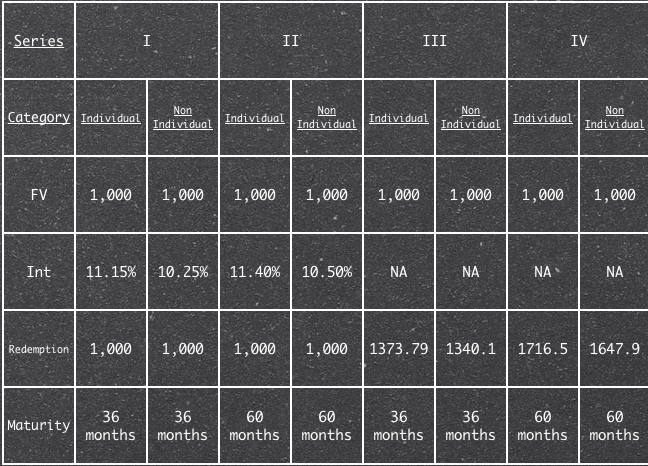

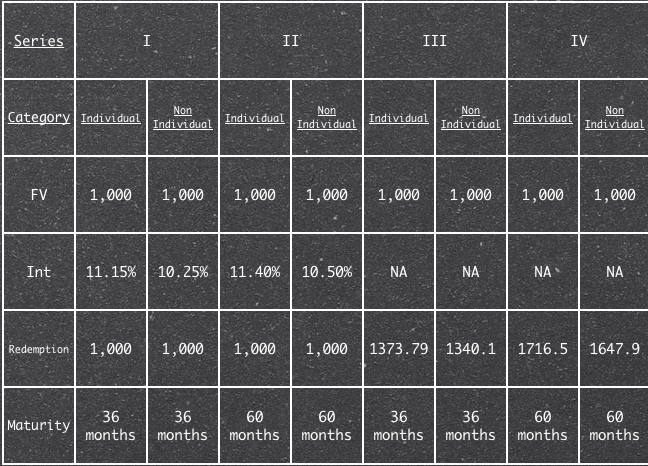

The bonds offer an annual coupon rate of 10.25% and 10.50% for a period of 36 months and 60 months respectively. What the company has done to make these NCDs attractive for the individual investors is that they will be offered an additional 0.90% p.a. making it an annual coupon rate of 11.15% and 11.40% respectively. This means even if an individual investor buys it from the secondary markets they are going to get 11.15% or 11.40%.

Many of you must have remembered that the company came with a similar kind of issue last year also. Bonds issued last year are currently yielding 11.07% under the 60 months reserved individual option and 12.23% under the 36 months reserved individual option. So, going by these yields, 11.40% and 11.15% is actually attractive for the individual investors.

The investors will have the option to get the interest either paid annually or at the end of the tenure along with the principal. Under the cumulative interest option, retail investors will get Rs. 1,716.15 after 5 years and Rs. 1,373.19 after 3 years for every Rs. 1,000 invested. For all other investors, these amounts stand at Rs. 1,647.90 and Rs. 1,340.10 respectively.

The interest earned would be taxable but the company will not deduct any TDS on it as is the case with all of the listed NCDs. The issue keeps a minimum investment requirement of Rs. 10,000 (or 10 bonds of face value Rs. 1,000) which seems reasonable from the small retail investors’ point of view.

These bonds will offer reasonable liquidity to the investors as they are going to list on both the stock exchanges – NSE and BSE. Unlike last year, the retail investors will have the option to apply these bonds in physical form also. All the remaining investors will have to subscribe these bonds compulsorily in demat form only.

40% of the issue is reserved for the Reserved Individual Category i.e. for the individual investors investing up to Rs. 5 lakhs and another 40% of the issue is reserved for the Non-Reserved Individual Category i.e. for the individual investors investing above Rs. 5 lakhs. 10% of the issue is reserved for the institutional investors and the remaining 10% is for the non-institutional investors. NRIs and foreign nationals among others are not eligible to invest in this issue.

A slew of NCD issues had hit the markets last year when companies like Shriram Transport, Shriram City Union Finance, Muthoot Finance, Manappuram Finance, Religare Finvest, India Infoline Investment Services etc. came with approximately ten such issues. I must tell you, except Shriram Transport NCDs, all other NCDs listed at a discount and that too at quite a deep discount of 5-8% in some cases. Many of them have still not been able to recover from those losses. They must be yielding higher than 13% even now.

But Shriram group is a quite stable group and the issue has been rated ‘AA/Stable’ by CRISIL and ‘AA+’ by CARE suggesting that these bonds are reasonably safe to invest. Unlike last year, there are no put/call options available either to the investors or to the company.

when the bond period is over will the company credit the interest + principle [for cumulative] directly to bank accounts. what abt the bonds. will they be debited automatically from demat accounts ? or do we have to send mail to them saying “Dear sir..36 months are over ..pls send us interest .. and also debit the bond” . pls provide more details. Thanks.

Good question, pradeep.

I would like to know this as well.

If the terminal tenor of the bond is 36 months then the bond would be redeemed and paid into your bank ac for demat bonds.

If the terminal tenor is higher but you have a put/call option 36 months then the co would mostly send u a communique in this regards, asking if you want to exercise your put option or the co would credit your payment if the co exercises call option.

Hi Pradeep, Vikas & Aditya,

Just to mention Aditya’s info in a different way – No action is required on the part of a NCD holder for the NCDs held in his/her demat account. The company transfers the maturity proceeds directly into the bank account linked to the demat account and the NCDs stand extinguished on the payment of maturity proceeds.

Thanks Shiv and Aditya.

I purchased some Shriram Transport NCDs for 3 yr and 5 yrs tenor through BSE. Will I be getting the 0.9% additional coupon?

This article says that I will be getting the additional coupon. But I just wanted to confirm this.

Yes Deepak, you’ll get the additional incentive 0.90%.

Dear Mr. V.K. Gupta… Thanks a lot for your kind words!

I want to stand corrected on my earlier comment of Rs. 5 lakhs limit for additional incentive of 0.90%. Actually, the limit was for the allotment purposes and not for the incentive. My apologies for mistakenly making an incorrect statement. The additional incentive of 0.90% is applicable to all individuals/HUFs irresepective of their investment amount. So, in your case also, you will get 11.40% for all of the 698 NCDs.

not sure if this is the right place to talk but here’s something related I did not really understand. Today (14/09/12), I noticed that one bond offering of Shriram City Union Finance – N6 was up by 1.43% while N5 was down by 1.15%. Another, Shriram Transport Finance N1 was down by 1.72% while N2 was up by 1.08%.

How could 2 very similar products go in reverse directions in 2 cases. N1 down, N2 up; N5 down, N6 up. N1/N2 have very similar tenors (60months), similar coupons (11/11.25%). Same for N5/N6 (11.6/11.85%).

Is it just a case of demand/supply or is there something more to it since each of the pairs is from the same company, same financials etc. The only thing I can see is that the in each case the bond with higher coupon went up. Anyone?

Hi Gaurav… It is only due to the demand and supply factors and nothing else. The volumes traded during the day were very low. There were only 95 units traded under STFC – N1 and only 85 units traded under SCUF – N6.

Dear Mr. Kukreja,

I want to invest in NCDs from the secondary market. Could you suggest 2-3 NCDs for a tenor of 5 years, the basis of the suggestion to be based on reliability and return.

Thanks,

Chinmoy Nag

Dear Mr. Nag,

Reliability-wise, I would personally invest in 9.95% SBI bonds and 10.75% IFCI bonds.

Returns-wise, reliability-wise and liquidity-wise, I would invest in 11.50% Shriram Transport Finance NCDs only.

These are my personal preferences and may differ from others’ preferences.

Hi Shiv,

Any special reason you say ” I would invest in 11.50% Shriram Transport Finance NCDs only”? Do you like Shriram Transport group in general or specifically their 11.5% NCDs?

Hi VikasG… I’ve observed the business model of all these companies, their financials, their management, these NCD issues and their performance over the past 2 years. Business models of all other cos. like Muthoot, Manappuram, IIFFL and Religare look fragile to me. Shriram Transport has a good control over its business and it does not attract much competition. Financials also give me enough comfort. Thats why I would prefer NCDs of Shriram group among these cos.

Hi Shiv

WHere can we check details like business model and financials for these companies issuing NCDs? Also any particular reason Shriram Transport Finance NCDs issued recently are at lower price than issue price. If I am not wrong dividend payout should be in Oct so shouldnt it rise?

Hi harineem… You can check all these business and financial details on their website and digging deep into their prospectus and annual reports.

STFC NCDs, issued last month, are trading at a discount due to higher supply, lower demand and a large no. of other issues hitting the markets. Actually the problem is that all these NCDs are sold by our agents to us and very few people invest in them on their own, with a long-term view, realising a value in these fixed income instruments. These issues get subscribed to the tune of 750 crore, 600 crore or 500 crore during their offer periods but when they list at a 50-40-30-20 rupee discount to their issue prices, then no agent approaches the clients to buy them at the discounted market price. Hardly any NCD attracts a turnover of more than Rs. 1 crore in a single day. Once the selling gets reduced in 3-4 months time, these NCDs start recovering and give good returns after that.

All NCDs of the Shriram group, both STFC and SCUF, give interest (& not dividend) on April 1st every year. But still it should start rising soon, hopefully if the RBI announces any rate cut tomorrow.

Thanks again Shiv. One question if I buy the NCDs now at the discounted rate am I still entitled the dividend at same rate or will it be calculated at market rate. Also how do they calculate dividend in April if somebody purchases say in Sep 15,2012. Will it be still yearly?

It seems a good deal to buy if dividend remains same for a discounted NCD?

Yes, you’ll get the interest at the same rate of 11.50% p.a. for 234 days i.e. from August 10th, 2012 (the date of allotment) to March 31st, 2013. When you buy the bond at the discounted price, then yield to maturity (YTM) is your actual yield per annum, if you hold the bonds till maturity.

Sorry, it is @ 11.40% p.a. and not 11.50%. Also, be very careful that your investment does not cross Rs. 5 lakhs under a single name.

Dear Mr. Shiv Kukreja,

Pl accept my heartiest congratulations for the xecellent knowledge about the NCD”s & other investment tools.

In you Q&A session dated Sept 17,2012, you have stated that – “Your investment does not cross Rs 5 Lacs under a single name ( In NCD’s of a single Co). My request & querry is …

I was allotted 398 NCD of Shriram TR. fin co @ 10.50 +0.90 (Total 11.40% ) date of allotment 10-08-2012. Later on I purchased 300 more NCD from open market, now total 698 NCD. Pl. clarify that I shall be getting Interest @ 11.40% on full 698 NCD”s & there will not be any limit of Rs 5 Lac investment( NCD are in my single name capacity).

Thanking you for your nice advise as always.

V.K.Gupta

M:09829006715

Dear Sir,

Highly impressed to go through full interactive Q & A session. & most of my querries got solved related to Shri Ram NCD Series II Aug 2012.

Thnxs again.

V.K.Gupta

Thank you! We’ll try to maintain the quality of the posts here and make it more interactive with your active participation.

For those of you having trouble finding these bonds on NSE, I am posting the link here:

http://www.nse-india.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=SRTRANSFIN&series=NU

Series NU is a relatively thinly-traded series as total no. of bonds issued is 643853 and offers cumulative interest of 11.40%.

Series NS offers 11.40% annual interest and is the most active series with total no. of bonds issued is 2621121:

http://www.nse-india.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=SRTRANSFIN&series=NS

Series NR offers 11.15% annual interest and is the 2nd most active series with total no. of bonds issued is 2346416:

http://www.nse-india.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=SRTRANSFIN&series=NR

Hi all,

I am a retail individual investor. Can I buy 500 bonds in *both* series 2 and 4 and still extra 0.9%.

Does anyone have a link to the detailed pdf of the offering?

Thanks.

Hi VikasG… Total no. of bonds in your name should not be more than 500 (across all the Series – I, II, III and/or IV) on the record date to be eligible for 0.90% additional incentive.

Here is the link to check the prospectus of the offer:

http://www.stfc.in/board-of-director.aspx

You need to click on the ‘Prospectus’ under the list.

Thanks Shiv.

Pasting the direct link of the prospectus here: http://www.stfc.in/pdf/static_pdf/STFC%20Prospectus%20Final.pdf

> Total no. of bonds in your name should not be more than 500 (across all the Series – I, II, III and/or IV) on the record date to be eligible for 0.90% additional incentive.

Please tell me where in the prospectus this is mentioned. I got 398 bonds out of 500 I had applied. Thinking of buying some more as the bonds are trading below their face value.

“Reserved Individual Investors” – “Resident Indian individuals who apply for NCDs aggregating to a value not more than Rs. 5 Lacs, across all Series I, Series II, Series III and/or Series IV NCDs”

“Reserved Individual Portion” – “Applications received from Reserved Individual Investors grouped together across all Series I, Series II, Series III and/or Series IV NCDs”

“NCD Holders who are Non Individuals SHALL NOT be eligible for the additional incentive of 0.90% per annum for Series I NCDs held on any Record Date”

“NCD Holders who are Non Individuals SHALL NOT be eligible for the additional incentive of 0.90% per annum for Series II NCDs held on any Record Date”

Thanks Shiv.

I wish they had written it clearly. We have to combine 2 statements to reach the conclusion.

Probably that is where financial advisors come into play.

Shriram Transport Finance NCDs have listed today at a discount, but thankfully a very marginal discount. The highest traded category on the NSE “SRTRANSFIN NS†listed at Rs. 997.90, which is also the highest price of the day, touched a low of Rs. 990 and are currently trading at Rs. 995. Probably a good opportunity for investors to invest in these bonds and also the bonds which got issued last year. The yield is around 11.44%.

Shriram Transport Finance NCDs to list on BSE/NSE on August 21st, 2012.

Series I – 11.15% Annual Interest – BSE Code “934850” – NSE Code “SRTRANSFIN NR”

Series II – 11.40% Annual Interest – BSE Code “934851” – NSE Code “SRTRANSFIN NS”

Series III – 11.15% Cumulative Interest – BSE Code “934852” – NSE Code “SRTRANSFIN NT”

Series IV – 11.40% Cumulative Interest – BSE Code “934853” – NSE Code “SRTRANSFIN NU”

Source: http://beta.bseindia.com/markets/MarketInfo/DispNoticesNCirculars.aspx?page=20120816-8

Lets see how it goes…

That is correct.Thanks for the clarification. By the way, what is the opinion on Shriram transport finance FDs which are currently on offer? They are also being offered @10.75% for 3 years. Though not connected with this post, I have another question . Is it possible to apply for HDFC platinum deposits online?

Personally I would rather invest in Shriram NCDs or other NCDs as compared to Shriram FD @ 10.75% for 3 years.

Yes, it is possible to invest in HDFC Platinum deposits online. Please check this link:

https://www.fundsindia.com/content/jsp/fixedDeposit/FixedDepositAction.do?method=showFixedDepositHome

Refund amount is now credited to the Bank Account. I have applied on 27th July’2012. Applied for 75K and were allotted 60K. Can anybody tell me how the interest amount has been calculated?

Hi Srinivas…

The company has given 9% interest on the application money to the successful allottees and 2.50% on the refund amount. The interest has been calculated for 12 days. So I think you should have got Rs. 189.86 (Rs. 177.53 + Rs. 12.33) into your savings account.

Hi Madhab… Please dont worry, this is actually how it should be. Series-I carries the coupon rate of 10.25%. All those investors, who are individuals and have an investment of less than Rs. 5 lakhs on the record date, will be eligible for an additional incentive of 0.90%. This additional incentive will make you get 11.15% on the interest payment date.

Thanks Shiv, for sharing the status link. I got 80% allotment and the bonds are now appearing in my demat a/c. The name of the NCD appearing in demat a/c has coupon rate in it and it says 10.25%. I was expecting 11.15% and I am pretty sure I applied for the option one as retail investor (applied only for 75K).

Here is the name – SHRIRAM TRANSPORT FINANCE COMPANY LIMITED SERIES-I 10.25 NCD 10AG15 FVRS1000

Allotment has started… “Deemed Date of Allotment” is August 10, 2012. You can check the allotment status from this link:

http://www.iepindia.com/irncd_detail_2.asp

STFC NCD 2012 – “Basis of Allotment†has been announced:

Category 1 – Institutional Investors – 100% Allotment

Category 2 – Non-Institutional Investors – 100% Allotment

Category 3 – HNIs – 94.84% Allotment

Category 4 – Retail Investors – Day 1 – 100% Allotment, Day 2 – 79.52% Allotment

Tentative Listing Date – August 16th, 2012 – Thursday

Thanks for the update Shiv. So, like previous occasions, people who applied early got the full quota this time as well.

STFC NCD 2012 – “Basis of Allotment” has been announced:

Category 1 – Institutional Investors – 100% Allotment

Category 2 – Non-Institutional Investors – 100% Allotment

Category 1 – HNIs – 94.84% Allotment

Category 1 – Retail Investors – Day 1 – 100% Allotment, Day 2 – 79.52% Allotment

Tentative Listing Date – August 16th, 2012 – Thursday

Did anyone got the bonds alloted to your demat account ? Aug 10 is the allotment date right ?

There was no confirmed date of allotment as such. I’ve not got the bonds alloted in my family members’ demat accounts. I think the allotment will start sometime next week.

As expected, the issue got oversubscribed and the company closed the offering prematurely yesterday itself. Bonds are expected to list in the third week of this month.