This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In today’s volatile equity markets, investors are increasing their allocation to fixed income investments. But, it is still an untapped market as far as debt fund investments are concerned. Investors here still remain wary of these fund investments as they do not understand where and how their money gets invested and hence, still prefer to park their money in bank fixed deposits.

But, as a matter of fact, in a falling interest rate environment, bank fixed deposits give lower returns as compared to debt funds, especially, market-linked debt-funds. There are a couple of reasons for that, first, whenever the interest rates fall, the banks also cut their deposit rates and second, a fall in interest rates results in an appreciation in the market prices of debt fund holdings.

In the past one year ending 31st October, 2012, debt funds category has generated returns between 8.44% (Gilt Short-Term Funds) and 11.54% (Gilt Medium & Long-Term Funds), with Income Funds, Short-Term Funds, Ultra Short-Term Funds and Liquid Funds generating 10.53%, 10.04%, 9.55% and 9.35% respectively.

So, what are these debt funds and what factors should the investors look out for to get potentially higher returns?

Equity vs. Debt – Like equity funds invest in equity capital of various companies listed on the stock exchanges, debt funds invest in various listed or unlisted debt instruments of such companies. Fundamentally, this way, equity mutual funds become shareholders of these companies and debt mutual funds become the debtors of such companies.

The first step in any debt fund investment is to determine your time horizon and objective of the investment and also to understand what kinds of investments the debt fund makes. You should invest in a fund which is in sync with your investment horizon and risk profile.

Debt fund category has many sub-categories and it is important to understand how each sub-category is different from the other sub-categories.

Here are the sub-categories under the debt fund category and their characteristics:

Gilt Funds – Invest in Government Securities (G-Secs) primarily; Longest Maturity; Highest Duration; typically invest in securities with an average maturity of more than five years

Income Funds – Invest in corporate bonds and/or G-Secs primarily; Long Maturity; High Duration; typically invest in securities with an average maturity of more than three years

Short-Term Funds – Invest in short-term corporate instruments primarily; Short Maturity; Low Duration; typically invest in securities that mature in one to three years

Ultra Short-Term Funds – Invest in ultra short-term corporate instruments primarily; Shorter Maturity; Lower Duration; typically invest in securities with an average maturity of three months to one year

Liquid Funds – Invest in money-market instruments primarily; Shortest Maturity; Lowest Duration; typically invest in securities with an average maturity of less than three months

Fixed Maturity Plans (FMPs) – Invest in fixed maturity corporate instruments primarily; Fixed Maturity

So, if your investment horizon is short and the objective is to earn safe returns then you should not invest in a Gilt fund or an Income Fund as a rise in interest rates could result in negative returns for such funds.

Now, here are the factors that the investors need to consider while choosing a debt fund.

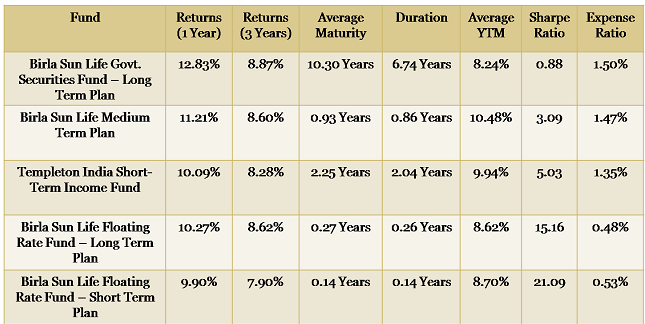

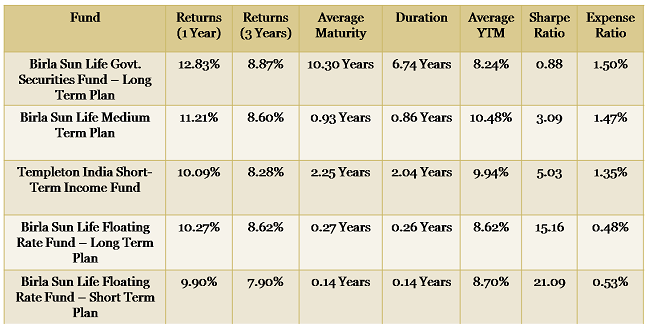

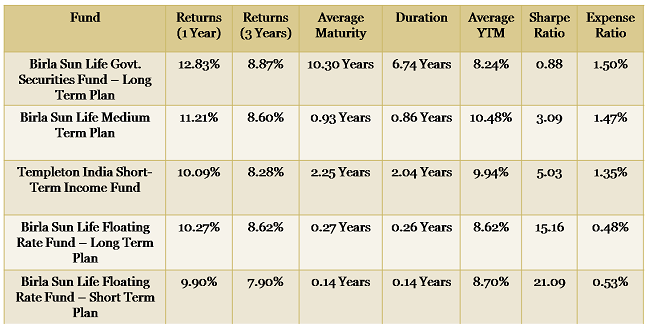

Performance/Returns

We invest in various asset classes to earn potential returns out of them. So, a fund’s past performance becomes the first important factor to be looked at. An investor should check a fund’s returns over different time periods, like six-month returns, one-year returns, three-year returns, five-year returns, returns since inception and returns since the current fund manager has taken over.

But, as with any investment, you need to understand that the returns in fixed income products also represent past performance and there is no guarantee that they will continue to give the same returns.

Making a comparison of the fund’s performance vis-a-vis the performance of other funds in the same category is a very important exercise. It gives you a clear idea how good or bad the fund has been performing. Also, make sure to check only the ‘Growth’ option of all the funds to make a meaningful comparison as different dividend payment dates of different funds would provide an unclear picture for comparison purposes.

Fund Management Team – Experience & Qualifications

Fixed income investing has become a difficult job in a much more complex economic environment and an uncertain yet dynamic interest rate scenario. How well a fund performs primarily depends on how good the fund manager is.

So, an investor must check the fund manager’s experience and qualification and the returns generated by the fund under his/her fund management tenure. A detailed summary of each fund’s management team, its experience and qualifications can be found in the fund’s prospectus.

Also, a fund house well equipped with thorough research and analysis tools in debt fund management will definitely be able to take quick quality decisions as compared to a team with lack of such tools.

Average Time to Maturity

A bond fund carries a weighted average time to maturity, which is the average of the current maturities of all the bonds held in the fund. The longer the average maturity, the more sensitive the fund tends to be to the changes in interest rates.

Duration

Though duration and maturity sound similar, never confuse duration of a bond or a fund with its time to maturity. Duration measures how much a bond’s price will rise or fall with a percentage fall or rise in interest rates and is calculated in a similar manner in which maturity is calculated. A fund with an average duration of 6.74 years (or just 6.74) will theoretically appreciate 6.74% in value with a 1% fall in interest rate, keeping all other factors constant.

Average Yield to Maturity

Yield to Maturity (or YTM) is the annualised rate of return that an investor earns on a fixed income instrument, if the investor purchases the bond today and holds it until maturity. Average yield to maturity of a debt fund is the average of the current maturities of all the bonds held in the fund.

Companies offer higher yields on their debt securities in order to attract common investors like you and me and also to attract the managers of these debt funds. Some fund managers get attracted to these higher yields and compromise on the quality front by investing in lower-quality securities. So, you should not invest in high yield bond funds only on the basis of its potential yield. You need to factor in the credit risk, risk of default associated with the issuers, and how that risk might affect the safety of your investment.

Standard Deviation and Sharpe Ratio

While a debt fund may generate a higher return, the return may be the result of potentially higher risk. Standard deviation calculates the sensitivity of a security or a fund. The higher the standard deviation, the higher the security’s volatility risk.

Sharpe Ratio is an equation to calculate risk-adjusted performance of a portfolio and for a debt fund, it is calculated by subtracting the risk-free rate from the debt fund’s return, divided by its standard deviation.

Sharpe Ratio = (Portfolio Return – Risk-Free Rate) / Portfolio Standard Deviation

The higher the Sharpe Ratio, the better the debt fund has performed after being adjusted for its risk.

Portfolio/Holdings and Credit Quality

Credit quality of a debt investment is the most important factor for any investor. The overall credit quality of a debt fund will depend on the credit quality of the securities in the portfolio. Different debt funds invest in different debt securities with varying degree of credit quality, ranging from risk-free government securities to high-risk corporate securities.

Though credit ratings do not guarantee against any default in payments and are not 100% foolproof either, the relative credit risk of a bond gets reflected in the ratings assigned to them by the independent rating companies such as Crisil, ICRA, CARE, Fitch and Brickwork. Bonds, which are considered to be the safest from credit risk point of view, are given the highest credit rating of AAA. The lower the ratings are for the securities of a debt fund, the riskier the fund becomes for you to invest.

Debt funds which invest in lower-quality securities can potentially deliver higher returns, but will also be vulnerable to some level of default risk both in terms of interest payments as well as principal repayments. So, the investors should choose debt funds with better asset quality.

Expenses/Charges/Fees

A fund charges expenses and fees for managing your investment. These expenses are a certain percentage of the total assets managed by the fund and hence are termed as the “Expense Ratioâ€. As these expenses are ultimately affect your returns only, the lower these expenses are the better it is for you. But, at the same time, you should focus more on the returns generated by a fund and less on the expenses.

Exit Load

After SEBI’s ban on “Entry Loadâ€, most mutual funds have introduced “Exit Loads†on most of their schemes and that too in different proportions with different applicable time periods. Also, exit load is charged on the investor’s total investment amount i.e. the principal investment amount plus the return generated on it. So, it becomes important for you as an investor to check the exit load before making the investment, as if the investment horizon is short, then the exit load might reduce your overall returns considerably.

Taxation

Short-term capital gain (STCG) in debt funds is taxed as per your applicable income-tax slab, whereas long-term capital gain (LTCG) is eligible for the inflation indexation benefit and is taxed at the lower of the two, either 10% without indexation or 20% with indexation.

Dividend received from the debt funds are tax-free in the hands of its investors as the fund houses are required to deduct and pay dividend distribution tax (DDT) to the tax authorities. Liquid funds or money-market funds are required to pay dividend distribution tax at an effective rate of 27.0375% (25%*1.05*1.03), including 5% surcharge and 3% education cess. Dividend distribution tax for other debt funds is 13.51875% (12.5%*1.05*1.03) effectively.

So, if your investment horizon is less than a year and you fall in the 30% tax bracket, then you should invest in either an ultra short-term fund or a short-term fund and opt for a regular dividend option as the dividend will be tax-free for you and might result in a zero capital gain tax.

To me this is an exhaustive list of factors which you should consider as you decide to invest in debt funds. If you want to suggest some other factors to be considered, then you are most welcome to share them here. If you want to learn more about the fund you’re considering, you need to check the fund’s prospectus or its monthly factsheet.