This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

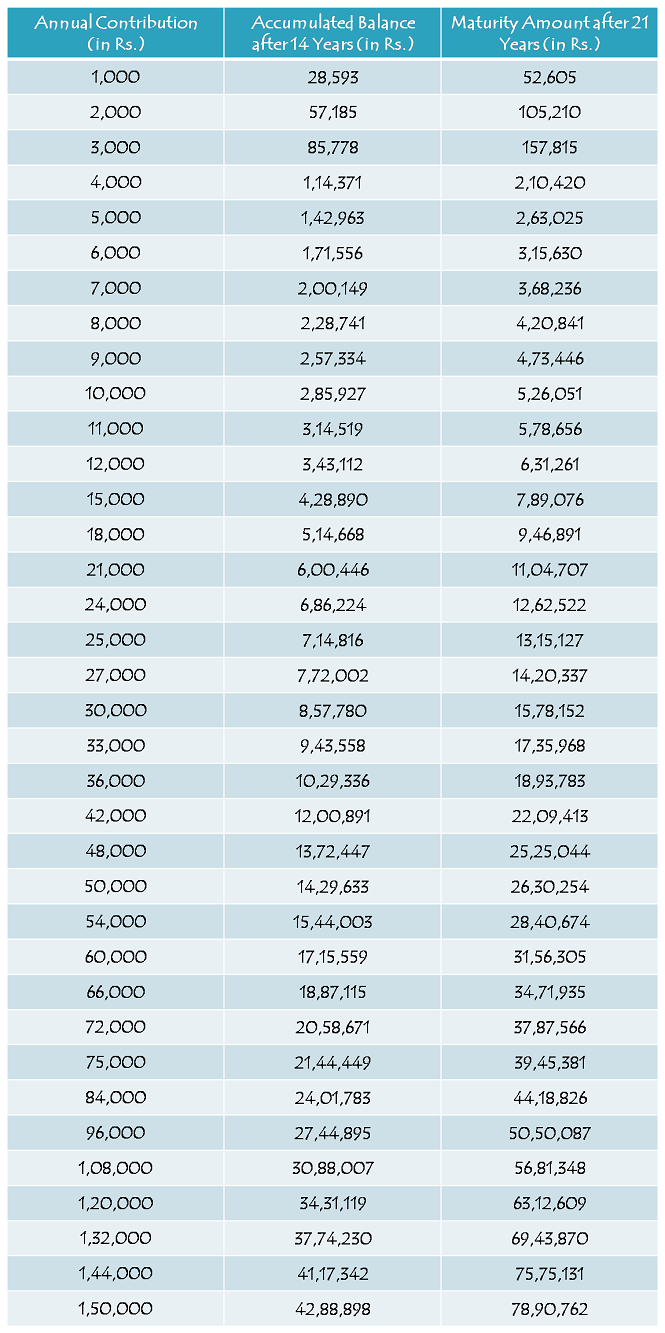

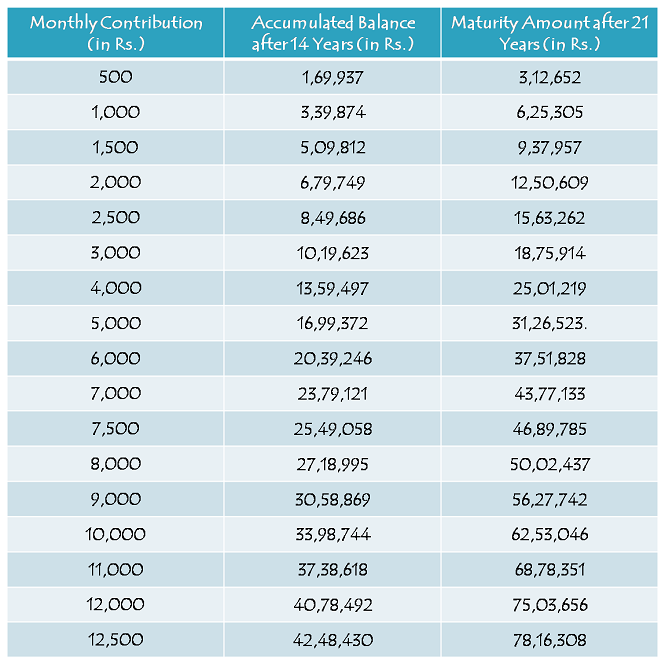

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Hi shiv Sir,

will the partial withdrawal be tax free?

Hi Vinay,

Yes, partial withdrawal will also be tax-free.

Good morning Sir,

Child girl is 8 year old so “ssy” scheme me 1000 rs. yearly dposite kerne k baad 10 year k baad uske merrige(in 18 year) k lea total kitna amount milega.

Thank you

Hi Rohit,

It should be approximately Rs. 16,654.80

Sir,If she withdraw the 50 % amount after 9yrs i,e. ,when she will be 18 yrs old. Investing 150000 per year. How much will she get at the time of maturity?

Hi Deepa,

Based on certain assumptions & 9.1% rate of interest, it should be approximately Rs. 48.48 lakh after 21 years.

dear team,

please tell as my conditions,

1. in case of deeply incident/accident with applience than what to you do?

2. in case of applience is no more with any reason than what to you do?

3. in case of emergency personal/family work, we want to withdrawl some deposited payment than what to you do.

You can make a request to prematurely close the account and withdraw the amount under special circumstances, like death etc.

Dear Team,

Please tell me about this yojana and tell me minimum deposited rs. in annual and my daughter is 6 year 6 month 10 day so please updated me immediate.

Thanks

Nepal Singh Dhaked

Minimum annual deposit is Rs. 1000. Please check this post, it has all the details about this scheme – http://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

In case of death of parents before 21 years policy or marriage of girl child what will happen to the invested money ? will it be refunded deposited amount with interest without continuing ? or child will be bound to pay remaining years or have to wait till marriage ?

You can make a request to prematurely close the account and withdraw the amount under special circumstances like death etc.

sir my doughter is 2year6mounth and i am open this acc. 12000 per year

and got after 21year meturity ammount

Please check the table above. As per the table, it is Rs. 6,31,261.

sir

Is it possible for NRI to open this account for their daughters and is the matured value tax free. my daughter is 2 year old now if i invest 150000 how much she will get on maturity at the age of 21

Thank you

Is yojana ke anusar har saal kitne rupey pay karna padega plzz ans

Dear Sir

Thank you for sharing this information.

Is NRI can invest in this scheme and take benefit. If the daughter is norn outside India but she and parents are still Indian citizens. Will they entitled for the benefit

Thanks for your help

OK thank you sir

Dear Sir

Thank you for sharing this informatin.

Is NRI can invest in this scheme and take benefit.

Thanks for your help

Dear Sir

Thank you for sharing this informatin.

Is NRI can invest in this scheme and take benefit.

Thanks for your help

Hello sir,

Need to deposit for upto 14 years right.But in Case if i deposied only two years, ofter unble to deposit Next 2 years.After this 2 years gap again if i will start to deposit upto 5 years-In this case amount will get back or will get interest for that money upto 21 years.

Dear Mr Kukreja,

Thanks for the guidance.

I have a different query. Actually I am availing Home Loan from PNB. I am paying approx Rs 70,000/- towards interest per year in addition to principal. Am I eligible for tax deduction of Rs 70,000/- which I am paying towards interest. I mean to say this Rs 70,000/- will be automatically deducted from my gross salary. It is also pertinent to mention here that still I am not in possession of flat. Litigation is going on in State Commission. It will take lot of time. My office says until and unless I am not in possession of flat, I am not eligible for tax deduction. Is it so, kindly guide.

Head postmaster ye post office ne hota h ya kisi badi branch par

Ye aapko apne post office mein pata karna padega ki wahaan ka Head Postmaster kahaan hota hai.

sir i want to know,

1.)at the time of 18 year where partial withdrawal will be granted or at 21st year 100% withdrawal ,who can withdraw this amount either girl child or the parent suppose if i am paying every month

2)what would be the scene in case of divorce of parent bec i am on the verge of divorce bt want to subscribe for my daughter this plan,please intimate

Hi Rohit,

1. As it is for the girl child, she will have the right to the maturity amount.

2. I have no idea what would be the impact of some family disruption on this scheme. But, if you are doing it for the benefit of your daughter, who I am sure has no role in your disputes, I think it hardly matters what happens at the end of this unfortunate event. I think you should go ahead and do that for your daughter.