This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

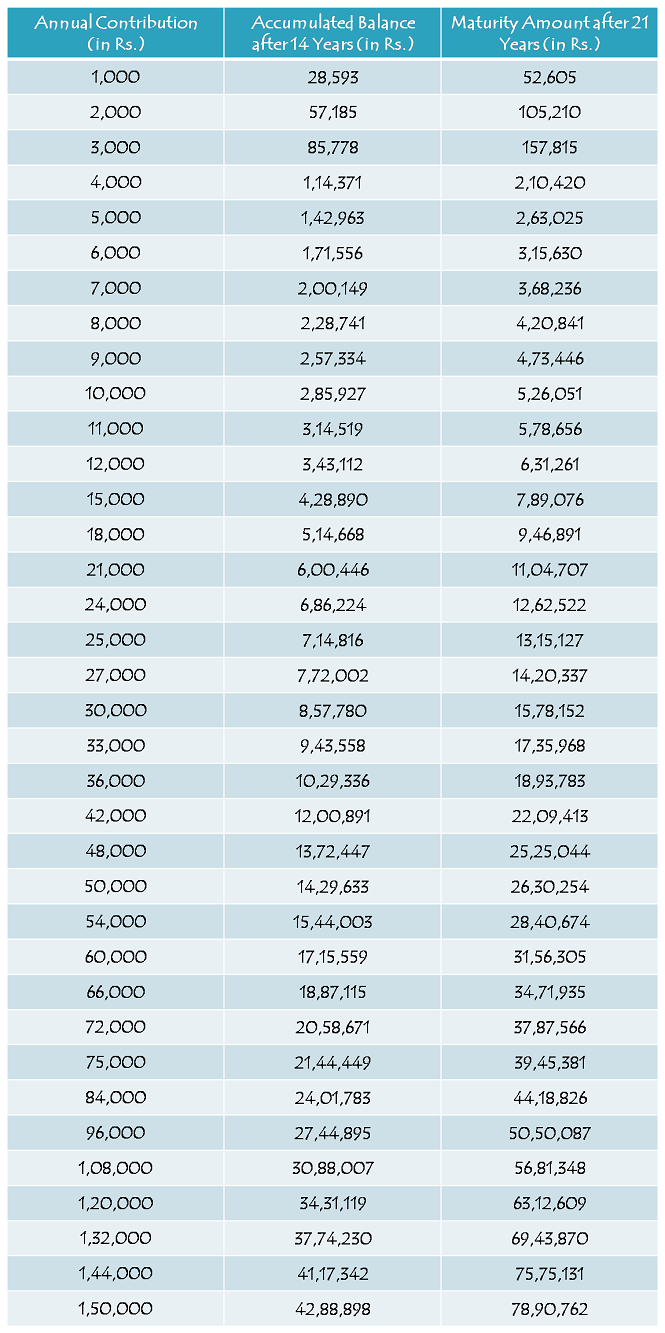

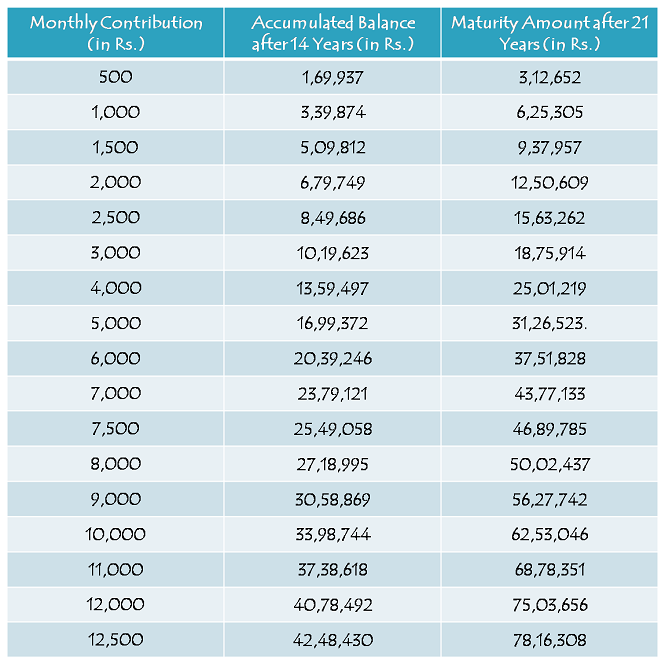

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Sir, I also want one clarification abt the scheme. Whether govt. Employees (state/central/banks) can open the account?

Hi Pradeep,

Yes, govt. employees can get this account opened for their daughters.

Sir I wanna open this account. I want to know that if I get it open on yearly investment of rs.12000 and after some years before my baby completes 10 can I increase the investment amount in the same account? Or open a different account in the same plan with increased investment amount?

Hi Monikaa,

You can increase the amount whenever you want.

Hi sir,

I wanted to know what’s accumulated balance and maturity amount.ie.if i deposit 1000 yearly and i withdraw after 14 yrs will i get 28593 and if i take it after 21 it is 50,000?..also whether each yr the interest change?the interest is calculated on the matured amount of the previous yr right?..

Hi Sheba,

Yes, the interest rate will be revised every financial year on April 1. You need to deposit money for 14 years and you can withdraw after 21 years or when the girl child gets married, whichever is earlier. You can withdraw 50% of the balance as the girl child attains 18 years of age. If you deposit Rs. 1,000 every year on April 1, it would be approximately Rs. 52,605 after 21 years.

Beti bachav yojana aur sukanya samruddhi yojana me kya farak he

“Beti Bachao, Beti Padao” ek financial scheme nahin hai, ek social initiative hai. Sukanya Sammriddhi Yojana ek financial scheme hai.

meri badiwali bacchi ki janam tarikh 31/7/2002 aur chotiwali janm tarikh 24/11/2008 hai Kay main unke naam se sukanya samruddhi yojana ka khata khol sakta hu aur agar is 14 Saal ke darmiyan uske pita/father ko kuch ho jayega to kya hoga

Agar in 14 saal mein father ko kuch ho jaata hai, to aap special request kar ke account close karwa sakte hain. Beti ko balance amount mil jaayega.

Hello sir

Kya Hume her month ik fixed amount hi deposit kerni hai. Ya change b ker saktey hai

.

Hi Manoj,

Aap amount change bhi kar sakte hain. Aur har month deposit karna zaroori nahin hai, saal mein ek baar deposit karne se account active rahega.

hello my big daughter birth on 31-07-2002 n second daughter birth on 24-11-2008 can we open her account for sukanya samruddhi yojana

Hi Deepak,

You can open this account for your younger daughter whose date of birth is 24-11-2008. Elder daughter is not eligible.

sir 1000 per month dale or 5y tak dale to kitna milega

Jodh Singhji,

14 saal tak deposit karna hoga, 5 saal nahin. Aur monthly deposit karna zaroori nahin hai, saal mein ek deposit bhi chalega.

My daughter is only 8 months old. Is she eligible for the scheme.

Yes, she is eligible for this scheme.

Sir,

Can i open this account through online ?

Hi Abdul,

No, online investment facility is not available.

Hi,

Could you please tel me can we open two accounts for a single girl child, one account is opended by her grand father and another account is opened by father. does it possible.

Hi Suresh,

No, you cannot open two accounts for a girl child. It is not allowed.

Good investment

Kya ye yojna ek beema yojna ki Torah hi ? Jisme yadi patients ko kuch ho jai to bhi last me poora pesa Malta hi yadi nhi to kya hi ….

Nahin, ye scheme bima suraksha nahin deti. Agar parents ko kuch ho jaaye, to beti ko balance paisa mil jaayega.

Today I enquired in PNB and SBI about SSY. Both the banks said forms are not available. when will we get the forms ??

Only these banks can tell you about that.

If I open this account with 9.1 % interest. Will it be applicable for all 21 years

No, rate of interest for this scheme is not fixed and is subject to a revision every financial year like all other small savings schemes, including PPF. 9.1% rate of interest for SSY is for FY 2014-15 only. For FY 2015-16, the rate of interest will be announced soon in a few days time.

Sir

Meri beti ki age 2 years and 7 years hai to me yearly 1000-1000 diposit karu to 21 sall and 18 saal ke baad dono ko kitna milega??

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Dear Sir

What application I got from post office has the letters like SAVING/RD/TD/(1/2/3/5 YEARS/MIS. As you have mentioned in the application form sample SSA option is not there. what should I write in type of account? kindlt clarify.

Hi Janet,

You should write SSA or Sukanya Samriddhi Account there.

I have just posted an article having a sample duly filled application form, please check – http://www.onemint.com/2015/03/12/sukanya-samriddhi-yojana-sample-filled-application-form/

hello Sir,

Can you please tell me if i have opted for 10000 annually and in next year i wantto deposit 20000 in an account can I. And yearly how many times i can deposit.

Sir,

Can you please tell me if i have opted for 10000 annually and in next year i wantto deposit 20000 in an account can I. And yearly how many times i can deposit.

Hi Dushyant,

Yes, you can do that. You can deposit any amount between Rs. 1,000 and Rs. 1.5 lakh. Also, there is no cap on the number of deposits.