This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

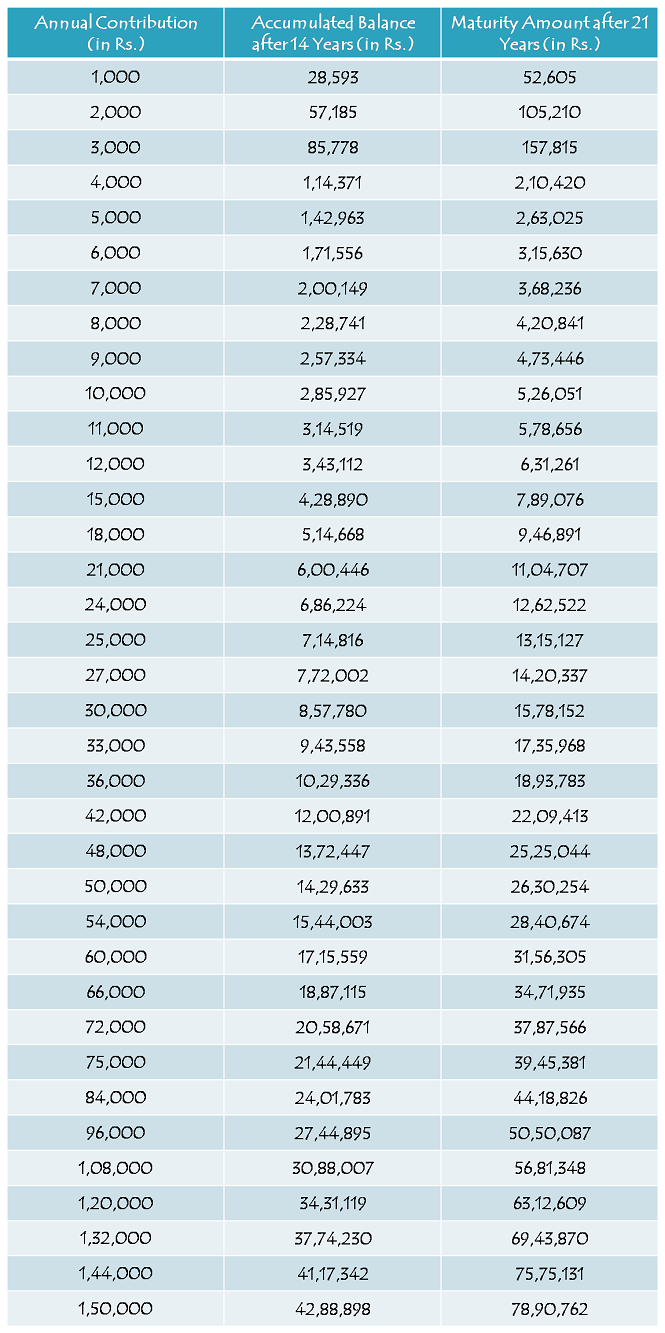

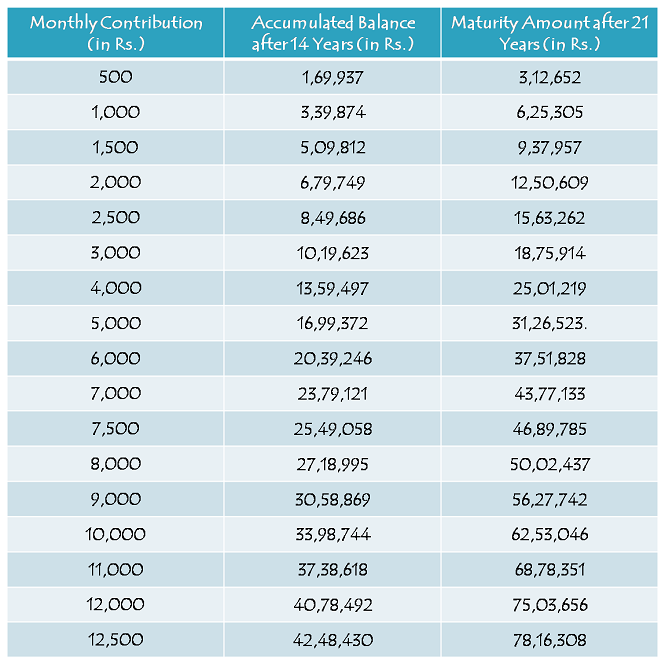

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

hi please tell me if i deposit 1000/- this year next year can i change the amount to 2000/- next year or should i pay the same amt till d end of maturity….i mean the amount i pay initially will be the amount which i should pay every or i can pay more or less…

please advise and is it safe and guaranteed bcoz its hard earned money n includes childs future..

Sir agar ladkii Ke papa ki govt. Job hai to kya vo iss scheme Ko fill kr skte hai?plz Ans me

Dear sir,

My daughter was born on 20/01/2012.I opened her account in 2015.annually I deposit around 50000.what would be the interest at the end. Actually the problem is the changing government and changing interest rates.. Do you think this would be a safe scheme to invest in or should I reduce my investments. I am scared that I don’t block my money for nothing, because eventually I am doing all this just for my daughter and her benefits.

I have 2 girl childs

Can i open 2 accounts for 1-1 each ?

Kindly give brief explain details of total intrest of amount in 21years after and per years my doughter is in 3 year. So I am going to invest yearly 20000.

Plz ing my child 3years ahe kit years money bharu plz .

My Daughter Is 10 years and 6 months Old. So which Scheme is Suitable For Me Plz Suggest??

1000 manthly

21

Mujhe katana he

My daughter is 5year next 21yearofter how many rupees given me

Monthly 2000 so after 21 yrs how much got

very nice this scheme thanks.

Koi new policy age

Dear sir/mam,

I hope this time you would answer my question. I have two question.

1. can i open SSY account for my daughter any of the bank or particular SBI branch only.

2.how to open this account means through the agent or direct to bank or post office?

sir,

i want to know what is grace period up to December 1, 2015.

Dear,

I want to know that icici bank available this scheme.

I would like to open my account ..is 100/protect??.. plz tell me

If unfortunately any accidents and scheme are not mature

What is the maturity value if 10000 is deposited yearly n withdraw after 18 years