This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

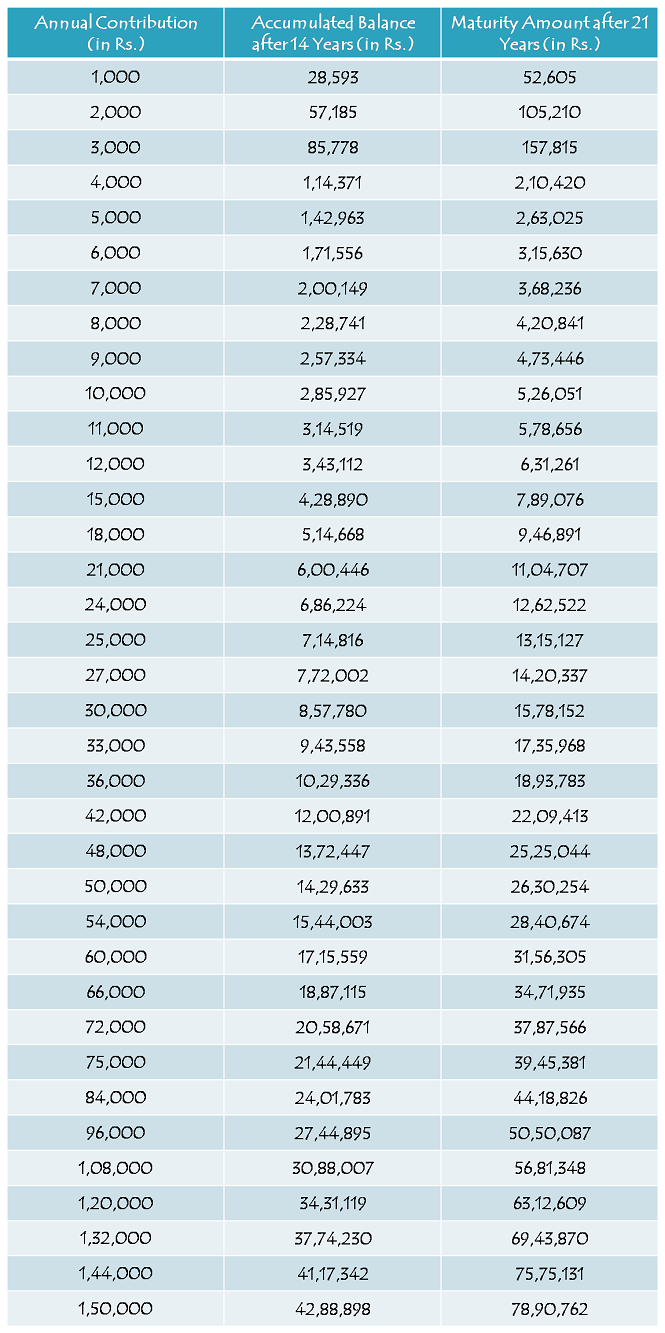

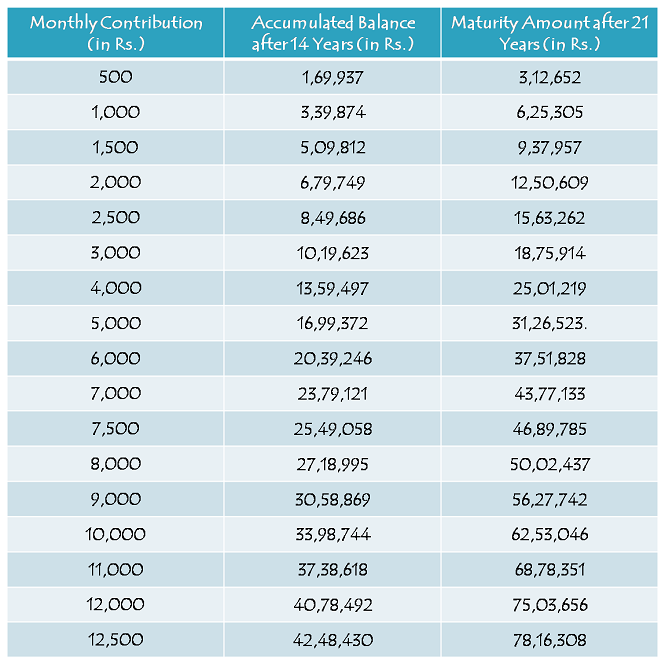

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

What happens if the government changes, will this yojana still be applicable?

I don’t think any government would like to stop a good scheme like this. They would not like to face public ire by making adverse changes to any scheme. Even the current government has not stopped a poorly drafted scheme called Rajiv Gandhi Equity Savings Scheme (RGESS). So, be positive, go ahead with this scheme and enjoy the benefits.

Hi Sir,

A quick query.In case I pay money monthly or yearly at the end of 21 years i observe as per the above chart returns are almost same.Just trying to understand how because I was thinking If I pay monthly return at end of 21 years should be atleast 20-25% less than we pay premims yearly.Can you help me understand more how is the premium calculated.

Hi Ram,

I don’t know how you are calculating it, but I think you are calculating it with monthly payments made at the end of the month. Calculate it by making it beginning of the month and if you still find a discrepancy, please let me know.

Hi,

Thanks for the above information’s, I do have few clarifications, kindly help me in the same.

1. My daughter is 7yrs 11 months ,( say 8yrs ) if i start with 2000/- monthly, for next 14yrs ( she would attain 22yrs ), i would have contributed 336000/-, if she gets married in the age of 25yrs what is the amt i get ? is it 679749 ? or with interest of additional 3 yrs ( 22yrs – 25yrs ) ? can you pls give one example of the calculation so that i can calculate if their is a variation in my monthly investment.

2. Do we have to show a proof of marriage to withdraw the money after the completion of 14yrs or they release the money only after the marriage?

3. If any unexpected incident occurs for the Depositor within 14yrs, do the money which is invested is returned back or with interest ?

3. Can i combine monthly & yearly deposit ? eg- first yr i just pay 10000/- as one shot, and the next yr monthly small amts ?

4. Can we wait till 21yrs to withdraw the maturity amt even after my daughter gets married during the 17th yr ( her age would be 25 then ) ?

Thanks …. Jonsie

Thanks Jonsie,

1. Interest for 3 years would also be added to your approximate calculation of Rs. 6,79,749. So, with 9.1% annual interest, it would be approx. Rs. 8,82,719. What kind of example you need?

2. The money will only be released as the girl child gets married. Though the government has not clarified about the proof for marriage in case of withdrawal as the girl child gets married, I think a declaration from the girl child would also do.

3. The money will be returned back with interest.

4. No, you will have to compulsorily withdraw the amount and close the account as & when your daughter gets married. You cannot keep the account open beyond your daughter’s marriage.

Thanks for the clarifications Mr.Shiv,

I just wanted to know the calculation step. If you could pls….

Regards… Jonsie

It is a simple calculation in excel, nothing extraordinary I think. There is no variation with what you had calculated and with that amount the interest for 3 years is added.

Sir, my daughter age 8 mmonths, I didn’t apply birth certificate, its compulsory for open SSY.

Yes, it seems it is compulsory. No other option has been mentioned in the Circular in its absence.

Sir agar kisi ladki ki umar 10 Sal hai To after 14sal he will get marriege at The age of 24 Yrs In that condition u told that parents have to pay only 14 Yrs nd rest 7 Yrs will be paid by govr. Us condition me jo parents pay krenge wahi milega n govt ke taraf se kuch to nahi milega.

Akhileshji, jab aapki beti ki shaadi hogi, aapko ye account close kar ke sara amount withdraw karna hoga.

Sir . My daughter’s DoB is 6/11/2005 . I have opened the SSA acount yesterday i.e., 19 jul 2015 .. The account needs to be operated by me for 14 years … Means she would be 24 years … After that (1) what percent will the govt contribute (2) if she gets married by 24 -25 years , as per norms , the account needs to be closed … will the amount to be withdrawn contain the government contribution… or will the interest added amt will b the maturity amount …. 3. If we let it continue till 21 years is that possible

dear sir,

my child dob is 14.nov.2004 ..she is eligible to open an account?

Hi Bhaskar,

Yes, your daughter is eligible.

My daughter age 8 yrs. I deposit 14 yrs means till 2029 .but my daughter age in 2029 22 yrs.this is marrige age.can I withdrawl money

You can withdraw the balance and close the account whenever your daughter gets married after she attains 18 years of age.

sir

is there any scheme like this for boy child…

No, there is no such scheme specifically for a boy child.

sir,

is there any other scheme like this for boy …

sir

if my daughter gets married before the maturity period can i continue or leave the amount till the completion of maturity period of 21 yrs

No, you will have to compulsorily close the account as your daughter gets married.

My daughter date of birth is 16/09/2006, I deposit 12000/= P.A. How many amount get after maturity.

Please check the table above – it is approximately Rs. 6,31,261.

Rate of Interest (9.1%) is fixed for whole tenure or flexible ?

It is variable, not fixed.

Sir,

Can we use this scheme for boy child

No, you cannot.

Sir.

Kya meray bank account say automaticly har month is yojna may deposit hotay rahayngay ya har month mujhko bank jana padayga ?

Aapko is account mein har month deposit karna zaroori nahin hai, saal mein ek baar deposit karne se bhi chalega. Is account mein automatic transfer karne ki suvidha abhi nahin hai.

SIr 1 question agar birth sartificat m galat naam he or beby 1 saal ki he to khata kholne m konsa naam likhege kya naam badal sakte he

Ye aapko post office/bank se pata karna padega.

sir, if the girl child gets married at the age of 30 yrs, then will it be possible to withdraw the amount then? and if she never gets married , then how will she claim the money?

You can withdraw the balance as & when the girl child gets married or on completion of 21 years from the date of opening this account, whichever is earlier.

I have 6200 rd in post office for 120 months weather my investment will attract any tds or not

There is no TDS on recurring deposits in a post office till date.

Dear shiv kukreja ji,

My daughter age is 8 yrs and if I invest in march 2015.till how many years I have to pay the amount.

You’ll have to pay for 14 years or till your daughter gets married, whichever is earlier.

Res sir,

At the time of her marriage how can I withdraw full money from this account? Will withdrawl application submitt before bank manager or marriage card show to manager for withdrawl ? Pls clear it…

I am not sure about the government’s requirements in that case, but I think a declaration from the girl child would do.

sir, i want to know that my daugher is 8and 1/2 years old, if i deposit rs -12000p.a the what maturity amt may she get at the age of 21 years(suppose getting marriiage)( 13 yrs of policy, secondly can i increase the amt in future

Yes, you can increase the amount in future. Your maturity amount will vary according to your contributions every year and the rate of interest in future years.